Mortgage Note

Overview of this form

A Mortgage Note is a formal promissory note in which the borrower agrees to repay a specific amount of money, including interest, by a specified date. It differs from a mortgage in that it primarily details the borrower's obligation to repay the loan rather than the collateral securing it, which is the real property pledged in the mortgage. This form is essential in establishing the terms of the loan agreement and is often required in foreclosure proceedings to prove the lender's right to collect the debt.

When to use this document

This Mortgage Note should be used when an individual or entity lends money secured by real property. It is necessary in situations such as purchasing a home, refinancing an existing mortgage, or for any loan agreement where real estate serves as collateral. It clarifies the repayment obligations and helps protect the lender's rights in case of non-payment.

Who can use this document

This form is intended for the following individuals or entities:

- Borrowers seeking to secure a loan against real property.

- Lenders who require a documented agreement for repayment.

- Real estate professionals involved in home purchases or refinancing.

- Investors interested in lending secured loans.

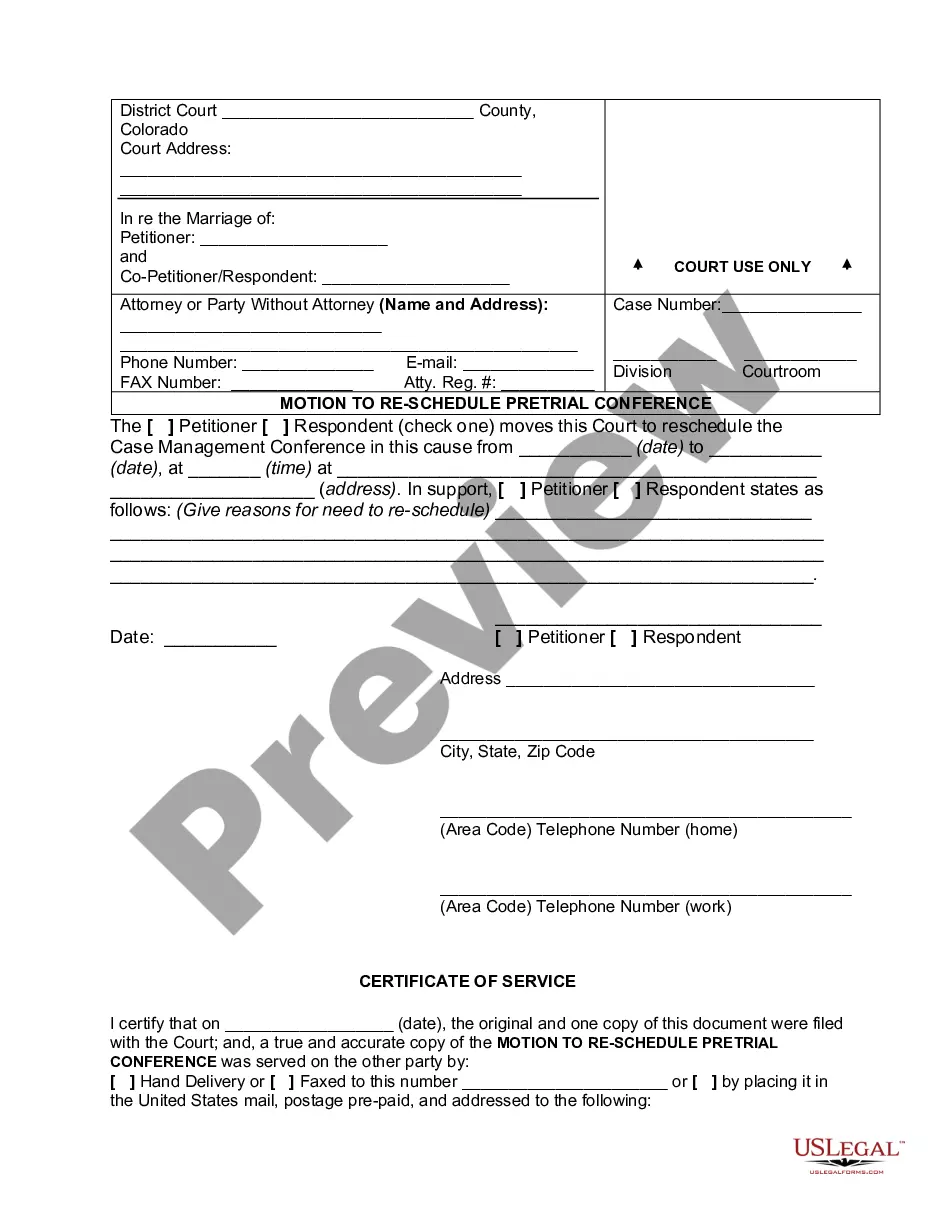

How to complete this form

- Identify the parties involved: clearly state the names and addresses of both the borrower and the lender.

- Specify the loan amount and interest rate: enter the total amount to be borrowed and the annual interest rate applicable.

- Outline the payment schedule: indicate the repayment terms, including the frequency of payments and the due date.

- Detail the terms of default: explain what will happen if the borrower fails to repay as agreed, including foreclosure rights.

- Obtain necessary signatures: both parties need to sign the document to make it binding.

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include all relevant parties' names can invalidate the agreement.

- Not specifying the interest rate or payment schedule may lead to misunderstandings.

- Overlooking the legal implications of default clauses can result in difficulties during foreclosure.

- Not obtaining proper signatures can make the note unenforceable.

Benefits of using this form online

- Convenience of downloading and completing from any location at any time.

- Editability allows for easy customization to fit specific loan terms.

- Access to professionally drafted templates ensures legal soundness.

- Immediate availability eliminates the need to wait for physical copies.

Looking for another form?

Form popularity

FAQ

It's only four pages long (five if you count the blank one at the end). You'll supply information about your identification, the property, and your income, assets and credit use.

Type of Mortgage and Terms of Loan. Property Information and Purpose of Loan. Personal Information. Employment Information. Monthly Income and Combined Housing Expenses. Assets and Liabilities. Details of Transaction. Declarations.

Essentially, a mortgage promissory note is an agreement that promises that the money borrowed from a lender will be paid back by the borrower. The mortgage note also explains how the loan is to be repaid, including details about the monthly payment amount and length of time for repayment.

A promissory note is often referred to as a mortgage note and is the document generated and signed at closing. A mortgage, or mortgage loan, is a loan that allows a borrower to finance a home.The promissory note is exactly what it sounds like the borrower's written, signed promise to repay the loan.

A mortgage is a loan that the borrower uses to purchase or maintain a home or other form of real estate and agrees to pay back over time, typically in a series of regular payments. The property serves as collateral to secure the loan.

Mortgage notes are a type of promissory note that details repayment of a loan used to purchase real estate. This legal document describes the amount of the loan and terms of repayment, including duration and interest rate. In a private mortgage, the borrower makes payments to a private person or entity directly.

The mortgage note is a legal document that sets out all the terms of the mortgage between a borrower and their lending institution. It includes terms such as: The amount of the mortgage loan.

The Note will provide you with details regarding your loan, including the amount you owe, the interest rate of the mortgage loan, the dates when the payments are to be made, the length of time for repayment, and the place where the payments are to be sent.

The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.A mortgage, or mortgage loan, is a loan that allows a borrower to finance a home.