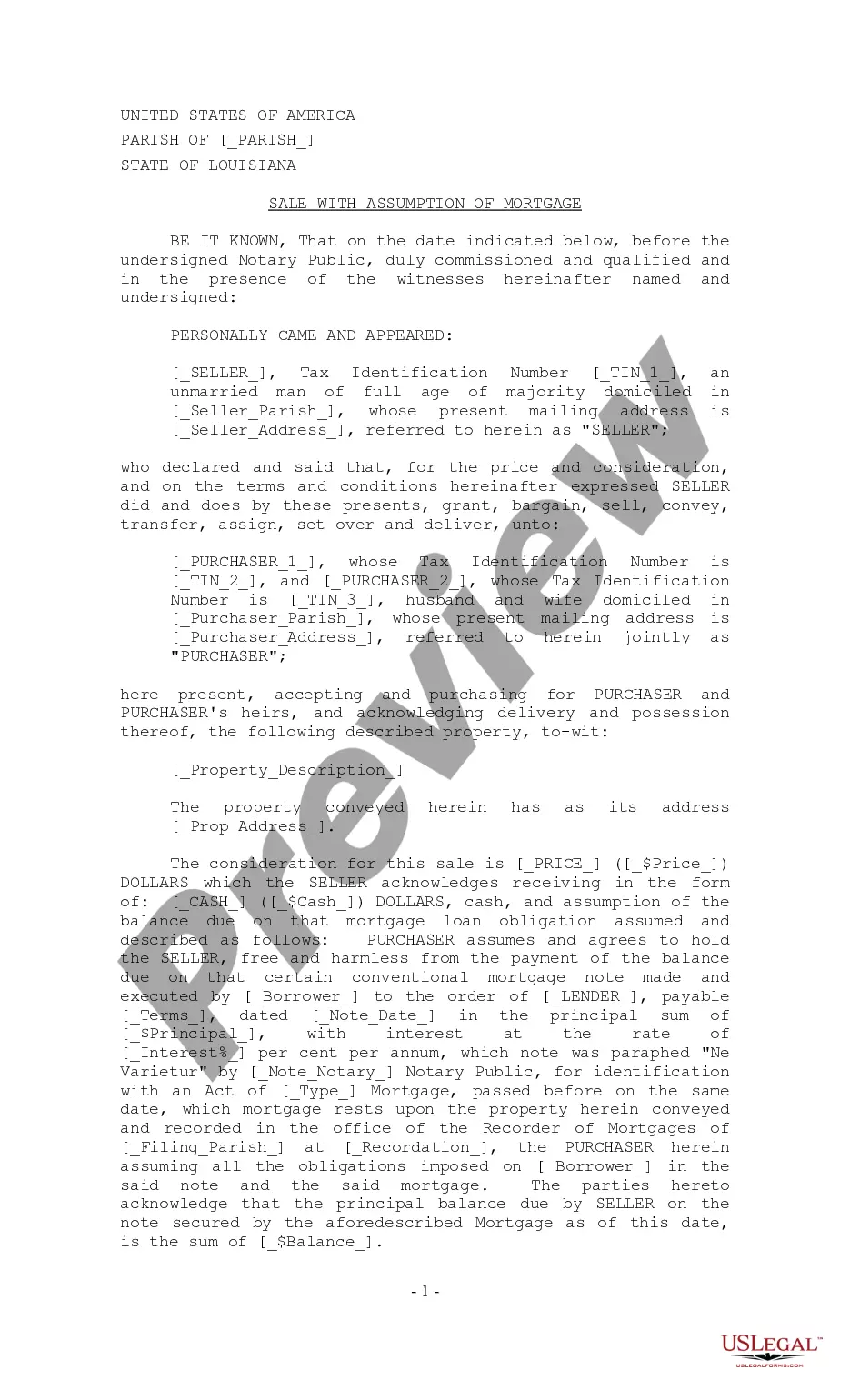

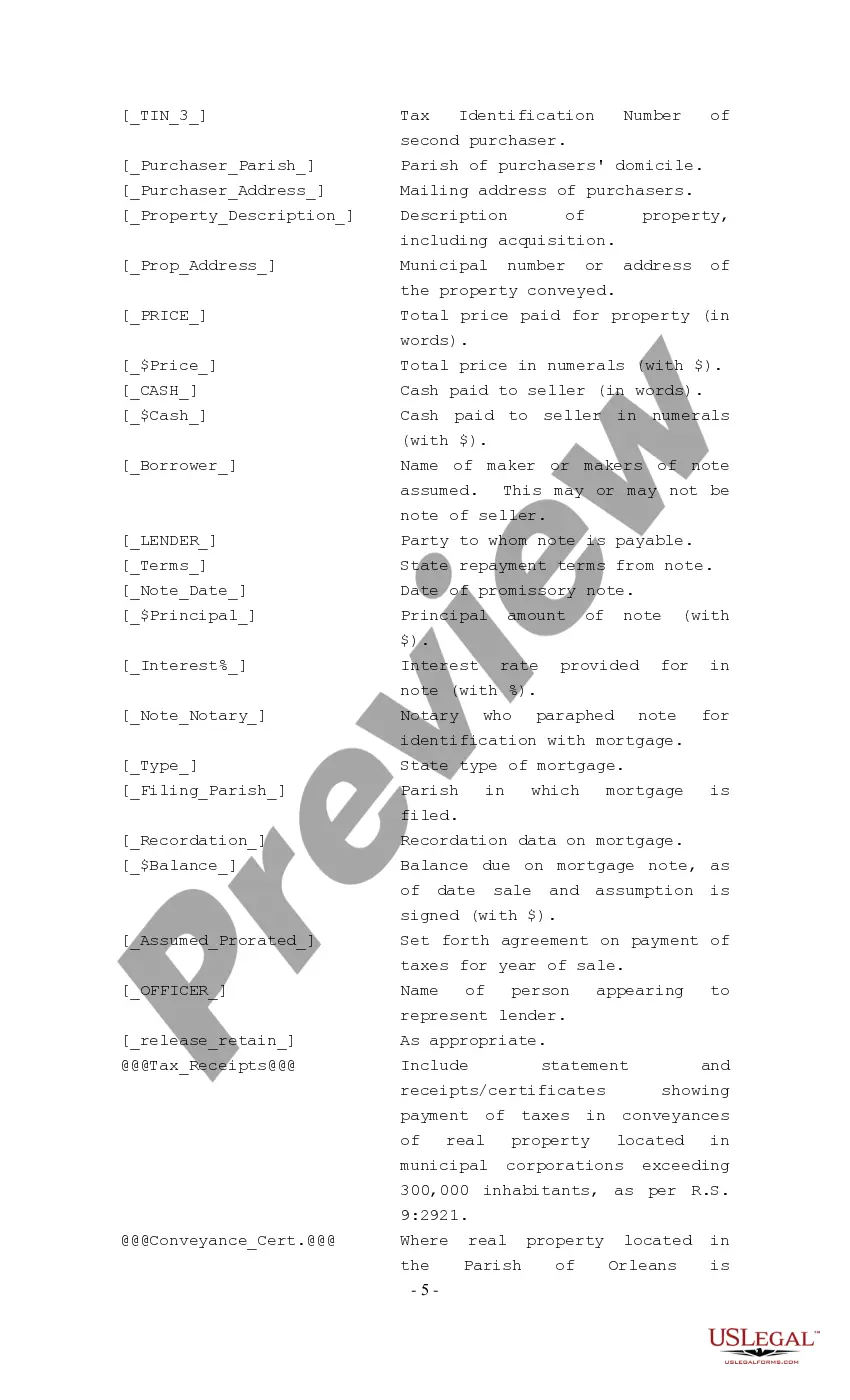

Louisiana Sale with Assumption of Mortgage

Description

How to fill out Louisiana Sale With Assumption Of Mortgage?

You are welcome to the most significant legal documents library, US Legal Forms. Here you can find any sample such as Louisiana Sale with Assumption of Mortgage forms and download them (as many of them as you want/require). Prepare official papers within a few hours, instead of days or even weeks, without having to spend an arm and a leg on an attorney. Get the state-specific example in a couple of clicks and be confident with the knowledge that it was drafted by our qualified legal professionals.

If you’re already a subscribed customer, just log in to your account and click Download near the Louisiana Sale with Assumption of Mortgage you need. Because US Legal Forms is web-based, you’ll generally get access to your downloaded templates, regardless of the device you’re utilizing. See them inside the My Forms tab.

If you don't come with an account yet, what are you waiting for? Check our instructions below to get started:

- If this is a state-specific document, check its applicability in your state.

- See the description (if readily available) to understand if it’s the right example.

- See a lot more content with the Preview function.

- If the example matches all of your requirements, click Buy Now.

- To create an account, pick a pricing plan.

- Use a card or PayPal account to register.

- Save the template in the format you want (Word or PDF).

- Print out the file and fill it with your/your business’s info.

When you’ve completed the Louisiana Sale with Assumption of Mortgage, send out it to your attorney for confirmation. It’s an extra step but a necessary one for being confident you’re totally covered. Become a member of US Legal Forms now and get thousands of reusable samples.

Form popularity

FAQ

Having an assumable loan might give a seller a marketing edge, particularly if mortgage rates have risen since the seller got the loan. For a buyer, assuming a mortgage can save thousands of dollars in interest payments and closing costs but it could require making a big down payment.

The contractual agreement for repaying the property loan includes the interest that the borrower has to pay per month in addition to the principal repayments to the lender.Therefore, an assumable mortgage during this period is likely to have a lower interest rate reflecting the current state of the economy.

Keep in mind that the average loan assumption takes anywhere from 45-90 days to complete. The more issues there are with underwriting, the longer you'll have to wait to finalize your agreement.

Start with the Newspaper. Look in the newspaper. Utilize Online Resources. Search online for a mortgage loan to assume. Contact a Local Real Estate Agent. Talk to your real estate agent. Consider Short Sales.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

You may be charged a loan assumption fee on top of your closing costs. For example, FHA lenders can charge buyers up to $900 for assuming a loan.

You will need a minimum credit score of 580 to 620, depending on individual lender guidelines. Your household income cannot exceed 115% of the average median income for the area. Your debt ratios should not exceed 29% for your housing expenses and 41% for your total monthly expenses.

What is a mortgage assumption agreement? It's actually pretty self-explanatory. A person who assumes a mortgage takes over a payment from the previous homeowner. Basically, the agreement shifts the financial responsibility of the loan to a different borrower.