Twelve-Month Cash Flow

About this form

The Twelve-Month Cash Flow form is a financial tool that tracks the movement of cash in and out of a business over a specified 12-month period. This form helps business owners and financial managers understand their liquidity position by detailing cash receipts and cash payments. Unlike other financial forms, the Twelve-Month Cash Flow focuses specifically on cash movement rather than profitability, making it essential for evaluating a company's short-term financial health.

What’s included in this form

- Company name and fiscal year start date.

- Cash on hand at the beginning of the period.

- Breakdown of cash receipts, including cash sales and loans.

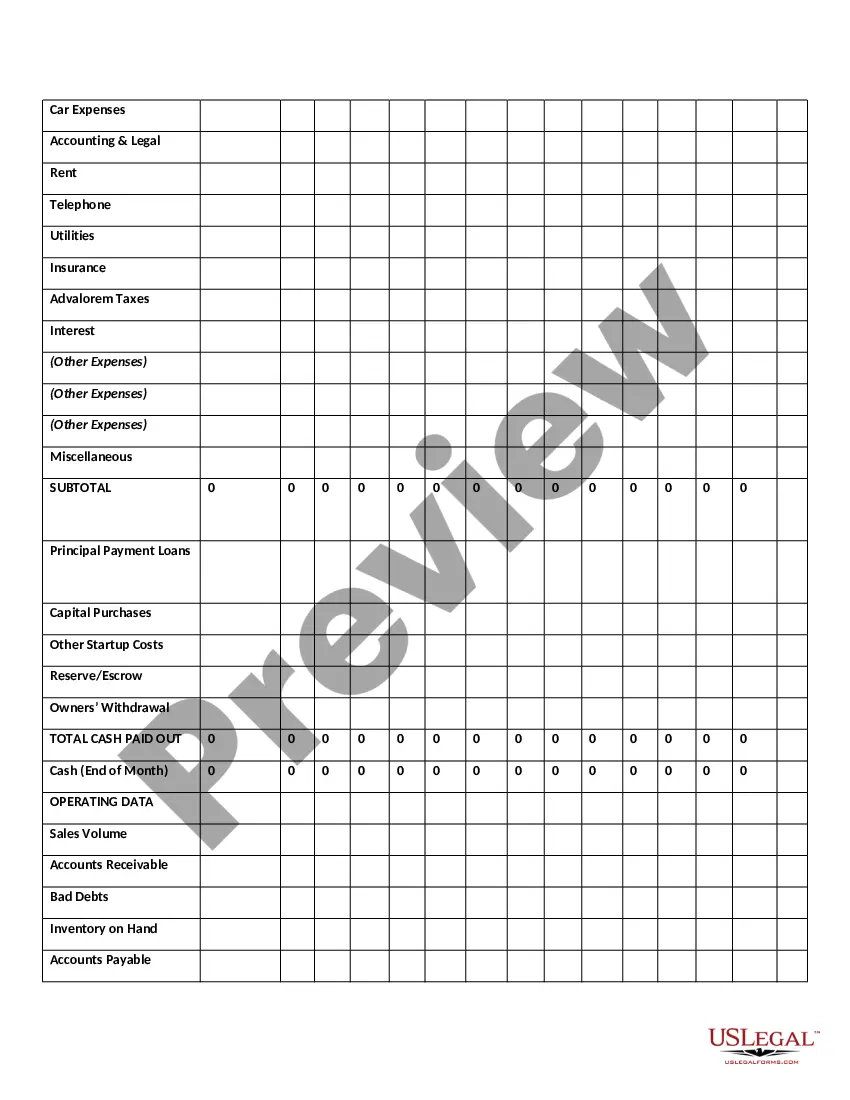

- Detailed list of cash paid out, categorized by expenses such as wages, services, and miscellaneous costs.

- Calculation of cash at the end of each month.

- Operating data including sales volume, accounts receivable, and inventory on hand.

When this form is needed

This form is used when a business needs to project its cash flow for the upcoming year. It is particularly useful for startups, small businesses, or any company looking to manage cash more effectively. Use this form to anticipate periods of cash shortage, plan for large expenses, or ensure that cash reserves are adequate to cover operational costs.

Intended users of this form

This form is intended for:

- Small business owners seeking to manage their cash flow.

- Financial managers responsible for budgeting and forecasting.

- Entrepreneurs planning startup operations.

- Accountants needing to provide clients with insights into cash management.

Steps to complete this form

- Enter the name of your company and the start date of your fiscal year.

- Document your cash on hand at the beginning of the period.

- Detail cash receipts and total them to determine the total cash available.

- Complete the cash paid out section by listing all expenses and payments.

- Calculate cash at the end of the month by subtracting total cash paid out from total cash available.

- Fill in the operating data to assess additional financial metrics.

Notarization guidance

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all income sources, such as loans and credit collections.

- Not accurately categorizing expenses, which can lead to cash flow miscalculations.

- Overlooking non-cash items that can affect cash quality assessments.

Why complete this form online

- Convenient access to a comprehensive cash flow management tool.

- Easy to download and customize for specific business needs.

- Reliably drafted by licensed attorneys to ensure compliance andLegal standards.

Looking for another form?

Form popularity

FAQ

Key 1 Get Started and Keep it Simple. As with any project, the best place to start is at the beginning. Key 2 Update the Forecast Frequently. and Improve its Accuracy by Fine Tuning. Key 3 Use the Forecast to Manage Your. Cash Position and Your Business.

Start with the Opening Balance. For the first month, start with the total amount of cash your business has in its bank accounts. Calculate the Cash Coming in (Sources of Cash) Determine the Cash Going Out (Uses of Cash) Subtract Uses of Cash (Step 3) from your Cash Balance (sum of Steps 1 and 2)

Free Cash Flow = Net income + Depreciation/Amortization Change in Working Capital Capital Expenditure. Operating Cash Flow = Operating Income + Depreciation Taxes + Change in Working Capital. Cash Flow Forecast = Beginning Cash + Projected Inflows Projected Outflows = Ending Cash.

Free Cash Flow = Net income + Depreciation/Amortization Change in Working Capital Capital Expenditure. Operating Cash Flow = Operating Income + Depreciation Taxes + Change in Working Capital. Cash Flow Forecast = Beginning Cash + Projected Inflows Projected Outflows = Ending Cash.

Decide how far out you want to plan for. Cash flow planning can cover anything from a few weeks to many months. List all your income. For each week or month in your cash flow forecast, list all the cash you've got coming in. List all your outgoings. Work out your running cash flow.

Add the balance in your operating activities, financing activities, and investing activities columns together. This amount is your monthly business cash flow. If you have a positive number, you have a positive cash flow. If the number is negative, your business spent more than it earned that month.

Subtract your total cash outflows from your total cash inflows to determine your yearly cash flow. A positive number represents positive cash flow, while a negative result represents negative cash flow. Continuing with the example, subtract $139,000 from $175,000 to get $36,000 in positive yearly cash flow.

Enter Your Beginning Balance. For the first month, start your projection with the actual amount of cash your business will have in your bank account. Estimate Cash Coming In. Fill in all amounts you expect to take in during the month. Estimate Cash Going Out. Subtract Outlays From Income.

A projected cash flow statement is best defined as a listing of expected cash inflows and outflows for an upcoming period (usually a year). Anticipated cash transactions are entered for the subperiod they are expected to occur.