New York Warranty Deed from Individual to LLC

Definition and meaning

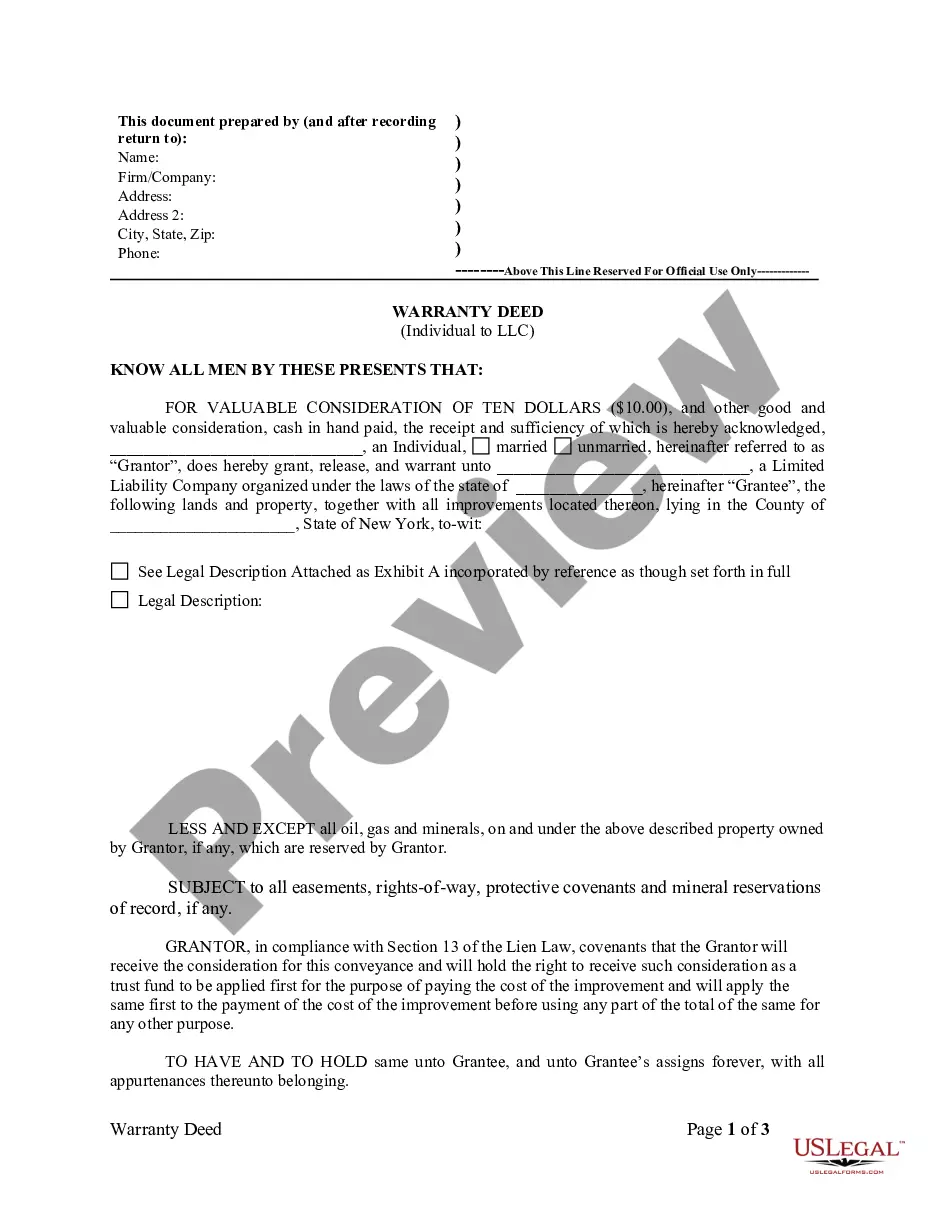

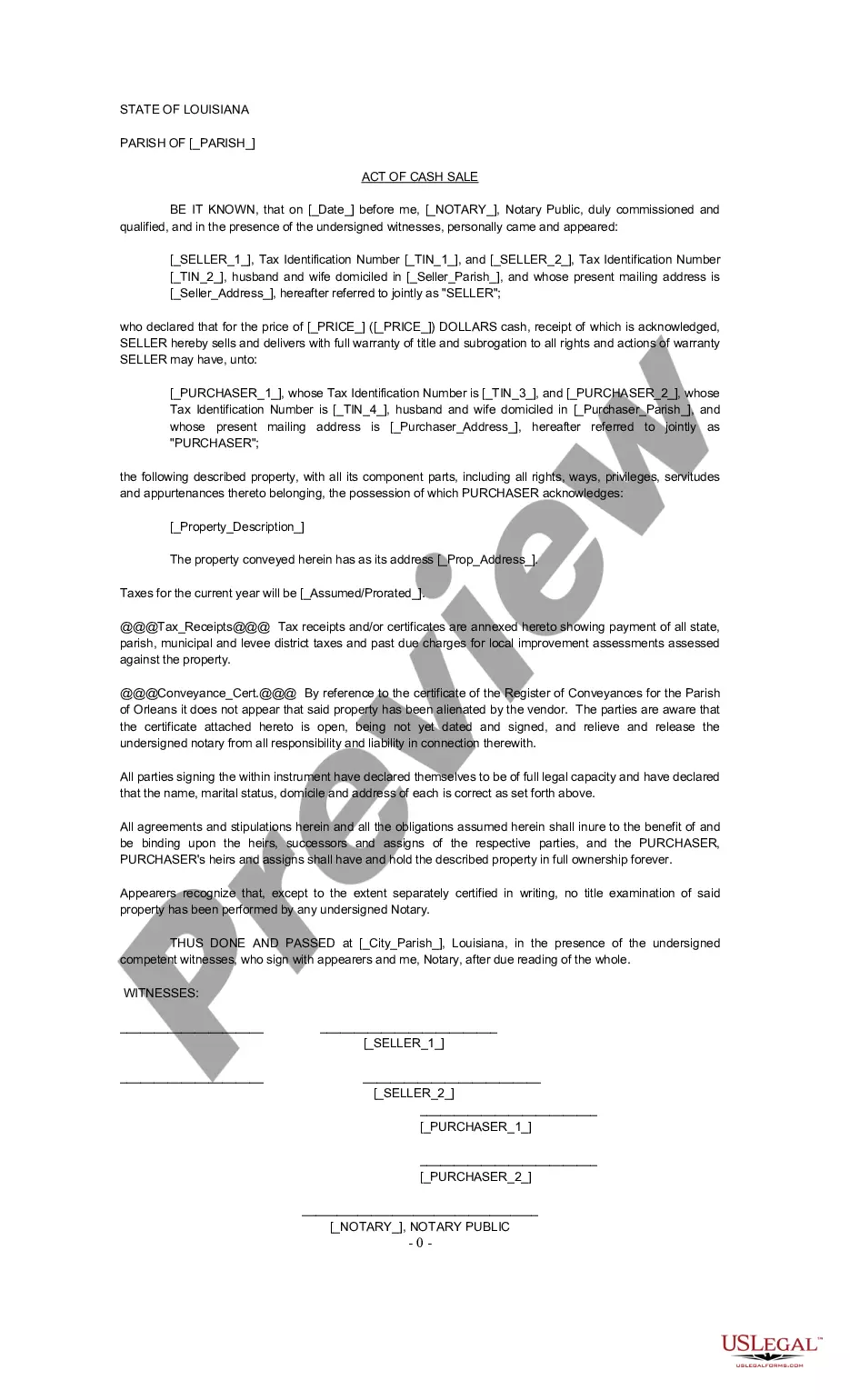

A New York Warranty Deed from Individual to LLC is a legal document used to transfer property ownership from an individual to a Limited Liability Company (LLC). This document ensures that the property is free from liens and encumbrances, granting the LLC full ownership rights. The warranty deed provides protection to the grantee (the LLC) by guaranteeing that the grantor (the individual) holds clear title to the property being transferred.

How to complete a form

Completing the New York Warranty Deed from Individual to LLC involves several steps:

- Start with the title of the document, stating it as a 'Warranty Deed.'

- Fill in the names of the grantor (individual) and grantee (LLC).

- Provide a legal description of the property being transferred, which can often be found in previous deeds or public records.

- Specify the consideration, often a nominal amount, such as ten dollars, acknowledging the exchange.

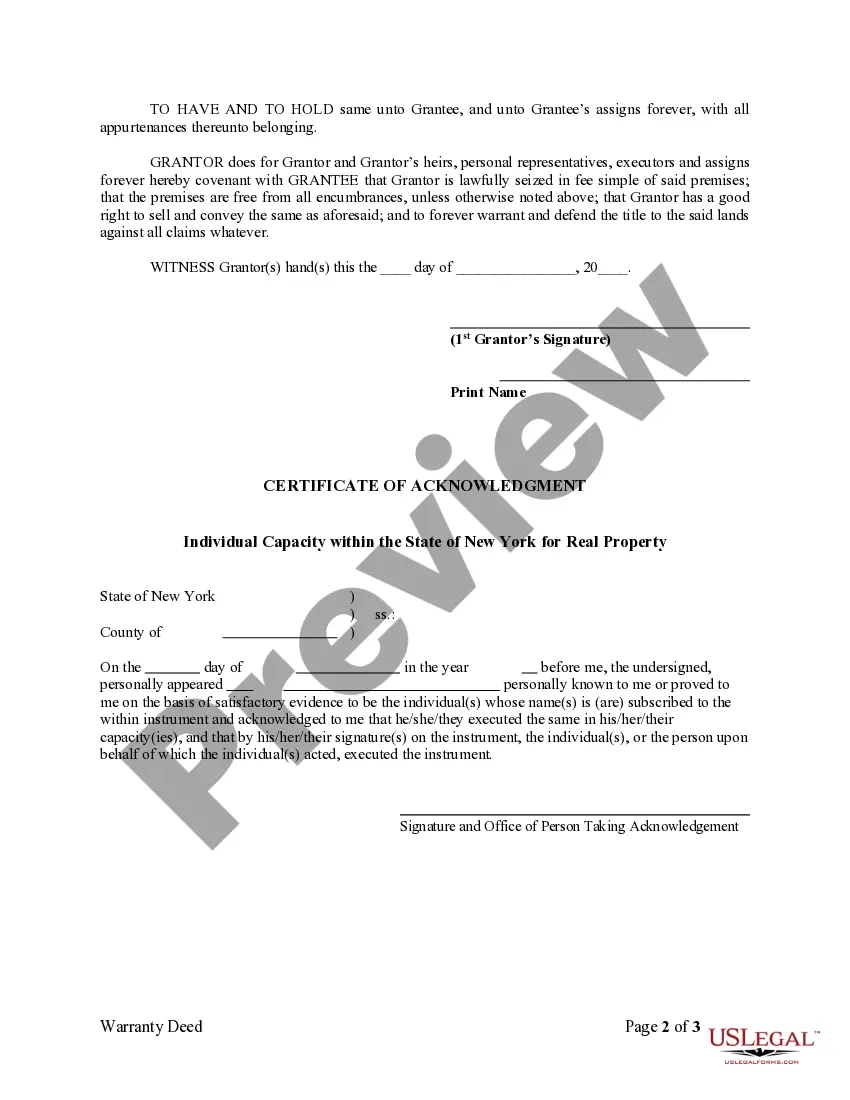

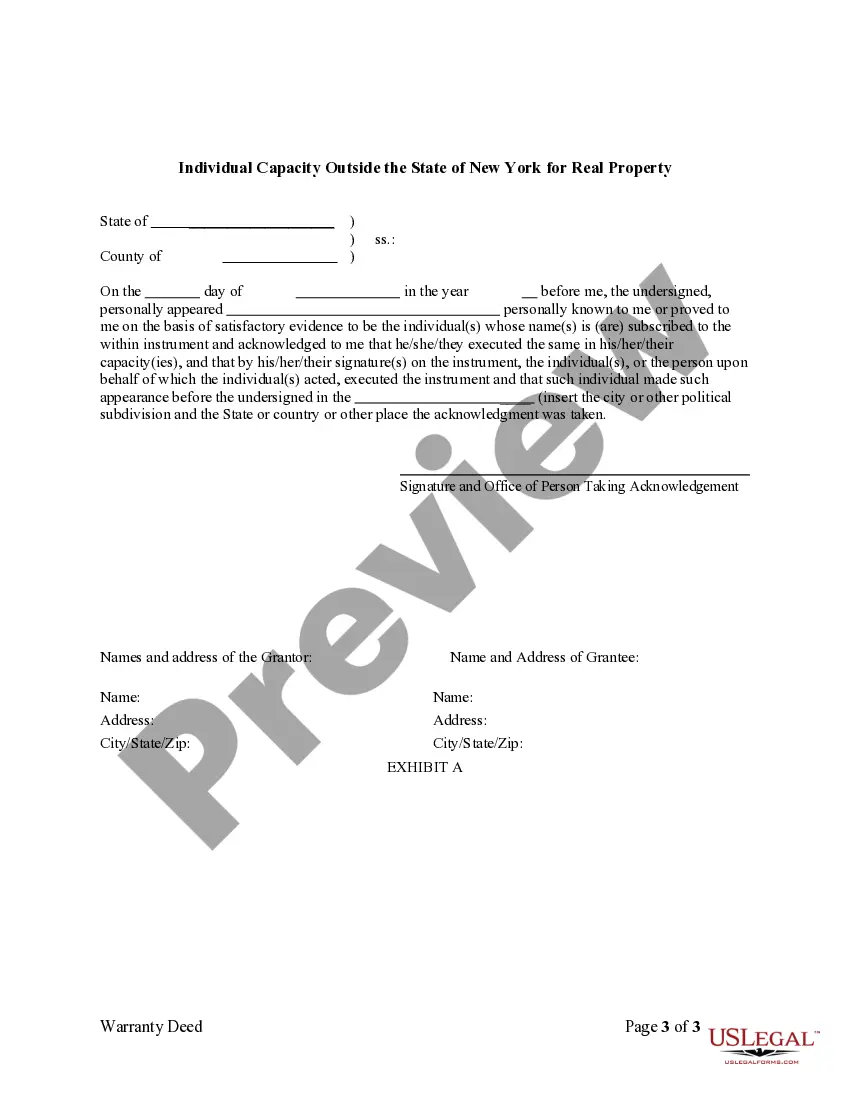

- Sign the document in the presence of a notary public and ensure the notary completes the acknowledgment section.

Who should use this form

This form is suitable for individuals who wish to transfer real estate to their LLC. This is often done for various reasons, including liability protection, tax benefits, or estate planning. Anyone who owns property and decides to manage it through an LLC structure may benefit from using this warranty deed.

Legal use and context

The New York Warranty Deed serves as a formal legal instrument under New York State law. It is utilized in situations where an individual transfer real estate to their formed LLC. The deed provides proof of the transfer and is filed with the county clerk’s office where the property is located, ensuring that public records reflect the LLC as the new owner.

Key components of the form

Key components of the New York Warranty Deed from Individual to LLC include:

- The title indicating the nature of the deed.

- Identification of the grantor and grantee.

- A legal description of the property.

- The consideration amount for the transfer.

- Grantor's signature and date.

- Notary acknowledgment section for legal validation.

Common mistakes to avoid when using this form

When filling out the New York Warranty Deed, be mindful of the following common mistakes:

- Failing to provide an accurate legal description of the property.

- Not having the document notarized, which is essential for its validity.

- Missing signing the document where indicated.

- Using incorrect names or entities for the grantor and grantee.

Form popularity

FAQ

Creating an LLC for your rental property is a smart choice as a property owner. It reduces your liability risk, effectively separates your assets, and has the tax benefit of pass-through taxation.You can add unique bank accounts for each rental property.

The fees to file a New York quitclaim deed vary from county to county, but some of the fees are similar. As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

Does LLC ownership count as time used as a primary residence? For a single-member LLC, the answer is typically yes. For example, if the house is owned by an LLC. The Treasury Regulations allow for the capital gains exclusion when title is held by a single-member disregarded entity.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

To change the deed in New York City, as we discussed, we will need a deed signed and notorized by the grantor. Additionally, the deed must also be filed and recorded with the Office of the City Register along with transfer documents which identify if any taxes are due.

To change the deed in New York City, as we discussed, we will need a deed signed and notorized by the grantor. Additionally, the deed must also be filed and recorded with the Office of the City Register along with transfer documents which identify if any taxes are due.