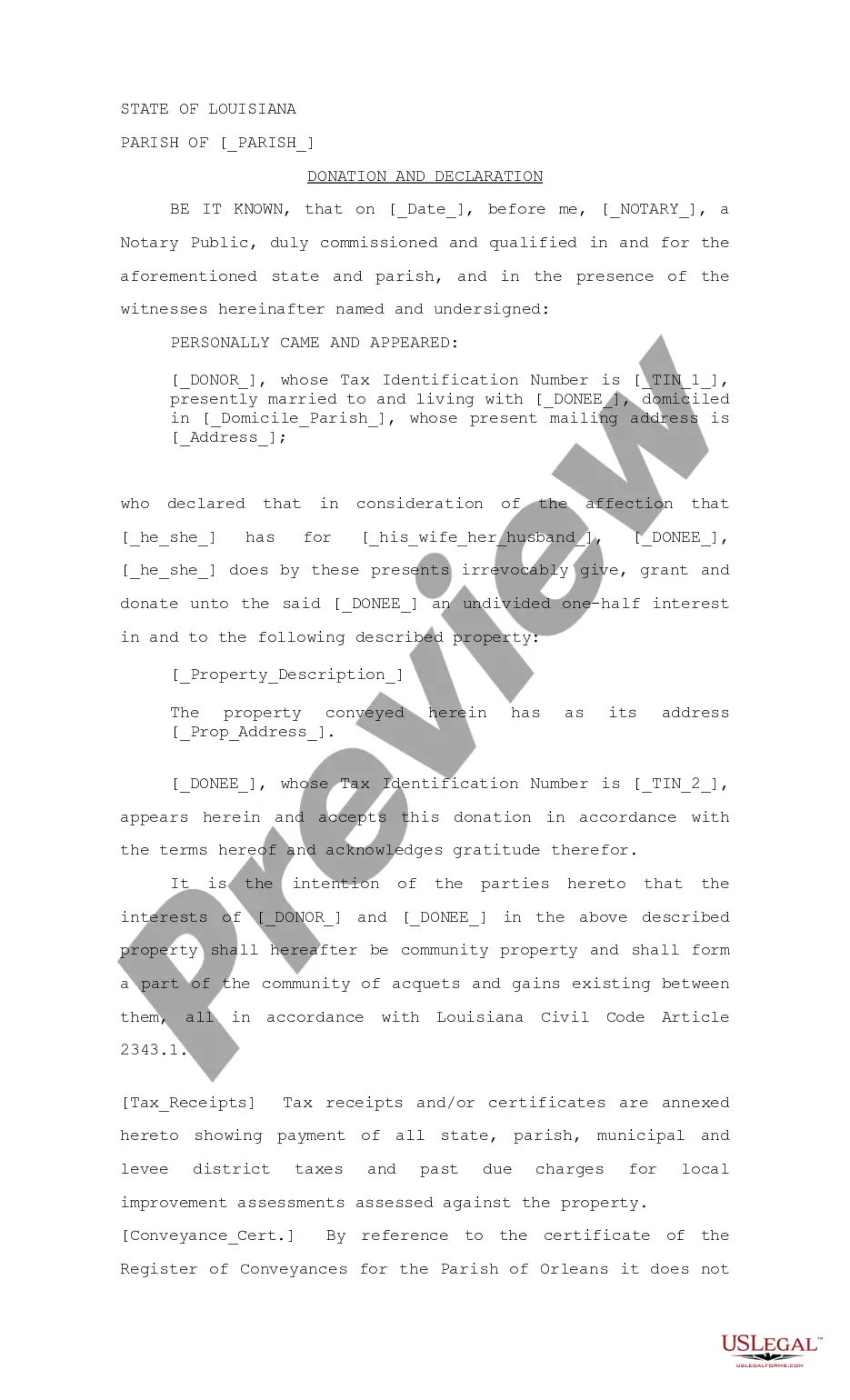

Louisiana Recognitive Act and Act of Donation

Description

How to fill out Louisiana Recognitive Act And Act Of Donation?

Locating Louisiana Recognition Act and Donation Agreement templates and completing them could pose a challenge.

To conserve significant time, expenses, and effort, utilize US Legal Forms to discover the appropriate example specifically tailored for your state within a few clicks.

Our lawyers prepare all documents, allowing you to simply fill them in. It's truly effortless.

Choose your plan on the pricing page and create an account. Select whether you would like to pay by credit card or through PayPal. Download the form in your preferred file format. You can now print the Louisiana Recognition Act and Donation Agreement template or complete it using any online editor. There's no need to worry about errors since your sample can be used and submitted, as well as printed multiple times. Explore US Legal Forms for access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to download the sample.

- All your downloaded samples are stored in My documents and are accessible at all times for future use.

- If you haven't subscribed yet, you need to sign up.

- Review our detailed guidelines on how to obtain your Louisiana Recognition Act and Donation Agreement sample in just a few minutes.

- To acquire a qualified example, verify its relevance for your state.

- Examine the sample using the Preview feature (if it's available).

- If there's a description, read it to understand the details.

- Click Buy Now if you found what you’re looking for.

Form popularity

FAQ

Get a lien release (if necessary) Get the gifter's signature on the title notarized. Complete a Vehicle Application form. Complete and notarize an Act of Donation of a Movable form.

Act of Donation Forms LouisianaAct of Donation. To donate a thing or right to another person is to transfer such thing or right to another person without an exchange or payment. In other words it is the giving of something to another without receiving anything of value in return.

The gift cannot ever be revoked nor can you later ask for financial compensation. Disadvantages of a Gift Deed? Usually a Gift Deed is used to transfer property between family members. As a result, the transaction may be subject to coercion or fraud.

In Louisiana, giving away some of your surplus to a friend, relative or charitable organization is a simple matter of completing a form called an Act of Donation and having it notarized. The process is relatively quick and easy, but it does have potential tax implications.

Secure.actblue.com. ActBlue is an American nonprofit technology organization established in June 2004 that enables left-leaning nonprofits, Democratic candidates, and progressive groups to raise money from individual donors on the Internet by providing them with online fundraising software.

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases.

You can make sure that your donation is to a charity and tax-deductible by looking up the organization in the IRS's Tax Exempt Organization Search. Check to see if the fundraiser and charity are registered with your state's charity regulator (if that's required in your state).

Salvation Army. When you think about where to donate unwanted belongings, your mind might go to Salvation Army first. Goodwill. AMVETS National Service Foundation. Habitat for Humanity. The Arc. Pickup Please. Furniture Bank Network. PickUpMyDonation.com.