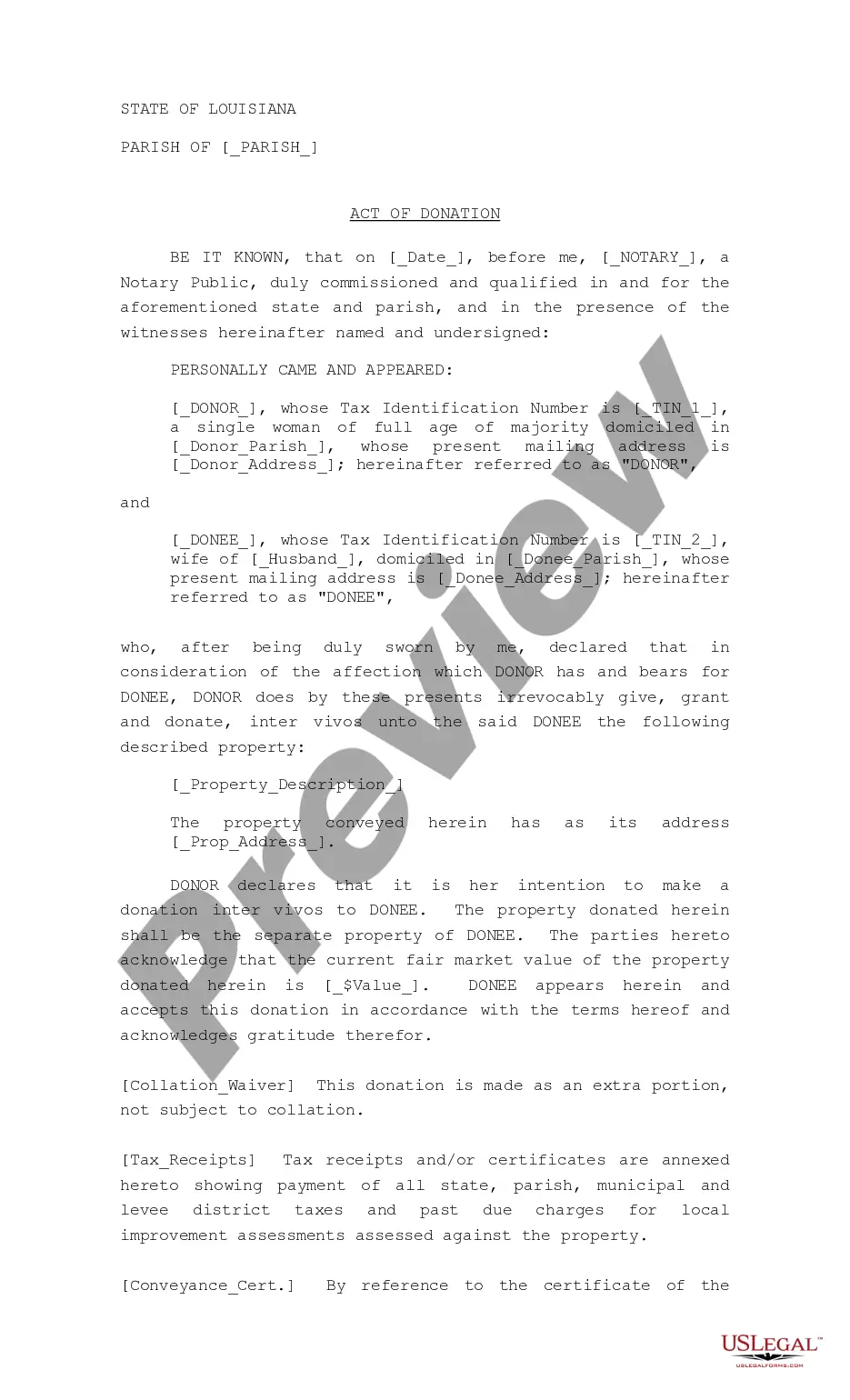

Louisiana Donation and Declaration

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Louisiana Donation And Declaration?

You are invited to the most important legal documents repository, US Legal Forms.

Here you can discover any template such as Louisiana Donation and Declaration forms and download them (as many as you wish/need).

Prepare official documents in a few hours, rather than days or even weeks, without spending a fortune on a lawyer.

If the template meets your needs, click Buy Now. To create your account, select a payment plan. Utilize a card or PayPal account to register. Download the file in your preferred format (Word or PDF). Print the document and fill it in with your or your business’s information. After you’ve finalized the Louisiana Donation and Declaration, send it to your attorney for verification. It’s an additional step but an essential one for ensuring you’re entirely secure. Register for US Legal Forms now and access a large number of reusable templates.

- Obtain your state-specific form in a few clicks and be assured with the knowledge that it was created by our licensed attorneys.

- If you’re already a subscribed member, just Log In to your account and then click Download next to the Louisiana Donation and Declaration you need.

- Since US Legal Forms is online-based, you’ll consistently have access to your saved templates, regardless of the device you’re using.

- Check them in the My documents section.

- If you don't possess an account yet, what are you waiting for.

- Follow our guidelines below to get going.

- If this is a state-specific document, verify its relevance in the state where you reside.

- Examine the description (if available) to determine if it’s the suitable template.

Form popularity

FAQ

Act of Donation Forms LouisianaAct of Donation. To donate a thing or right to another person is to transfer such thing or right to another person without an exchange or payment. In other words it is the giving of something to another without receiving anything of value in return.

To claim tax deductible donations on your taxes, you must itemize on your tax return by filing Schedule A of IRS Form 1040 or 1040-SR. For the 2020 tax year, there's a twist: you can deduct up to $300 of cash donations without having to itemize. This is called an "above the line" deduction.

In Louisiana, giving away some of your surplus to a friend, relative or charitable organization is a simple matter of completing a form called an Act of Donation and having it notarized. The process is relatively quick and easy, but it does have potential tax implications.

Charitable donations go on line 40 of your Form 1040 tax return along with all your other itemized deductions.

Essentially, the main takeaway of the letter is that donations are only taxable income if donors receive something in exchange for their donation, such as a service or product. If not, they're non-taxable giftsat least if you're a private individual and not a business.

You can deduct donations you make to qualified charities. This can reduce your taxable income, but to claim the donations, you have to itemize your deductions. Claim your charitable donations on Form 1040, Schedule A.

TYPES OF DONATIONS There are four ways to donate: plasma, platelets, red cells, and whole blood. Those different components in our blood have many uses. During and after a donation, we are able to separate those components, to give a recipient exactly what they need.

Transitive verb. 1 : to make a gift of especially : to contribute to a public or charitable cause.

Salutation. Explanation of your mission. Your project, event, or needs. Compelling details. A specific request. A call-to-action.