Louisiana Donation and Declaration

What this document covers

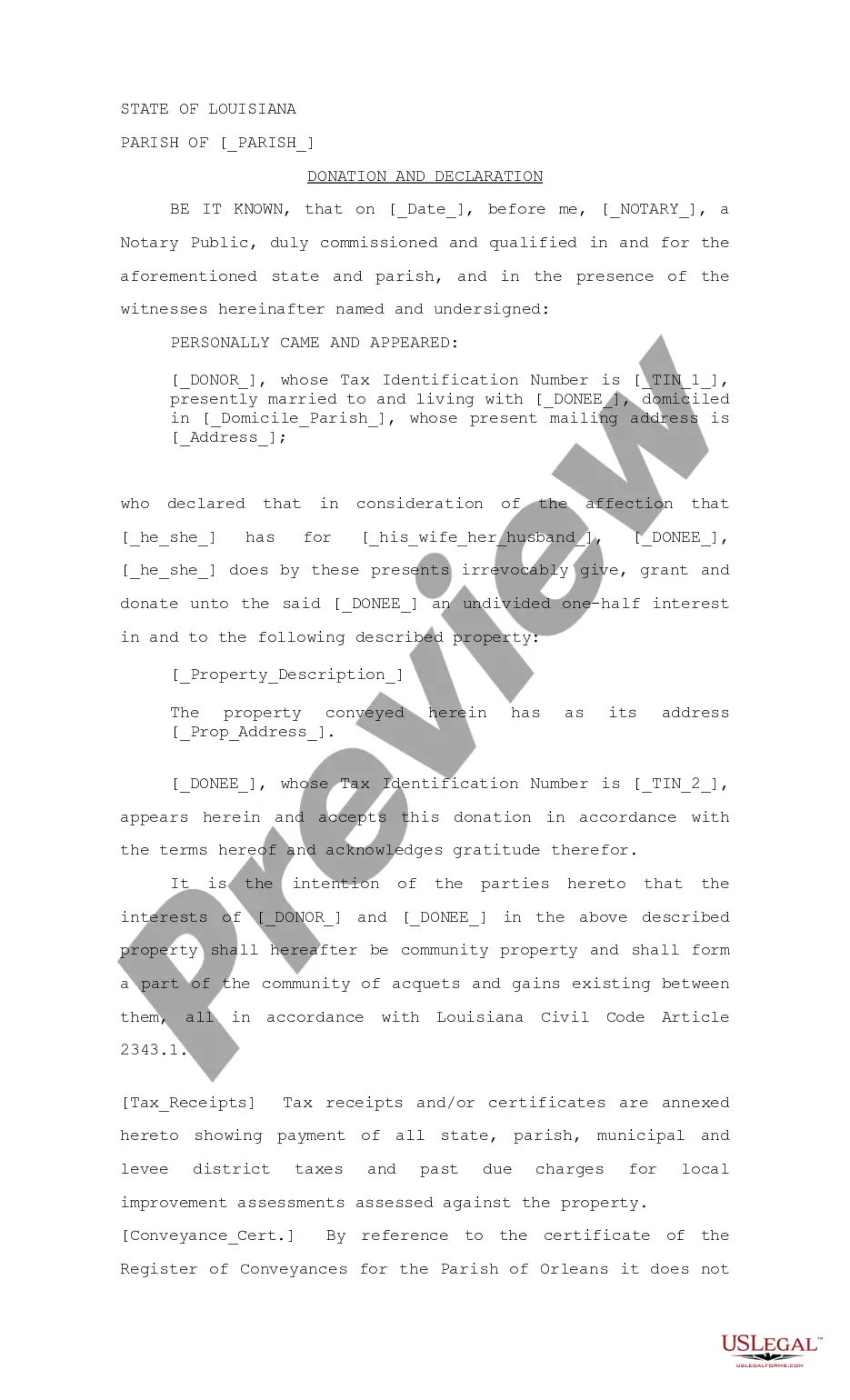

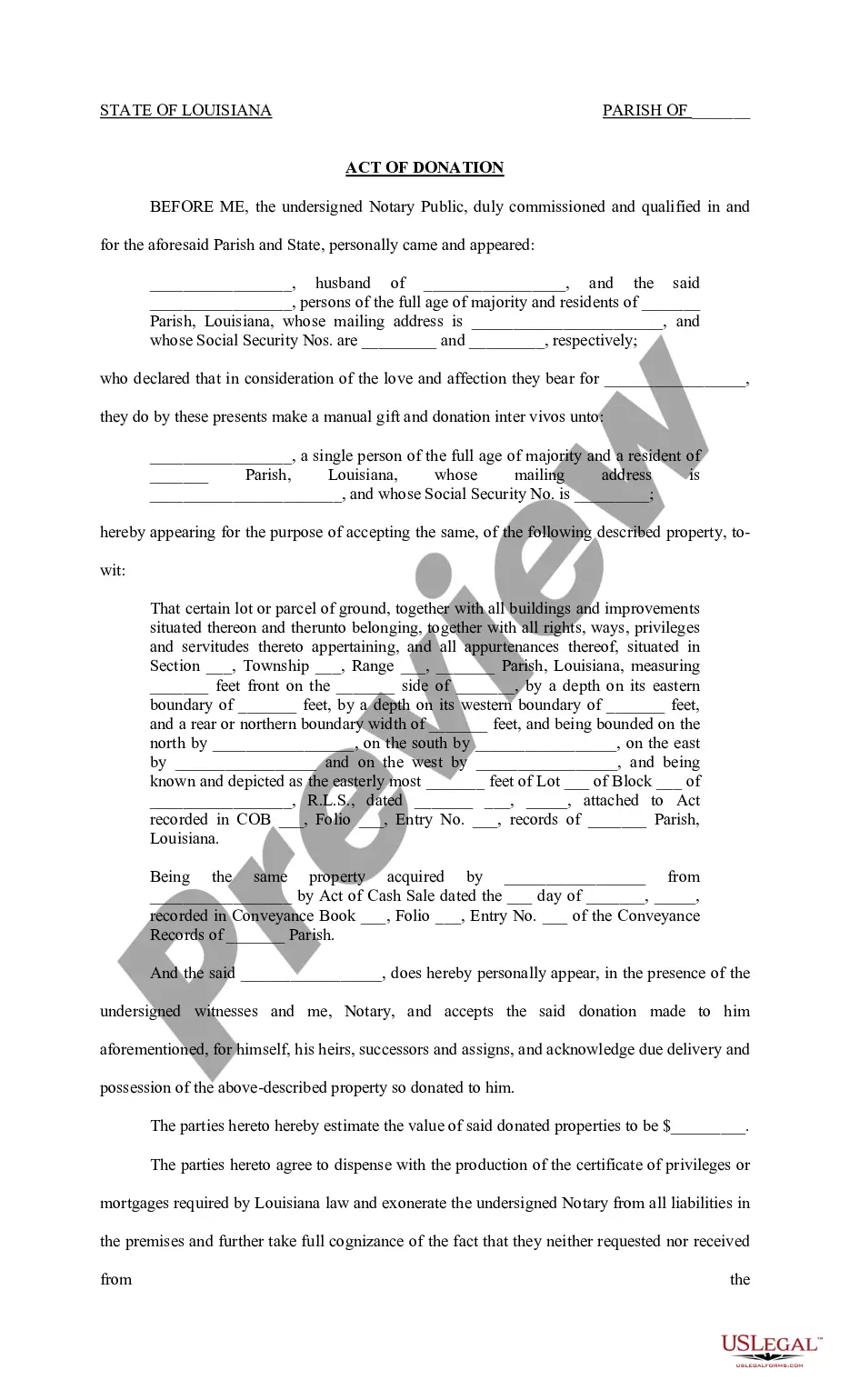

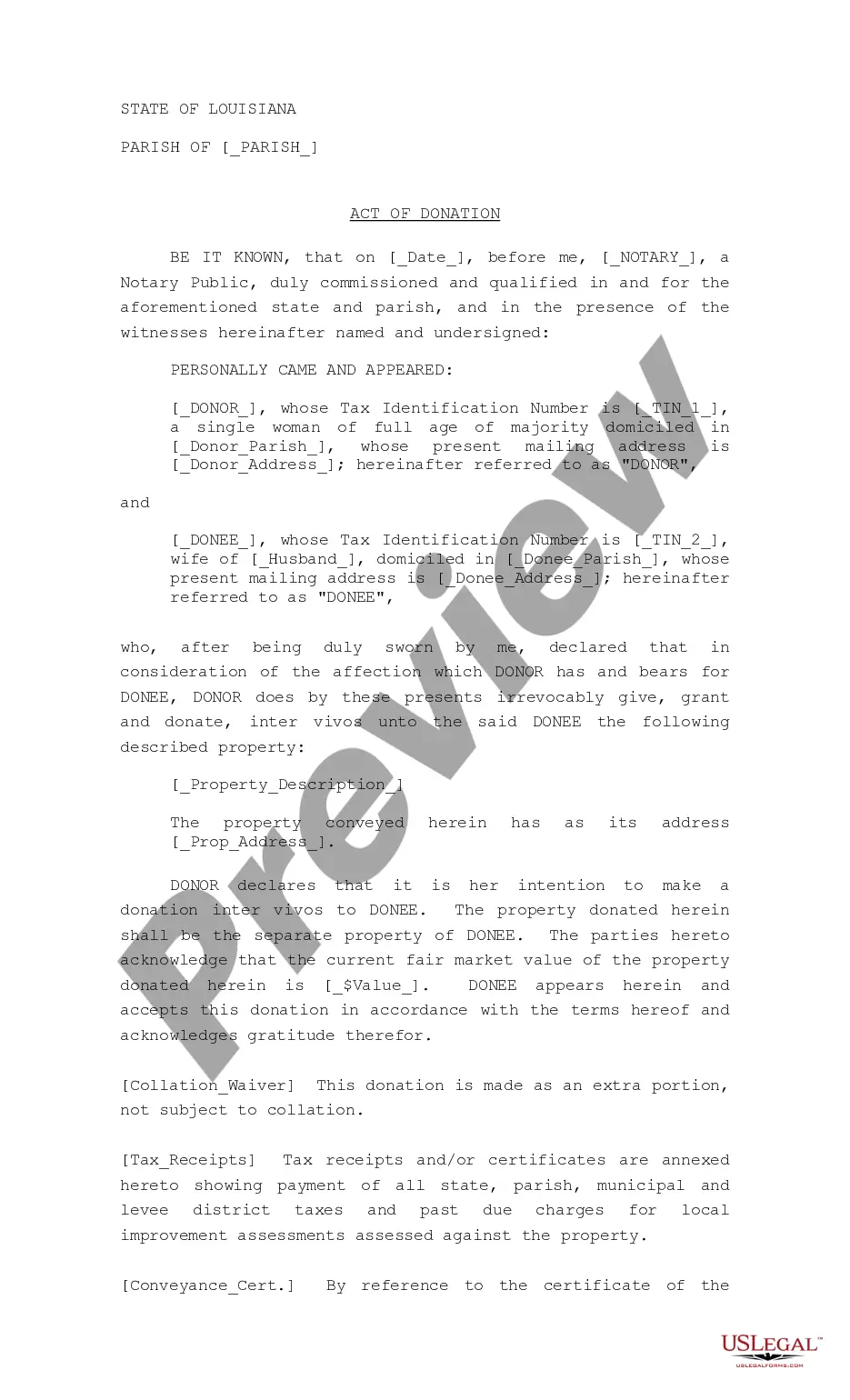

The Donation and Declaration form is a legal document wherein one spouse irrevocably donates an undivided one-half interest in an item of their separate property to the other spouse. This form also includes a declaration that the spouses' interests in the property will be treated as community property, in accordance with Louisiana Civil Code Article 2343.1. It differs from other donation forms by specifically addressing the conversion of separate property into community property between spouses.

What’s included in this form

- Identification of the donor and donee, including their tax identification numbers.

- Details of the property being donated, along with its description and address.

- Declaration of intention for the property to be classified as community property.

- Inclusion of tax receipts confirming payment of any taxes related to the property.

- Witness signatures and notarization section for legal validation.

Common use cases

This form is used when one spouse wants to donate part of their separate property to the other. It is particularly relevant in Louisiana, where such transfers can affect property classification and rights in marital property. Use this form to ensure that both spouses understand the implications of converting separate property into community property.

Who can use this document

- Married individuals wishing to transfer ownership interest in property to their spouse.

- Couples seeking to clarify their property rights and asset classification.

- Those needing a legal record of the donation for future reference or legal purposes.

Instructions for completing this form

- Identify and enter the names of the donor and donee, along with their tax identification numbers.

- Specify the date of the donation and the parish of execution.

- Describe the property being donated, including its address and any necessary details.

- Include information regarding tax receipts and the certificate of conveyance as required.

- Ensure both spouses sign the form in the presence of witnesses and a notary public.

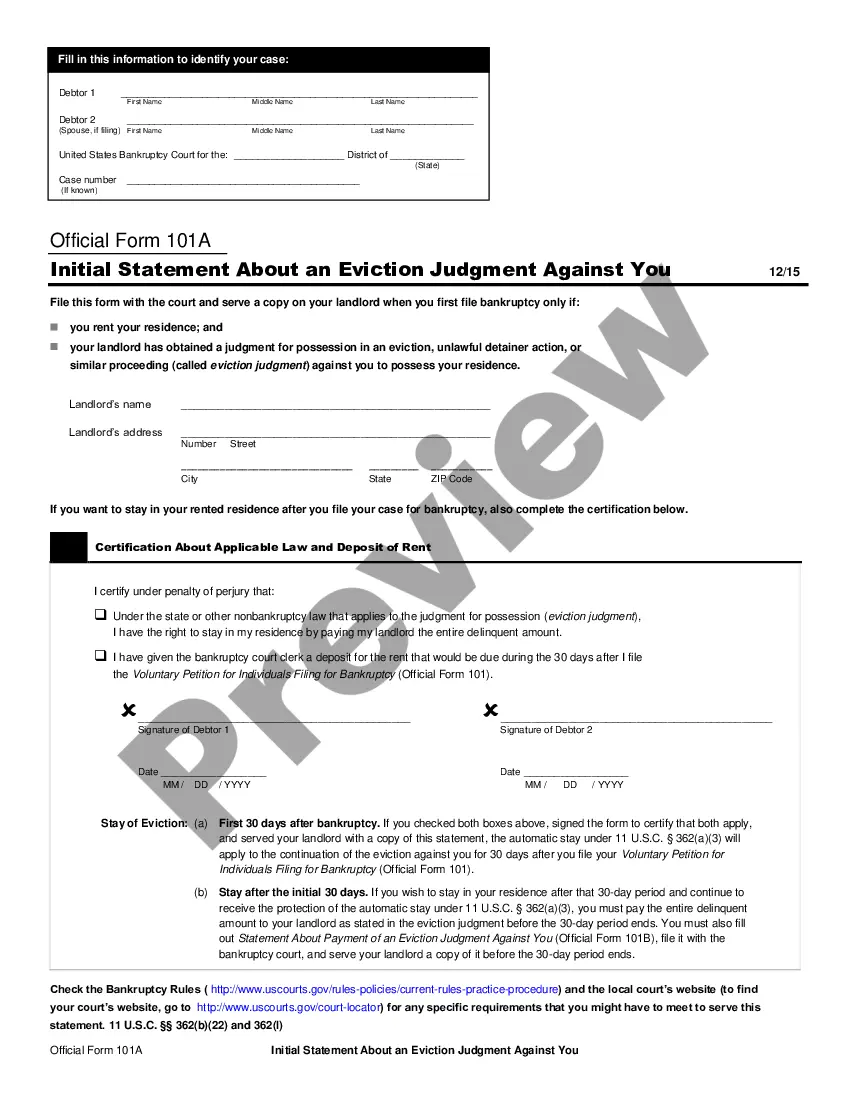

Does this form need to be notarized?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Not including accurate property descriptions, which can lead to legal disputes.

- Failing to include necessary tax receipts/documentation.

- Omitting signatures from witnesses or the notary public, making the document invalid.

Benefits of using this form online

- Immediate access to a professionally drafted legal form, reducing preparation time.

- Editable templates that allow users to customize their information easily.

- Secure download enables users to keep a permanent record of their donations.

Looking for another form?

Form popularity

FAQ

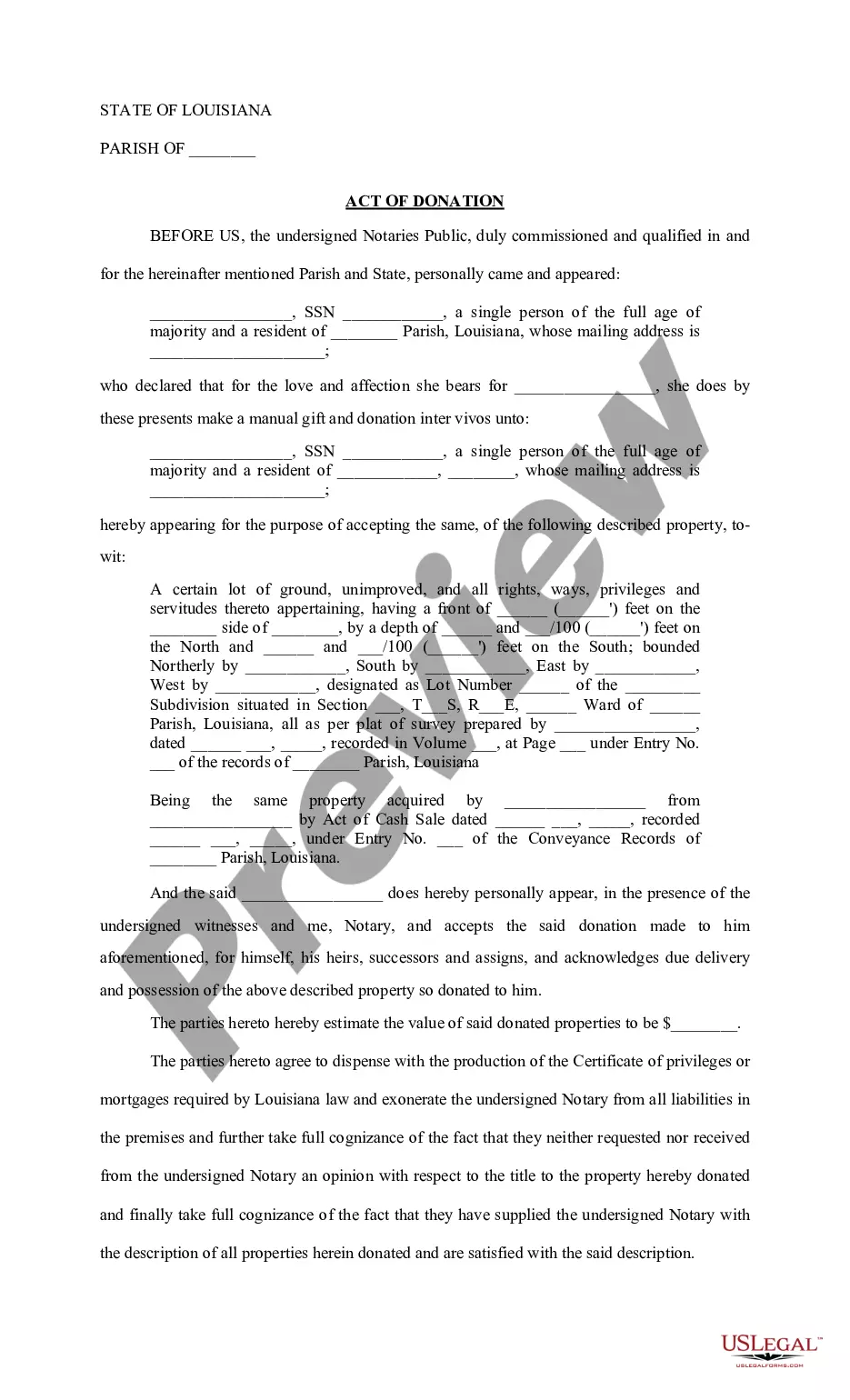

Act of Donation Forms LouisianaAct of Donation. To donate a thing or right to another person is to transfer such thing or right to another person without an exchange or payment. In other words it is the giving of something to another without receiving anything of value in return.

To claim tax deductible donations on your taxes, you must itemize on your tax return by filing Schedule A of IRS Form 1040 or 1040-SR. For the 2020 tax year, there's a twist: you can deduct up to $300 of cash donations without having to itemize. This is called an "above the line" deduction.

In Louisiana, giving away some of your surplus to a friend, relative or charitable organization is a simple matter of completing a form called an Act of Donation and having it notarized. The process is relatively quick and easy, but it does have potential tax implications.

Charitable donations go on line 40 of your Form 1040 tax return along with all your other itemized deductions.

Essentially, the main takeaway of the letter is that donations are only taxable income if donors receive something in exchange for their donation, such as a service or product. If not, they're non-taxable giftsat least if you're a private individual and not a business.

You can deduct donations you make to qualified charities. This can reduce your taxable income, but to claim the donations, you have to itemize your deductions. Claim your charitable donations on Form 1040, Schedule A.

TYPES OF DONATIONS There are four ways to donate: plasma, platelets, red cells, and whole blood. Those different components in our blood have many uses. During and after a donation, we are able to separate those components, to give a recipient exactly what they need.

Transitive verb. 1 : to make a gift of especially : to contribute to a public or charitable cause.

Salutation. Explanation of your mission. Your project, event, or needs. Compelling details. A specific request. A call-to-action.