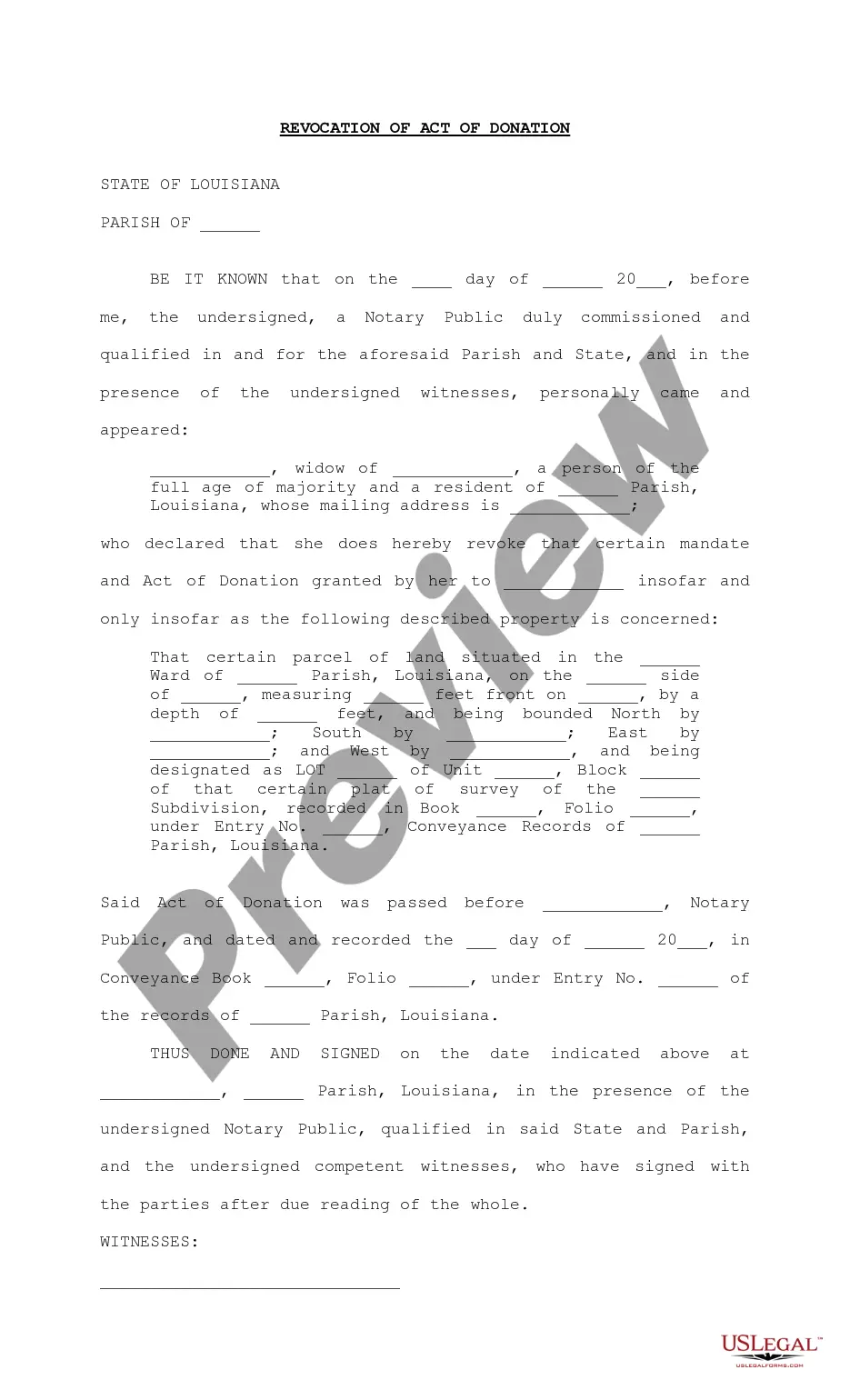

Louisiana Revocation of Act of Donation

Description

How to fill out Louisiana Revocation Of Act Of Donation?

Seeking a sample for the Louisiana Revocation of Act of Donation and completing it can be difficult.

To conserve substantial time, expenses, and effort, utilize US Legal Forms to find the appropriate example specifically for your state with just a few clicks.

Every document is prepared by our attorneys, so you only need to complete them. It really is that simple.

Once completed, you can print out the Louisiana Revocation of Act of Donation template or fill it in using any online editor. Don’t stress about typographical errors, as your template can be used, submitted, and printed as many times as you wish. Explore US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and go back to the form's page to save the sample.

- All downloaded templates are stored in My documents and are available at any time for future use.

- If you haven't subscribed yet, you need to sign up.

- Review our comprehensive instructions on how to obtain your Louisiana Revocation of Act of Donation sample in a matter of minutes.

- To acquire a valid example, verify its applicability for your state.

- Examine the sample using the Preview option (if it's provided).

- If there's an explanation, read it to grasp the essential points.

- Click on the Buy Now button if you found what you need.

Form popularity

FAQ

Filling out an act of donation form in Louisiana involves several steps to ensure your intentions are clear and legally binding. Start by providing detailed information about the donor and the recipient, including names and addresses. Make sure to outline the specifics of the donated property, as accuracy is crucial in the context of the Louisiana Revocation of Act of Donation. Utilizing a platform like US Legal Forms can simplify this process, offering templates and additional resources to guide you in completing the form correctly.

CC art 1468 A donation inter vivos (between living persons) is an act by which the donor divests himself, at present and irrevocably, of the thing given, in favor of the donee who accepts it. CC art. 1468 is not complete. A donation inter vivos is revocable for cause. It is not revocable at will.

A donation is deemed valid as long as it complies with the requirement provided by law.The acceptance may be made in the same deed of donation or in a separate public document, but it shall not take effect unless it is done during the lifetime of the donor.

1. To qualify as a deduction from taxable income, a charitable donation cannot be in payment for goods or services. Therefore, there is generally no basis for a donor to request a refund of a donation. To make an exception for one donor can disqualify the deductability of donations from other donors.

Act of Donation Forms LouisianaAct of Donation. To donate a thing or right to another person is to transfer such thing or right to another person without an exchange or payment. In other words it is the giving of something to another without receiving anything of value in return.

DONATION INTER Vivos, contracts. A contract which takes place by the mutual consent, of the giver, who divests himself of the thing given in order to transmit the title of it to the donee gratuitously, and the donee, who accepts the thing and acquires a legal title to it.

Inter vivos is Latin for between the living. An inter vivos gift is a legal term that refers to a transfer or gift given to someone while both the giver and the receiver are alive. An inter vivos gift is the opposite of a testamentary transfer, which is a gift given after death.

The gift cannot ever be revoked nor can you later ask for financial compensation. Disadvantages of a Gift Deed? Usually a Gift Deed is used to transfer property between family members. As a result, the transaction may be subject to coercion or fraud.

A simple or pure donation is one whose cause is pure liberality (no strings attached), while an onerous donation is one which is subject to burdens, charges or future services equal to or more in value than the thing donated.