Louisiana Petition for Garnishment under Writ of Fieri Facias, with Interrogatories and Request for Rendition of Interlocutory Orders or Judgments

Description

Key Concepts & Definitions

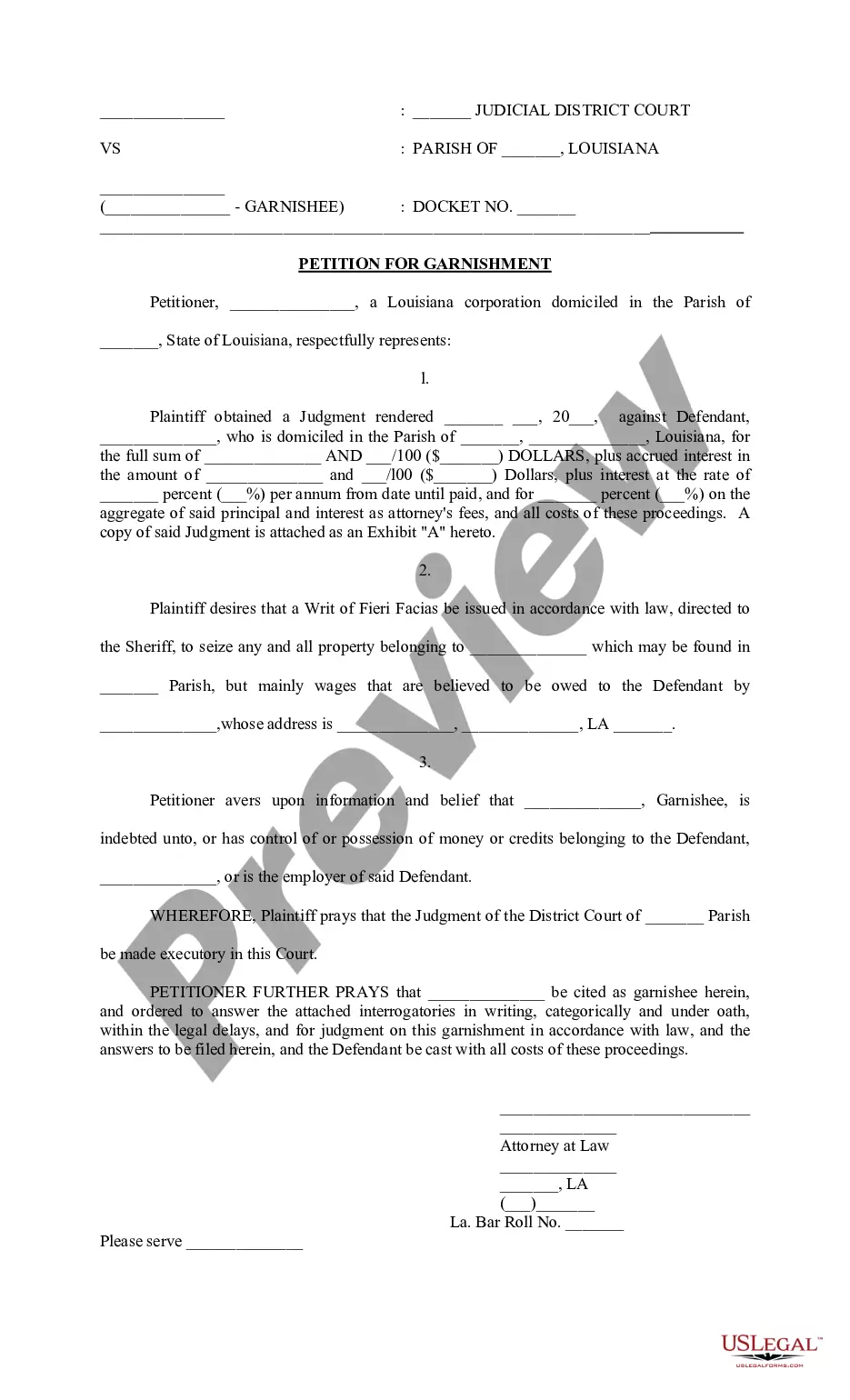

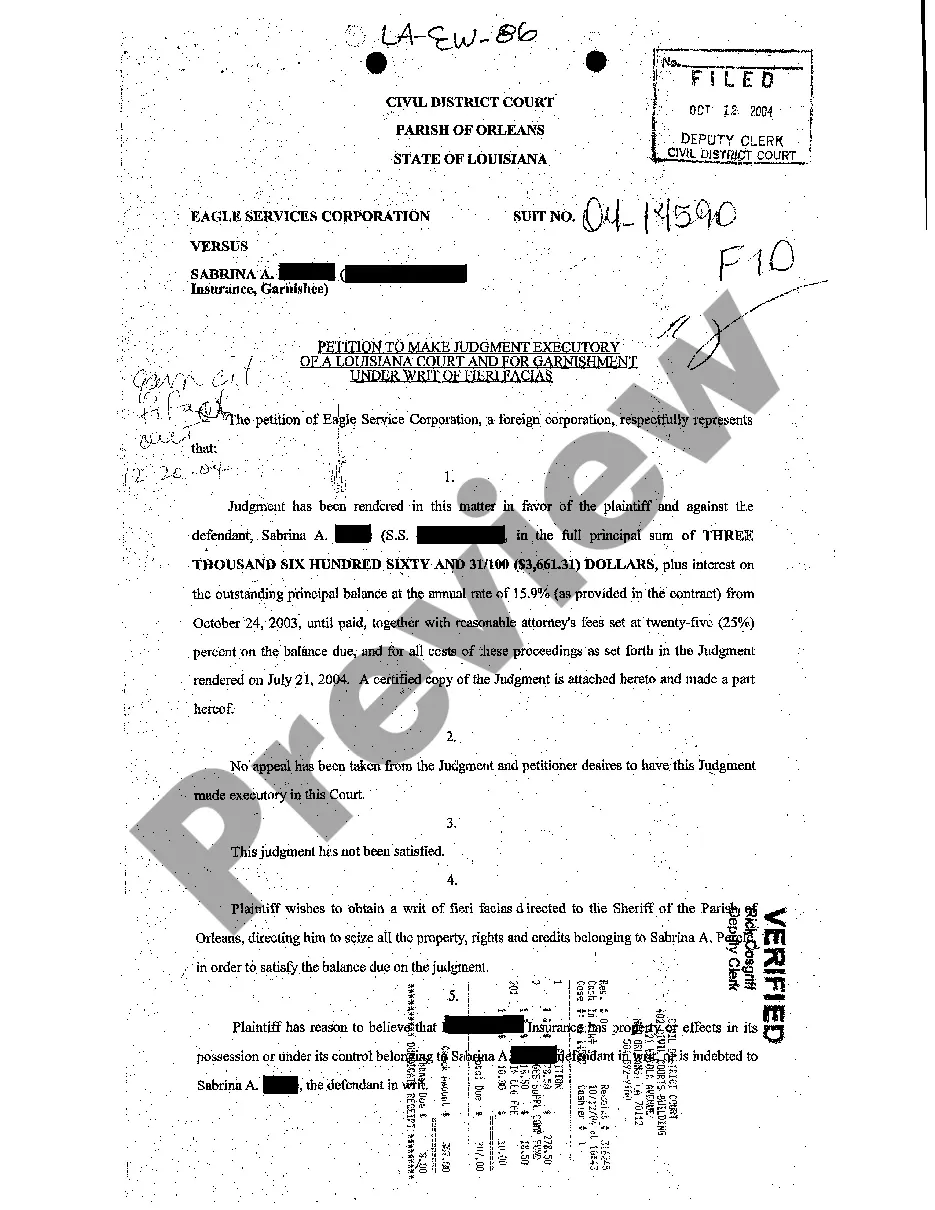

Petition for Garnishment Under Writ of Fieri Facias: This is a legal mechanism used to enforce a judgment to pay a debt by seizing the debtor's property in the United States. The writ of fieri facias is a court order that enables a creditor to garnish wages or bank accounts after a court judgment.

Step-by-Step Guide

- Obtain the Judgment: Secure a court judgment against the debtor, confirming they owe the debt.

- Apply for a Writ of Fieri Facias: This step involves filling out a form, typically at the courthouse, asking the court to issue a writ based on the judgment.

- File a Petition for Garnishment: After obtaining the writ, you must file a petition for garnishment, detailing how much is owed and identifying the debtor's assets or wages to be garnished.

- Serve the Garnishment: The petition must then be legally served to the debtor and the institution holding their assets (e.g., their employer or bank).

- Follow Legal Procedures: Ensure all local and state laws are strictly followed during the garnishment process to avoid legal repercussions.

Risk Analysis

- Legal Repercussions: Incorrect filing or failing to follow proper procedures can lead to penalties or the dismissal of your case.

- Financial Risks: There are costs associated with filing the necessary legal documents, and there's no guarantee of recovering the full amount owed due to debtor insolvency.

- Reputational Damage: Aggressive garnishment actions can lead to negative public perceptions or damage relationships with the debtor.

Best Practices

- Seek Legal Advice: Consult with a lawyer specializing in debt collection to navigate the complexities of garnishment laws.

- Documentation: Keep meticulous records of all communications and transactions related to the garnishment.

- Compliance: Familiarize yourself with state-specific garnishment laws to ensure compliance.

Common Mistakes & How to Avoid Them

- Inadequate Documentation: Always keep detailed records of the judgment and subsequent legal steps.

- Failing to Follow Specific State Laws: Each state has variations in their garnishment laws; failing to adhere to these can result in unsuccessful garnishment petitions.

- Ignoring Debtor's Rights: Ignoring exemptions and other protections can lead to legal challenges against the garnishment.

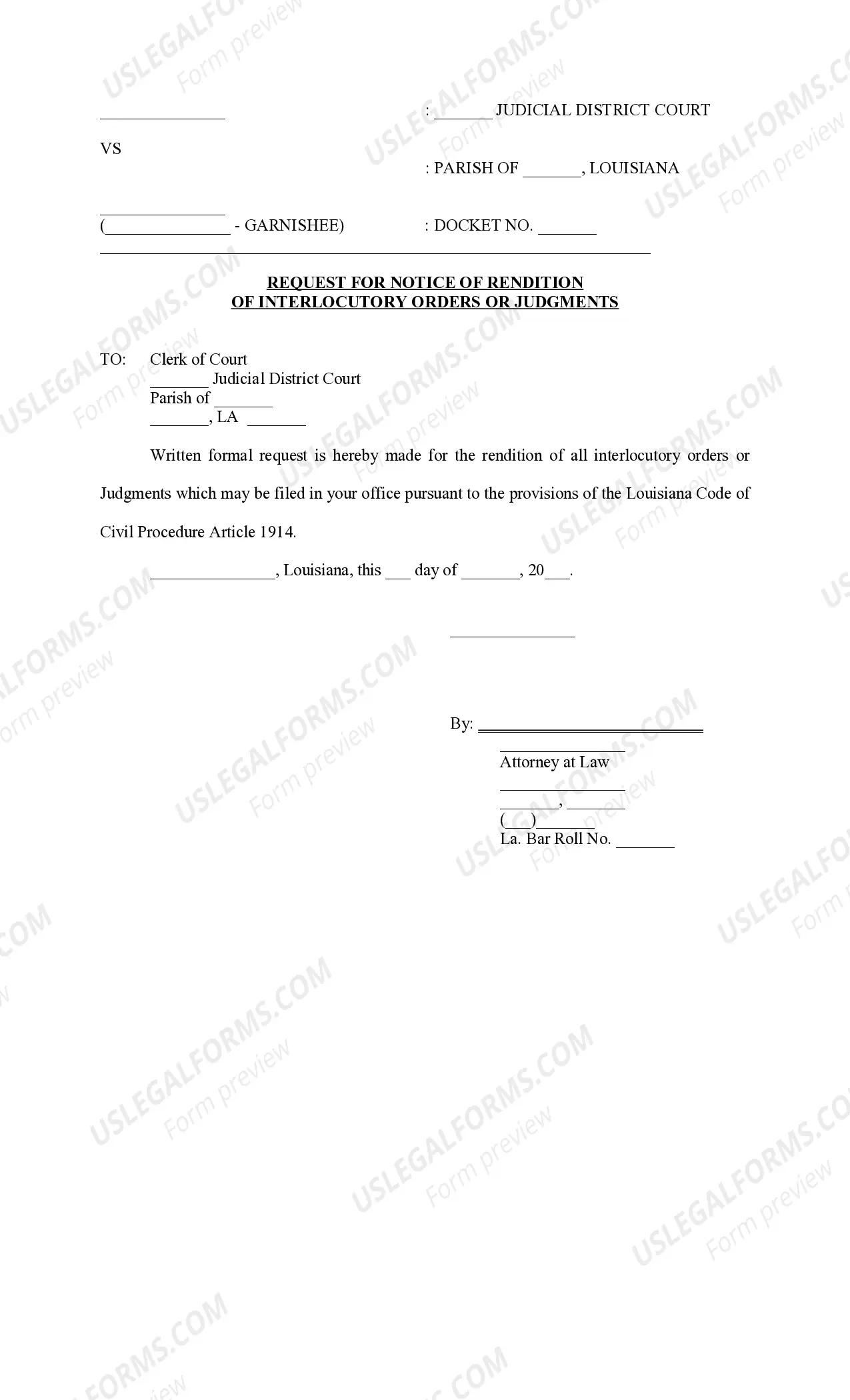

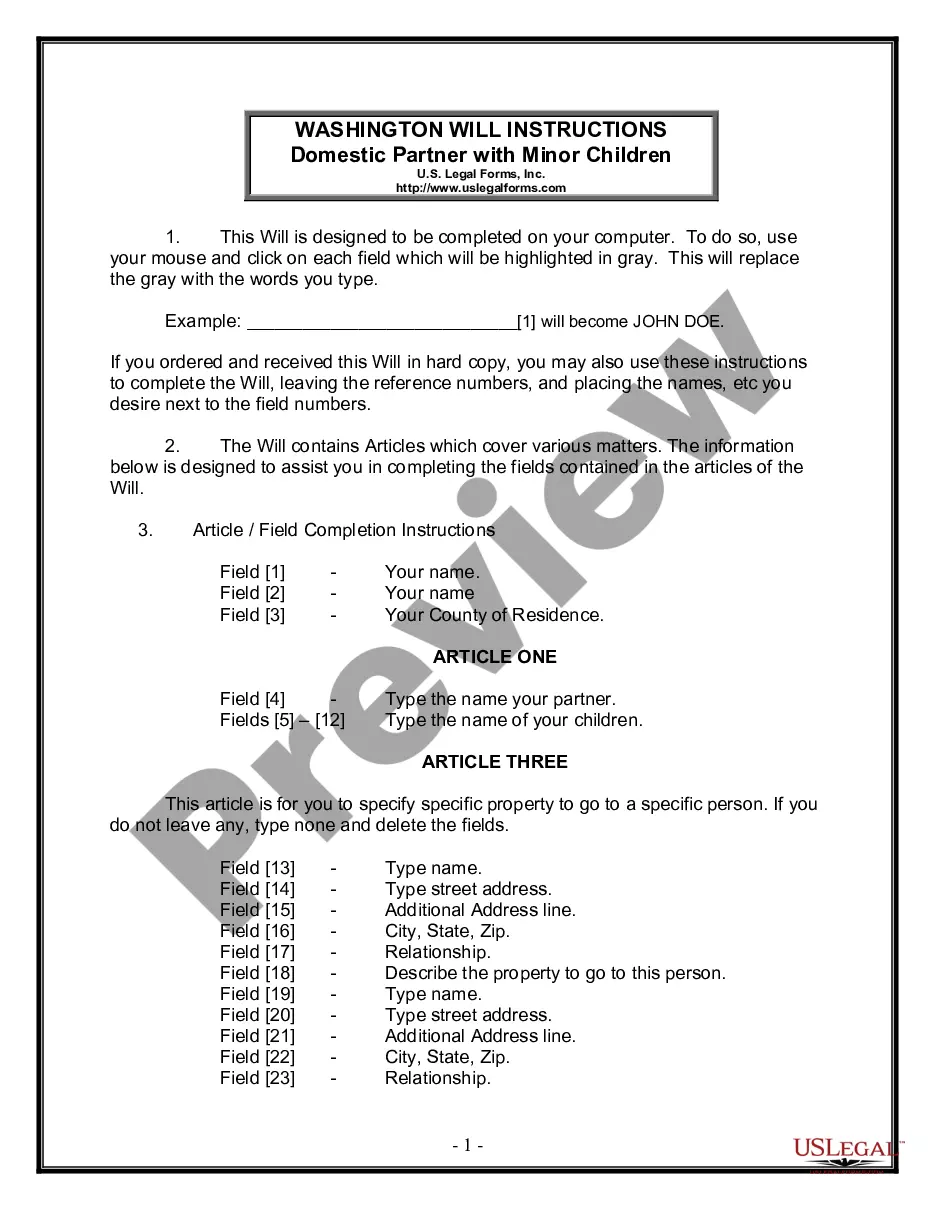

How to fill out Louisiana Petition For Garnishment Under Writ Of Fieri Facias, With Interrogatories And Request For Rendition Of Interlocutory Orders Or Judgments?

Searching for Louisiana Petition for Garnishment under Writ of Fieri Facias, including Interrogatories and Request for Rendition of Interlocutory Orders or Judgments template and completing them can be difficult.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the accurate template specifically for your state in just a few clicks.

Our legal experts prepare each document meticulously, so you only need to fill them in. It truly is that easy.

Click Buy Now if you have found what you are looking for. Select your payment plan on the pricing page and create your account. Choose your payment method via credit card or PayPal. Download the form in your preferred file format. You can now print the Louisiana Petition for Garnishment under Writ of Fieri Facias, with Interrogatories and Request for Rendition of Interlocutory Orders or Judgments form or complete it using any online editor. Don’t worry about typos because your sample can be utilized and submitted, and printed as many times as you desire. Try out US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to retrieve the document.

- All your saved templates are kept in My documents and can be accessed at any time for future use.

- If you are not yet subscribed, you will need to register.

- Review our comprehensive guidelines on how to acquire your Louisiana Petition for Garnishment under Writ of Fieri Facias, with Interrogatories and Request for Rendition of Interlocutory Orders or Judgments template in just a few moments.

- To obtain a suitable example, check its relevance for your state.

- Examine the sample using the Preview option (if it’s available).

- Read the description to understand the details if provided.

Form popularity

FAQ

What you can do about wage garnishment.You have to be legally notified of the garnishment. You can file a dispute if the notice has inaccurate information or you believe you don't owe the debt. Some forms of income, such as Social Security and veterans benefits, are exempt from garnishment as income.

The Order dissolves the existing writ of garnishment. It means that whatever was being garnished, wages or bank accounts, are no longer subject to the writ of garnishment.

The creditor must serve the Writ of Garnishment on the garnishee via certified mail, restricted delivery, private process, or sheriff/constable. For more information on service of process see Frequently Asked Questions about Service.

You do this by filing a Claim of Exemption with the court and mailing it to the judgment creditor, the sheriff or constable who served the collection paperwork, and any third party involved (such as your employer or bank). f063 Fill out the Claim of Exemption form completely.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

Identify The Funds Or Asset You Want To Collect. Prepare The Writ Of Execution. Prepare The Notice of Execution. Prepare The Writ Of Garnishment. Prepare Instructions To The Sheriff Or Constable. Have Your Papers Served And Watch For A Claim Of Exemption. Track Your Collection And Judgment.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

Wage garnishment can follow a debtor from job to job, but it requires separate court orders. This means a creditor will need to request the wage garnishment every time a person changes jobs.

Wage Garnishments Only Apply to the Employment Relationship In most situations, the creditor must first file a lawsuit, overcome any defenses the debtor may assert (many debtors simply default), and then obtain a Monetary Judgment in the exact amount of the debt due plus interest (both past and ongoing).