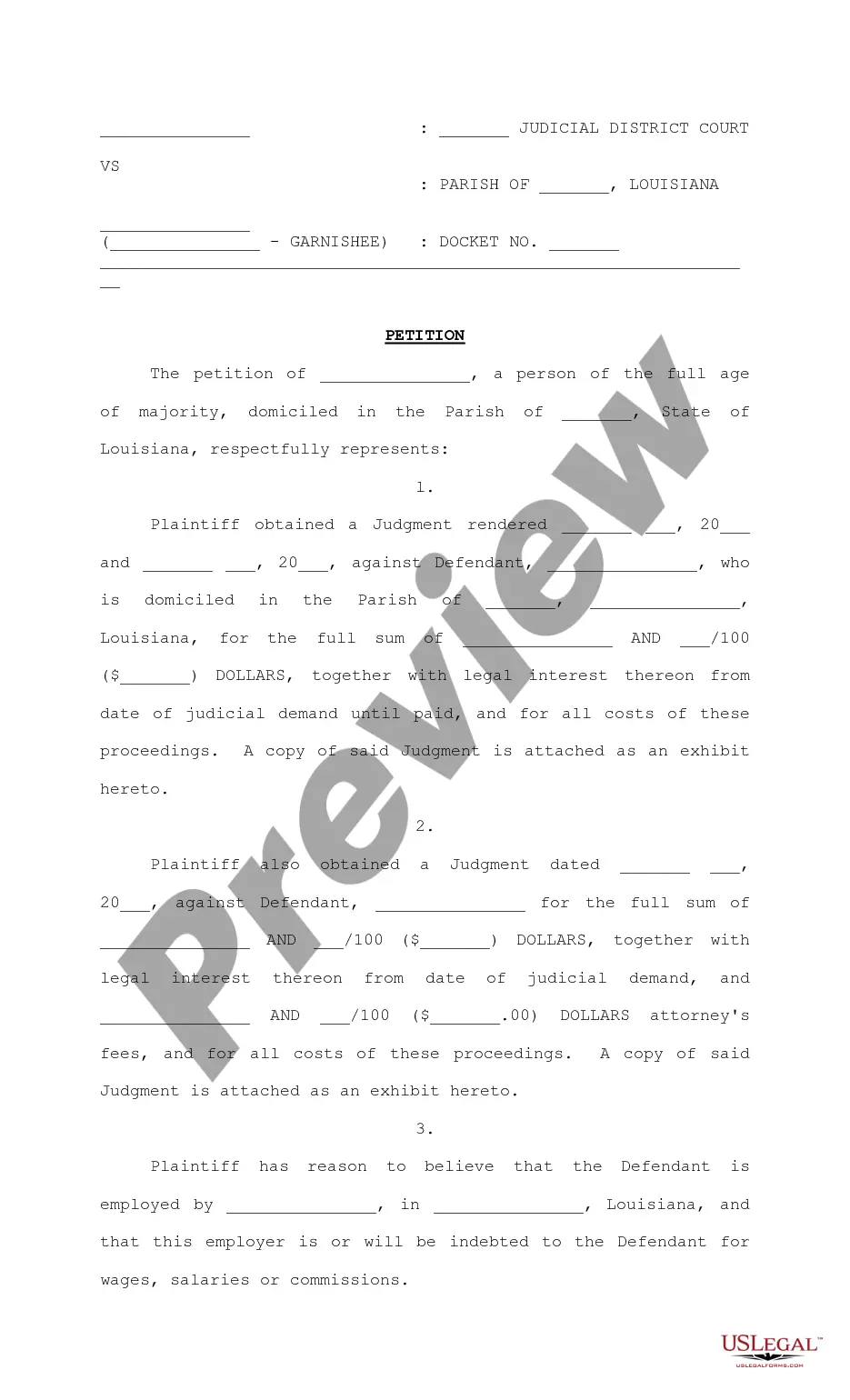

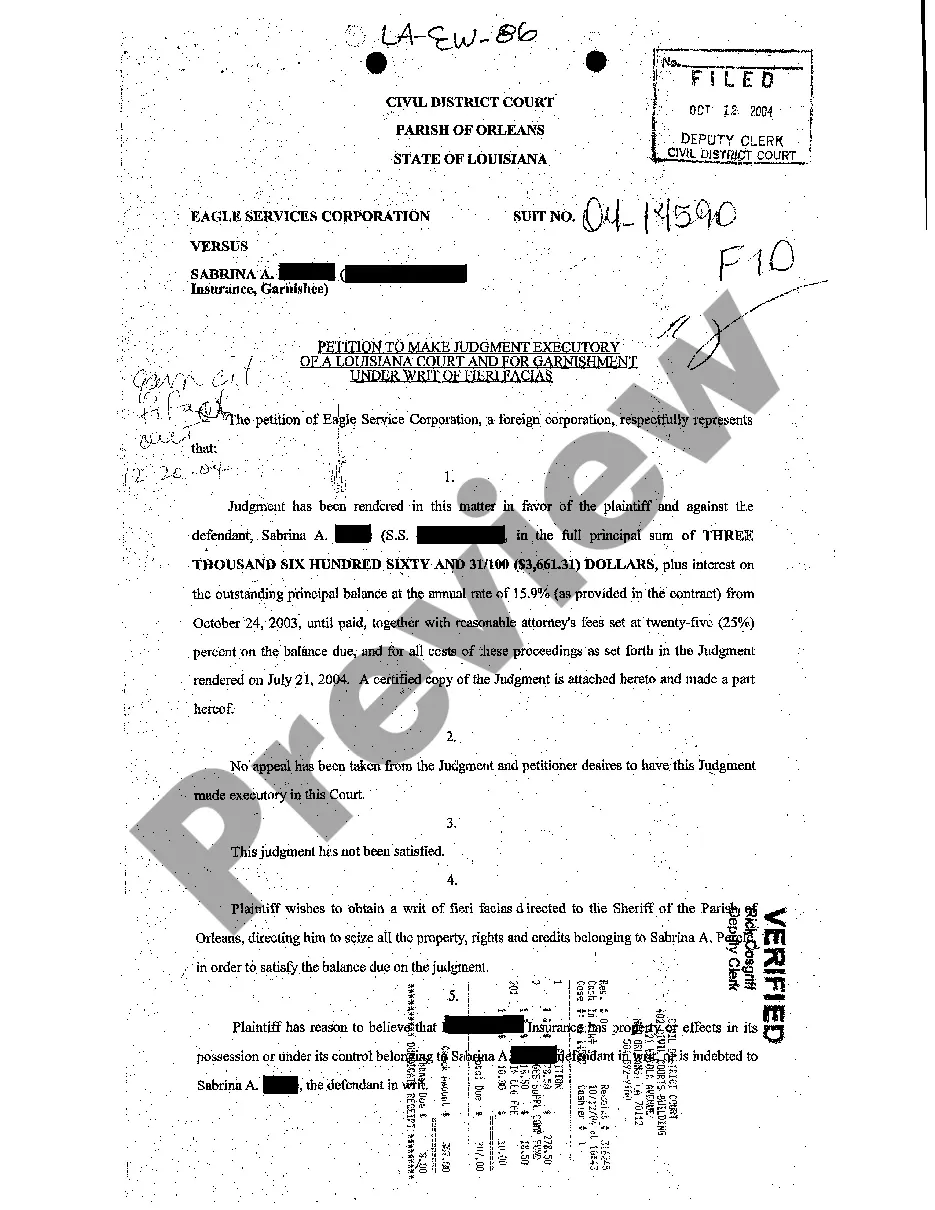

Louisiana Petition for Garnishment under Writ of Fieri Facias, with Interrogatories

Description

How to fill out Louisiana Petition For Garnishment Under Writ Of Fieri Facias, With Interrogatories?

Searching for Louisiana Petition for Garnishment under Writ of Fieri Facias, including Interrogatories example and completing them can pose a challenge.

To conserve time, money, and effort, utilize US Legal Forms and select the appropriate template specifically for your region in just a few clicks.

Our attorneys prepare all documents, so you only need to complete them. It really is that straightforward.

Select your payment method on the pricing page and set up your account. Choose how you want to pay, either by card or via PayPal. Download the document in your preferred file format. You can either print the Louisiana Petition for Garnishment under Writ of Fieri Facias, including Interrogatories template or fill it out using any online editor. Don’t be concerned about making errors as your sample can be used and submitted, and printed as many times as you need. Explore US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and navigate to the form's webpage to preserve the document.

- Your saved templates can be found in My documents and are accessible at any time for future use.

- If you haven't signed up yet, you should register.

- Review our comprehensive instructions on how to acquire your Louisiana Petition for Garnishment under Writ of Fieri Facias, including Interrogatories template in a matter of minutes.

- To obtain a valid sample, verify its relevance for your state.

- Examine the example using the Preview feature (if available).

- If there is a description, read it to understand the key aspects.

- Click Buy Now if you found what you're looking for.

Form popularity

FAQ

Article 2412 of the Louisiana Code of Civil Procedure outlines the procedures necessary for executing a judgment through garnishment. It enables creditors to attach a debtor's wages and accounts through a Louisiana Petition for Garnishment under Writ of Fieri Facias, with Interrogatories. This article specifies the required notices and responses involved, ensuring both creditors and debtors know their rights. You can rely on legal resources to interpret these complexities effectively.

Wage Garnishments Only Apply to the Employment Relationship In most situations, the creditor must first file a lawsuit, overcome any defenses the debtor may assert (many debtors simply default), and then obtain a Monetary Judgment in the exact amount of the debt due plus interest (both past and ongoing).

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

If you receive a notice of a wage garnishment order, you might be able to protect or "exempt" some or all of your wages by filing an exemption claim with the court or raising an objection.

The Order dissolves the existing writ of garnishment. It means that whatever was being garnished, wages or bank accounts, are no longer subject to the writ of garnishment.

You do this by filing a Claim of Exemption with the court and mailing it to the judgment creditor, the sheriff or constable who served the collection paperwork, and any third party involved (such as your employer or bank). f063 Fill out the Claim of Exemption form completely.

What you can do about wage garnishment.You have to be legally notified of the garnishment. You can file a dispute if the notice has inaccurate information or you believe you don't owe the debt. Some forms of income, such as Social Security and veterans benefits, are exempt from garnishment as income.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

The creditor must serve the Writ of Garnishment on the garnishee via certified mail, restricted delivery, private process, or sheriff/constable. For more information on service of process see Frequently Asked Questions about Service.