Louisiana Community Property Partition

Understanding this form

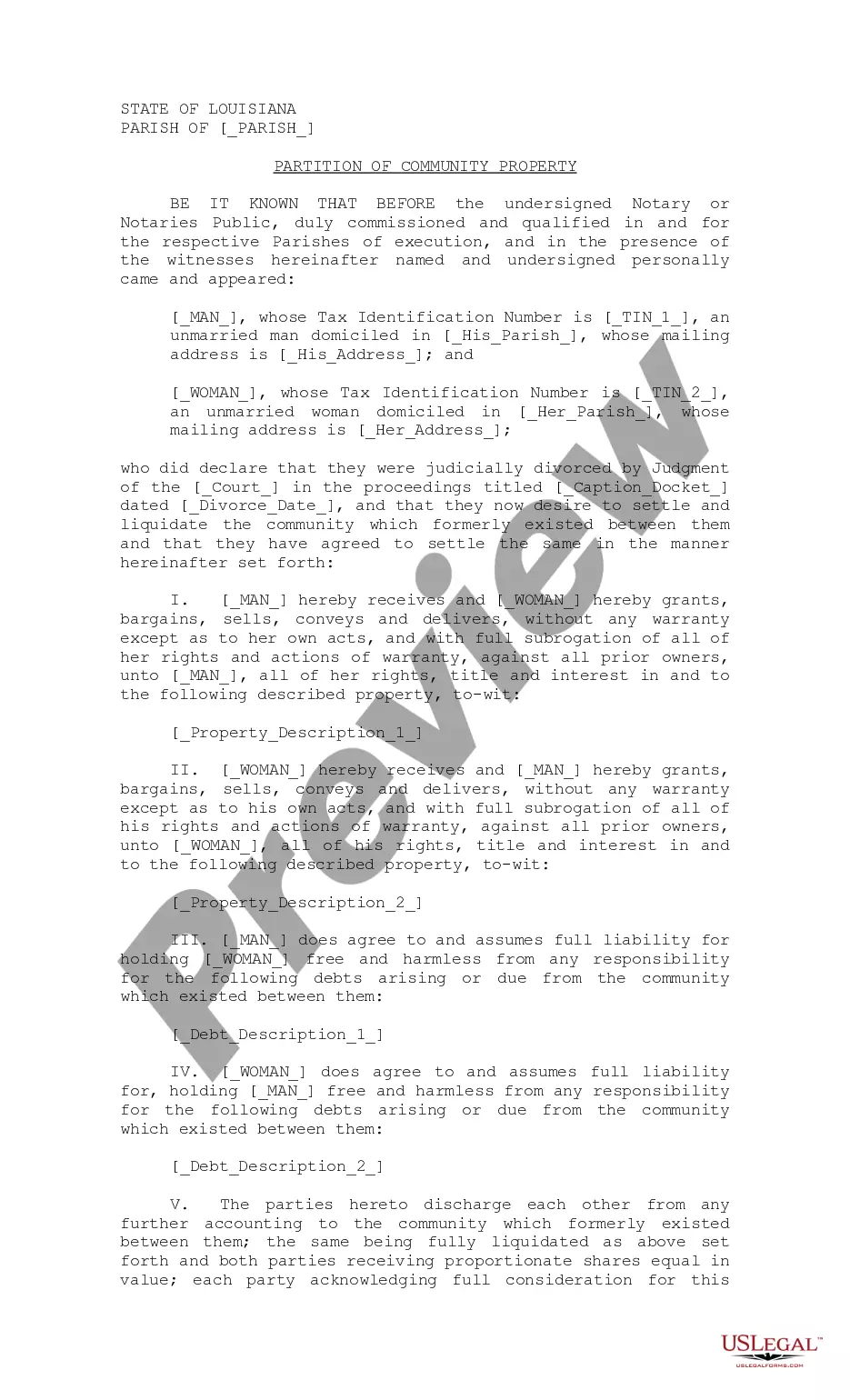

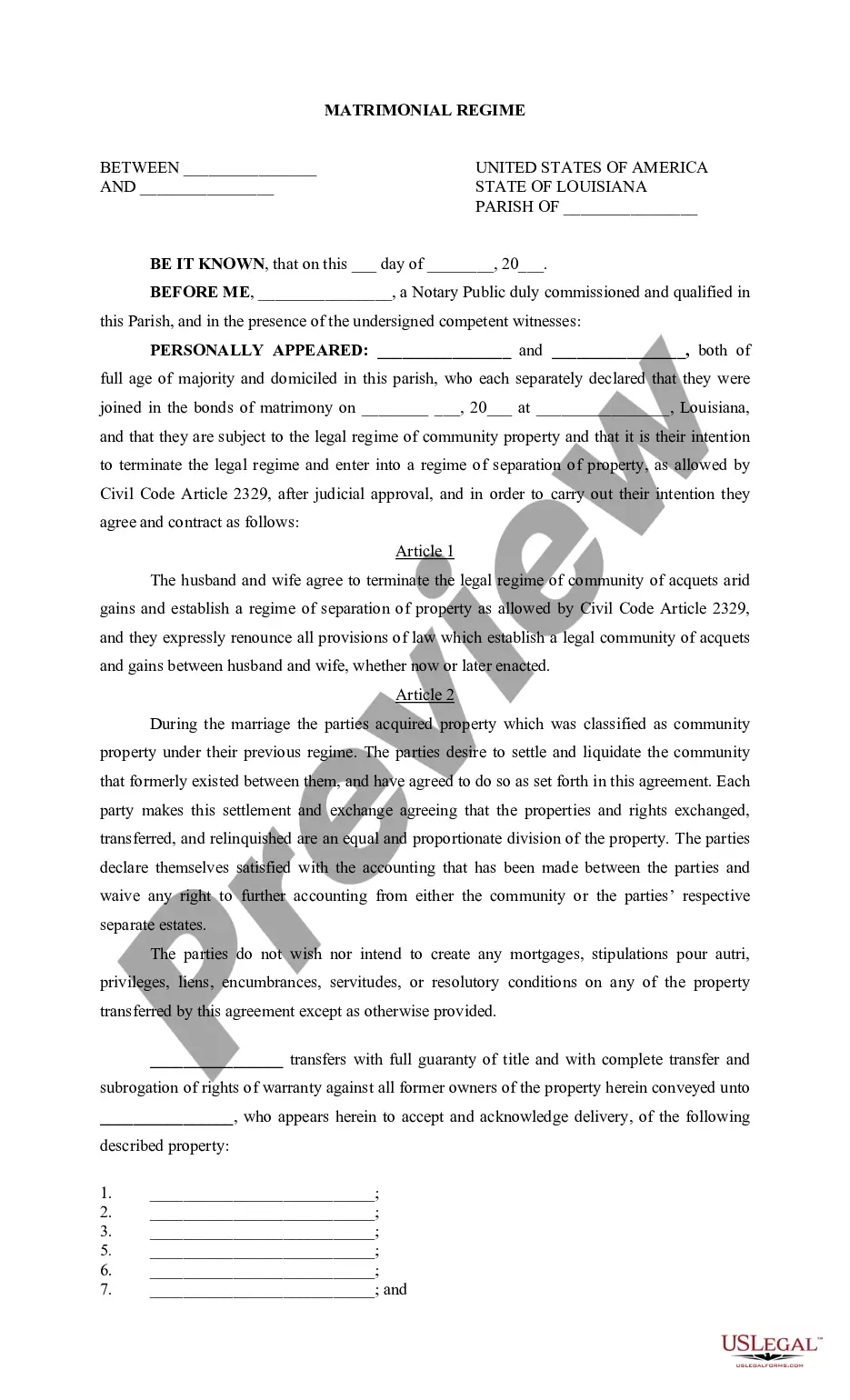

The Community Property Partition is a legal agreement used by divorcing spouses to divide community property and debts acquired during their marriage. This form facilitates a clear and equitable distribution of assets and obligations, ensuring that both parties understand their rights and responsibilities following their divorce. Unlike simple property division forms, this partition addresses both the physical assets and associated debts in a comprehensive manner.

Main sections of this form

- Identification of the parties involved and the relevant jurisdiction.

- Specification of community property and debts to be partitioned.

- Agreements on the assumption of debts and payment terms.

- Provisions for future enforcement of the agreement, including summary process use.

- Witness requirements and notarization details.

Situations where this form applies

This form should be used when a couple is going through a divorce and wishes to settle the division of their joint property and debts. It is particularly relevant if both parties want an organized process to address their community assets and liabilities, thereby preventing disputes and ensuring a smooth transition after the divorce. If there are significant assets or debts involved, this form provides clarity and structure to the settlement process.

Who can use this document

- Divorcing couples in jurisdictions recognizing community property laws.

- Spouses needing a formal agreement to partition jointly owned property.

- Individuals looking for a clear understanding of their financial obligations post-divorce.

- Couples wanting to avoid future disputes regarding property and debts.

Steps to complete this form

- Identify the parties involved, including their full names and addresses.

- Specify the date and location of the divorce judgment.

- Detail all community property assets and debts that are to be divided.

- Enter agreed-upon payment terms for any debts being assumed.

- Ensure both parties sign the agreement in the presence of witnesses and a notary public.

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to fully list all community properties and debts, leading to future disputes.

- Not having the form signed and notarized, which can question its validity.

- Leaving out specific payment terms for assumed debts, creating ambiguity.

- Not consulting with legal counsel, which can result in unfavorable terms.

Advantages of online completion

- Convenience of completing the form from home, without the need for legal appointments.

- Editability enables customization to fit unique personal situations.

- Access to templates drafted by licensed attorneys, ensuring legal compliance.

- Immediate download option allows for quick processing during divorce proceedings.

Looking for another form?

Form popularity

FAQ

At divorce, community property is generally divided equally between the spouses, while each spouse keeps his or her separate property. Equitable distribution. In all other states, assets and earnings accumulated during marriage are divided equitably (fairly), but not necessarily equally.

Louisiana's community property laws assert that all debts and assets acquired during a couple's marriage belong equally to both spouses. A judge dividing community property must make sure that each spouse receives property of equal net value.

Income from separate property is usually community property under Louisiana law. If either the husband or the wife does not want to share the ownership of the income from separate property, however, that spouse can make a declaration before a Notary Public.

At divorce, community property is generally divided equally between the spouses, while each spouse keeps his or her separate property. Equitable distribution. In all other states, assets and earnings accumulated during marriage are divided equitably (fairly), but not necessarily equally.

In California, each spouse or partner owns one-half of the community property. And, each spouse or partner is responsible for one-half of the debt. Community property and community debts are usually divided equally.

Under Louisiana law, marital property, or property acquired during the marriage, is distributed equally (50-50) to each party unless the court finds such a division to be inequitable or parties agree to a different formula under which to divide property.

Louisiana is a community property state. This means that spouses generally share equally in the assets, income and debt acquired by either spouse during the marriage. However, some income and some property may be separate income or separate property.

In California, each spouse or partner owns one-half of the community property. And, each spouse or partner is responsible for one-half of the debt. Community property and community debts are usually divided equally.If the debt was incurred during your marriage or domestic partnership, it belongs to you too.

Separate property is property belongs exclusively to one of two spouses. Under Louisiana law, assets acquired by a deceased person while unmarried, or acquired during the marriage by gift, is considered to be separate property.