Kansas Assignment of Security Agreement and Note with Recourse

Description

How to fill out Assignment Of Security Agreement And Note With Recourse?

Are you situated in an area where you frequently require documentation for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Kansas Assignment of Security Agreement and Note with Recourse, designed to meet state and federal requirements.

Once you find the appropriate document, click Buy now.

Select the pricing plan you want, fill in the necessary information to create your account, and complete the payment using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kansas Assignment of Security Agreement and Note with Recourse template.

- If you don't possess an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct city/state.

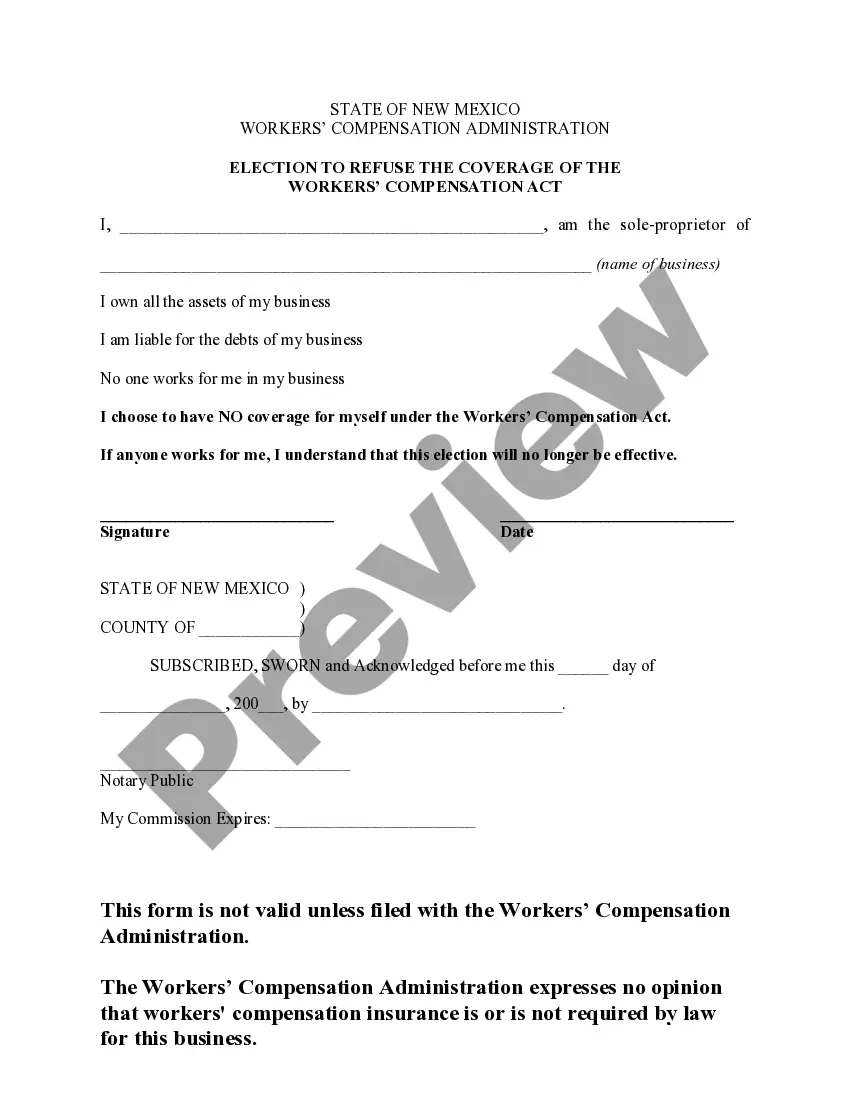

- Utilize the Preview button to review the document.

- Examine the description to confirm you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the template that meets your requirements.

Form popularity

FAQ

The assignment agreement is often seen in real estate but can occur in other contexts as well. An assignment is just the contractual transfer of benefits that will accrue or have accrued. Obligations don't transfer with the benefits of an assignment. The assignor will always keep the obligations.

What Is a Secured Note? A secured note is a type of loan or corporate bond that is backed by the borrower's assets as a form of collateral. If a borrower defaults on a secured note, the assets pledged as collateral can be sold to repay the note.

Security Assignment Agreement means a Global Assignment Agreement on the Global Assignment of Accounts Receivable, substantially in the form of EXHIBIT Q, entered into by the Subsidiary Borrower and the Administrative Agent for the benefit of the Lenders.

A loan agreement serves a similar purpose as a promissory note. Like a promissory note it is a contractual agreement between a lender who agrees to loan money to a borrower. However, a loan agreement is much more detailed than a promissory note. There are two types of loan agreements.

Unless specifically prohibited in the language of the note, a promissory note is assignable by the lender. That is, the lender can sell or assign the note to a third party who the borrower must then repay.

Security agreements are generally used to supplement a secured promissory note. The note is the borrower's actual promise to repay the money it received. The enclosed security agreement assumes the existence of a secured promissory note, but that agreement is not included with this package.

Enforcing a secured promissory note is simply a matter of either repossessing the secured asset through your own efforts, or hiring a professional agency to accomplish the task on your behalf. These agencies will charge a set fee for their services, but they usually have a very high rate of success.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A mortgage note is the document that you sign at the end of your home closing. It should accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if it doesn't.

Assignment by way of security is a concept that comes up on many construction projects; typically as a condition of providing finance a funder will require an assignment by way of security of key construction documents, including building contracts and appointments, with the intention that if the borrower defaults on