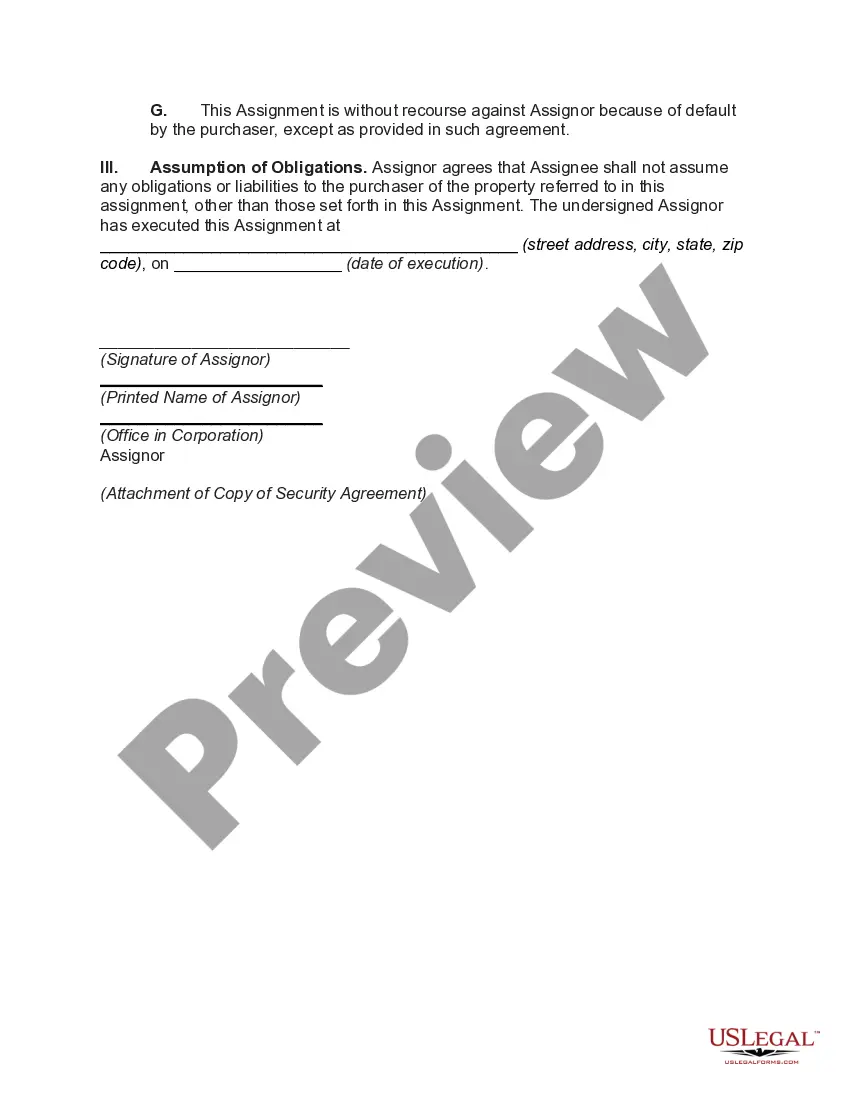

Kansas Assignment of Seller's Interest in Security Agreement

Description

How to fill out Assignment Of Seller's Interest In Security Agreement?

Choosing the best authorized record format might be a battle. Obviously, there are a lot of web templates available online, but how would you obtain the authorized kind you want? Take advantage of the US Legal Forms web site. The assistance offers thousands of web templates, like the Kansas Assignment of Seller's Interest in Security Agreement, which you can use for organization and personal requires. All the types are checked out by pros and meet up with state and federal specifications.

If you are already listed, log in to the account and click on the Download option to get the Kansas Assignment of Seller's Interest in Security Agreement. Make use of your account to look from the authorized types you may have bought formerly. Visit the My Forms tab of your respective account and get one more backup of the record you want.

If you are a brand new customer of US Legal Forms, listed here are straightforward guidelines so that you can stick to:

- Initial, be sure you have selected the appropriate kind for your city/region. You may check out the form utilizing the Preview option and browse the form information to guarantee this is basically the right one for you.

- When the kind will not meet up with your needs, utilize the Seach area to discover the correct kind.

- Once you are certain the form would work, select the Acquire now option to get the kind.

- Pick the rates program you would like and enter the needed information. Make your account and pay for an order using your PayPal account or bank card.

- Pick the submit structure and obtain the authorized record format to the product.

- Comprehensive, edit and produce and indicator the received Kansas Assignment of Seller's Interest in Security Agreement.

US Legal Forms will be the biggest catalogue of authorized types for which you can discover different record web templates. Take advantage of the company to obtain skillfully-produced paperwork that stick to status specifications.

Form popularity

FAQ

You give the lender this right when you sign your closing forms. The document granting the security interest can be called by different names, but the most common names are "Mortgage" or "Deed of Trust." My mortgage closing forms mention a "security interest." What is a security ... consumerfinance.gov ? ask-cfpb ? my-mort... consumerfinance.gov ? ask-cfpb ? my-mort...

Security interests for most types of collateral are usually perfected by filing a document simply called a "financing statement." You'll usually file this form with the secretary of state or other public office.

In general: (1) the creditor must give value, (2) the debtor must have rights in the collateral, and (3) there must be a security agreement or other action indicating an intent to convey a security interest. Once the security interest has ?attached,? it is effective between the debtor and the creditor.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the ... Secured Transactions Law & the UCC | Small Business Law Center - Justia justia.com ? business-operations ? docs ? sec... justia.com ? business-operations ? docs ? sec...

There are three requirements for attachment: (1) the secured party gives value; (2) the debtor has rights in the collateral or the power to transfer rights in it to the secured party; (3) the parties have a security agreement ?authenticated? (signed) by the debtor, or the creditor has possession of the collateral. Introduction to Secured Transactions github.io ? s22-01-introduction-to-se... github.io ? s22-01-introduction-to-se...

A Notice of Security Interest serves as notification to the Division of Vehicles that a person/business has applied for a loan on the vehicle described on this form and subsequently that a lien is to be reflected on the vehicle title record.

(i) a security interest can be assigned; (ii) if the security interest is perfected by filing, the assignee can, but does. not have to, become the secured party of record by having the fact of the. assignment made part of the financing statement;3.

A security interest attaches to collateral when it becomes enforceable against the debtor with respect to the collateral, unless an agreement expressly postpones the time of attachment. 9-203. ATTACHMENT AND ENFORCEABILITY OF SECURITY ... LII / Legal Information Institute ? ucc LII / Legal Information Institute ? ucc