Indiana Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets

Description

How to fill out Agreement For Sale Of All Assets Of A Corporation With Allocation Of Purchase Price To Tangible And Intangible Business Assets?

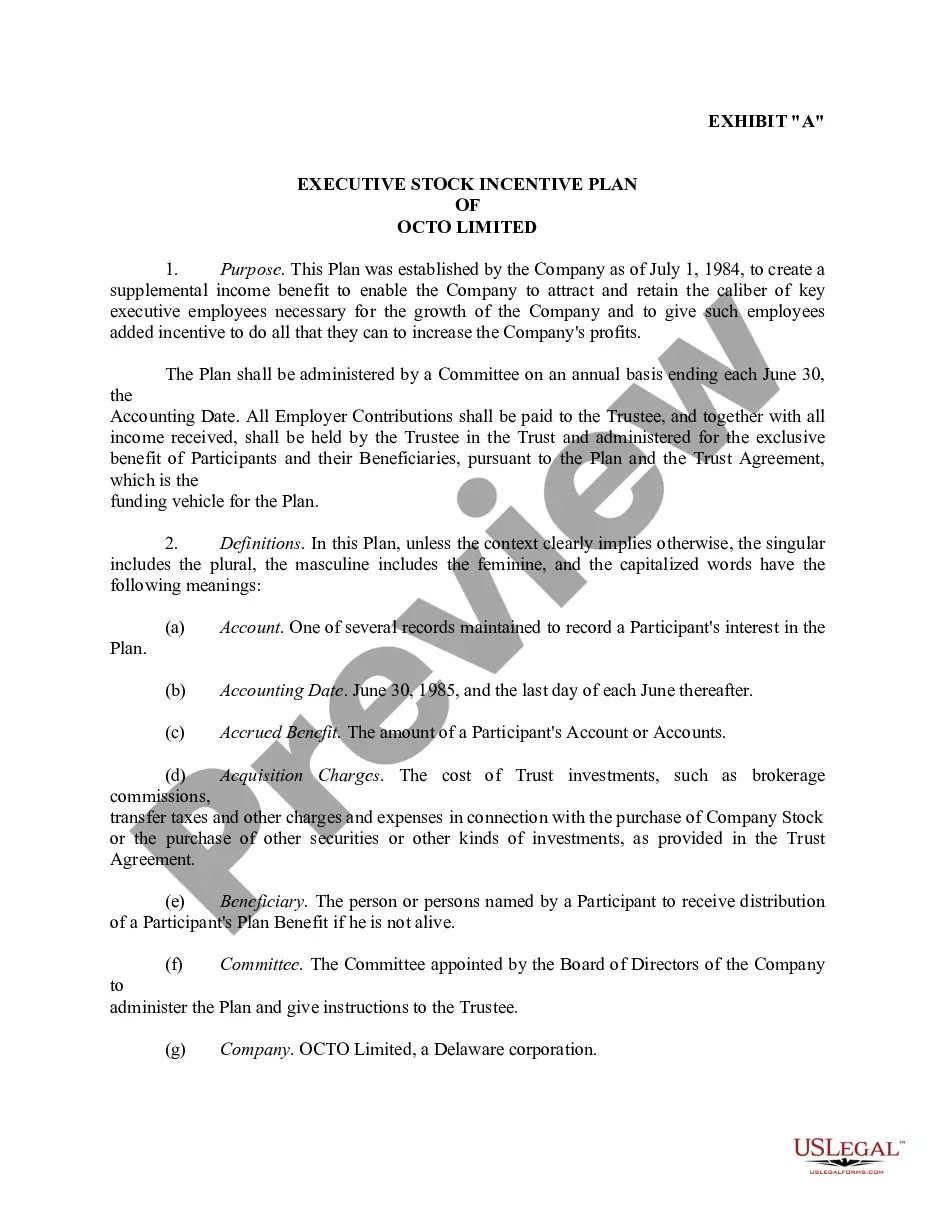

US Legal Forms - one of the most prominent repositories of legal documents in the United States - provides a broad selection of legal document templates available for download or customization.

By using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can quickly locate the latest versions of documents such as the Indiana Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets.

Review the form description to ensure you have selected the correct document.

If the form does not suit your needs, utilize the Search field at the top of the screen to locate the one that does.

- If you possess a subscription, Log In to download the Indiana Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If this is your first time using US Legal Forms, here are simple instructions to get started.

- Ensure you have chosen the correct form for your city/state.

- Click on the Preview option to examine the form's content.

Form popularity

FAQ

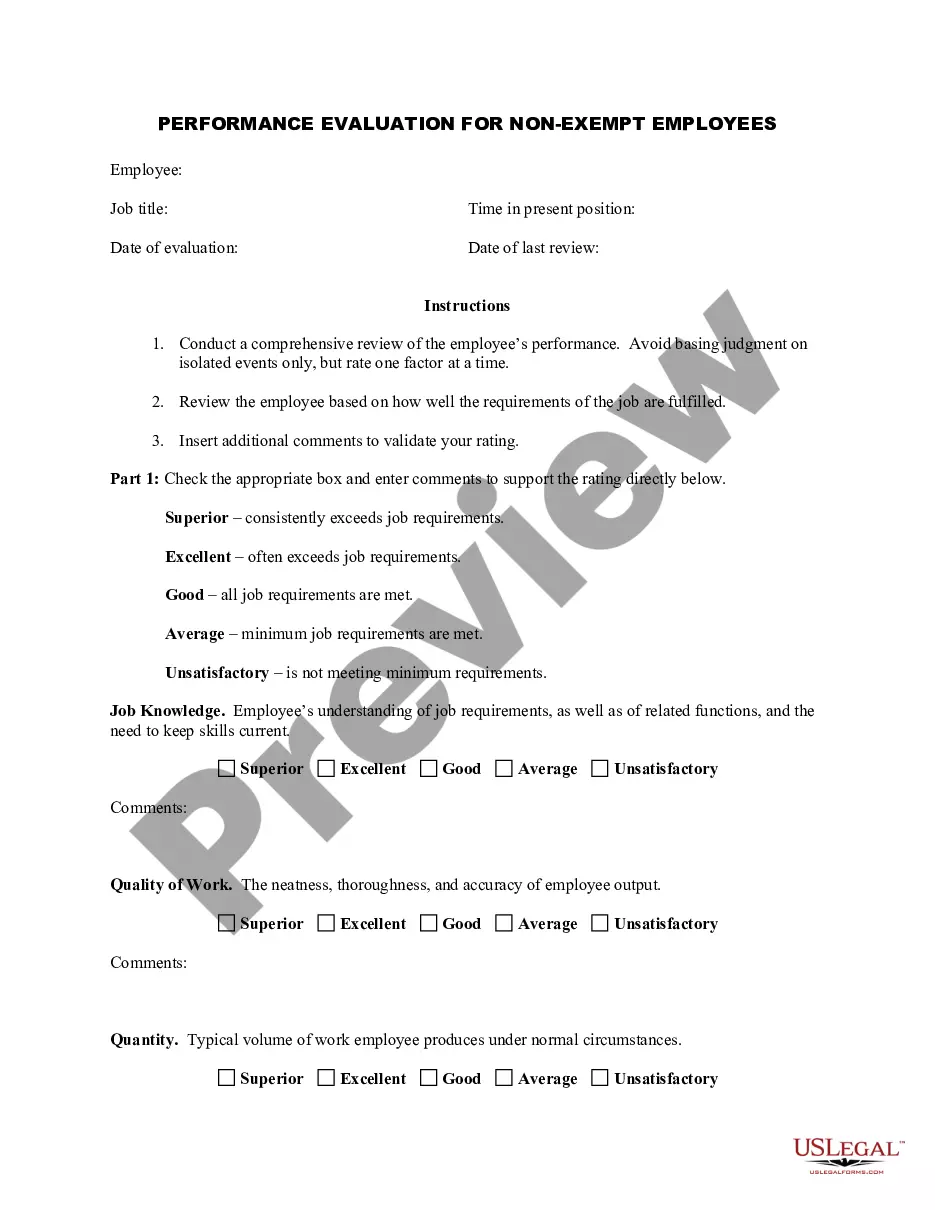

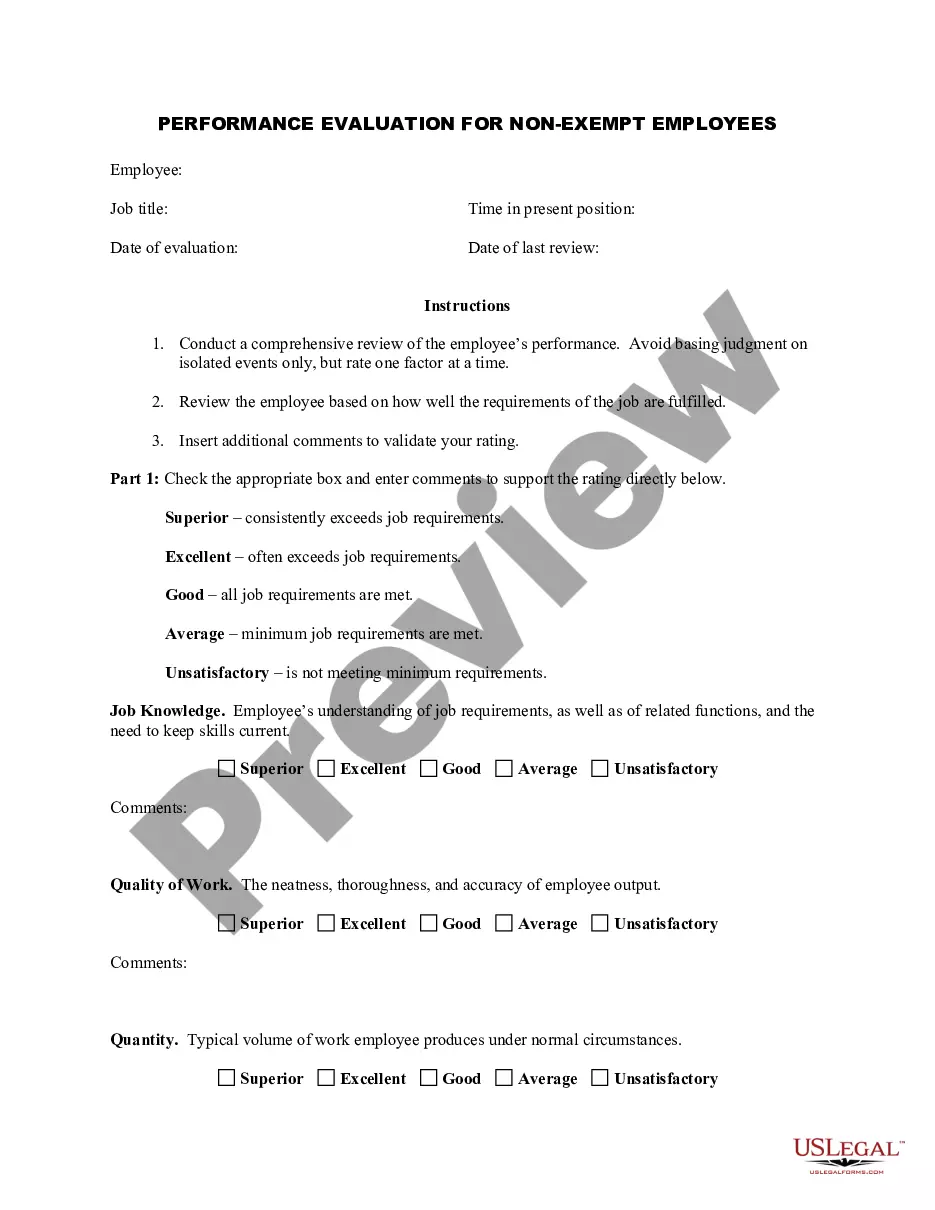

An asset only acquisition occurs when a buyer purchases specific assets of a business rather than its entire equity. This type of transaction often involves the Indiana Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets. By using this agreement, parties can clearly outline which tangible and intangible assets are included in the sale. Additionally, asset acquisitions allow buyers to limit liability and retain only the desired business attributes.

Form 8594 is used to report the asset allocation between parties involved in a sale or exchange of an entire business. This form plays a crucial role in the context of the Indiana Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets. It helps in documenting how the purchase price is divided among the different assets, which is vital for tax reporting purposes. Utilizing uslegalforms enables you to understand and accurately complete Form 8594, ensuring compliance and clarity in your asset sales.

An asset allocation agreement outlines the distribution of purchase price among the various assets of a business during a sale. This agreement is particularly essential in the Indiana Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets. By clearly defining how assets are valued and allocated, businesses can avoid disputes and ensure a smoother transaction. Engaging with uslegalforms can provide you with the necessary templates and guidance for creating a comprehensive asset allocation agreement.

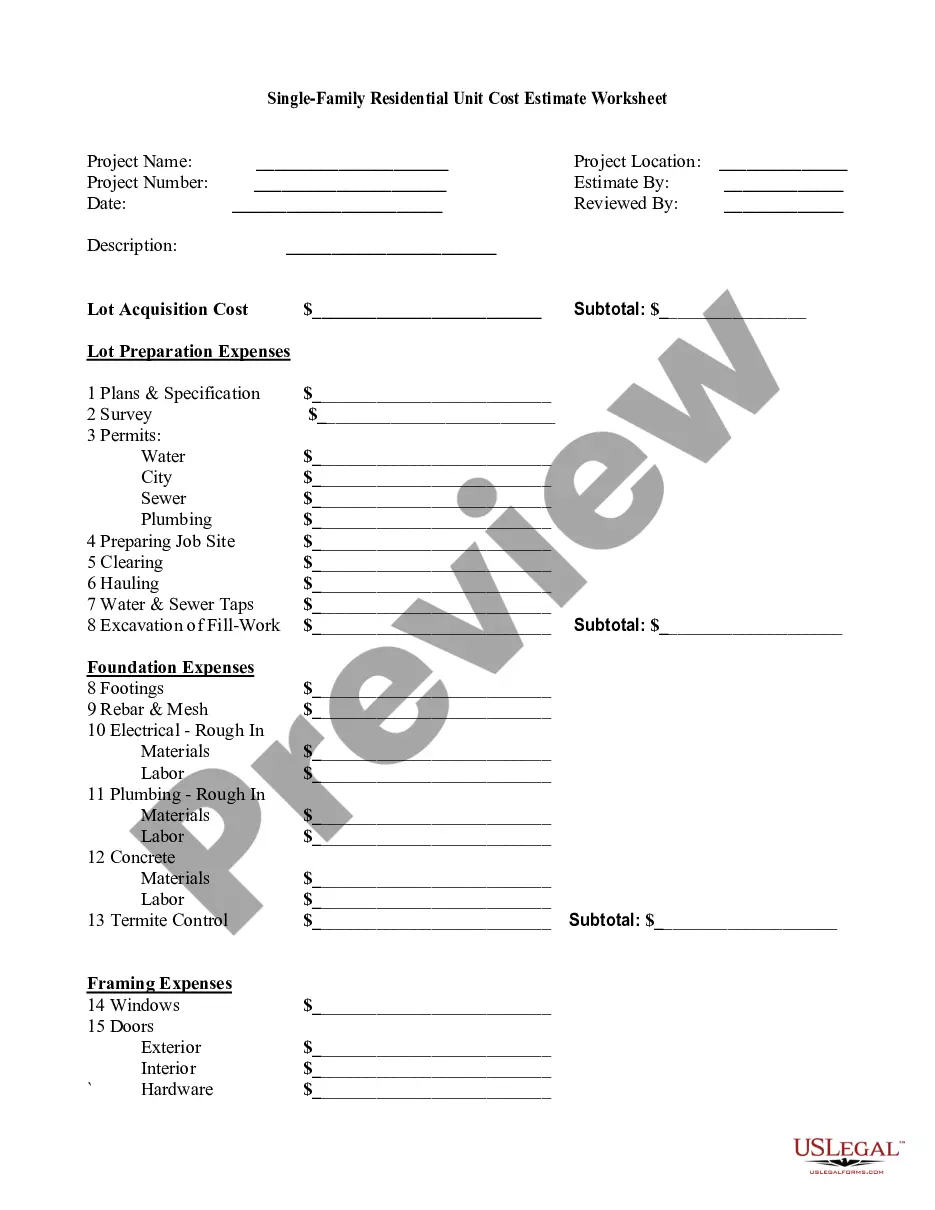

Typically, it is a three-step process:Determining the purchase price (total consideration paid)Identifying the correct assets acquired and liabilities assumed.Calculating the fair market value of those assets and liabilities.

Purchase price allocation (PPA) is an application of goodwill accounting whereby one company (the acquirer), when purchasing a second company (the target), allocates the purchase price into various assets and liabilities acquired from the transaction.

Allocating the purchase price, or total sale price, of a business among the various assets of the business (asset classes) is necessary for tax purposes when a business is sold. This is the case regardless of whether the sale is structured as a stock sale or an asset sale.

Purchase price allocations help to accurately reflect value drivers for an acquired business and help financial statement users understand what each part of the purchased business is worth. It is important to highlight that not all acquired targets are subject to being recorded as a business combination.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

Allocating the purchase price Subsequently, the financial reporting standards (RJ and IFRS) require that the purchase price paid (in a business combination) needs to be allocated to the assets acquired and liabilities assumed, a process that is also referred to as a 'purchase price allocation' or PPA.