Indiana Guaranty by Corporation - Complex

Description

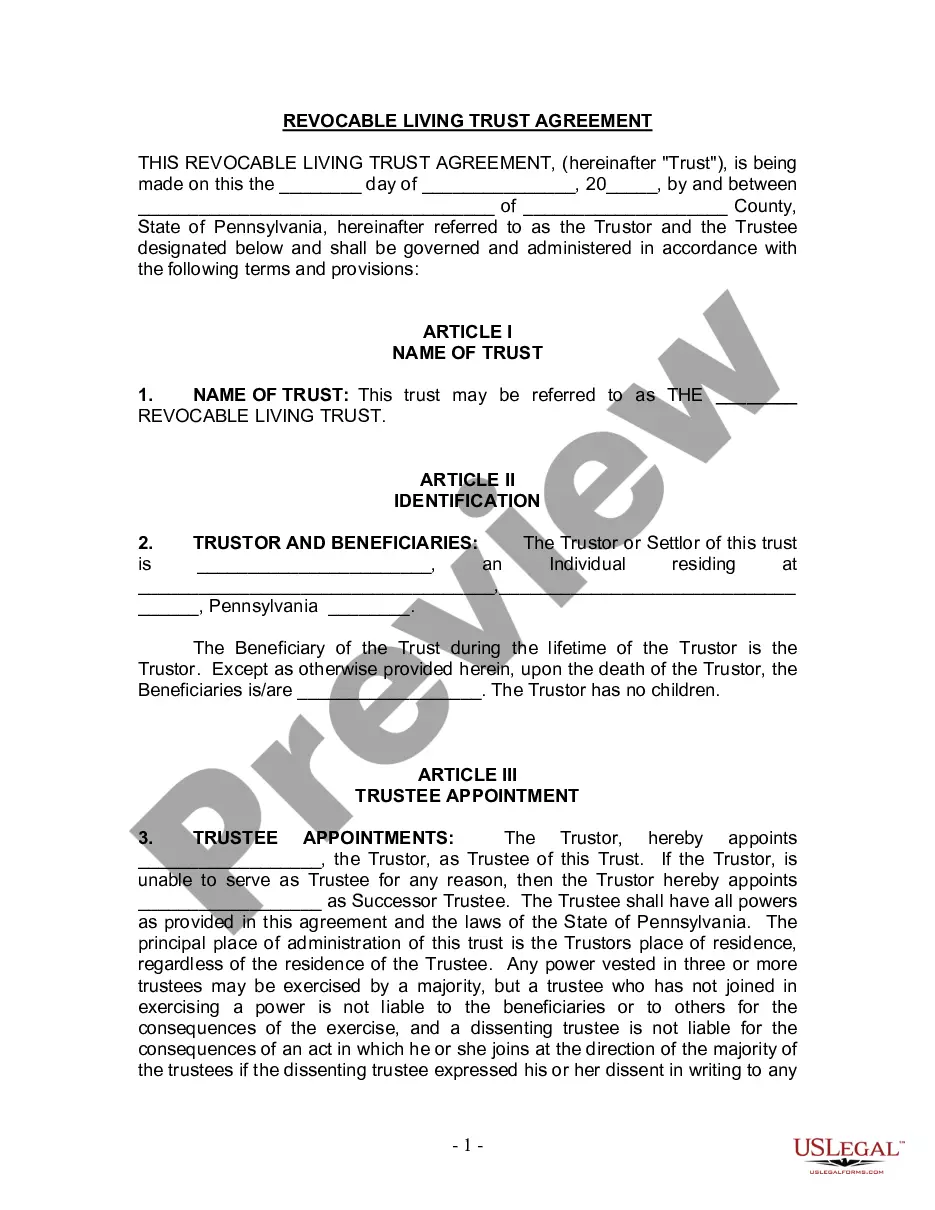

How to fill out Guaranty By Corporation - Complex?

If you want to complete, acquire, or produce lawful document themes, use US Legal Forms, the greatest assortment of lawful kinds, which can be found on the Internet. Make use of the site`s easy and handy search to get the files you need. Various themes for enterprise and person uses are sorted by types and says, or key phrases. Use US Legal Forms to get the Indiana Guaranty by Corporation - Complex in a handful of mouse clicks.

If you are already a US Legal Forms consumer, log in to your profile and click on the Down load key to have the Indiana Guaranty by Corporation - Complex. You may also accessibility kinds you previously acquired within the My Forms tab of your own profile.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape to the appropriate town/region.

- Step 2. Utilize the Preview choice to look over the form`s content. Never overlook to read the outline.

- Step 3. If you are not satisfied using the form, make use of the Lookup field towards the top of the screen to get other versions in the lawful form template.

- Step 4. After you have found the shape you need, click the Acquire now key. Select the prices prepare you favor and include your references to register for the profile.

- Step 5. Approach the financial transaction. You should use your bank card or PayPal profile to accomplish the financial transaction.

- Step 6. Pick the structure in the lawful form and acquire it on your gadget.

- Step 7. Total, edit and produce or sign the Indiana Guaranty by Corporation - Complex.

Every single lawful document template you acquire is yours for a long time. You might have acces to each form you acquired within your acccount. Click the My Forms segment and select a form to produce or acquire yet again.

Remain competitive and acquire, and produce the Indiana Guaranty by Corporation - Complex with US Legal Forms. There are thousands of expert and state-specific kinds you may use for your personal enterprise or person needs.

Form popularity

FAQ

Payment guarantee - What is a payment guarantee? A payment guarantee provides the beneficiary with financial security should the applicant fail to make payment for the goods or services supplied.

A corporate guarantee is also written as a "guaranty" or "corporate guaranty." This guarantee benefits the debtor and the lender. For the lender, the loan is more secure since the guarantor assures that the money will be repaid.

Guarantee of collection means a loan guarantee under which the authority agrees to pay ing to the terms of the guarantee agreement if the instrument is not paid when due and the participating lender has pursued all reasonable efforts relative to collection.

Guaranty of payment and not of collection. A statement to this effect allows the lender to go after the guarantor immediately upon default by the borrower, without having to first seek collection from the borrower.

A guarantor contracts to pay if, by the use of due diligence, the debt cannot be paid by the principal debtor. The surety undertakes directly for the payment. The surety is responsible at once if the principal debtor defaults. In other words, a guaranty is an undertaking that the debtor shall pay.

Guaranty Agreement means a supplemental indenture, in a form satisfactory to the Trustee, pursuant to which a Subsidiary Guarantor guarantees the Company's obligations with respect to the Securities on the terms provided for in this Indenture.

With a guaranty of payment, you can collect payment from the guarantor without first trying to collect from the primary debtor. With a guaranty of collection or performance, you must first attempt (and fail) to collect from the primary debtor before you can collect from the guarantor.

A financial guarantee is an agreement that guarantees a debt will be repaid to a lender by another party if the borrower defaults. Essentially, a third party acting as a guarantor promises to assume responsibility for a debt should the borrower be unable to keep up on its payments to the creditor.