Indiana Personal Guaranty - General

Description

How to fill out Personal Guaranty - General?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can retrieve or print.

By using the site, you can access thousands of forms for business and personal needs, categorized by types, states, or keywords.

You can find the latest editions of forms like the Indiana Personal Guaranty - General within moments.

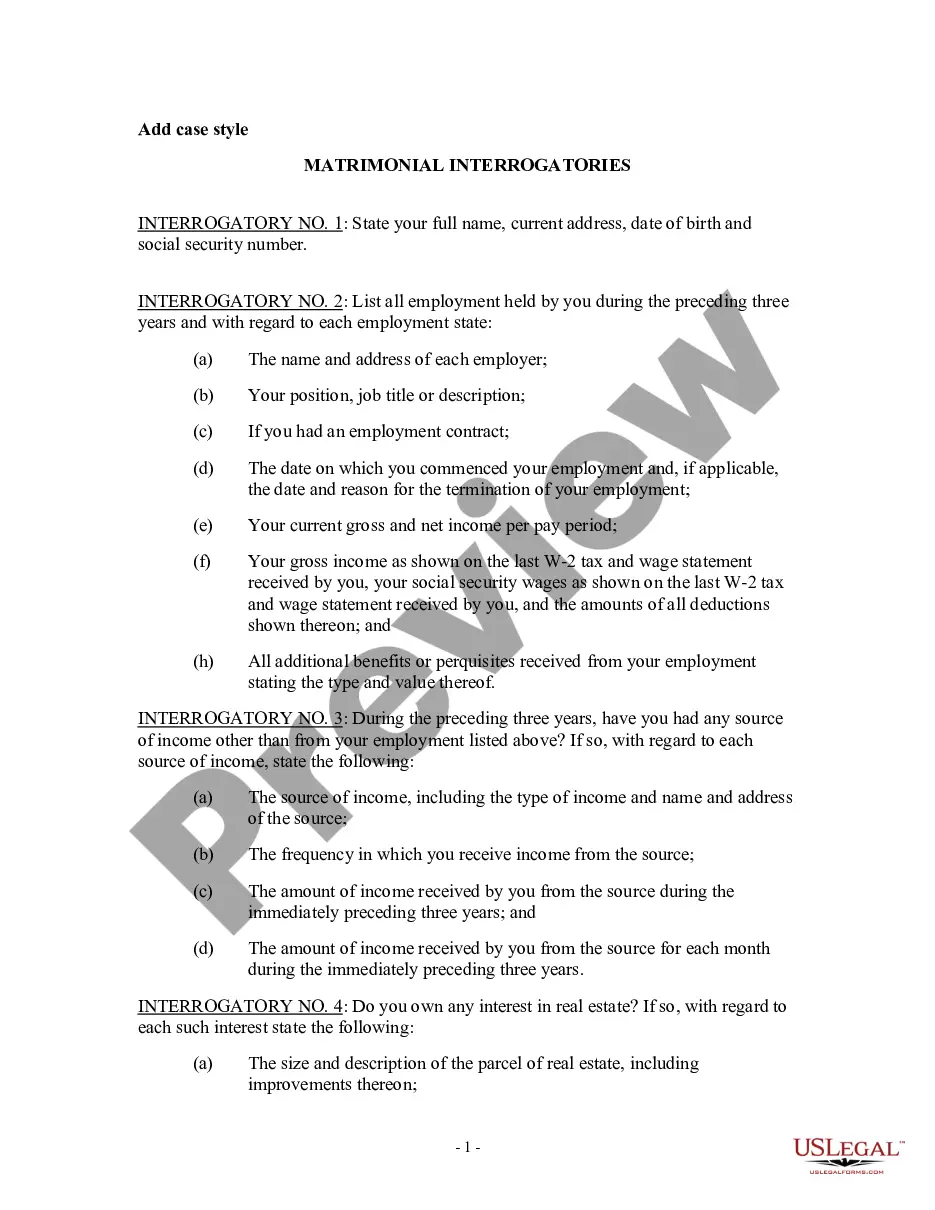

Click the Preview button to review the form's details.

Read the form description to confirm that you have chosen the right form.

- If you currently hold a subscription, Log In and download Indiana Personal Guaranty - General from the US Legal Forms library.

- The Download button will show up on every form you view.

- You can access all previously downloaded forms in the My documents section of your profile.

- If you are using US Legal Forms for the first time, here are some simple tips to help you begin.

- Make sure you have selected the correct form for your city/county.

Form popularity

FAQ

The risks of a personal guarantee are considerable and can include financial repercussions. You risk losing personal assets, including savings or property, if the borrower defaults. Additionally, signing a personal guarantee can have long-term effects on your creditworthiness. Being aware of these risks related to Indiana Personal Guaranty - General helps you weigh your options before committing.

Getting out of a personal guarantee may not be straightforward, but it is possible. You can negotiate with the lender to be released from the guaranty or seek to reduce your liability. It is crucial to carefully review your original agreement and consider seeking legal assistance. Resources like US Legal Forms can provide templates and guidance pertinent to Indiana Personal Guaranty - General to help you navigate the process.

The consequences of a personal guarantee can be significant. If the borrower defaults, you, as the guarantor, may be held responsible for the entire debt, impacting your credit score. This responsibility can affect your financial standing and limit your ability to secure loans in the future. Understanding the implications of an Indiana Personal Guaranty - General ensures you make informed decisions.

To write a guarantee agreement under Indiana Personal Guaranty - General, outline the parties involved, the obligations being guaranteed, and any conditions for enforcement. Make sure to use clear and concise language to define the agreement's terms. If you are unsure, platforms like US Legal Forms offer templates to help you craft a solid agreement.

Enforcing an Indiana Personal Guaranty - General involves taking legal action if the primary obligation is not fulfilled. Typically, the lender must provide proof of default and notify the guarantor of the intent to enforce the guarantee. Having a well-drafted personal guarantee can make this process smoother, so consider using resources from US Legal Forms for adequate documentation.

To establish an Indiana Personal Guaranty - General, certain requirements must be met. These include providing personal identification, detailing your financial situation, and signing a written agreement with the lender. Clear terms regarding the debt and obligations are also essential. Using uslegalforms can assist you in preparing the necessary documentation accurately.

To collect on an Indiana Personal Guaranty - General, the lender typically must follow legal procedures for enforcement. They must demonstrate your default and provide the necessary documentation to the court. Successful collection can result in seizing your assets, including property or bank accounts. Ensure proper legal guidance by exploring options available through uslegalforms.

Withdrawing an Indiana Personal Guaranty - General generally requires negotiation with the lender. You may need to provide a valid reason and possibly compensate the lender in some form. Once an agreement is reached, ensure that you receive confirmation in writing. It's beneficial to consult resources like uslegalforms for steps on how to effectively communicate your intent to withdraw.

The process of creating an Indiana Personal Guaranty - General begins with drafting a written agreement that details your obligations. You will need to provide personal information, such as your income and assets, to the lender. After both parties review and sign the document, it becomes binding. Utilizing uslegalforms can simplify this process by providing templates and guidelines.

An Indiana Personal Guaranty - General is typically enforceable if it meets legal requirements. This means the document must be clear, specific, and executed properly. Lenders can take legal action to enforce the guarantee if you default. To ensure your personal guarantee holds up in court, it may help to consult legal resources or professionals.