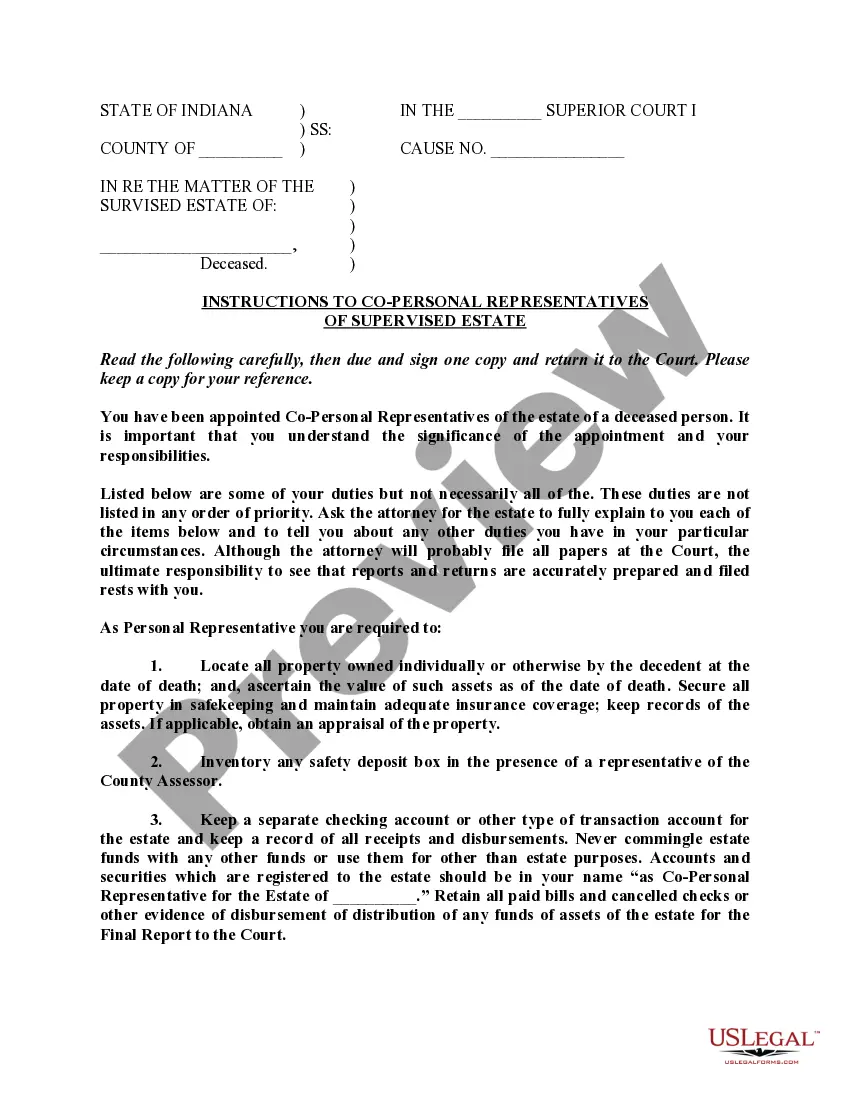

Indiana Instructions to Personal Representative of Unsupervised Estate — Form PR 00-2 (PDF) is a form used in the state of Indiana to provide instructions to the Personal Representative of an unsupervised estate. The form is used to provide the Personal Representative with the necessary information to properly administer the estate. There are two types of PR 00-2 forms available for use in Indiana: the original version and a revised version. The original version provides instructions for the Personal Representative on preparing and filing the necessary documents to open the estate, including the petition, inventory, and accounting. It also instructs the Personal Representative on how to handle payments to creditors, distribution of assets to heirs, and the closing of the estate. The revised version provides additional instructions for the Personal Representative on preparing and filing additional documents, such as a motion to close the estate, and information about the appointment of an attorney and other professionals. Both versions of the form also provide detailed information about the duties and responsibilities of a Personal Representative, and the laws and regulations applicable to the estate.

Indiana Instructions to Personal Representative of Unsupervised Estate - Form PR 00-2 (PDF)Opens a New Window.

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Indiana Instructions To Personal Representative Of Unsupervised Estate - Form PR 00-2 (PDF)Opens A New Window.?

How much effort and resources do you frequently allocate to creating formal documentation.

There’s a better method to obtain such forms than engaging legal professionals or spending hours searching the internet for an appropriate template.

Another benefit of our library is that you can access previously acquired documents that you safely keep in your profile under the My documents tab. Retrieve them at any time and re-complete your paperwork as often as you require.

Conserve time and effort drafting legal documents with US Legal Forms, one of the most dependable online services. Join us today!

- Browse through the form details to ensure it complies with your state regulations. To do this, review the form description or utilize the Preview option.

- If your legal template doesn’t satisfy your requirements, find another one using the search bar at the top of the page.

- If you already possess an account, Log In and download the Indiana Instructions to Personal Representative of Unsupervised Estate - Form PR 00-2 (PDF)Opens a New Window.. Otherwise, continue to the following steps.

- Click Buy now once you identify the correct blank. Choose the subscription option that fits you best to access our library's complete offerings.

- Register for an account and settle your payment. You can pay using your credit card or via PayPal - our service is fully secure for that.

- Download your Indiana Instructions to Personal Representative of Unsupervised Estate - Form PR 00-2 (PDF)Opens a New Window. onto your device and fill it out on a printed version or electronically.

Form popularity

FAQ

Is Probate Required in Indiana? Any estate worth more than $50,000 is subject to probate in Indiana. Estates worth less than $50,000 transfer ownership to heirs through the small estate administration with a written statement proving entitlement to the assets.

In Indiana, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Inspect all documents and personal papers of the decedent and retain anything pertinent to tax reporting, location and value of assets, debts or obligations of or to the decedent, or any other items of significance to administration of the estate of the decedent.

Conducting a probate in Indiana commonly takes six months to a year, depending on the situation. It can take longer if there is a court fight over the will (which is rare) or unusual assets or debts that complicate matters.

Unsupervised administration is conducted by personal representatives who operate without court supervision. It is typically authorized pursuant to the decedent's will, although heirs and other interested parties can request unsupervised administration if it is not provided by will and if the estate is solvent.

With unsupervised administration, the Personal Representative of the estate can carry out his or her duties without obtaining court approval for things like selling assets or dealing with inheritances and taxes. With supervised administration, the probate court must approve all actions taken.

With unsupervised administration, the Personal Representative of the estate can carry out his or her duties without obtaining court approval for things like selling assets or dealing with inheritances and taxes. With supervised administration, the probate court must approve all actions taken.