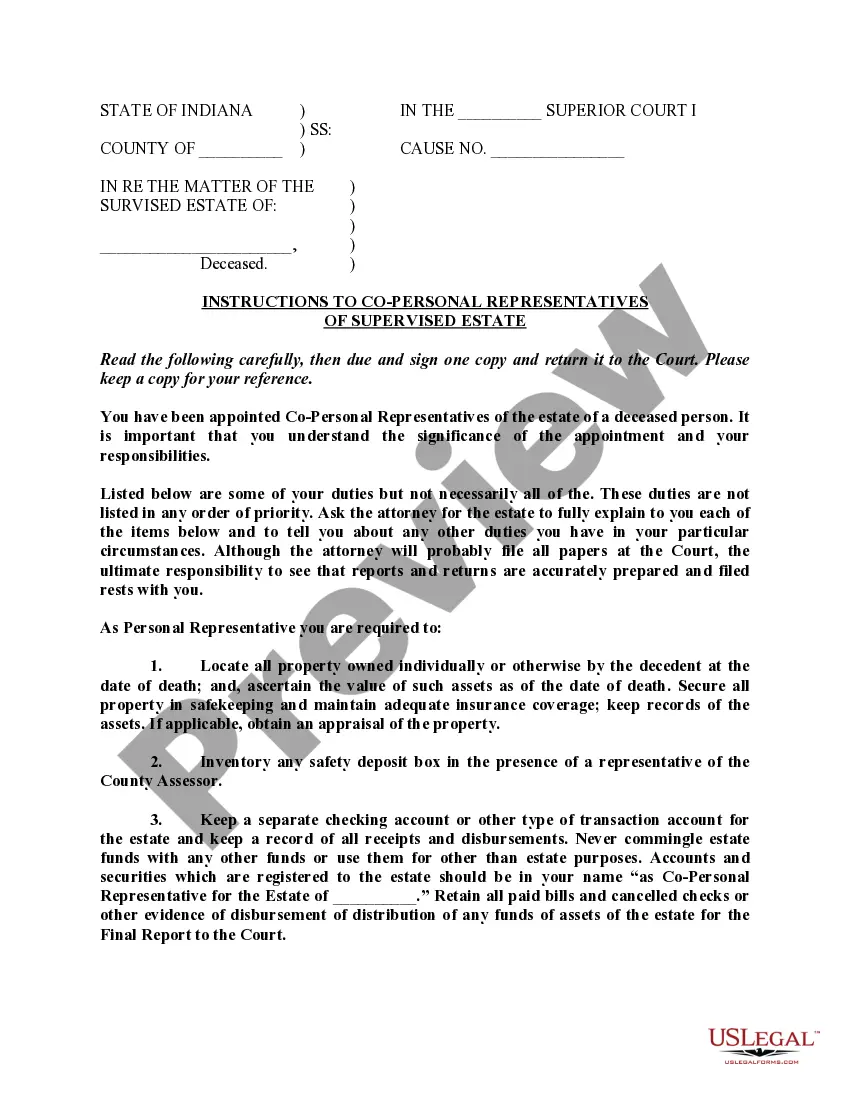

Indiana Instructions to Personal Representative of Supervised Estate — Form PR 00-1(PDF)OpenWindowowoIsiIsisis a form issued by the Indiana Department of Revenue that provides guidance to a personal representative of a supervised estate. The form outlines the tasks and duties that a personal representative is required to perform when administering a supervised estate. It includes instructions on how to file the required tax returns, how to manage and distribute assets, how to keep accurate records, and how to handle creditor claims. The form also provides guidance on probate and other court proceedings, executor's fees, and any additional requirements imposed by Indiana law. There are two types of Indiana Instructions to Personal Representative of Supervised Estate — Form PR 00-1(PDF)Opens a New Window.: (1) General Instructions and (2) Special Instructions. The General Instructions provide general information about supervised estates and the role of the personal representative, while the Special Instructions provide additional guidance specific to a particular estate.

Indiana Instructions to Personal Representative of Supervised Estate - Form PR 00-1(PDF)Opens a New Window.

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Indiana Instructions To Personal Representative Of Supervised Estate - Form PR 00-1(PDF)Opens A New Window.?

Completing formal documentation can be quite challenging unless you have accessible fillable templates. With the US Legal Forms online repository of official forms, you can trust in the documents you receive, as they all adhere to federal and state laws and are validated by our specialists.

Thus, if you require the Indiana Instructions to Personal Representative of Supervised Estate - Form PR 00-1(PDF)Opens a New Window., our service is the ideal source for downloading it.

Here’s a brief guide for you: Document compliance verification. Ensure to meticulously examine the contents of the form you desire and confirm it meets your needs and adheres to your state law stipulations. Previewing your document and reviewing its brief description will assist you in that regard.

- Retrieving your Indiana Instructions to Personal Representative of Supervised Estate - Form PR 00-1(PDF)Opens a New Window. from our service is straightforward.

- Users who have previously registered with a valid subscription need only sign in and click the Download button after identifying the correct template.

- If needed, users can also retrieve the same form from the My documents section of their account.

- However, even if you are new to our service, creating an account with a valid subscription will only take a few moments.

Form popularity

FAQ

(15) Hold, manage, safeguard, and control the estate's real and personal property, insure the assets of the estate against damage, loss, and liability, and insure the personal representative personally against liability as to third persons.

6% for the first $100K. 4% for the next $200K. 3% for the next $700K. 1% for everything more.

Is Probate Required in Indiana? Any estate worth more than $50,000 is subject to probate in Indiana. Estates worth less than $50,000 transfer ownership to heirs through the small estate administration with a written statement proving entitlement to the assets.

Inspect all documents and personal papers of the decedent and retain anything pertinent to tax reporting, location and value of assets, debts or obligations of or to the decedent, or any other items of significance to administration of the estate of the decedent.

I, , accept my appointment as personal representative of the estate of and affirm under the penalties for perjury that I will faithfully discharge the duties of my trust, ing to

In Indiana personal representative, also referred to as an executor, is the individual appointed by the court or named in a will to handle the administration of another person's estate.

In general, expect it to take at least six months up to a year before probate is closed and the assets distributed to the heirs. If there are disputes, claims against the estate or other delays, it could take much longer.