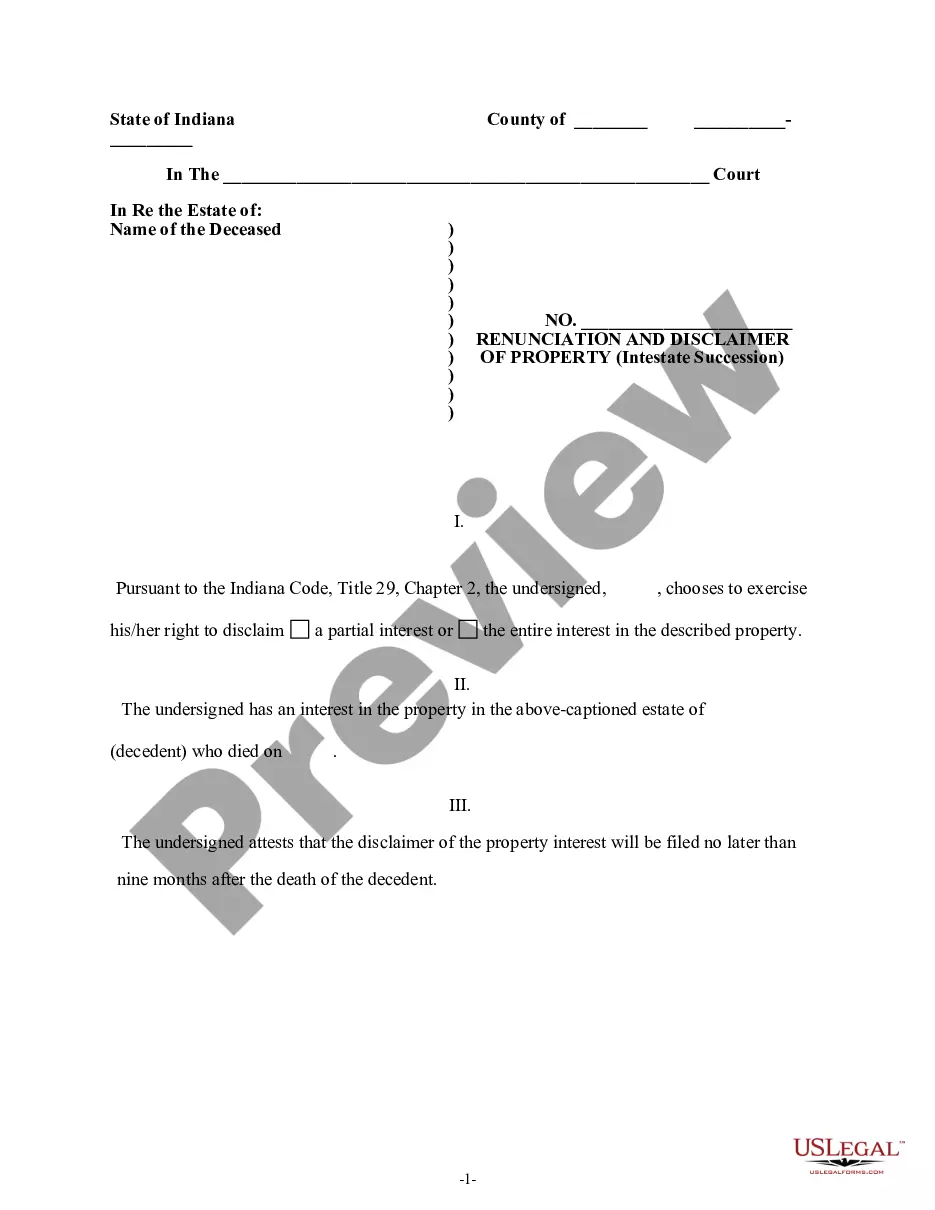

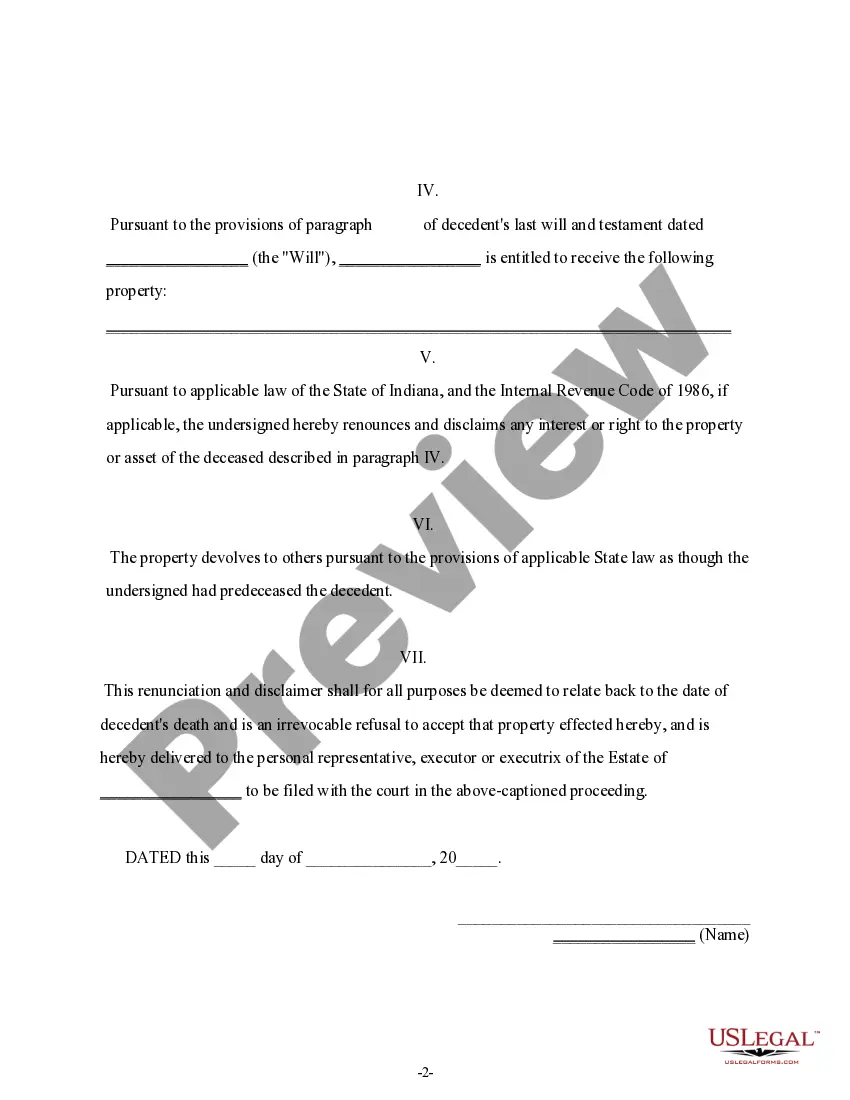

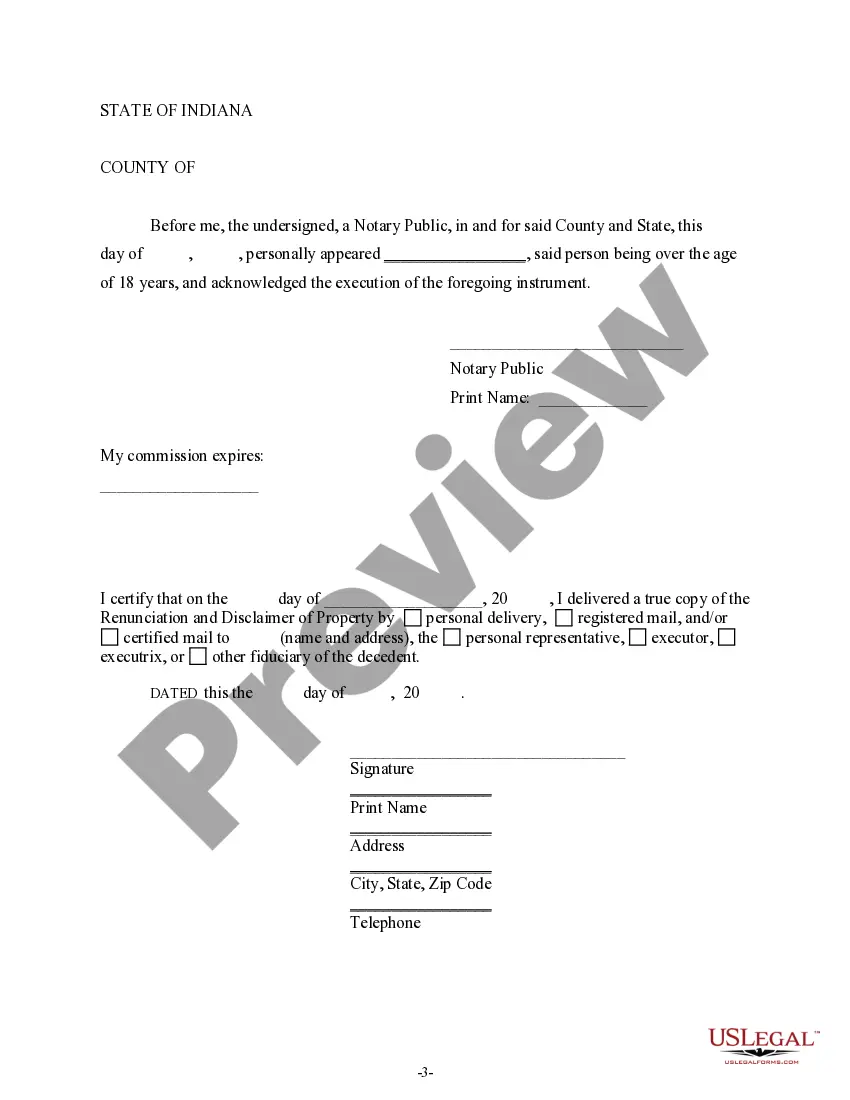

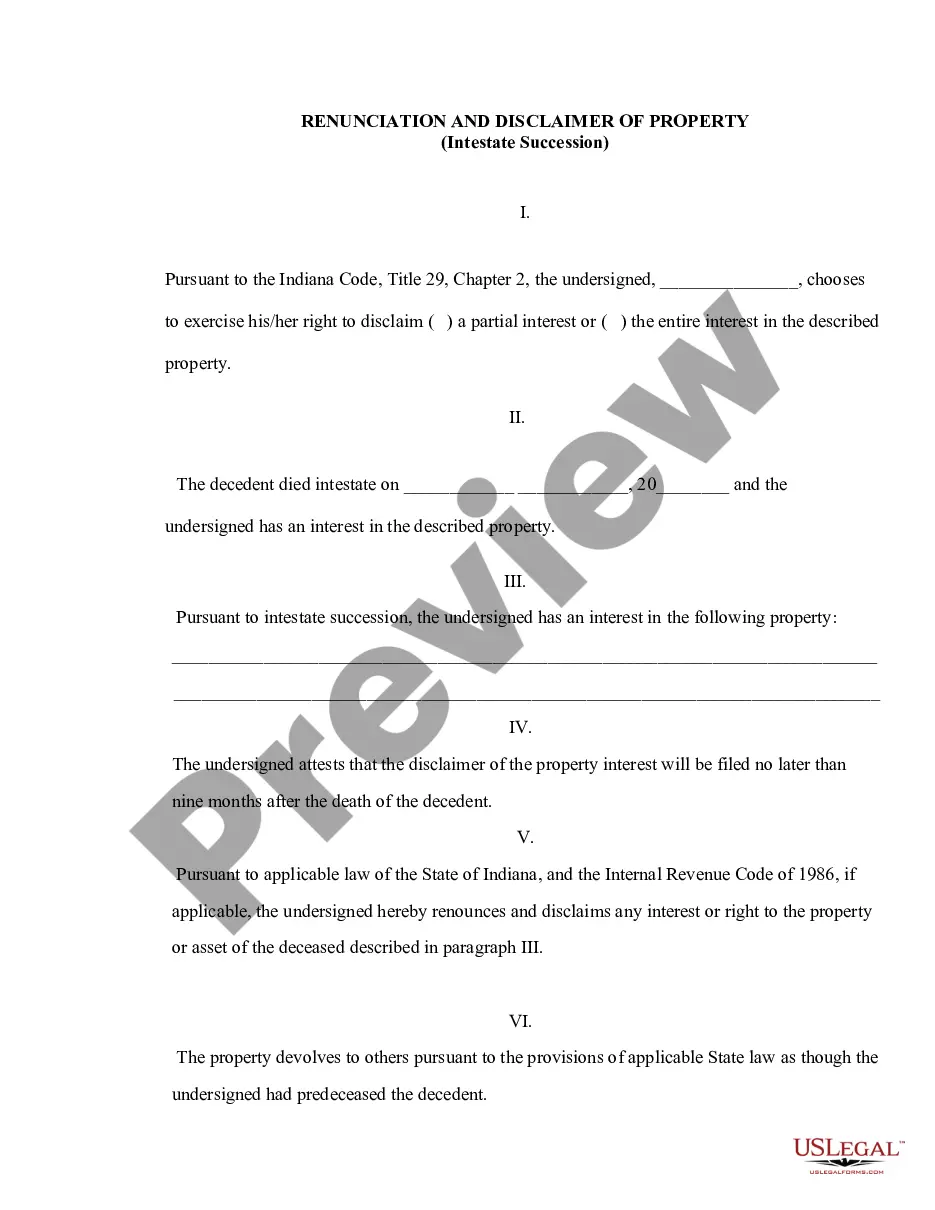

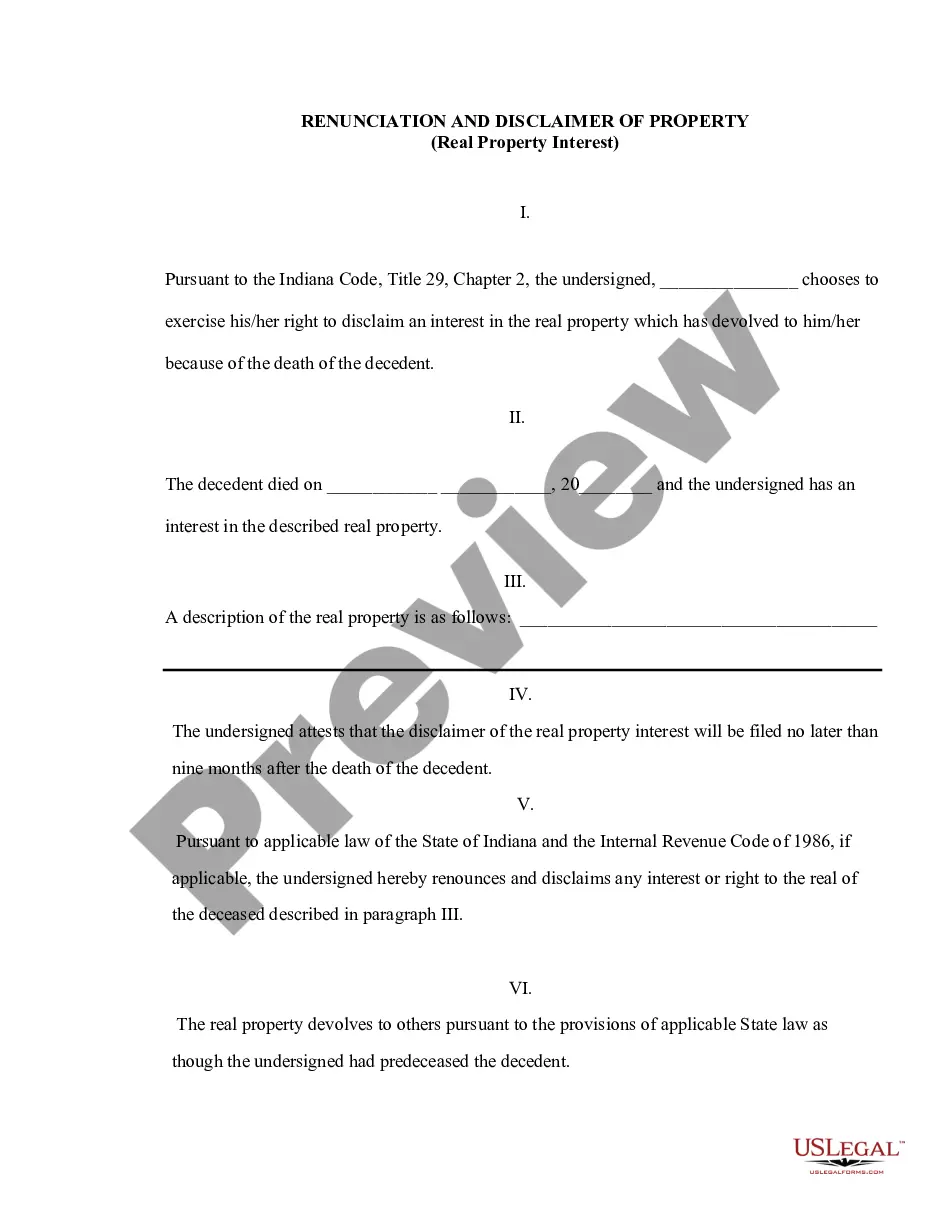

This form is a Renunciation and Disclaimer of Property acquired by intestate succession. The decedent died intestate (without a will) and the beneficiary gained an interest in the property. However, according to the Indiana Code, Title 29, Chapter 2, the beneficiary wishes to disclaim a portion of, or the entire interest in the property. The beneficiary attests that the disclaimer will be filed no later than nine months after the death of the decedent. The form also contains an acknowledgment and a certificate to verify delivery.

Indiana Renunciation and Disclaimer of Property received by Intestate Succession

Description

How to fill out Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession?

Searching for the Indiana Renunciation and Disclaimer of Property obtained through Intestate Succession example and completing them can be daunting.

To conserve time, expenses, and effort, utilize US Legal Forms to locate the suitable template specifically for your state in just a few clicks. Our attorneys prepare all documentation, so all you have to do is fill them out. It's truly that simple.

Log in to your account, revisit the form's page, and download the template. All your saved templates can be found in My documents and are accessible at any moment for future use. If you haven't registered yet, now is the time to sign up.

Now you can print the Indiana Renunciation and Disclaimer of Property obtained through Intestate Succession form or complete it using any online editor. Don’t fret about errors, as your form can be used and submitted, and printed as many times as you need. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- To obtain a valid form, ensure its applicability for your state.

- Examine the sample using the Preview feature (if available).

- If there is a description, read it to understand the specifics.

- Click the Buy Now button if you found what you're looking for.

- Select your plan on the pricing page and create your account.

- Choose your payment method, whether by card or PayPal.

- Download the document in your preferred format.

Form popularity

FAQ

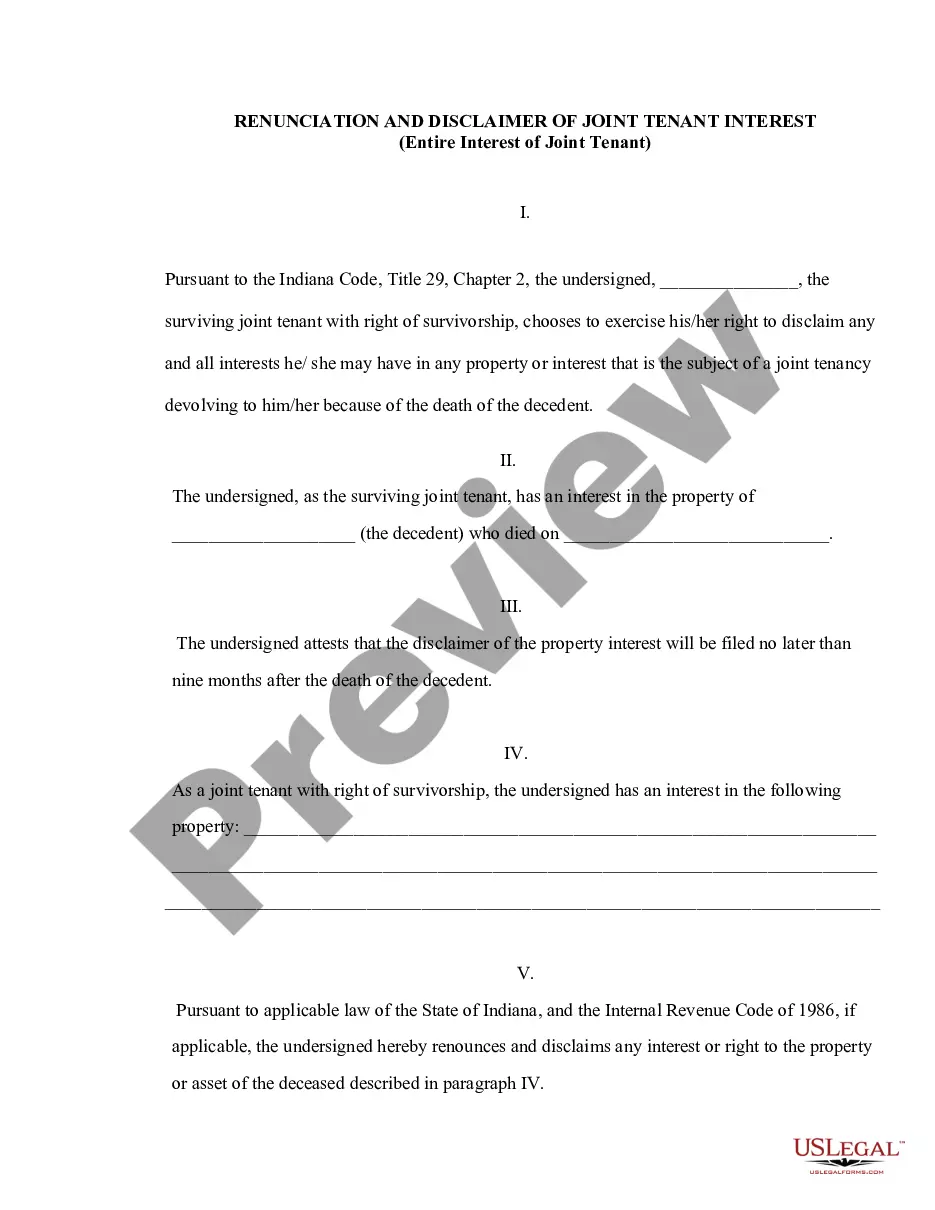

If one owner of a jointly held property dies in Indiana, the surviving owner automatically inherits the deceased owner’s share due to the right of survivorship. This transfer occurs without the need for probate, simplifying the transition. For further clarity on this process, consider how the Indiana Renunciation and Disclaimer of Property received by Intestate Succession could impact the outcome.

Disclaim the asset within nine months of the death of the assets' original owner (one exception: if a minor beneficiary wishes to disclaim, the disclaimer cannot take place until after the minor reaches the age of majority, at which time they will have nine months to disclaim the assets).

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.A disclaimer of interest is irrevocable.

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.

The beneficiary can disclaim only a portion of an inherited IRA or asset, allowing some to flow to the contingent beneficiary(s). Partial disclaiming is either a specific dollar or percentage amount as of the date of death.The balance will go to the next beneficiary(s).