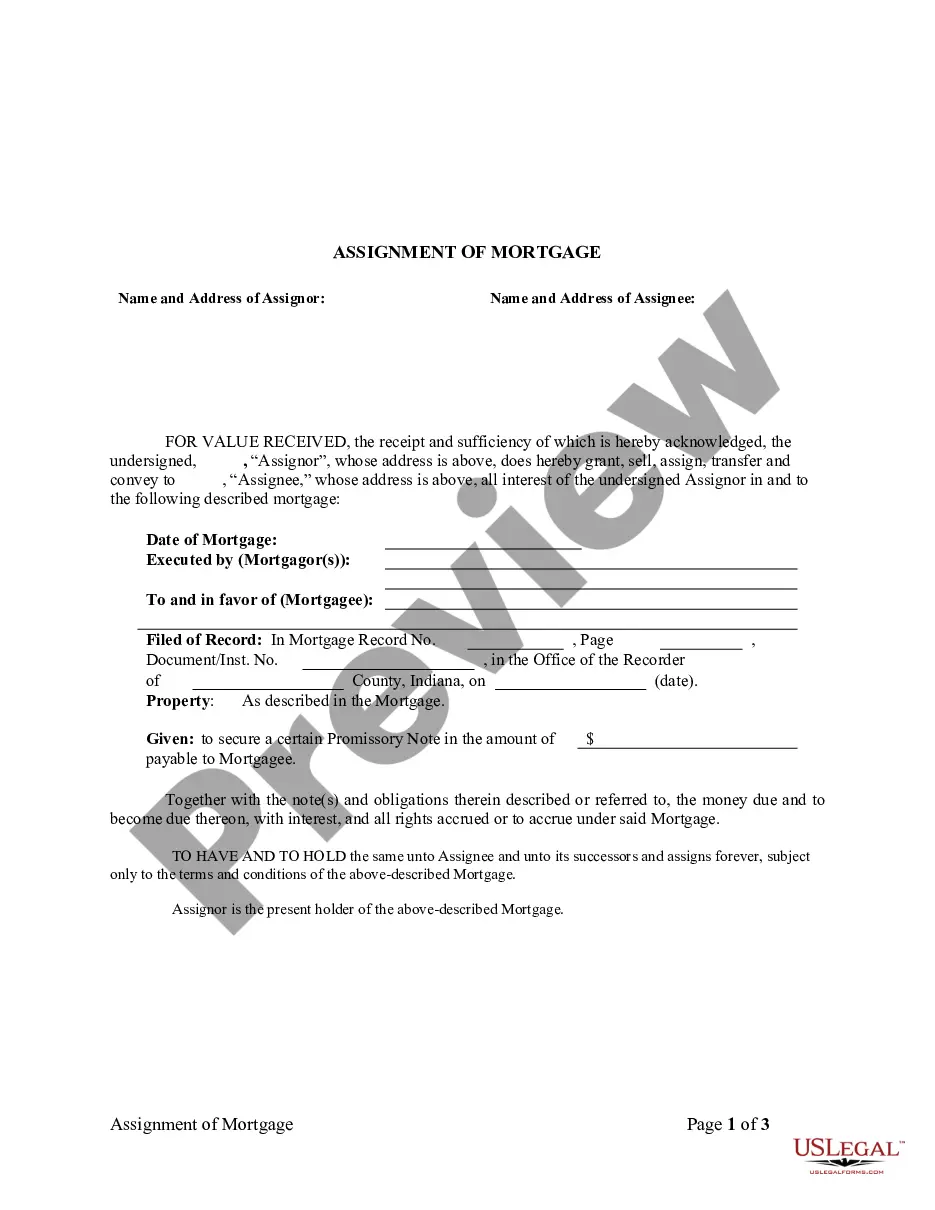

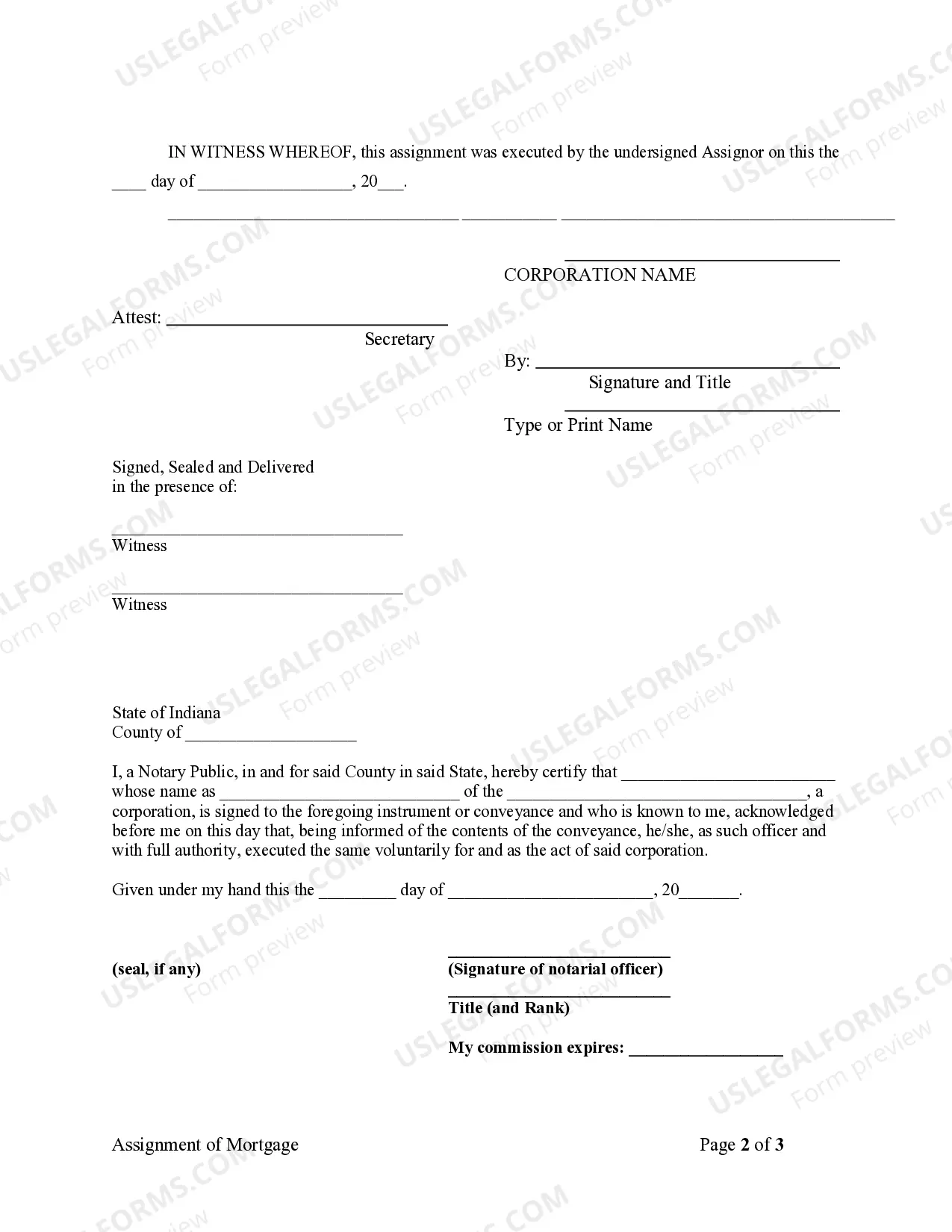

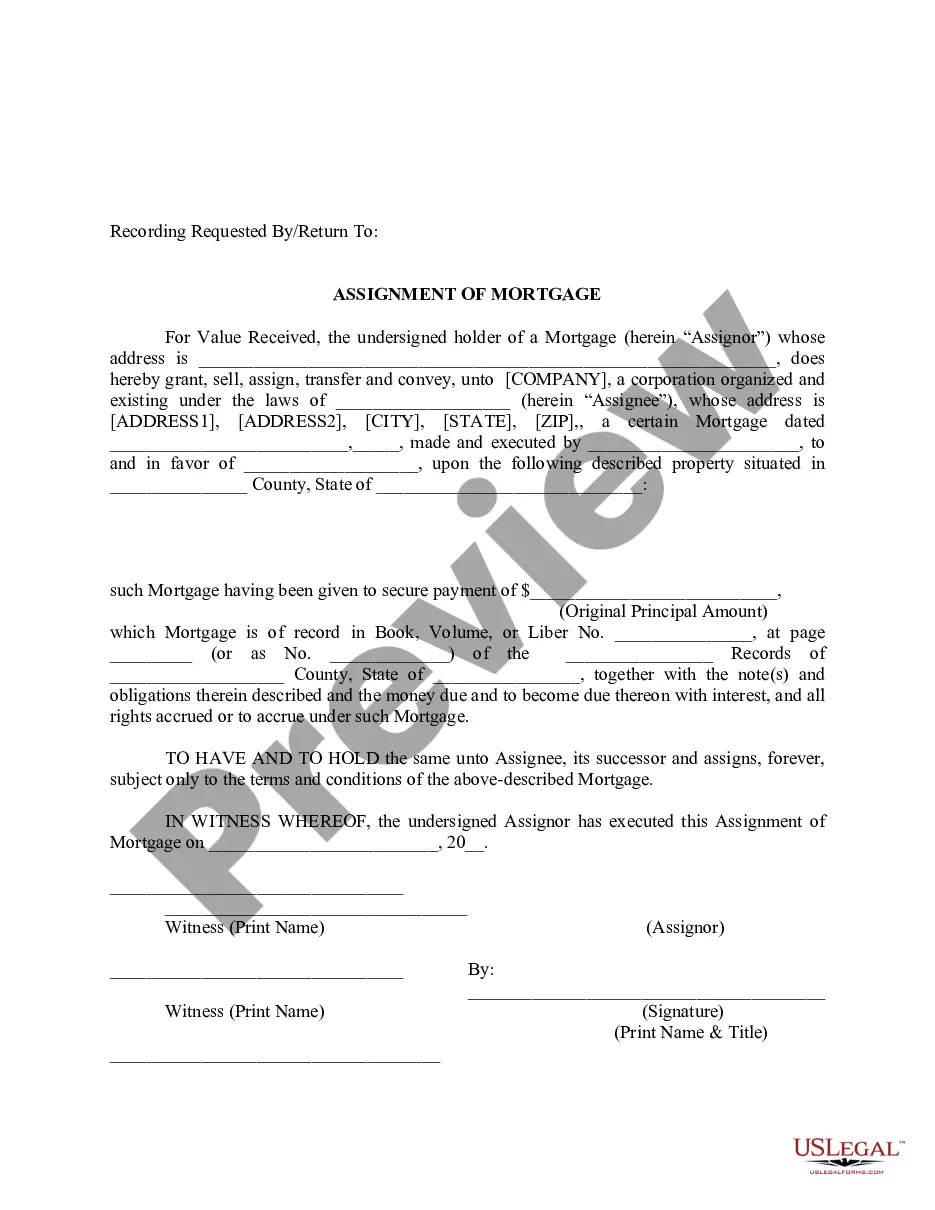

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Indiana Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Indiana Assignment Of Mortgage By Corporate Mortgage Holder?

Searching for Indiana Assignment of Mortgage by Corporate Mortgage Holder example and completing them can be daunting.

To save time, expenses, and effort, utilize US Legal Forms and locate the appropriate template specifically for your state in just a few clicks.

Our attorneys prepare all documents, so you only need to complete them. It's really that straightforward.

Select your plan on the pricing page and create an account. Choose to pay by credit card or via PayPal. Download the template in your desired file format. You can now print the Indiana Assignment of Mortgage by Corporate Mortgage Holder template or complete it using any online editor. There's no need to worry about typos because your template can be used, sent, and printed as many times as you desire. Explore US Legal Forms and gain access to nearly 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to save the template.

- Your saved templates are kept in My documents and are always available for future use.

- If you haven't subscribed yet, you should register.

- Review our detailed instructions on how to obtain the Indiana Assignment of Mortgage by Corporate Mortgage Holder template in just a few minutes.

- To acquire a qualified form, confirm its relevance for your state.

- Examine the form using the Preview option (if it’s accessible).

- If there's a description, read it to grasp the details.

- Click on the Buy Now button if you found what you're looking for.

Form popularity

FAQ

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

An assignment is the document that is the legal record of this transfer from one mortgagee to another. In a typical transaction, when the mortgagee sells the debt to another bank, an assignment is recorded and the promissory note is endorsed (signed over) to the new bank.

An assignment of mortgage is a document which indicates that a mortgage has been transferred from the original lender or borrower to a third party. Assignments of mortgage are more commonly seen when lenders sell mortgages to other lenders.This document indicates that the loan obligation has been transferred.

Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note. Assignment of the mortgage agreement occurs when the mortgagee (the bank or lender) transfers its rights under the agreement to another party.