A Restricted Stock Purchase Agreement is a legal document that is used by companies to grant restricted stock to employees or investors. Restricted stock is a form of equity compensation that is subject to certain restrictions, such as vesting, transfer, and forfeiture. The agreement outlines the terms of the restricted stock sale, including the company’s rights and obligations, the restrictions on the stock, and the terms of payment. There are two main types of Restricted Stock Purchase Agreement: an employee-based agreement and an investor-based agreement. Employee-based agreements are used to grant restricted stock to employees as part of an employee stock purchase plan, while investor-based agreements are used for private investments in the company’s stock. Both agreements typically include a vesting schedule, restrictions on transfer of the stock, and forfeiture provisions.

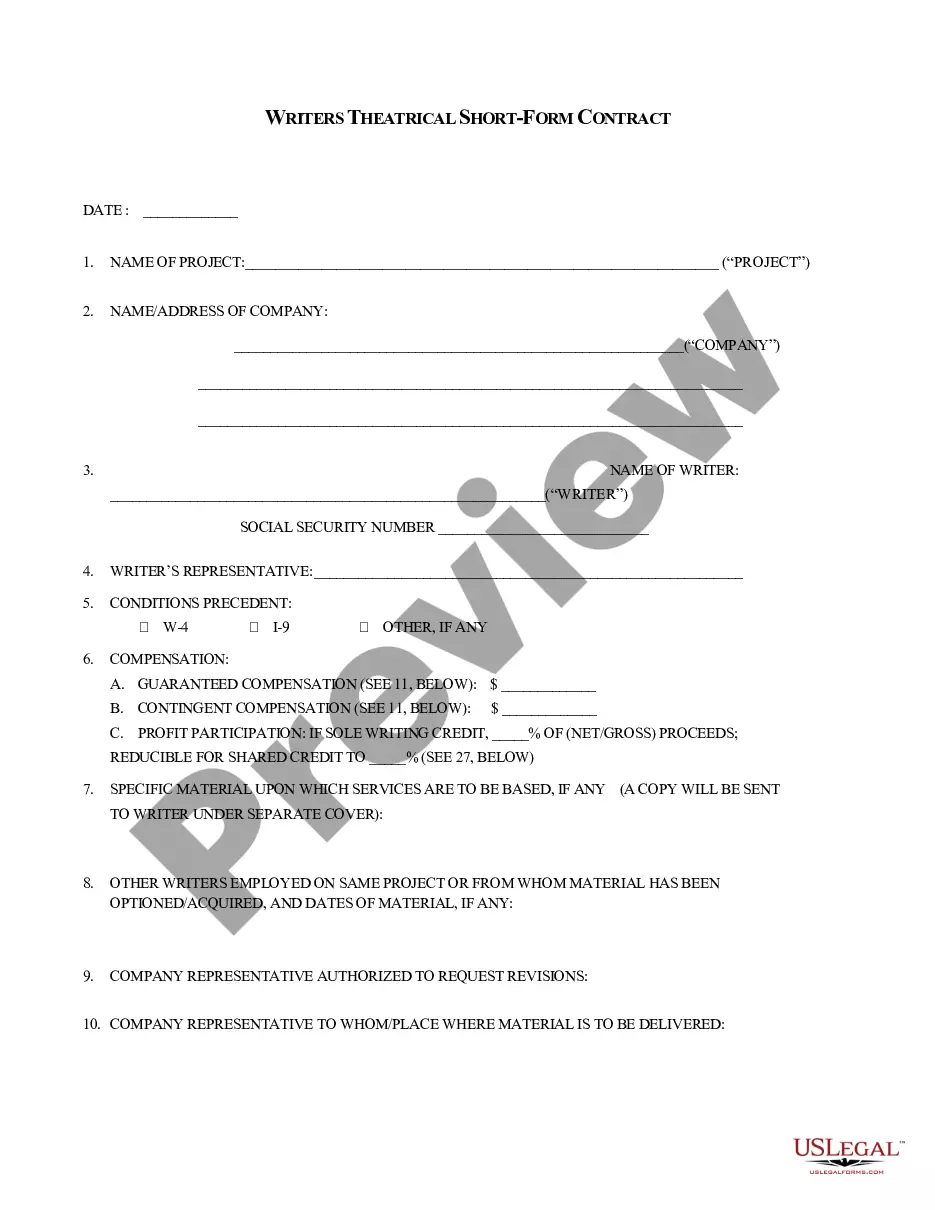

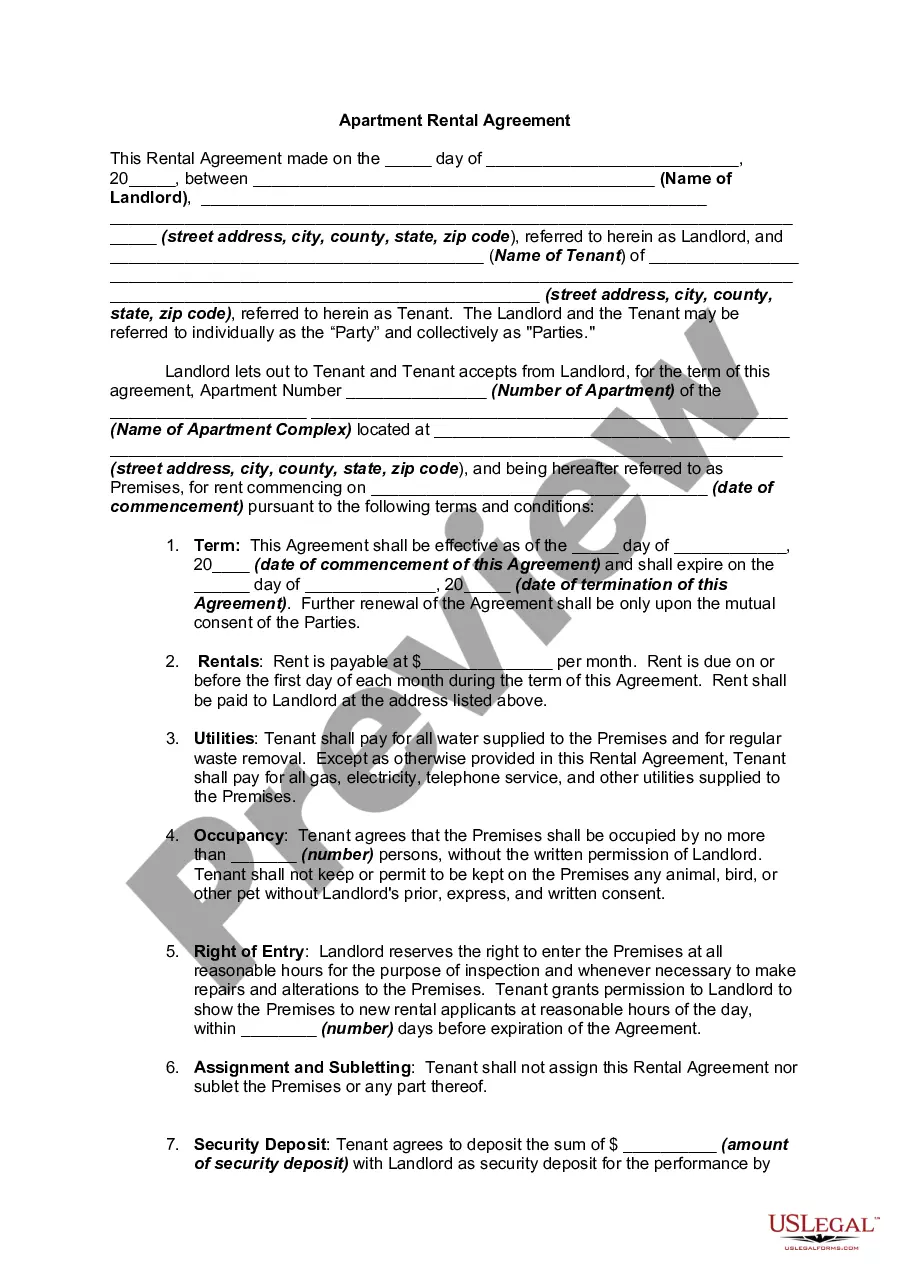

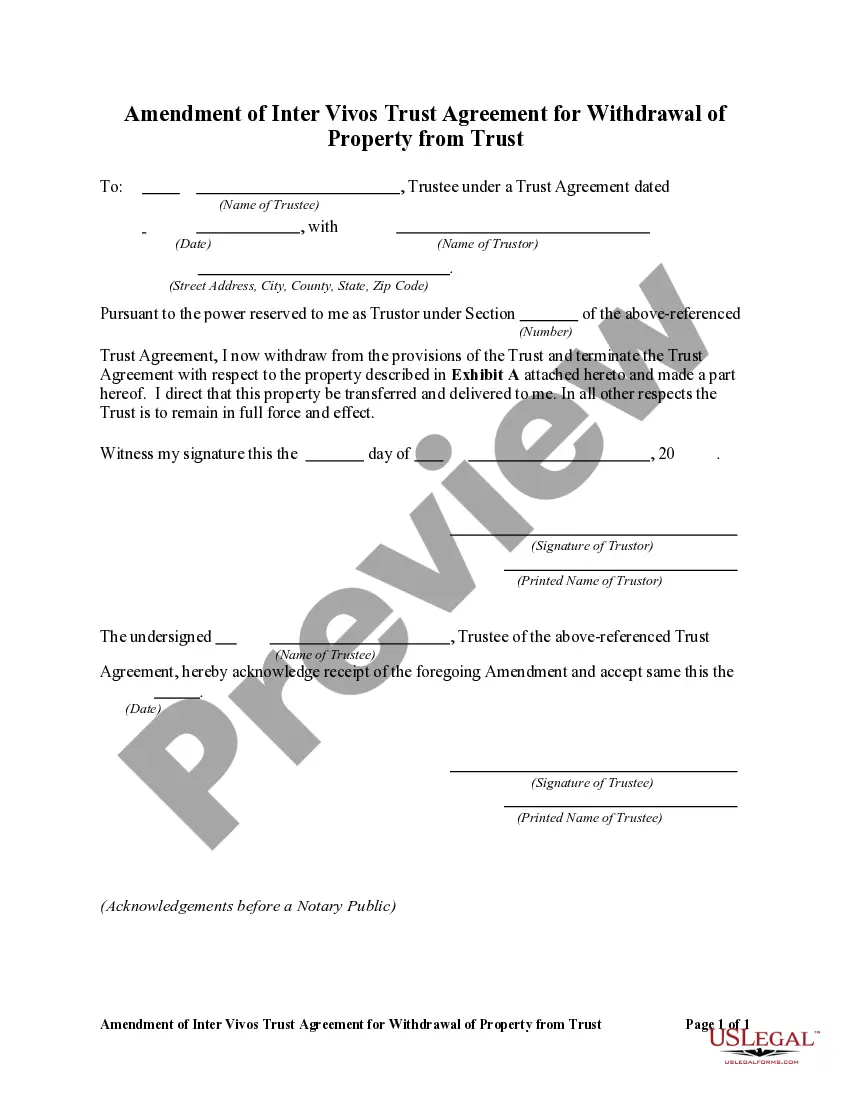

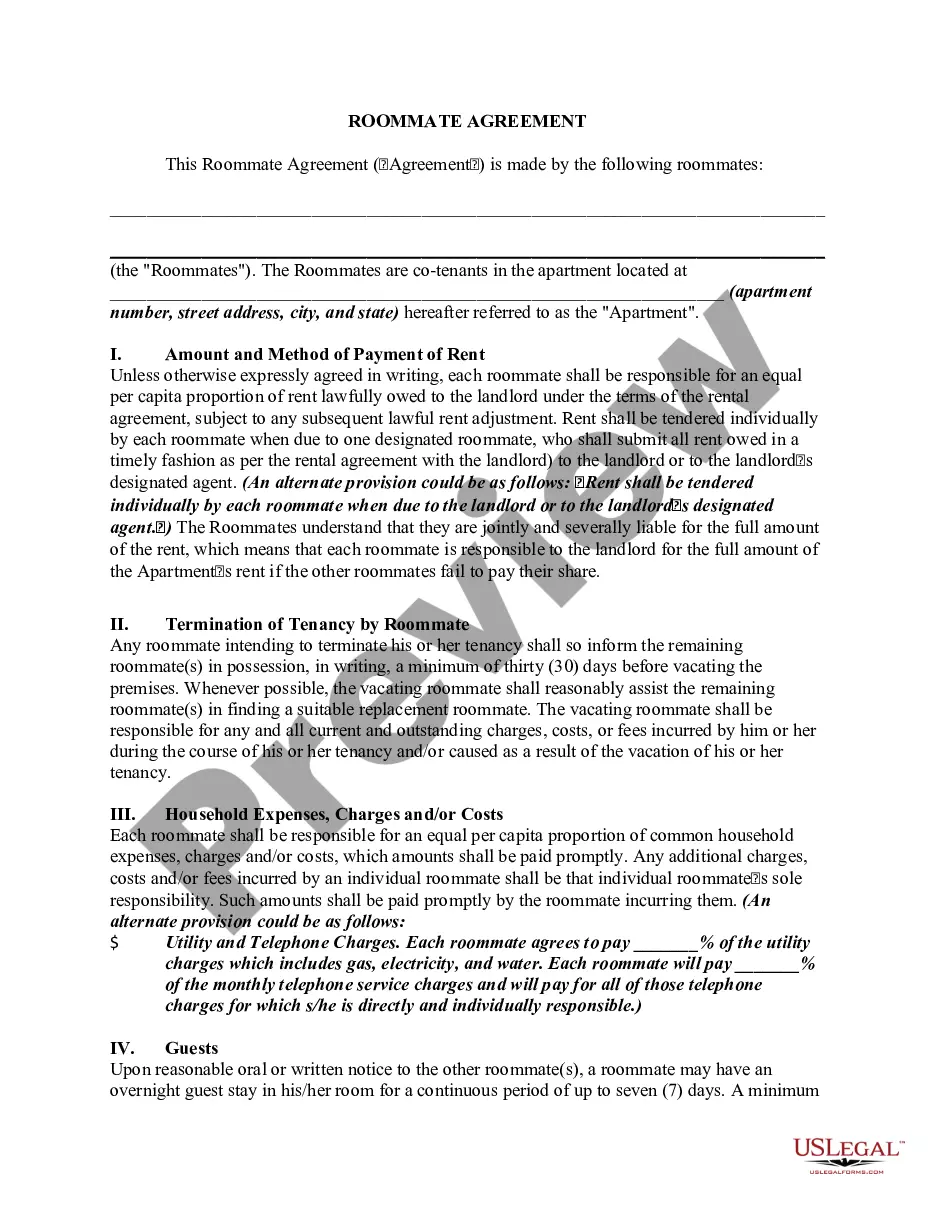

Restricted Stock Purchase Agreement

Description

How to fill out Restricted Stock Purchase Agreement?

US Legal Forms is the most straightforward and cost-effective way to locate appropriate formal templates. It’s the most extensive web-based library of business and personal legal paperwork drafted and verified by lawyers. Here, you can find printable and fillable templates that comply with national and local regulations - just like your Restricted Stock Purchase Agreement.

Obtaining your template takes just a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted Restricted Stock Purchase Agreement if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to guarantee you’ve found the one corresponding to your requirements, or find another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Register for an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Restricted Stock Purchase Agreement and download it on your device with the appropriate button.

Once you save a template, you can reaccess it at any time - simply find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more proficiently.

Benefit from US Legal Forms, your trustworthy assistant in obtaining the required official paperwork. Give it a try!

Form popularity

FAQ

Restricted stock (also called letter stock or section 1244 stock) is usually awarded to company directors and other high-level executives, whereas restricted stock units (RSUs) are typically awarded to lower-level employees. Restricted stock tends to have more conditions and restrictions than an RSU.

For example, a new tech startup might offer restricted stock to its key executives to provide additional compensation without the need for immediate cash. In addition, the stock may have a vesting timeline of five years before the executive has full ownership of the shares.

Common Sections in Restricted Stock Purchase Agreements Purchase and Sale of the Shares. Closing. Repurchase Option. Release of Shares from Repurchase Option; Vesting. Limitation on Payments. Restrictions on Transfer. Company's Right of First Refusal. Escrow.

Restricted stock units give employees interest in their employer's equity but have no tangible value until they are vested. The RSUs are assigned a fair market value (FMV) when they vest. Restricted stock units are considered income once vested, and a portion of the shares is withheld to pay income taxes.

A Restricted Stock Purchase Agreement (RSPA) is an agreement issuing restricted stock. RSPAs are typically granted to founders to prevent the founder from leaving the company prematurely and taking a lot of the ownership with her. The RSPA establishes when the shares will fully vest and belong to the founder.

A Simple Strategy for RSUs (Almost) Every Recipient Should Follow. So what's the most tax efficient way to manage your restricted stock? Sell your shares immediately upon vesting. In nearly all cases, this is most advantageous approach, especially if you expect to receive new awards each year going forward.