Employee Restricted Stock Purchase Agreement

Description

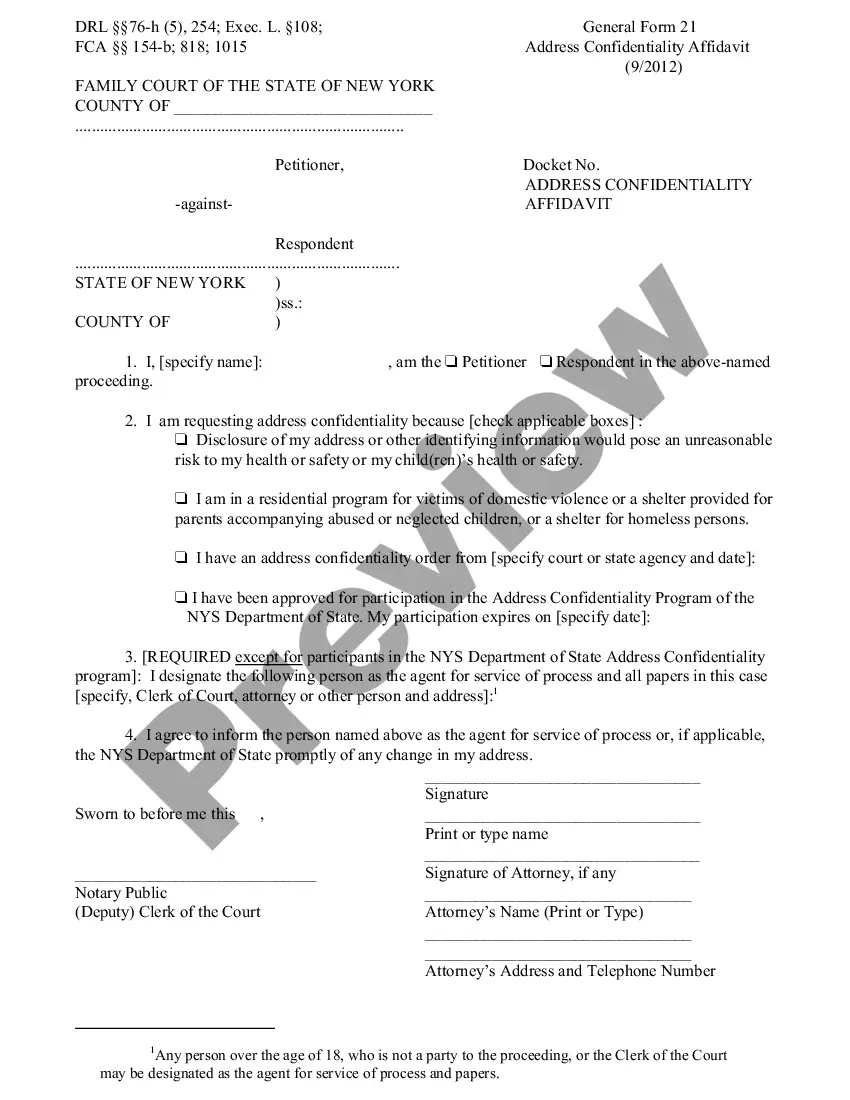

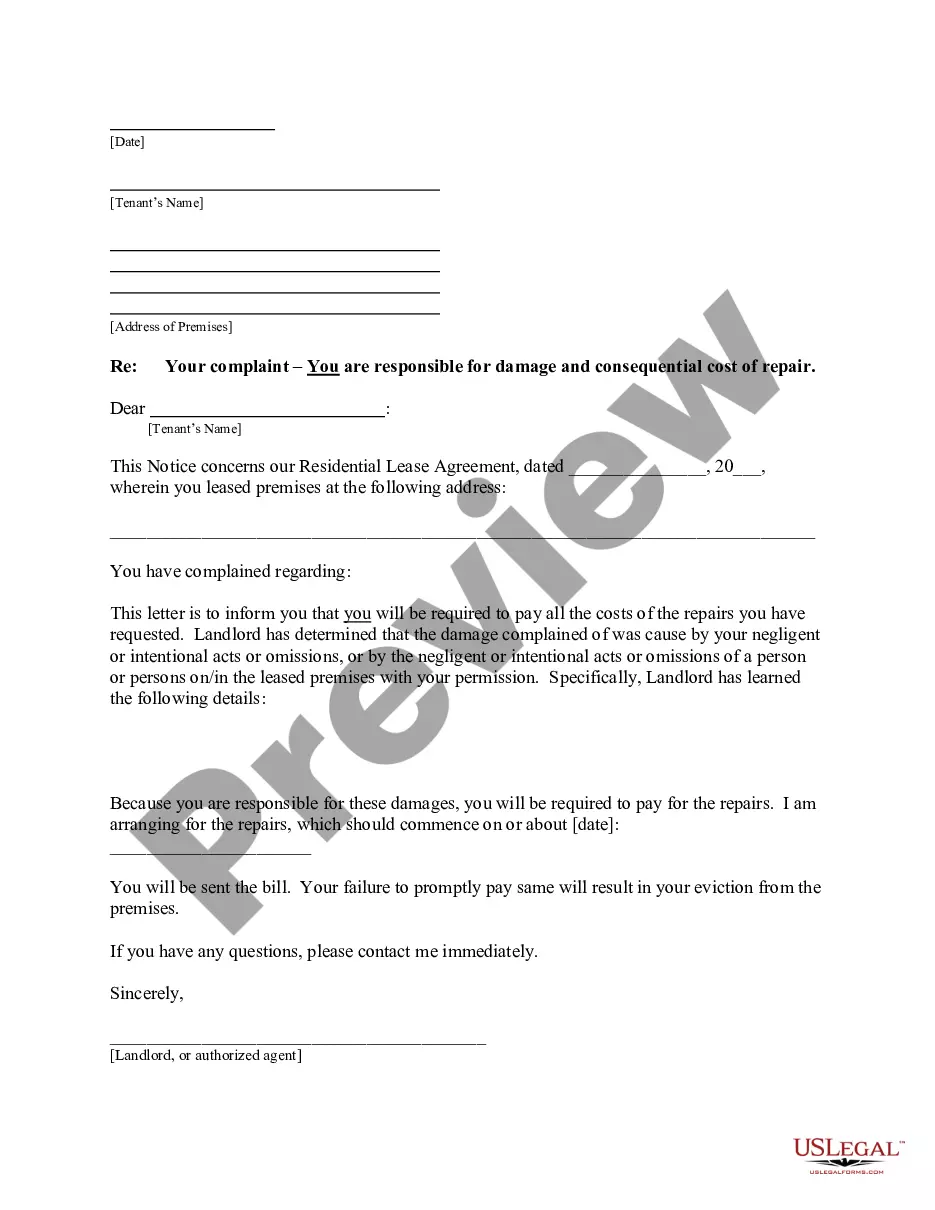

How to fill out Employee Restricted Stock Purchase Agreement?

Use US Legal Forms to get a printable Employee Restricted Stock Purchase Agreement. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most comprehensive Forms catalogue on the internet and provides cost-effective and accurate templates for customers and attorneys, and SMBs. The templates are categorized into state-based categories and a few of them might be previewed prior to being downloaded.

To download templates, users must have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For those who don’t have a subscription, follow the following guidelines to easily find and download Employee Restricted Stock Purchase Agreement:

- Check to make sure you get the proper form with regards to the state it’s needed in.

- Review the document by reading the description and using the Preview feature.

- Press Buy Now if it’s the document you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Make use of the Search engine if you want to get another document template.

US Legal Forms provides thousands of legal and tax templates and packages for business and personal needs, including Employee Restricted Stock Purchase Agreement. Above three million users have already used our platform successfully. Choose your subscription plan and get high-quality documents within a few clicks.

Form popularity

FAQ

Restricted stock is treated like any other issued and outstanding stock when it comes to entitlement to voting and dividend rightsthe major difference is the existence of restrictions on sale or transfer until the stocks vest.

IPO Lock-Up Period and Long Term Capital Gains In most scenarios when your RSUs vest you can sell them immediately and there is almost no tax impact.However, if the stock reverts to the original IPO/Vesting date price, don't hesitate to sell since there will be no additional tax benefit.

If you measure 1 RSU against 1 stock option, RSUs are pretty much always going to win. Because an RSU is basically just a stock option with a $0 strike price, and a stock option is always going to have a strike price higher than $0.Companies know this and generally will offer you more options than they would RSUs.

What are restricted share rights (RSRs)? An RSR is a right to receive a share of Wells Fargo common stock at a future date, provided certain vesting requirements and other conditions are satisfied.The potential value of an RSR is the value of the underlying Wells Fargo common stock.

RSUs give an employee interest in company stock but they have no tangible value until vesting is complete. The restricted stock units are assigned a fair market value when they vest. Upon vesting, they are considered income, and a portion of the shares is withheld to pay income taxes.

Restricted stocks have particular conditions that must be fulfilled before they can be transferred or sold, whereas unrestricted stocks have no such conditions.However, restricted stocks may be sold privately at any time, though such transactions are strictly regulated.

Restricted stock units are a way an employer can grant company shares to employees. The grant is "restricted" because it is subject to a vesting schedule, which can be based on length of employment or on performance goals, and because it is governed by other limits on transfers or sales that your company can impose.

While restricted shares are transferred to the owners on the grant date, RSUs act as a promise to transfer shares subject to meeting specific conditions, and they are units rather than shares so are not included in the shares outstanding.

Restricted stock units are a way an employer can grant company shares to employees. The grant is "restricted" because it is subject to a vesting schedule, which can be based on length of employment or on performance goals, and because it is governed by other limits on transfers or sales that your company can impose.