Indiana Assignment of Mortgage by Corporate Mortgage Holder

Understanding this form

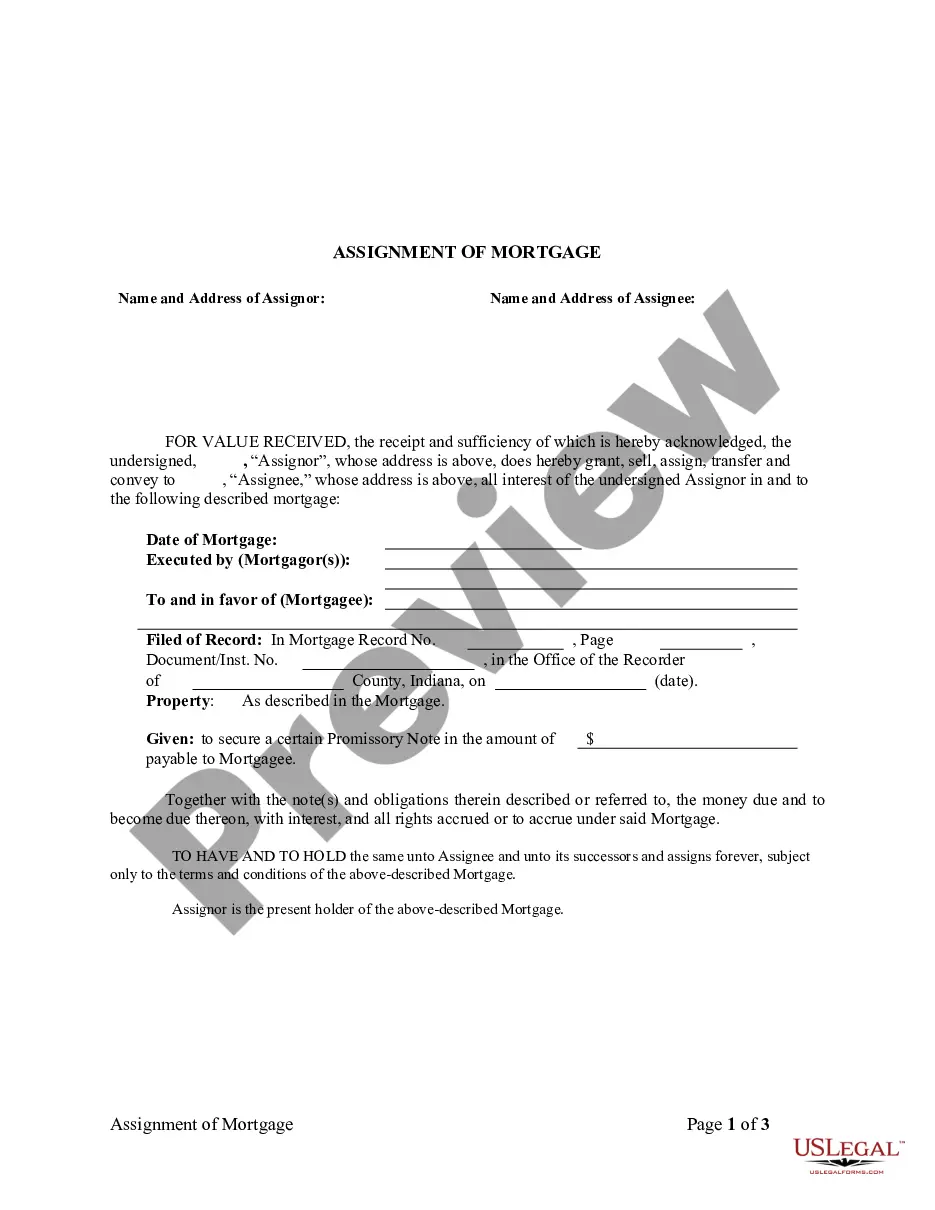

The Assignment of Mortgage by Corporate Mortgage Holder is a legal document used when a corporation that holds a mortgage assigns its rights and interests in the mortgage to another party. This form is essential for the transfer of mortgage obligations and ensures that the new assignee has the necessary legal authority regarding the mortgage, unlike similar forms that may only pertain to individual holders of mortgages.

Key components of this form

- Identification of the Assignor (the corporate holder of the mortgage).

- Details of the mortgage or deed of trust being assigned.

- Identification of the Assignee (the third party receiving the mortgage rights).

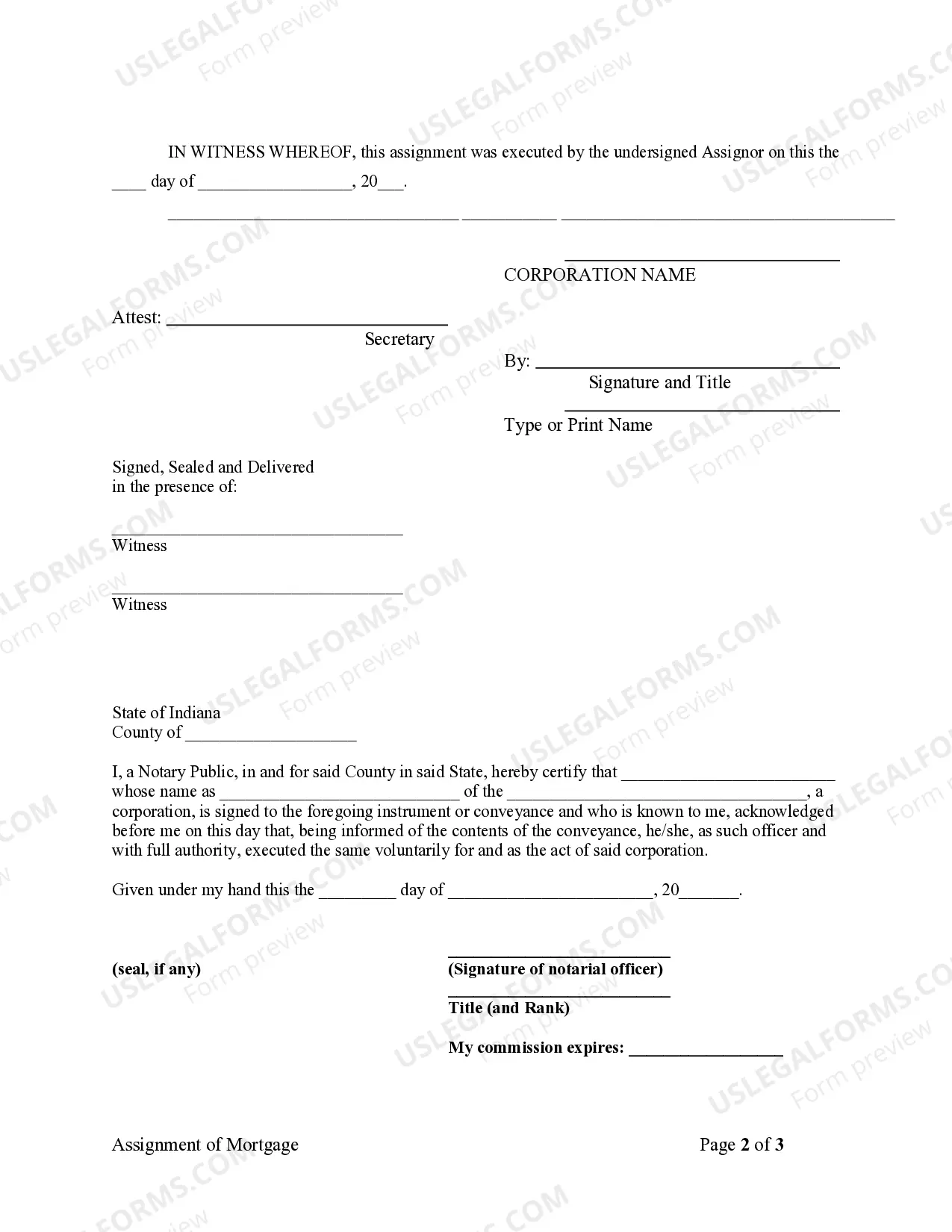

- Signature line for the Assignor to verify the assignment.

- Date of execution of the assignment.

When to use this document

This form should be used when a corporation wishes to transfer its mortgage interest to another entity. Common scenarios include selling a portfolio of mortgages, restructuring debt, or entering into a new financing arrangement. It is crucial in facilitating legal title transfers and ensuring all parties' rights are updated in the mortgage records.

Intended users of this form

- Corporations that currently hold a mortgage or deed of trust.

- Companies seeking to transfer their mortgage rights to another corporate entity.

- Financial institutions involved in restructuring or selling mortgage assets.

- Legal professionals assisting corporations with real estate transactions.

How to complete this form

- Identify the Assignor by providing the corporate name and relevant details.

- Specify the Assignee by including the name and contact information of the third party.

- Detail the mortgage or deed of trust being assigned, including any identifying numbers.

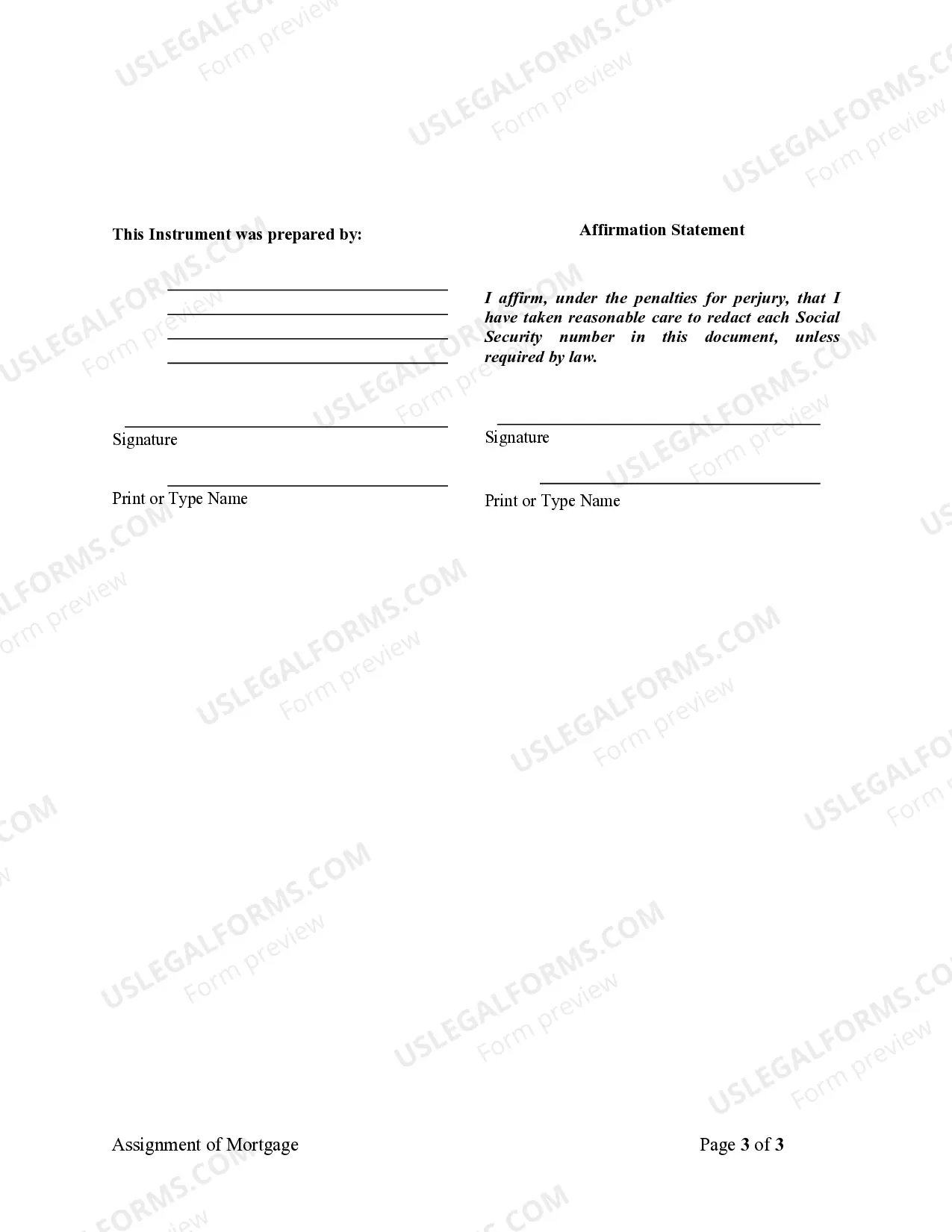

- Have authorized representatives sign the form to validate the assignment.

- Enter the date of the assignment in the designated section.

Does this document require notarization?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include complete information about the Assignor and Assignee.

- Not providing the correct details of the mortgage being assigned.

- Omitting signatures or dates, which can invalidate the document.

- Using outdated versions of the form that may not comply with current laws.

Advantages of online completion

- Convenient access to legal forms from your home or office.

- Editable formats that allow customization based on specific needs.

- Reliable templates drafted by licensed attorneys.

- Time-saving downloads that can be completed quickly.

Looking for another form?

Form popularity

FAQ

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

An assignment is the document that is the legal record of this transfer from one mortgagee to another. In a typical transaction, when the mortgagee sells the debt to another bank, an assignment is recorded and the promissory note is endorsed (signed over) to the new bank.

An assignment of mortgage is a document which indicates that a mortgage has been transferred from the original lender or borrower to a third party. Assignments of mortgage are more commonly seen when lenders sell mortgages to other lenders.This document indicates that the loan obligation has been transferred.

Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note. Assignment of the mortgage agreement occurs when the mortgagee (the bank or lender) transfers its rights under the agreement to another party.