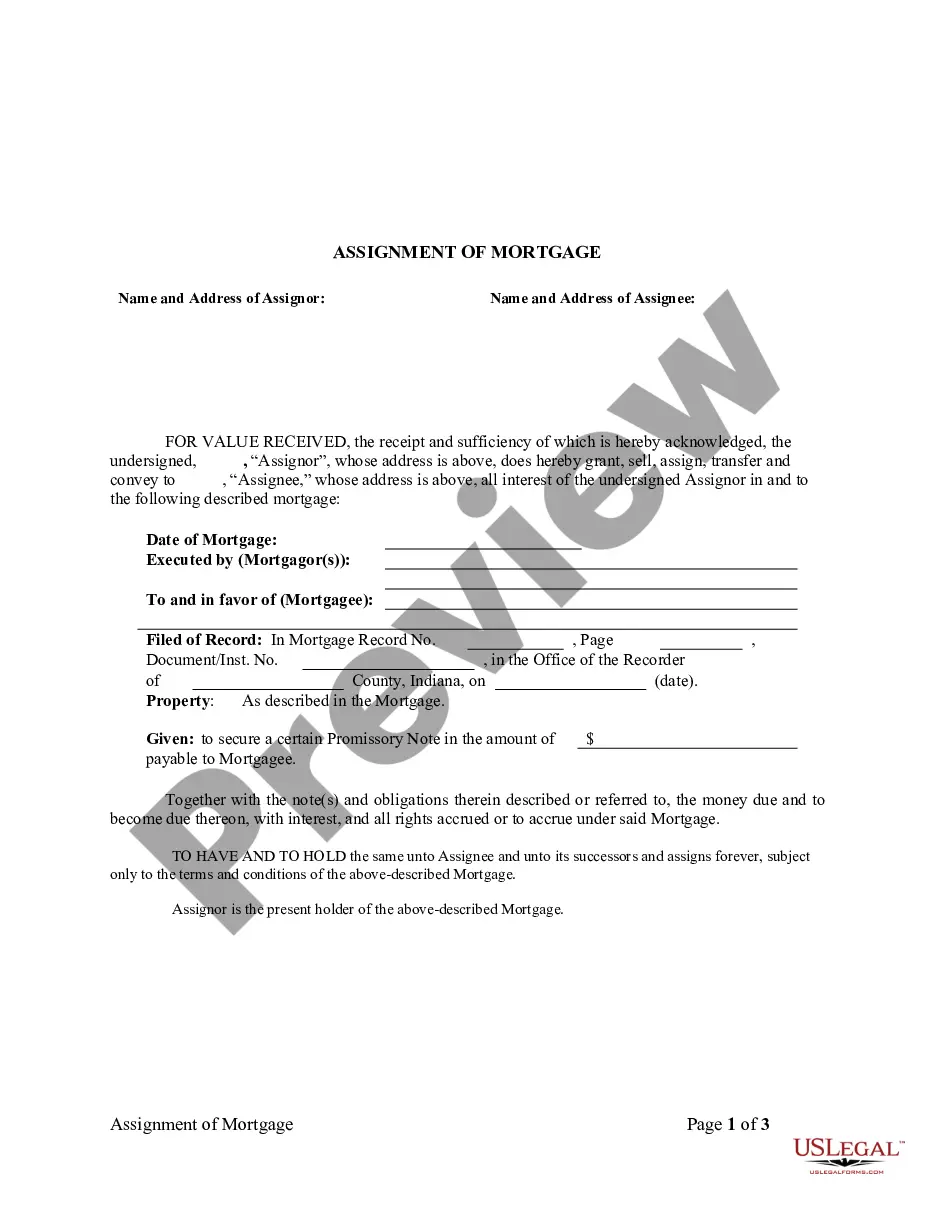

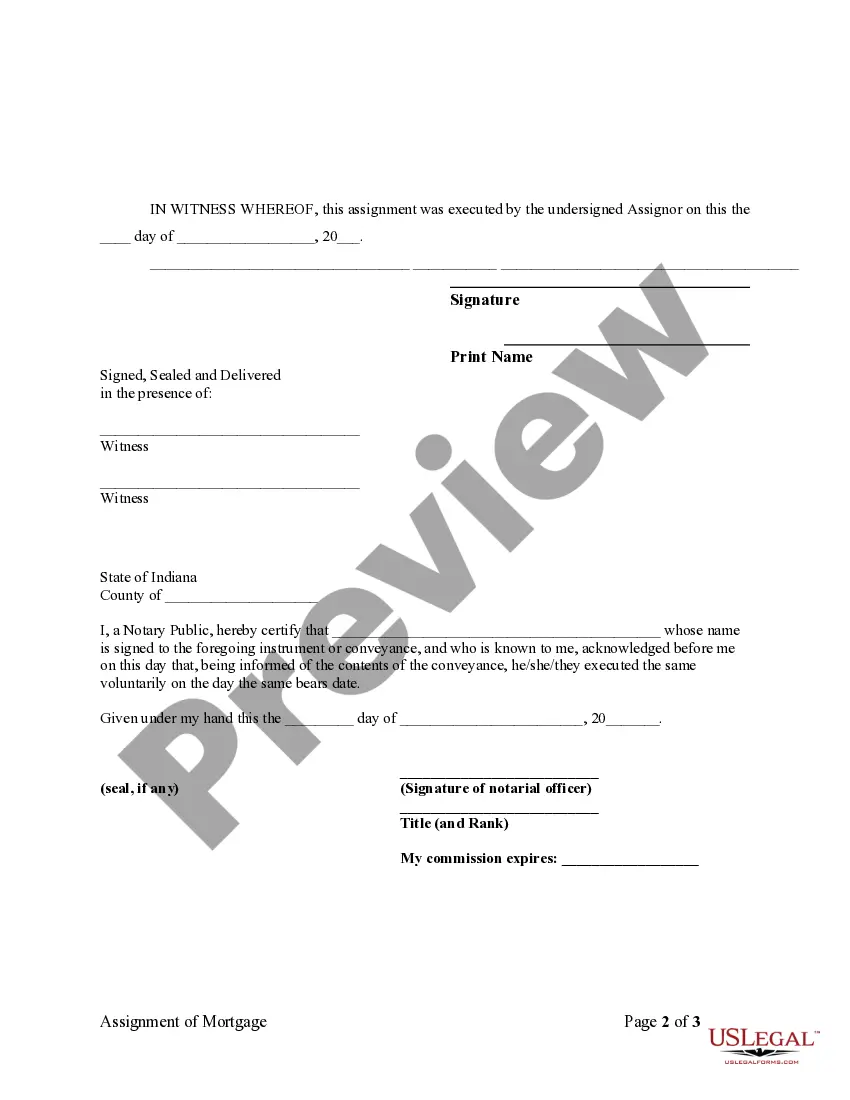

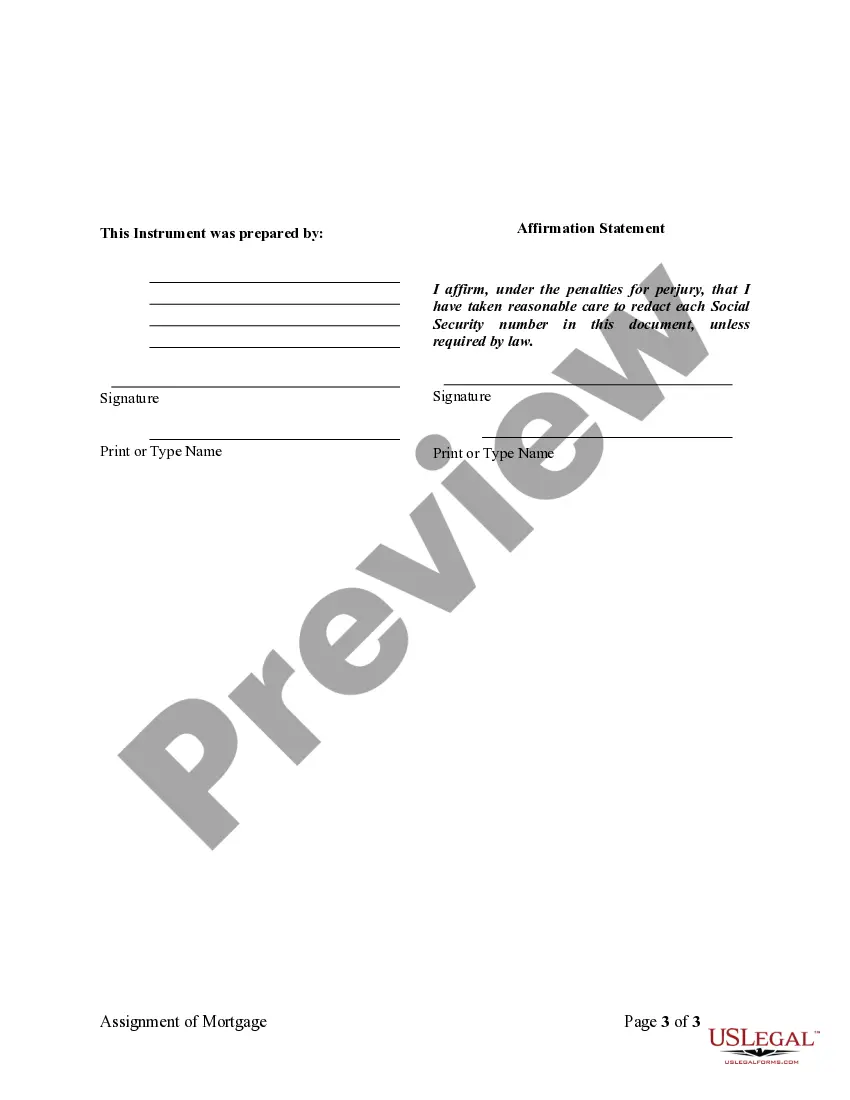

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Indiana Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Indiana Assignment Of Mortgage By Individual Mortgage Holder?

Attempting to locate Indiana Assignment of Mortgage by Individual Mortgage Holder forms and completing them can be difficult.

To conserve considerable time, expenses, and effort, utilize US Legal Forms and discover the right template specifically for your state in just a few clicks. Our attorneys prepare every document, so you merely need to fill them out. It truly is that simple.

Log in to your account and return to the form's page to download the document. Your downloaded templates are stored in My documents and are available at all times for future use. If you haven’t signed up yet, you need to create an account.

You can print the Indiana Assignment of Mortgage by Individual Mortgage Holder form or complete it using any online editor. No need to stress about making mistakes because your sample can be utilized and sent off, and printed out as many times as you wish. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- To obtain a qualified template, verify its relevance for your state.

- Examine the sample using the Preview feature (if it’s available).

- If there is a description, read it carefully to grasp the details.

- Click Buy Now if you found what you are looking for.

- Select your plan on the pricing page and establish your account.

- Choose whether you prefer to pay with a credit card or via PayPal.

- Download the sample in your selected file format.

Form popularity

FAQ

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

What is MERSCORP Holdings? MERSCORP Holdings, Inc. is a privately held corporation that owns and manages the MERS® System and all other MERSA® products. It is a member-based organization made up of more than 5,000 lenders, servicers, sub-servicers, investors and government institutions.

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

When a lender, bank, or mortgage company sells a home loan to another entity, the seller usually takes the following steps.An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

The assignment transfers all of the interest the original lender had under the mortgage to the new bank. By tracking loan transfers electronically, MERS eliminates the long-standing practice that the lender must record an assignment with the county recorder every time the loan is sold from one bank to another.

The servicer of a MERS-registered loan has the legal authority to discharge the mortgage on behalf of MERS because, as a member of MERS, authority was granted to their officers through a corporate resolution. The person authorized to sign discharges is sometimes referred to as a certifying officer by MERS.

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.

No. If MERS was not named as the original mortgagee on the security instrument at the time of closing, you can assign the mortgage to MERS after closing.