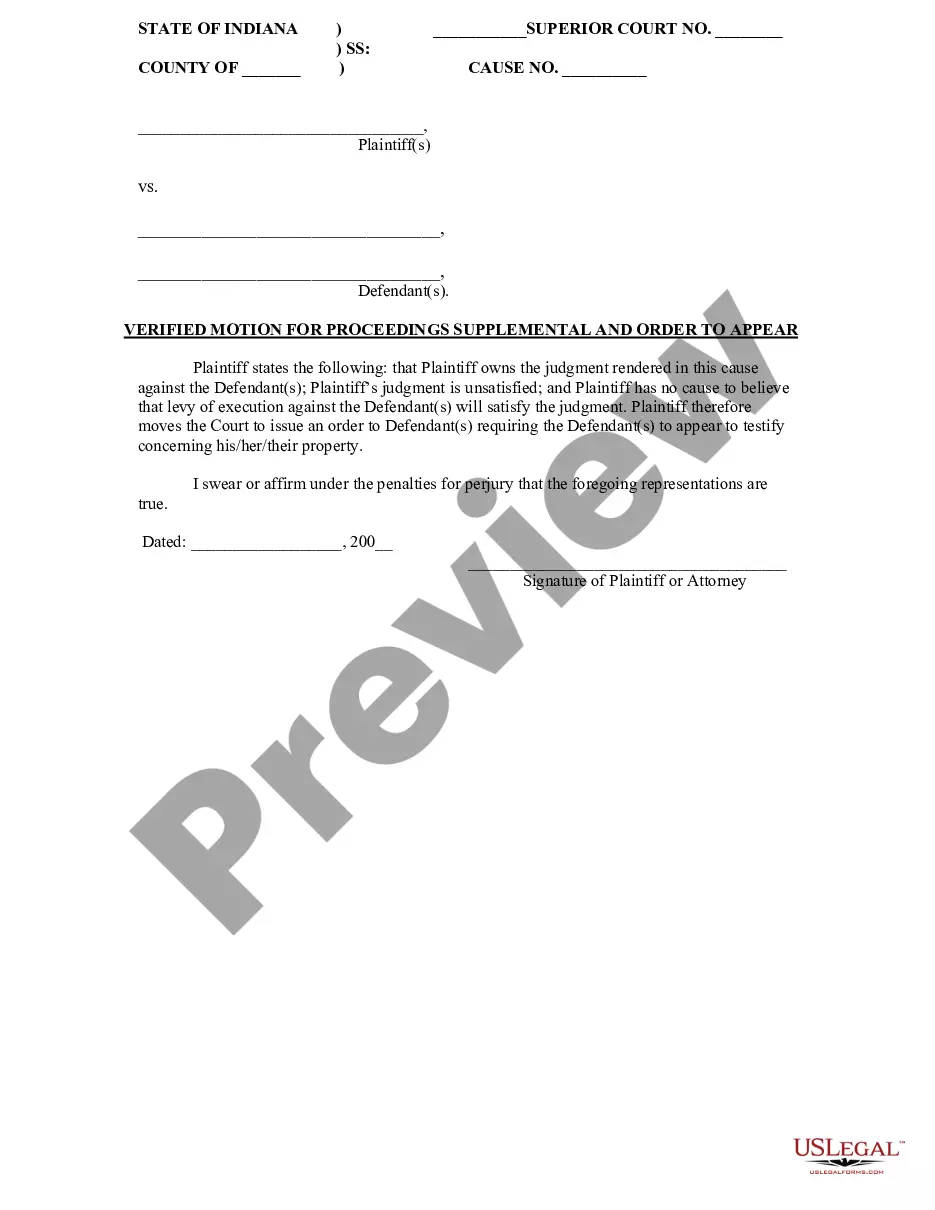

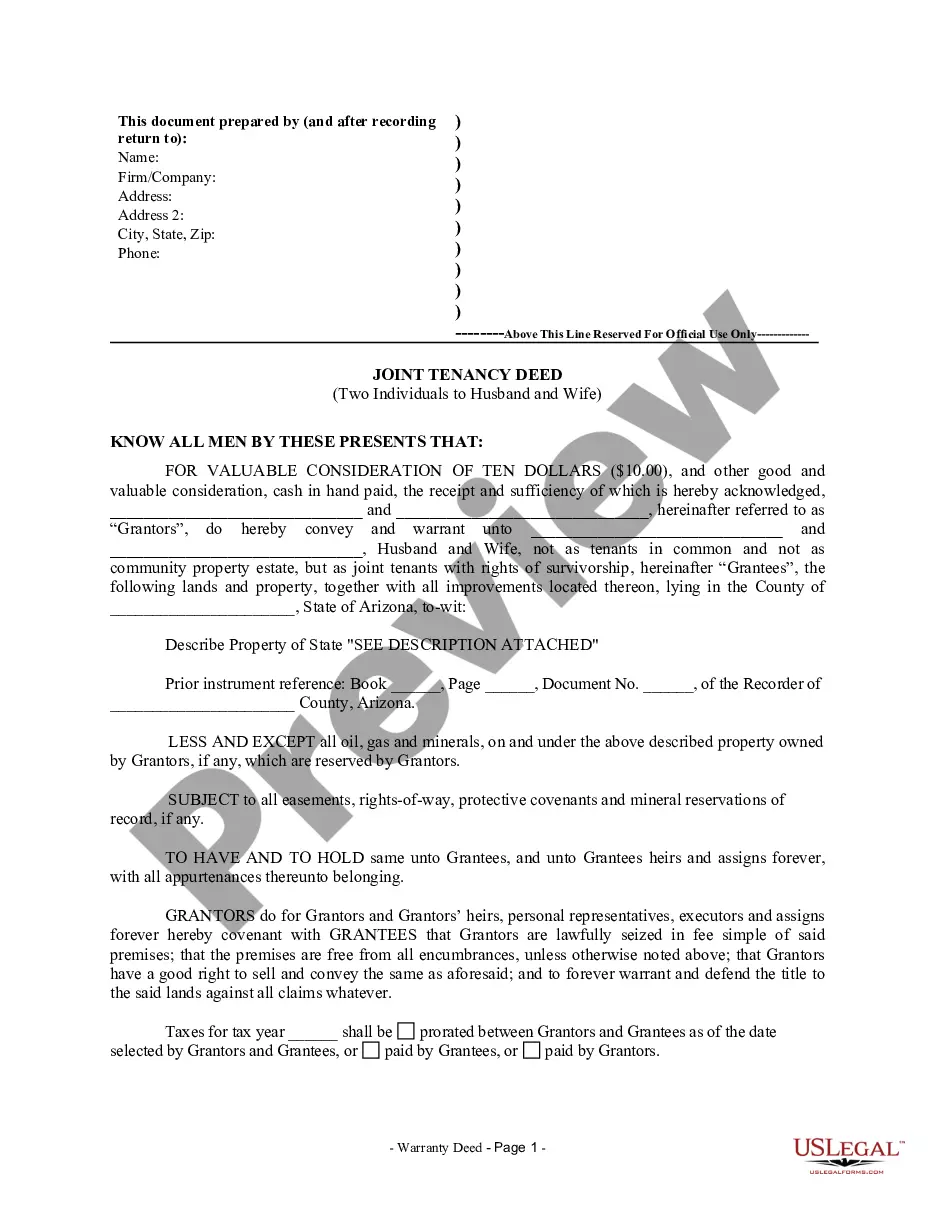

This is a Verified Motion for Proceedings Supplemental and Order to Appear to be used in the Small Claims Court for the State of Indiana. In this document, the Plaintiff moves the Court to compel the Defendant to appear and testify concerning his/her property.

Indiana Verified Motion for Proceedings Supplemental and Order to Appear

Description

How to fill out Indiana Verified Motion For Proceedings Supplemental And Order To Appear?

On the lookout for Indiana Verified Motion for Proceedings Supplemental and Order to Appear template and filling them out can be a task.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the suitable template specifically for your state with just a few clicks.

Our attorneys create every document, so you only need to complete them. It's truly that simple.

You can now print the Indiana Verified Motion for Proceedings Supplemental and Order to Appear template or fill it out using any online editor. There’s no need to worry about typos, since your template can be utilized and submitted, and printed as often as needed. Visit US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Access your account by logging in and return to the form's page to save the document.

- All of your downloaded templates are stored in My documents and are accessible at any time for future use.

- If you haven’t registered yet, make sure to sign up.

- Review our comprehensive guidelines on how to obtain the Indiana Verified Motion for Proceedings Supplemental and Order to Appear template within minutes.

- To acquire an authorized form, verify its relevance to your state.

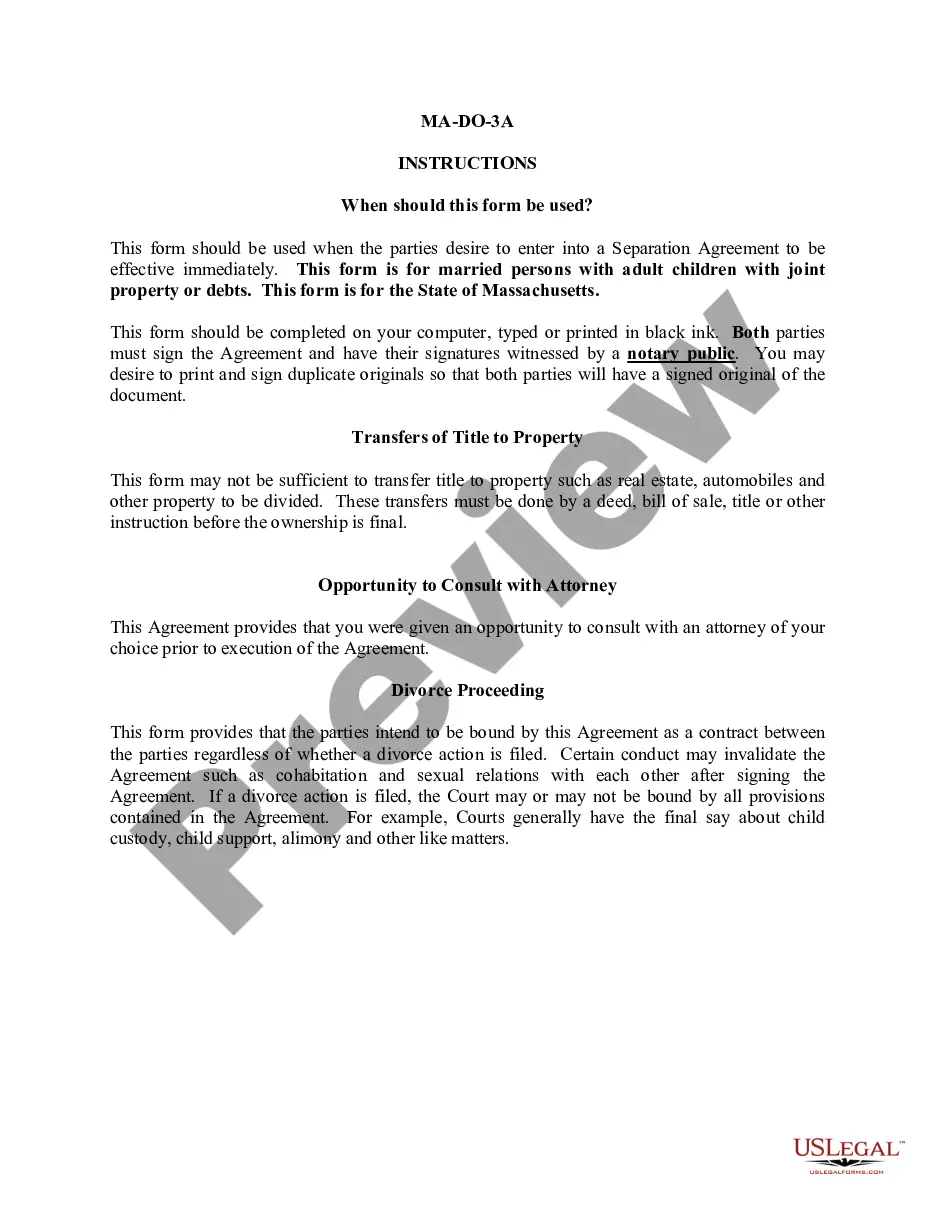

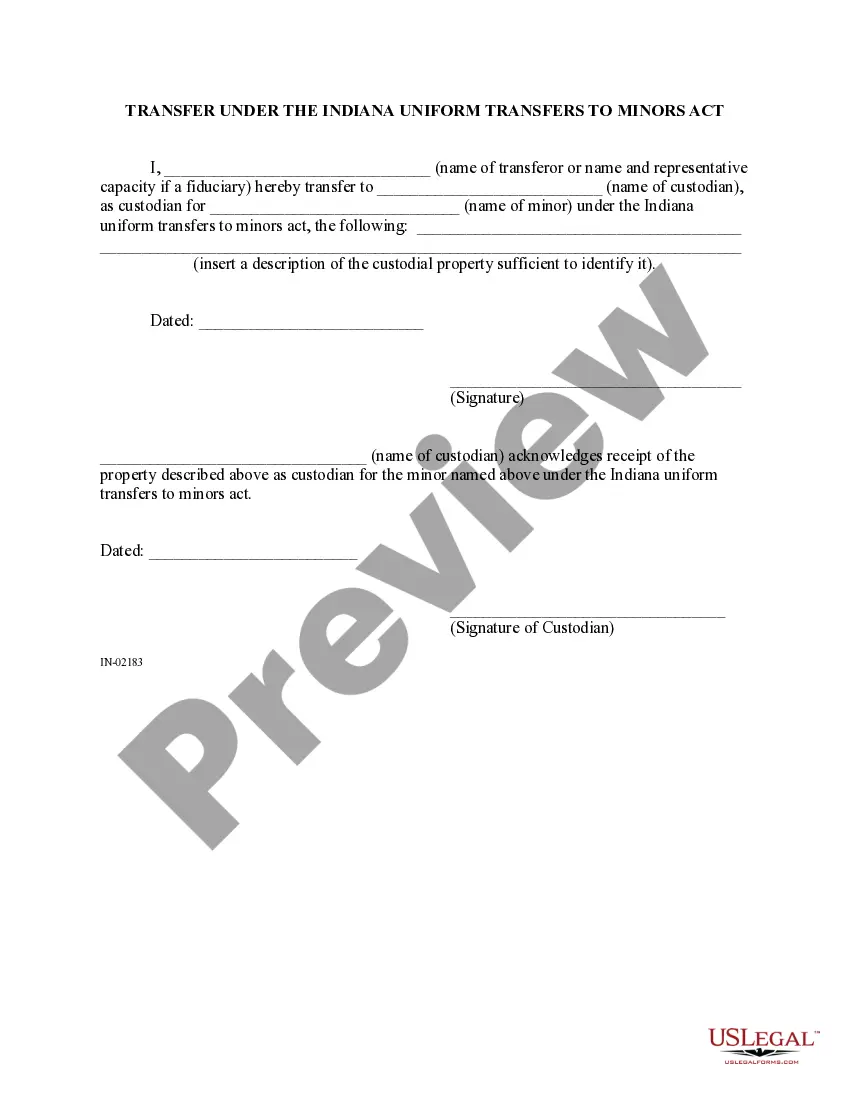

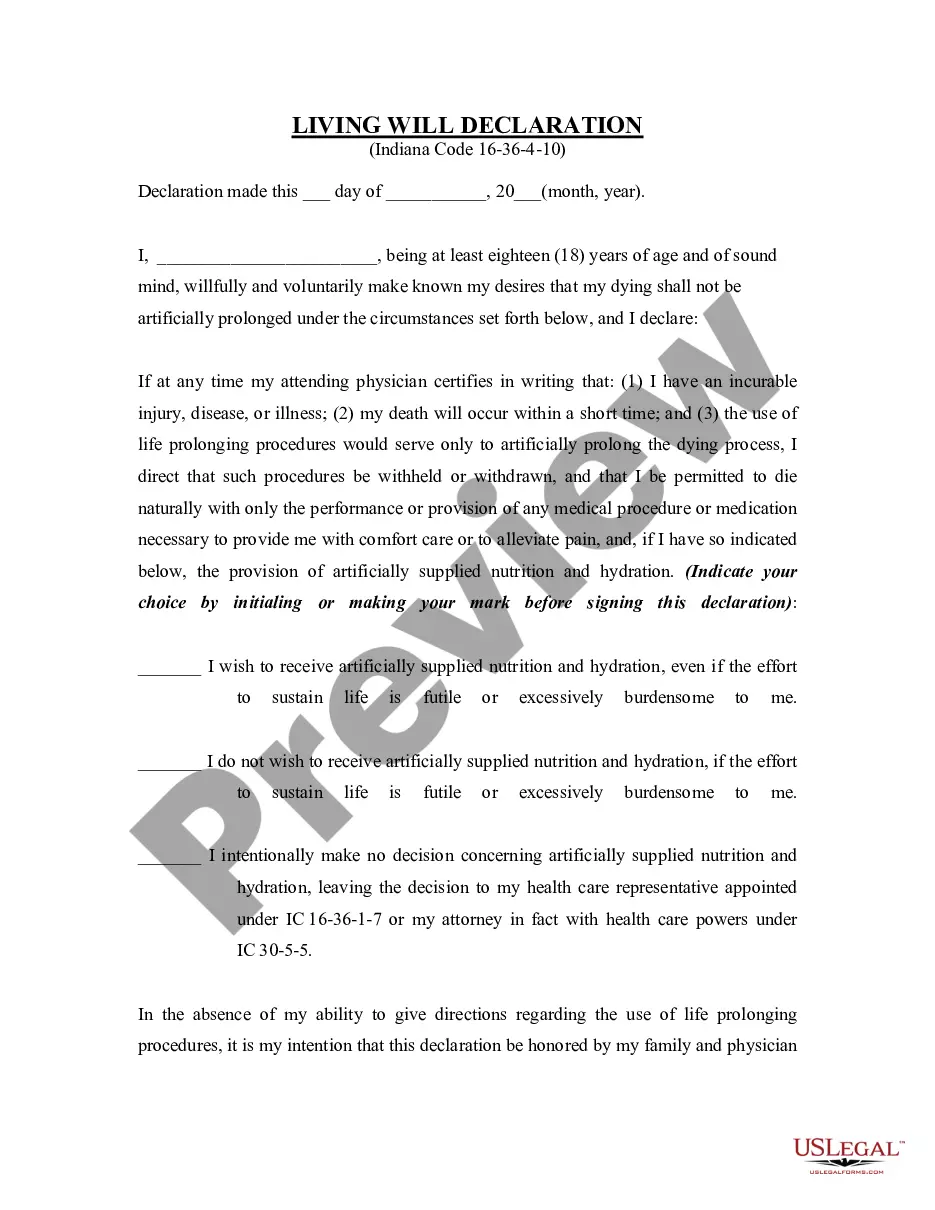

- Examine the example using the Preview feature (if available).

- If there’s a description, read it to understand the specifics.

- Click on the Buy Now button if you’ve located what you are searching for.

- Choose your plan on the pricing page and create an account.

- Decide whether you want to pay via card or PayPal.

- Download the template in your preferred file format.

Form popularity

FAQ

In Indiana, certain personal property can be seized to satisfy a judgment. This includes items such as bank accounts, vehicles, and valuable personal belongings. However, some items are exempt from seizure, such as necessary clothing or household goods. Understanding the process and leveraging the Indiana Verified Motion for Proceedings Supplemental and Order to Appear can help navigate these complexities.

A motion for default judgment in Indiana is a legal request made when a defendant fails to respond to a lawsuit. If the defendant does not file an answer within the specified time, the plaintiff can seek a judgment without the defendant's input. This motion allows the plaintiff to resolve their case efficiently. Utilizing an Indiana Verified Motion for Proceedings Supplemental and Order to Appear can speed up the process of obtaining the necessary judgments.

To set aside a default judgment in Indiana, you need to demonstrate several essential elements. These include showing a valid reason for your failure to respond, providing evidence to support your defense, and acting promptly after becoming aware of the judgment. Filing the necessary documents effectively, including an Indiana Verified Motion for Proceedings Supplemental and Order to Appear, is crucial in facilitating this process.

Once a judgment is entered against you in Indiana, the creditor has the right to collect the debt. This may include garnishing your wages, placing liens on your property, or starting the process through an Indiana Verified Motion for Proceedings Supplemental and Order to Appear. It’s advisable to seek legal advice to understand your options and navigate the implications of the judgment.

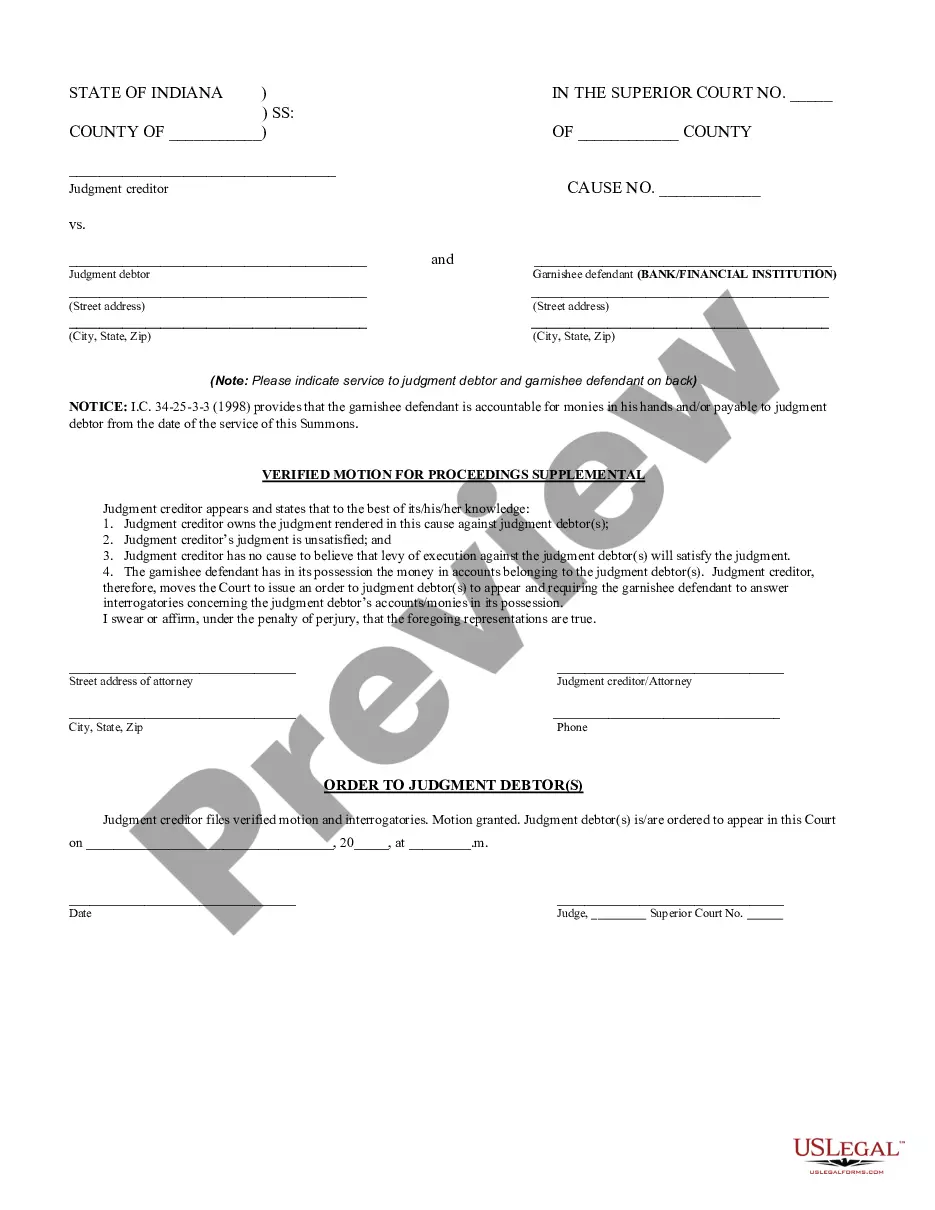

To collect on a judgment in Indiana, you typically start by obtaining a notice of judgment from the court. You may then file an Indiana Verified Motion for Proceedings Supplemental and Order to Appear to gather information about the debtor's assets. This motion allows you to compel the debtor to disclose their financial situation, which can help you find ways to collect the owed amount.

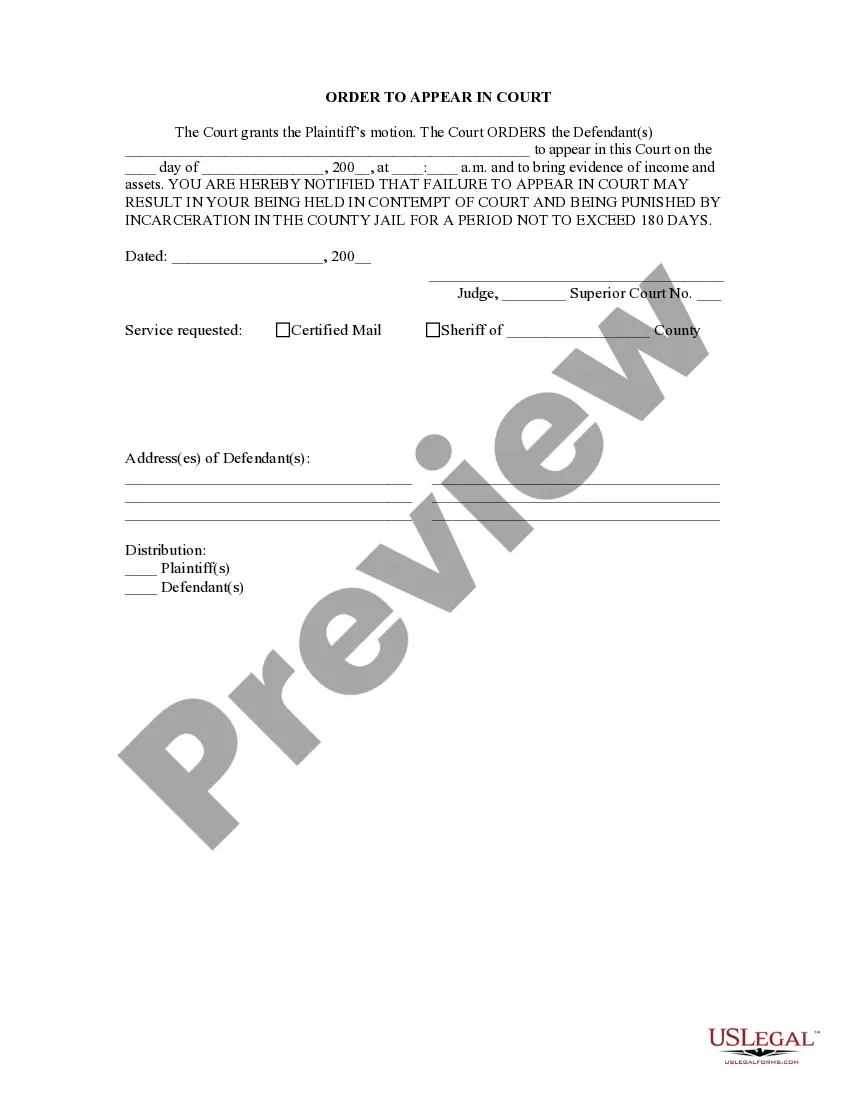

A Proceedings Supplemental is a court-ordered meeting between you and the creditor (the person you owe) to determine what your income, savings and property are. Your bank or employer may also have to give information to the creditor and the court.

A judgment may allow creditors to seize personal property, levy bank accounts, put liens on real property, and initiate wage garnishments. Generally, judgments are valid for several years before they expire. The statute of limitations dictates how long a judgment creditor can attempt to collect the debt.

Property damage. Bodily injury. Personal injury such as libel, slander and malicious prosecution (available under homeowners, renters and condo insurance) Your defense costs for civil lawsuits against you.

If your wages are being garnished for tax debt, Bankruptcy will stop the garnishment and in some cases you may not have to pay the tax debt. Filing Bankruptcy on tax debt will allow you to receive future tax refunds. If your wages are being garnished for student loans, filing Bankruptcy will stop the garnishment.

At the debtor's exam, you are required to answer questions, under oath, about your finances and ability to pay the judgment owed to that creditor. The judgment creditor will ask you questions about: whether you own any assets, including real estate and bank accounts. how much other debt you owe, and to who, and.