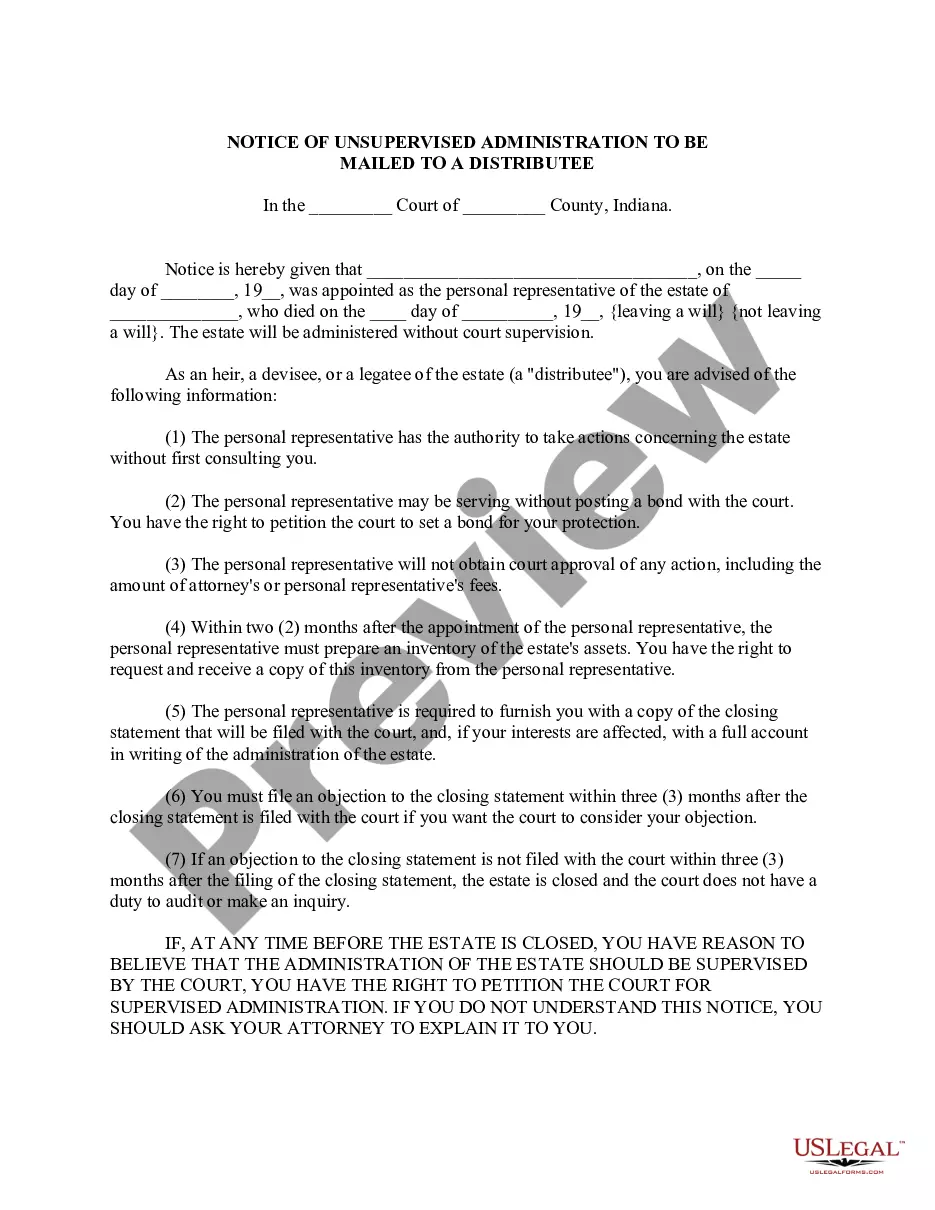

This is a Notice of Unsupervised Administration to be mailed to a Distributee. It is a statutory form to be used in the State of Indiana.

Indiana Notice of Unsupervised Administration to be mailed to a Distributee

Description

How to fill out Indiana Notice Of Unsupervised Administration To Be Mailed To A Distributee?

In pursuit of Indiana Notice of Unsupervised Administration intended for a Distributee sample may pose a challenge. To conserve time, expenses, and effort, utilize US Legal Forms to locate the appropriate template specifically for your state within a few clicks. Our attorneys prepare all documents, so you only need to complete them. It's incredibly straightforward.

Sign in to your account and navigate back to the form's webpage to download the sample. All your downloaded samples are stored in My documents and are accessible at any time for future use. If you haven't subscribed yet, registration is necessary.

Review our detailed instructions on how to obtain your Indiana Notice of Unsupervised Administration intended for a Distributee sample in just a few minutes.

You can print the Indiana Notice of Unsupervised Administration intended for a Distributee template or complete it using any online editor. There's no need for concern about typos since your sample can be utilized, sent, and printed as many times as you desire. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- To obtain a valid sample, verify its applicability for your state.

- Examine the example using the Preview option (if available).

- If there's a description, read it to comprehend the crucial details.

- Click Buy Now if you have found what you are looking for.

- Select your plan on the pricing page and create your account.

- Indicate whether you wish to make payment via card or PayPal.

- Download the sample in your desired file format.

Form popularity

FAQ

Once the personal representative is named by the court in an unsupervised probate administration, that individual will act independently in carrying out their duties, rather than needing court approval before making decisions regarding the estate as they would were the administration supervised.

While the probate process isn't necessary for every estate in Indiana, a sizable portion of them will be forced to go before the court. However, there are certain assets of a decedent that will skip past this process, as they already have heirs or beneficiaries chosen. These include: Life insurance.

Unsupervised Versus Supervised Estates An unsupervised estate, which is the vast majority of the estates opened in the Lombard area, is a proceeding whereby the representative could perform acts in the best interests of the estate without court approval. The classic example is selling real property.

What is the Independent Administration of Estates Act? It is a series of laws that allow an executor or administrator to manage or administer most aspects of the decedent's estate without court supervision.

To close the estate you must file a specific document with the court that says you finished administering the estate and did what you were required to do as the personal representative. You may also need to get receipts from the estate beneficiaries and make a final accounting.

Probate and its alternatives in Indiana. Conducting a probate in Indiana commonly takes six months to a year, depending on the situation. It can take longer if there is a court fight over the will (which is rare) or unusual assets or debts that complicate matters.

Co-personal representatives are two (or more) people named as personal representative simultaneously. Successor personal representatives are named as backups in case your first choice is unable to serve whether by reason of death, incapacity or unwillingness to serve.

Claims must be filed within three months of the date of creditor receiving notice of the opening of an estate administration. Additionally, claims must be filed, if at all, within nine months of the date of death, regardless of whether notice was received.

An unsupervised estate, which is the vast majority of the estates opened in the Lombard area, is a proceeding whereby the representative could perform acts in the best interests of the estate without court approval. The classic example is selling real property.