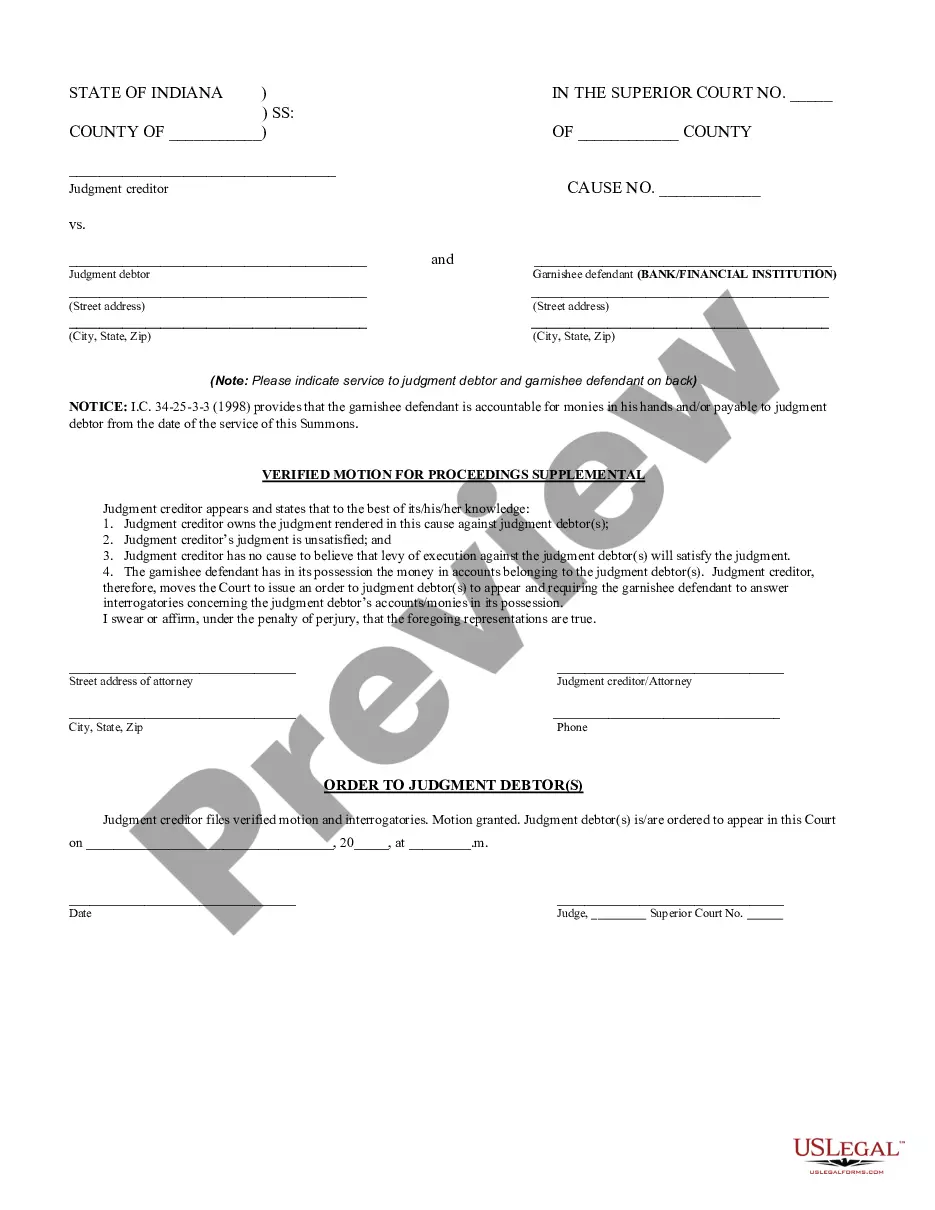

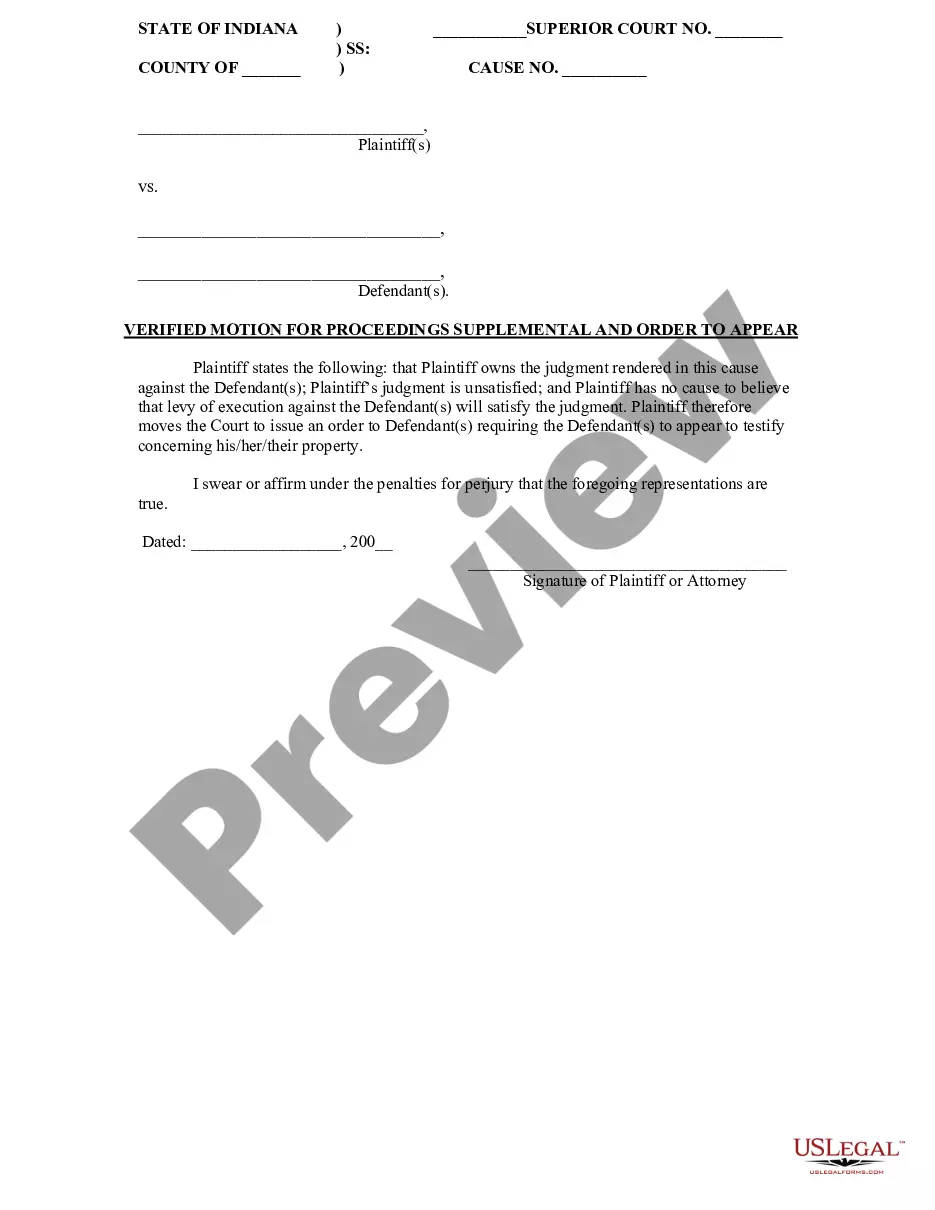

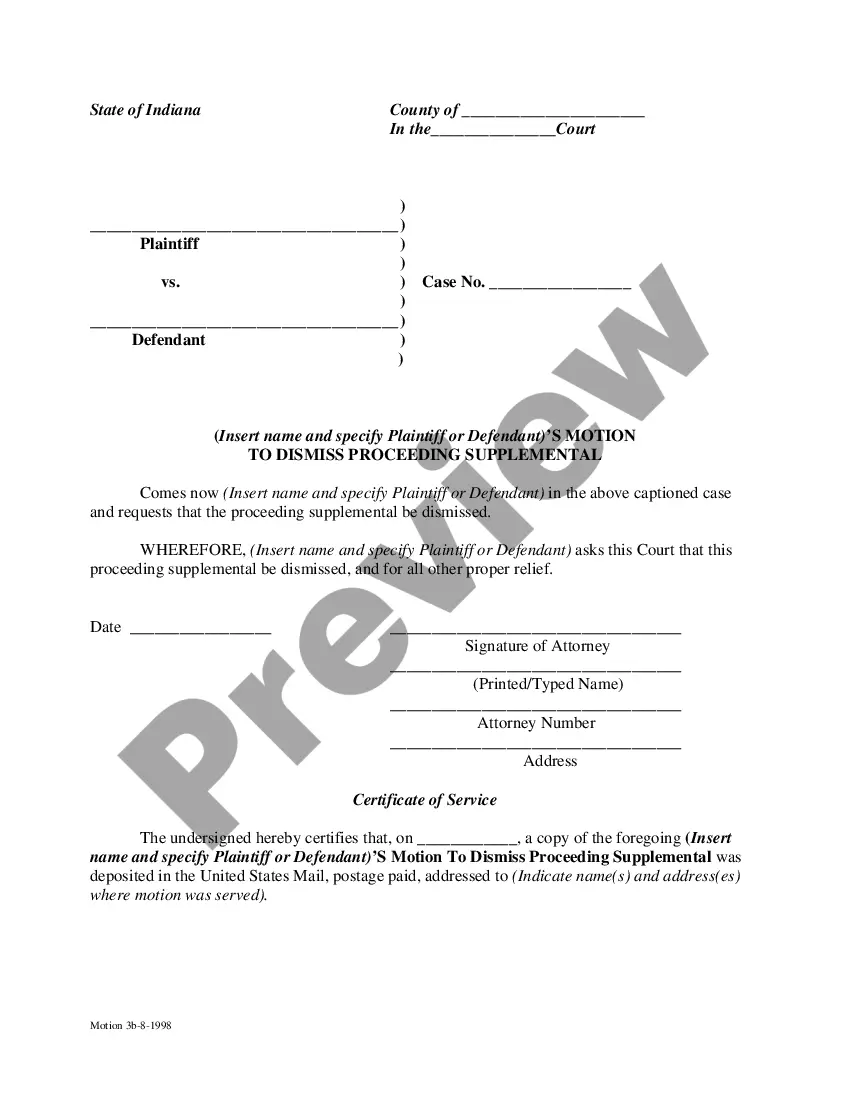

This is a Verified Motion for Proceedings Supplemental to be used in a Small Claims Court in the State of Indiana. A Garnishee Defendant is accountable for monies in his/her possession payable to the Judgment Creditor.

Indiana Verified Motion for Proceedings Supplemental

Description

How to fill out Indiana Verified Motion For Proceedings Supplemental?

Finding Indiana Certified Motion for Supplemental Proceedings paperwork and completing it can be challenging.

To conserve substantial time, expenses, and effort, utilize US Legal Forms to discover the appropriate template specifically for your state with just a few clicks.

Our attorneys create each document, so you simply need to fill them in. It’s truly that easy.

Select your payment method on the pricing page and create your account. Choose whether you want to pay via card or through PayPal. Download the document in your preferred format. You can print the Indiana Certified Motion for Supplemental Proceedings form or complete it using any online editor. Don’t be concerned about making errors since your template can be utilized and submitted, and printed as many times as you wish. Check out US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Access your account by logging in and return to the form's web page to download the template.

- Your downloaded files are saved in My documents and are available at any time for later use.

- If you haven’t signed up yet, you need to register.

- Refer to our detailed instructions on how to obtain the Indiana Certified Motion for Supplemental Proceedings template within minutes.

- To obtain an official template, verify its relevance for your state.

- Review the form using the Preview feature (if available).

- If there's a description, read it to understand the specifics.

- Press Buy Now if you found what you’re looking for.

Form popularity

FAQ

To enter a default judgment in Indiana, you typically need to file five essential documents: the complaint, a motion for default judgment, a notice of default, an affidavit of service, and supporting documentation demonstrating your claim. Each document supports your case and shows the court that the defendant has not participated. Using an Indiana Verified Motion for Proceedings Supplemental can help clarify asset details, enhancing your chances of a successful judgment.

A judgment is the court’s official decision regarding the outcome of a case, while a default occurs when one party fails to respond or appear in court. Generally, when a defendant does not respond, the court may issue a default judgment. To secure a default judgment in Indiana, it is essential to follow filing procedures, which may include an Indiana Verified Motion for Proceedings Supplemental in specific situations.

In Indiana, a judgment lasts for ten years from the date it is issued. After this period, the judgment can be renewed for an additional ten years if necessary. If you find yourself needing to enforce a judgment, consider filing an Indiana Verified Motion for Proceedings Supplemental to gather information about the debtor's assets.

If your wages are being garnished for tax debt, Bankruptcy will stop the garnishment and in some cases you may not have to pay the tax debt. Filing Bankruptcy on tax debt will allow you to receive future tax refunds. If your wages are being garnished for student loans, filing Bankruptcy will stop the garnishment.

A judgment may allow creditors to seize personal property, levy bank accounts, put liens on real property, and initiate wage garnishments. Generally, judgments are valid for several years before they expire. The statute of limitations dictates how long a judgment creditor can attempt to collect the debt.

Supplemental Order means the order or orders of the Authorized Officer making certain determinations and confirming the final details on the Bonds upon issuance, in accordance with the parameters of this Order.

What is a Supplemental Proceeding? A creditor (someone you owe money) has a judgment ordered by a court. They want. to collect the money from you. The creditor wants to know if you have property or income they can take.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

Supplemental judgment means a judgment that by law may be rendered after a general judgment has been entered in the action and that affects a substantial right of a party pursuant to a legal authority.

Hearing To Disclose Assets. You can get the court to order the judgment debtor to go to court to answer questions about the property they own and how much money they make.