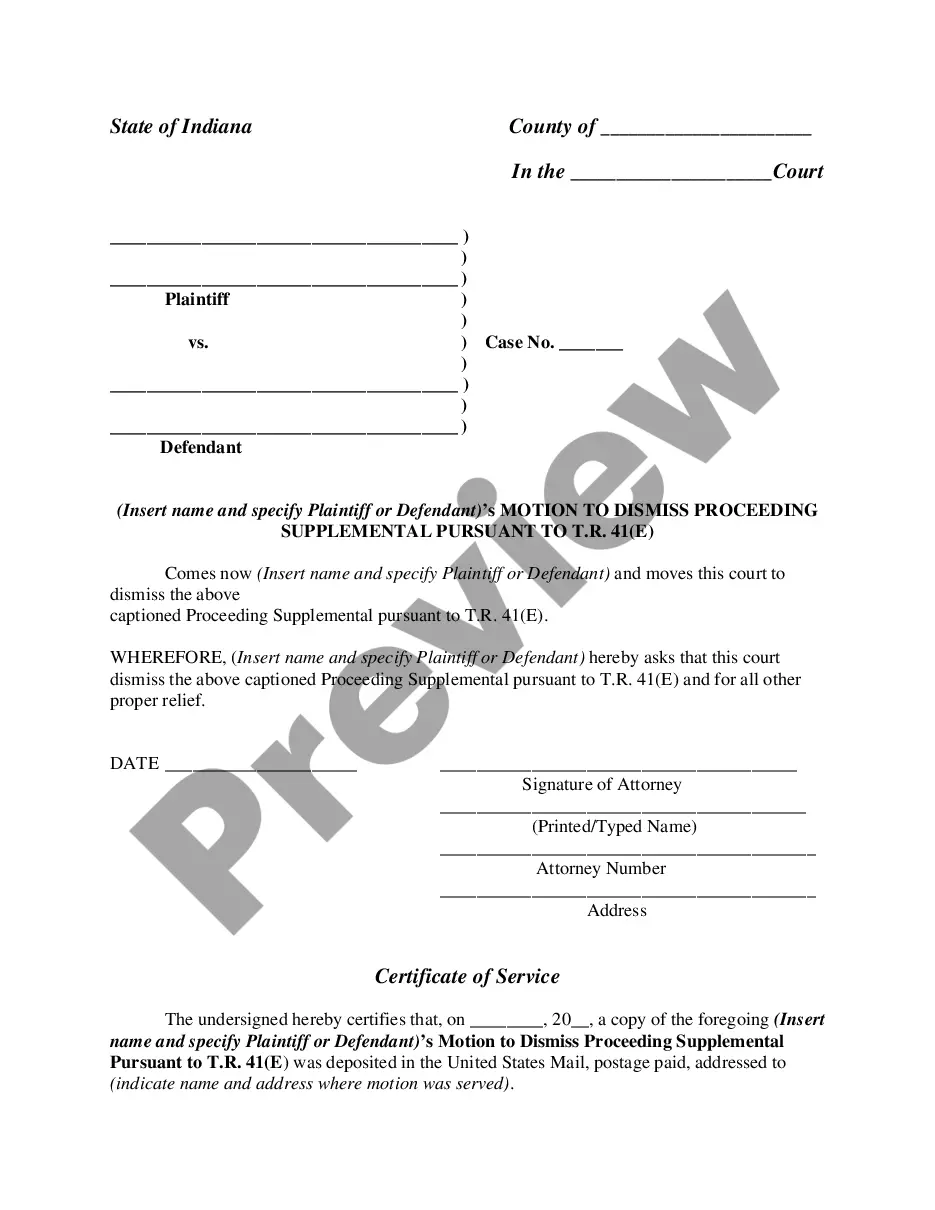

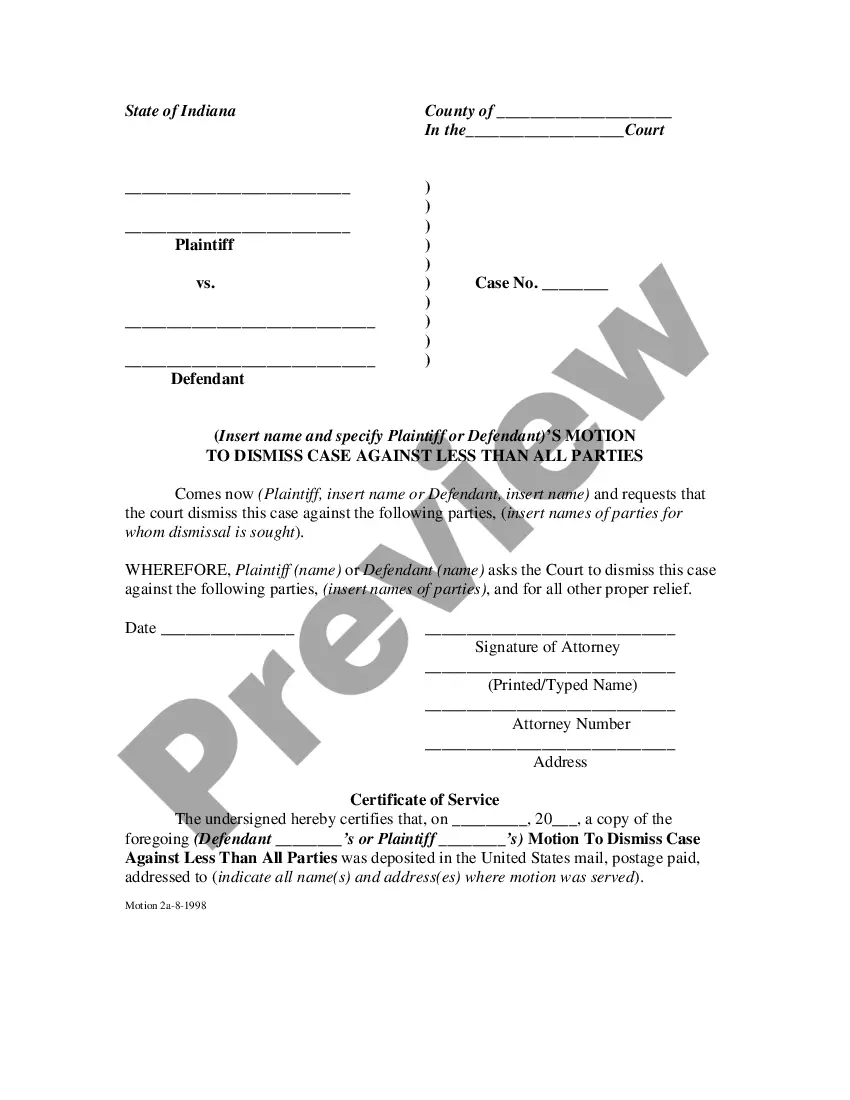

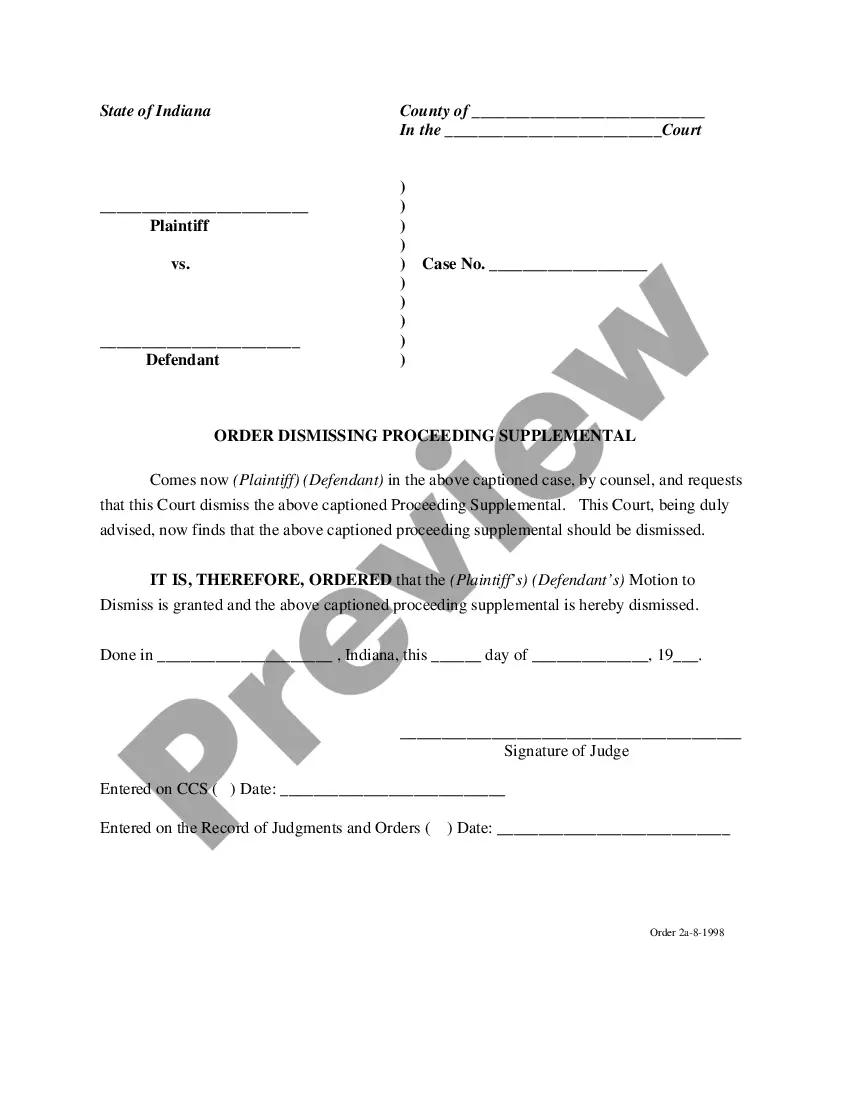

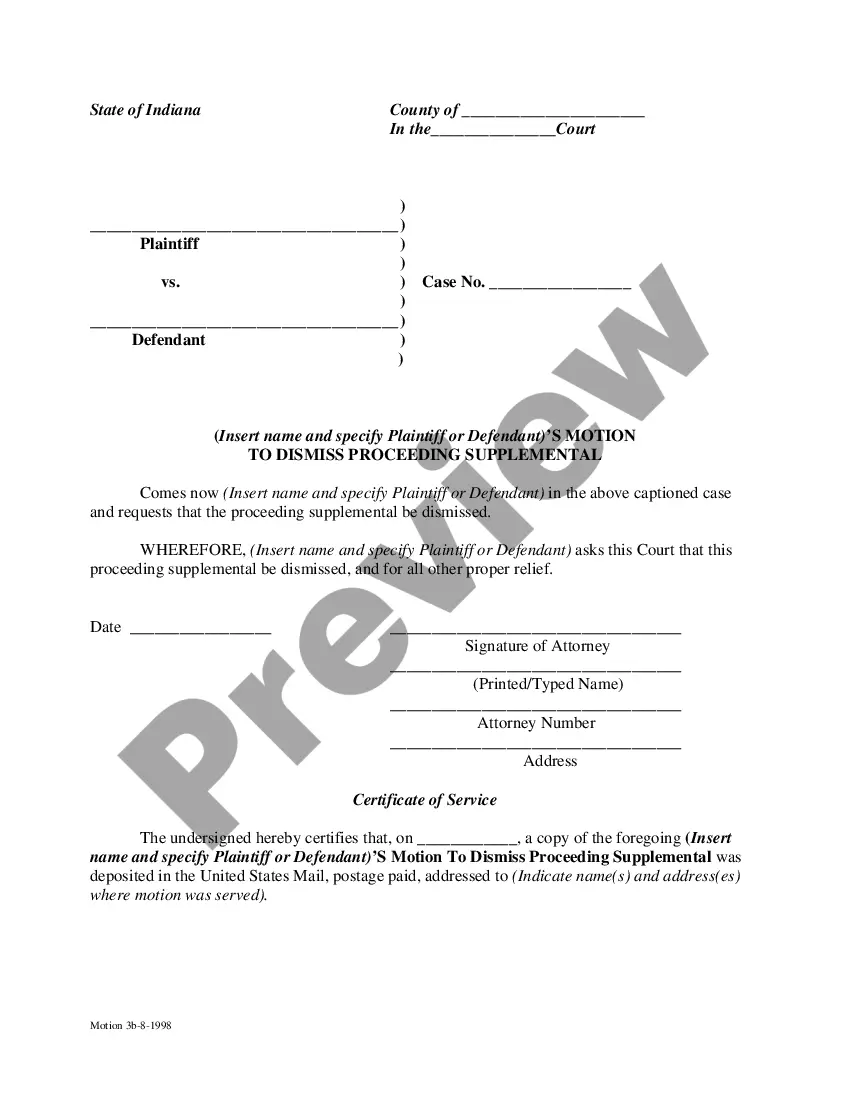

This form is an official form used in Indiana, and it complies with all applicable state and Federal codes and statutes. It is a Motion to Dismiss Proceeding Supplemental. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Indiana Motion to Dismiss Proceeding Supplemental

Description

How to fill out Indiana Motion To Dismiss Proceeding Supplemental?

Searching for Indiana Motion to Dismiss Proceeding Supplemental examples and completing them may pose difficulties.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate example tailored for your state in just a few clicks.

Our legal experts create all documents, so you simply have to complete them. It's truly effortless.

You can print the Indiana Motion to Dismiss Proceeding Supplemental form or fill it out using any online editor. No need to worry about making mistakes because your form can be used, submitted, and printed as many times as you wish. Try US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log into your account and return to the form's webpage to save the template.

- Your saved templates are stored in My documents and accessible at any time for future use.

- If you haven't registered yet, you need to sign up.

- Review our detailed guidance on how to obtain your Indiana Motion to Dismiss Proceeding Supplemental form within minutes.

- To acquire a valid template, confirm its legitimacy for your state.

- Examine the example using the Preview feature (if available).

- If there is a description, read it to grasp the essential details.

- Click Buy Now if you discover what you're looking for.

- Select your plan on the pricing page and create an account.

- Choose whether to pay with a card or via PayPal.

- Download the form in your preferred file format.

Form popularity

FAQ

After a default judgment is issued in Indiana, the winning party may begin enforcing the judgment. This usually involves the filing of a motion for proceedings supplemental to identify the debtor's assets. It is crucial to understand how the Indiana Motion to Dismiss Proceeding Supplemental functions in this context. Remember, a default judgment does not immediately result in payment; steps must be taken to collect the owed amount.

If you need to dispute a default judgment in Indiana, you can file a motion to set aside the judgment based on specific grounds such as mistake, inadvertence, or newly discovered evidence. Additionally, you may argue that the judgment was entered improperly because of lack of jurisdiction or improper service. It is crucial to act quickly and follow court procedures accurately. Using US Legal Forms can provide you with the necessary templates and guidance for your Indiana Motion to Dismiss Proceeding Supplemental.

To collect on a judgment in Indiana, you can utilize various enforcement methods such as wage garnishment, bank levies, or property liens. First, obtain a judgment order from the court, and then identify the debtor's assets. You may need to initiate additional court proceedings to enforce collection measures. Leveraging tools and resources from platforms like US Legal Forms can streamline this process when executing your Indiana Motion to Dismiss Proceeding Supplemental.

To set aside a default judgment in Indiana, you generally need to prove three key elements. First, demonstrate a reasonable excuse for failing to respond to the original complaint. Second, show that you have a meritorious defense to the underlying case. Finally, you must file your motion within a reasonable time frame, typically within one year of the judgment. Understanding these elements can help guide your Indiana Motion to Dismiss Proceeding Supplemental effectively.

All states have designated certain types of property as exempt, or free from seizure, by judgment creditors. For example, clothing, basic household furnishings, your house, and your car are commonly exempt, as long as they're not worth too much.

A judgment may allow creditors to seize personal property, levy bank accounts, put liens on real property, and initiate wage garnishments. Generally, judgments are valid for several years before they expire. The statute of limitations dictates how long a judgment creditor can attempt to collect the debt.

A Proceedings Supplemental is a court-ordered meeting between you and the creditor (the person you owe) to determine what your income, savings and property are. Your bank or employer may also have to give information to the creditor and the court.

If a summons has already been issued by the Clerk of the Court but another summons is needed, perhaps because there was an error in the original one, it was served on the wrong party or to the wrong address or not served within the required time frame, the plaintiff may file a Request for Alias Summons to request that

If your wages are being garnished for tax debt, Bankruptcy will stop the garnishment and in some cases you may not have to pay the tax debt. Filing Bankruptcy on tax debt will allow you to receive future tax refunds. If your wages are being garnished for student loans, filing Bankruptcy will stop the garnishment.

Assuming you have the date of birth and social security number for the debtor, you can try to get a garnishment in place against the wages of the person who owes you money. If you don't have their employer information, you can submit a request filed by the court to find out where they work.