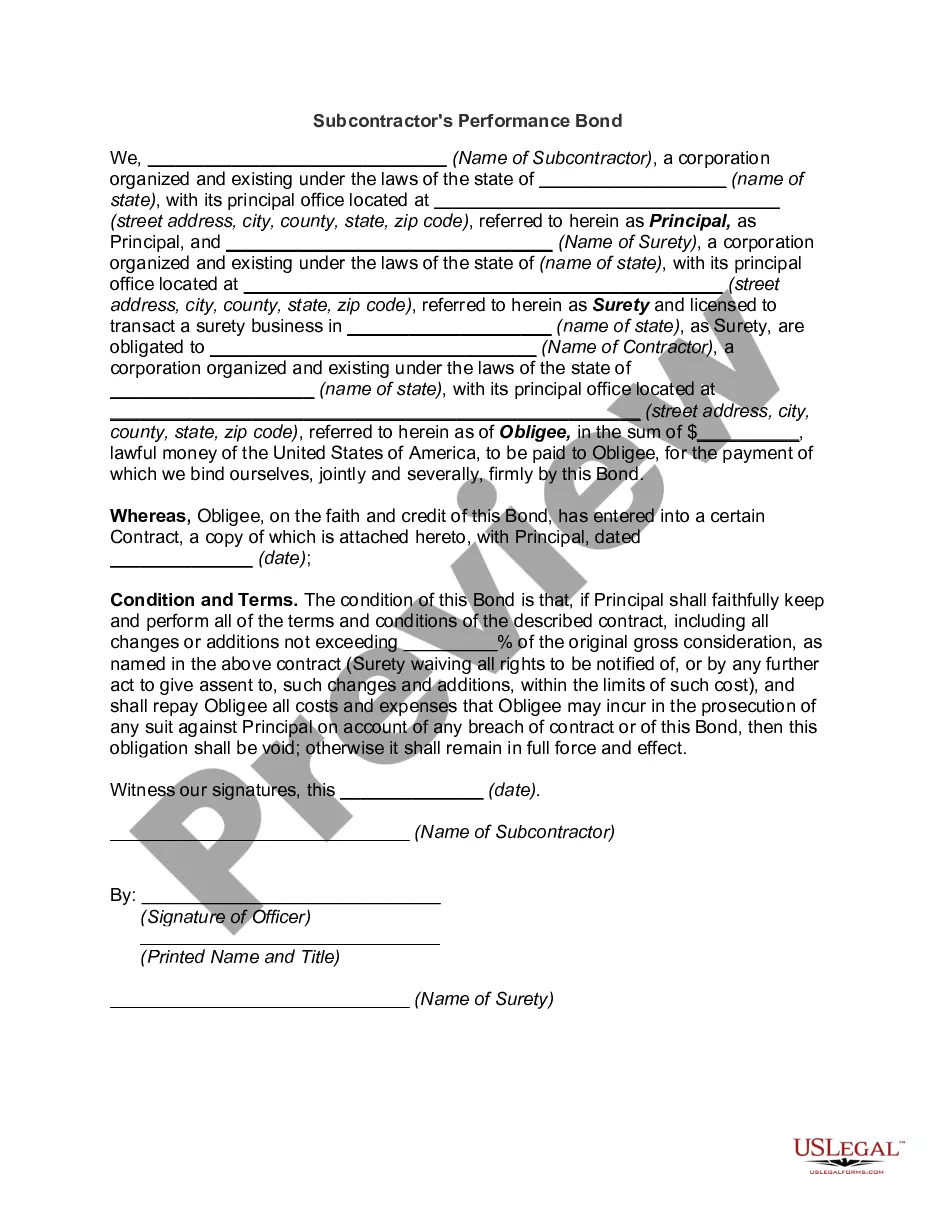

Illinois Performance Bond

Description

How to fill out Performance Bond?

You are able to invest hrs on-line trying to find the lawful papers format which fits the federal and state needs you require. US Legal Forms supplies thousands of lawful forms that happen to be reviewed by experts. You can actually download or print out the Illinois Performance Bond from the service.

If you have a US Legal Forms account, it is possible to log in and click on the Download switch. Following that, it is possible to full, edit, print out, or signal the Illinois Performance Bond. Each lawful papers format you buy is your own forever. To get an additional duplicate of any acquired kind, go to the My Forms tab and click on the related switch.

If you use the US Legal Forms web site the first time, adhere to the straightforward directions beneath:

- Initial, ensure that you have chosen the best papers format to the area/area that you pick. Look at the kind information to ensure you have picked the appropriate kind. If readily available, take advantage of the Review switch to search with the papers format as well.

- If you would like get an additional model of the kind, take advantage of the Search field to find the format that meets your requirements and needs.

- Once you have identified the format you would like, click on Buy now to carry on.

- Find the rates plan you would like, type in your qualifications, and register for a free account on US Legal Forms.

- Complete the deal. You can use your charge card or PayPal account to cover the lawful kind.

- Find the format of the papers and download it to the product.

- Make adjustments to the papers if required. You are able to full, edit and signal and print out Illinois Performance Bond.

Download and print out thousands of papers themes while using US Legal Forms web site, which provides the most important collection of lawful forms. Use professional and status-certain themes to deal with your small business or person requires.

Form popularity

FAQ

The Illinois Notary Public Act (5 ILCS 312/) requires that notary applicants file a $5,000 surety bond to guarantee they will complete their notarial acts ing to the law. Illinois notary bonds for residents run concurrently with the notary's 4-year commission.

A performance bond is issued to one party of a contract as a guarantee against the failure of the other party to meet the obligations of the contract. A performance bond is usually issued by a bank or an insurance company.

A Performance Bond, also known as a surety bond, contract bond or construction bond is a legal agreement issued by an insurance company. Performance bonds protect construction project owners by guaranteeing that the contractor will complete the construction project in ance with the terms of the contract.

A bank guarantee occurs when a lending institution stands as a guarantor and promises to cover any losses when the borrower fails to do so. A bond is a deal or agreement between the borrower and lender that acts as a surety of the payment for either borrower or lender.

A performance bond is a type of contract construction bond that guarantees a contractor will complete a project ing to the terms outlined in a contract by the project owner, also called the obligee. The obligee can be a city, state, or local government, as well as the federal government or a private developer.

A letter of credit can be posted to guarantee a purely financial obligation, such as a loan, or a performance obligation, such as a contract, while the On-Demand Performance (or Payment) bond is posted to meet specific performance, payment, and liquidated damages obligations as defined in the underlying contracts.

One key difference between performance bonds and surety bonds is the scope of their coverage. Performance bonds only cover a specific project, while surety bonds can cover multiple projects or ongoing business activities.

The contractor will engage with a bond provider, or surety, to provide a performance bond for that project. In order to get a performance bond, the contractor agrees to pay the surety a small percentage of the total bond amount, usually between 1% and 4%.