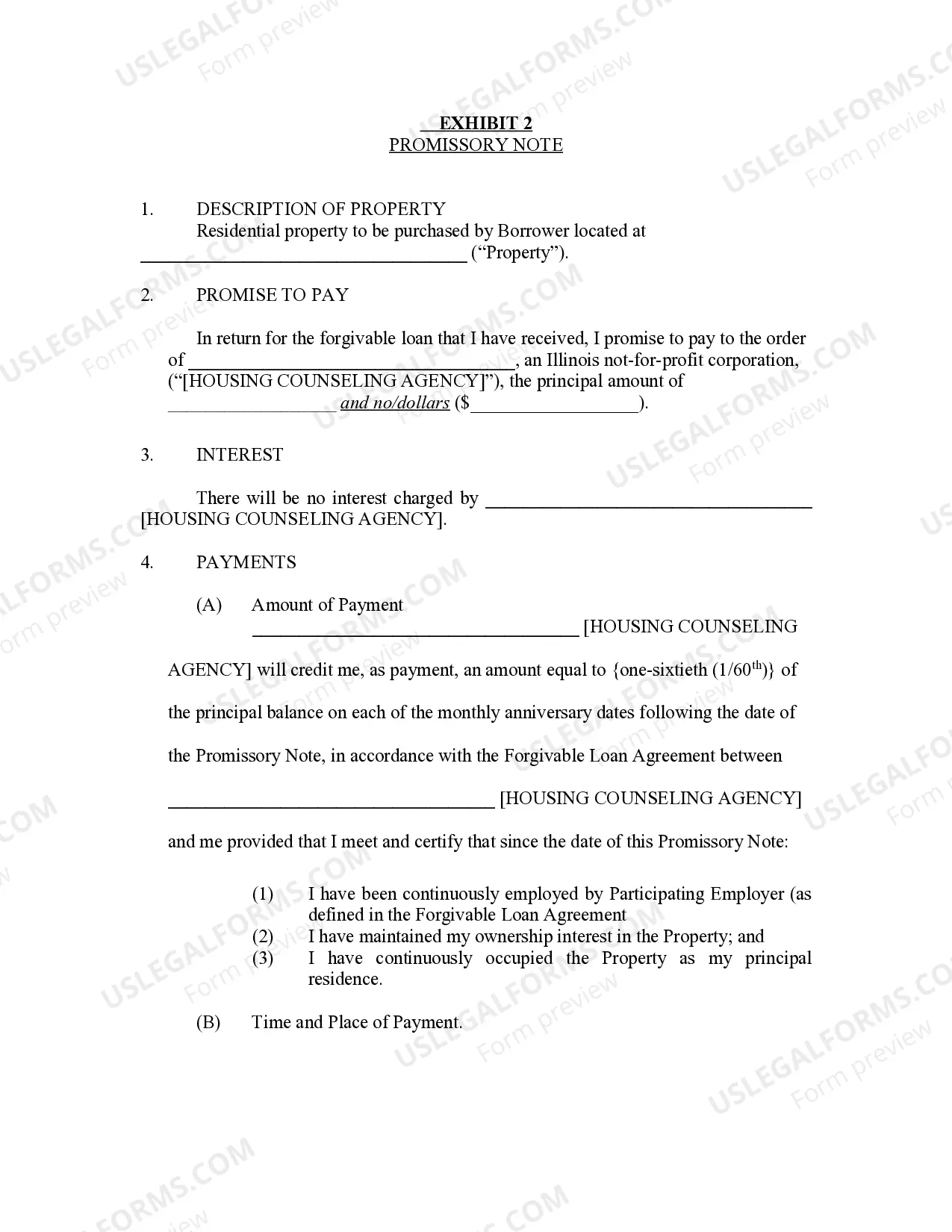

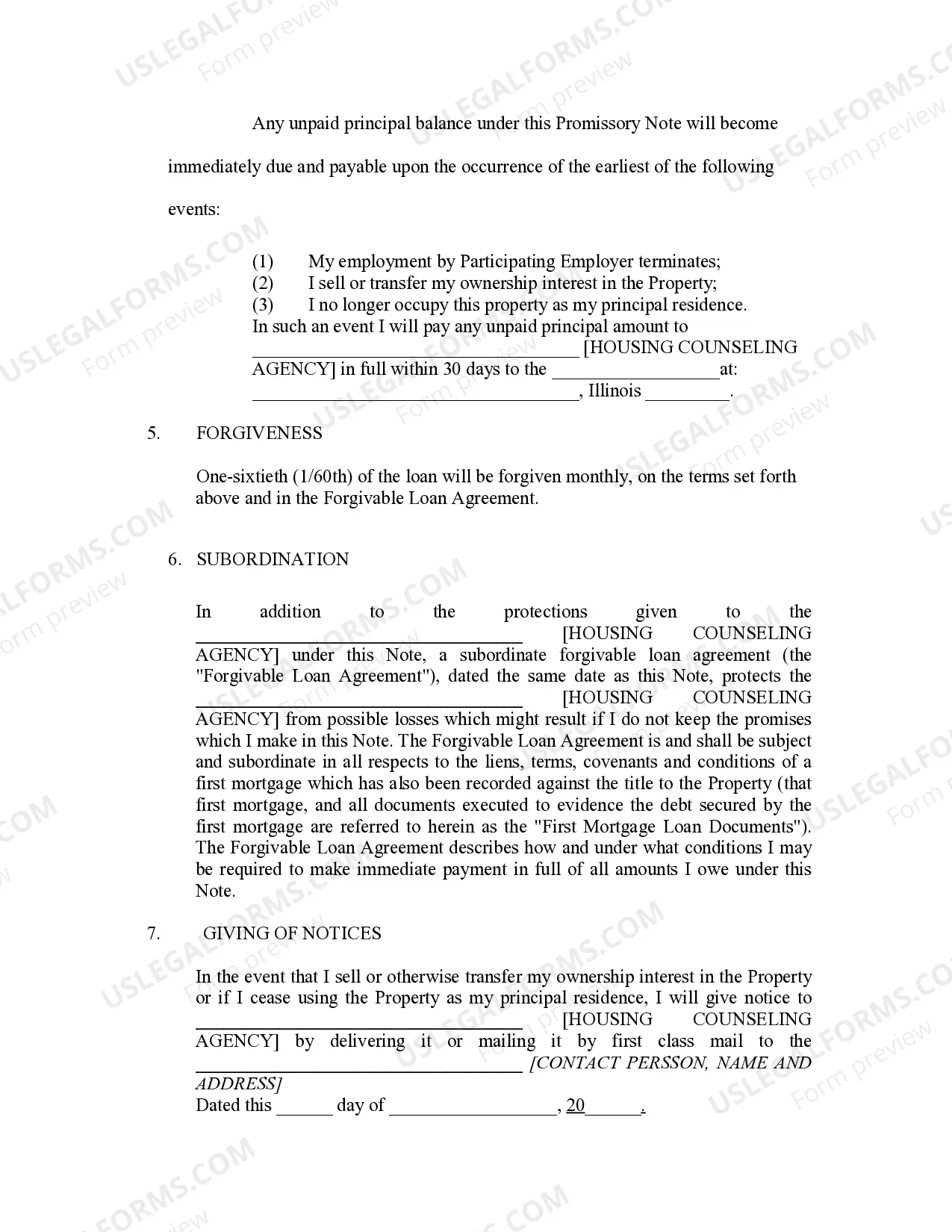

Illinois Forgivable Loan and Promissory Note is a form of financing that can be offered to individuals, businesses, or organizations in the state of Illinois. It is a loan that is given with the promise that the loan amount will be forgiven if the borrower meets the requirements and conditions of the agreement. The loan is usually secured with a promissory note, which is a legal document outlining the terms of the loan. The loan can be used for a variety of purposes, such as purchasing a home, business expansion, and educational expenses. There are three main types of Illinois Forgivable Loan and Promissory Note: 1. Single-Purpose Forgivable Loan: This type of loan is intended to be used for a single purpose, such as purchasing a home or business expansion. The loan amount is forgiven if the purpose of the loan is achieved. 2. Multi-Purpose Forgivable Loan: This type of loan can be used for multiple purposes and is typically used for educational expenses. The loan amount is forgiven if the borrower meets the requirements and conditions of the agreement. 3. Private Forgivable Loan: This type of loan is offered by private lenders and requires a promissory note as security. The loan amount is forgiven if the borrower meets the conditions of the agreement and pays back the loan in full. Overall, Illinois Forgivable Loan and Promissory Note is a form of financing that can be used to help individuals, businesses, and organizations finance their needs. It is a loan that is given with the promise that the loan amount will be forgiven if the borrower meets the requirements and conditions of the agreement and pays back the loan in full.

Illinois Forgivable Loan and Promissory Note

Description

How to fill out Illinois Forgivable Loan And Promissory Note?

Completing official documentation can be a significant hassle if you lack accessible fillable templates. With the US Legal Forms digital library of formal documents, you can be confident in the blanks you receive, as all of them adhere to federal and state regulations and are reviewed by our experts.

Acquiring your Illinois Forgivable Loan and Promissory Note from our collection is as easy as 1-2-3. Previously authorized users with an active subscription only need to Log In and press the Download button after they locate the correct template. Later, if necessary, users can reuse the same form from the My documents section of their account.

Have you not yet tried US Legal Forms? Register for our service now to acquire any formal document swiftly and effortlessly whenever you require it, and maintain your paperwork organized!

- Document compliance verification: Carefully examine the content of the form you desire and ensure it meets your requirements and adheres to your state regulations. Previewing your document and reviewing its overall description will assist you in doing just that.

- Alternative search (optional): If you notice any discrepancies, explore the library using the Search tab above until you discover a suitable template, and click Buy Now when you identify the one you prefer.

- Account registration and form purchase: Sign up for an account with US Legal Forms. After account validation, Log In and choose your desired subscription plan. Make a payment to proceed (PayPal and credit card options are provided).

- Template download and further usage: Select the file format for your Illinois Forgivable Loan and Promissory Note and click Download to save it on your device. Print it to fill out your documents manually, or utilize a multi-functional online editor to create an electronic copy more quickly and efficiently.

Form popularity

FAQ

Forgivable loan arrangements typically provide for the employee's repayment obligation to be contingent upon his or her continued employment with the employer.

In the housing industry, a forgivable loan is a type of second mortgage. You don't have to pay this type of loan back unless you move before your loan term ends. These loans usually come with an interest rate of 0%, so it could be an excellent solution for lower-income homebuyers.

A forgivable loan, also called a soft second, is a form of loan in which its entirety, or a portion of it, can be forgiven or deferred for a period of time by the lender when certain conditions are met.

If you qualify for forgiveness, cancellation, or discharge of the full amount of your loan, you are no longer obligated to make loan payments. If you qualify for forgiveness, cancellation, or discharge of only a portion of your loan, you are responsible for repaying the remaining balance.

WHAT IS A 5 YEAR FORGIVEABLE LOAN? -A 5 year forgivable loan is a loan that you do not have to pay back, provided you do not sell or move out of your home for a period of 5 years. -There are NO payments and NO interest during the loan period, regardless of how much is spent.

A forgivable loan, also called a soft second, is a form of loan in which its entirety, or a portion of it, can be forgiven or deferred for a period of time by the lender when certain conditions are met.