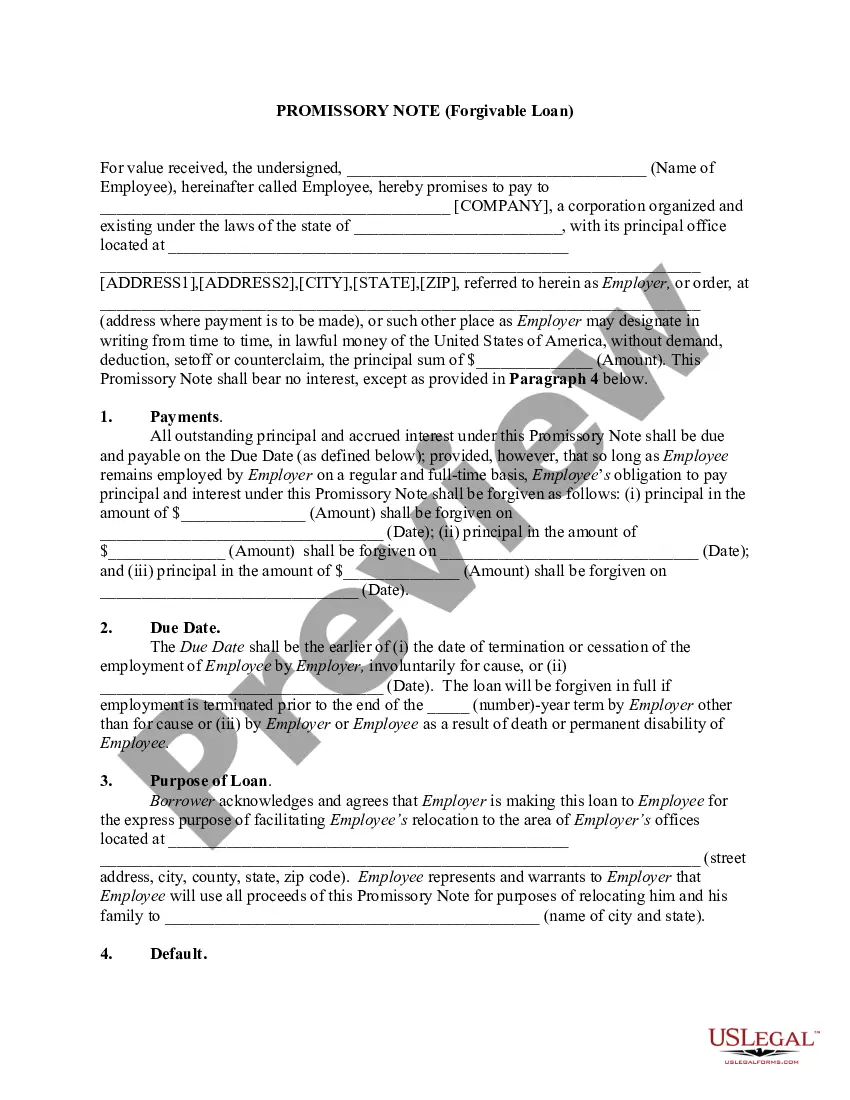

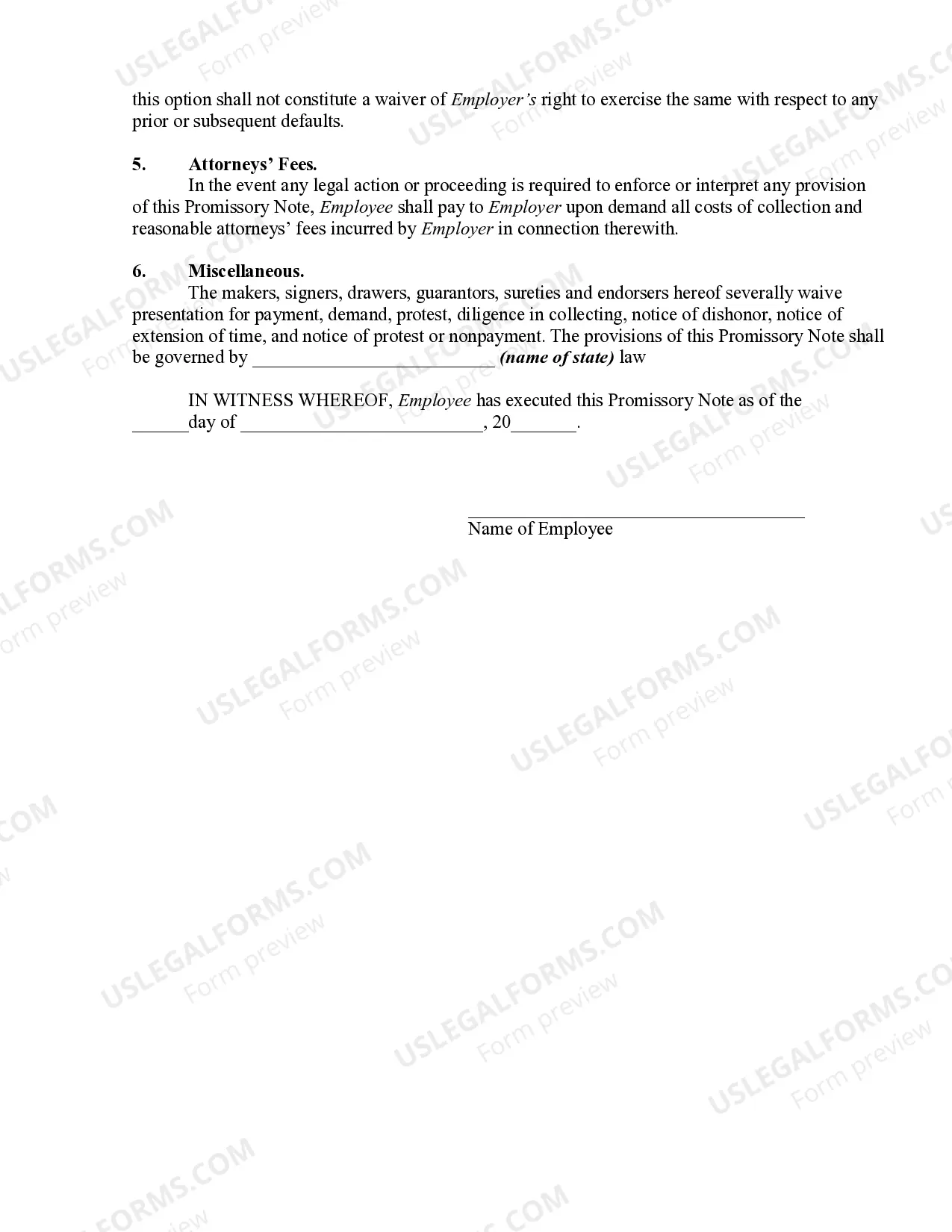

Promissory Note (Forgivable Loan)

Understanding this form

A Promissory Note (Forgivable Loan) is a legal document in which an employee agrees to repay a loan made by their employer, typically for relocation or home purchase expenses. What distinguishes this note is the potential for forgiveness of the loan amount over time, provided the employee maintains their employment. This form formalizes the terms of the loan, including the amounts forgiven, payment due dates, and conditions for forgiveness, ensuring clarity for both parties involved.

Key parts of this document

- Borrower and lender information: Includes names and addresses of the employee and employer.

- Loan details: States the principal amount and terms of repayment.

- Forgiveness schedule: Outlines how much of the loan will be forgiven and when, based on employment status.

- Default clause: Specifies conditions under which the employer can demand full repayment.

- Legal fees: Details any potential costs for legal action related to the note.

- Governing law: Indicates which state's laws will govern the promissory note.

When this form is needed

This form is typically used when an employer provides a financial loan to an employee for assistance with relocation expenses or purchasing a home. It is beneficial in situations where the employer intends to support the employee's move while also offering the potential for loan forgiveness, incentivizing longer-term employment. The Promissory Note is essential for clarifying the terms of the loan, protecting both parties' interests, and ensuring compliance with any legal obligations.

Who can use this document

This form is designed for:

- Employers looking to provide financial assistance to new executives.

- Employees who are receiving a forgivable loan for relocation or home purchase.

- Companies seeking to establish clear terms and conditions associated with employee loans.

How to complete this form

- Identify the parties: Enter the employee's name and the employer's name and address.

- Specify the loan amount: Clearly state the principal sum being borrowed.

- Outline the forgiveness terms: Include the specific amounts that will be forgiven and the corresponding dates.

- Indicate the due date: Specify the final repayment date or conditions for when the loan becomes due.

- Sign and date the document: Ensure both the employee and employer sign the document to validate the agreement.

Does this document require notarization?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

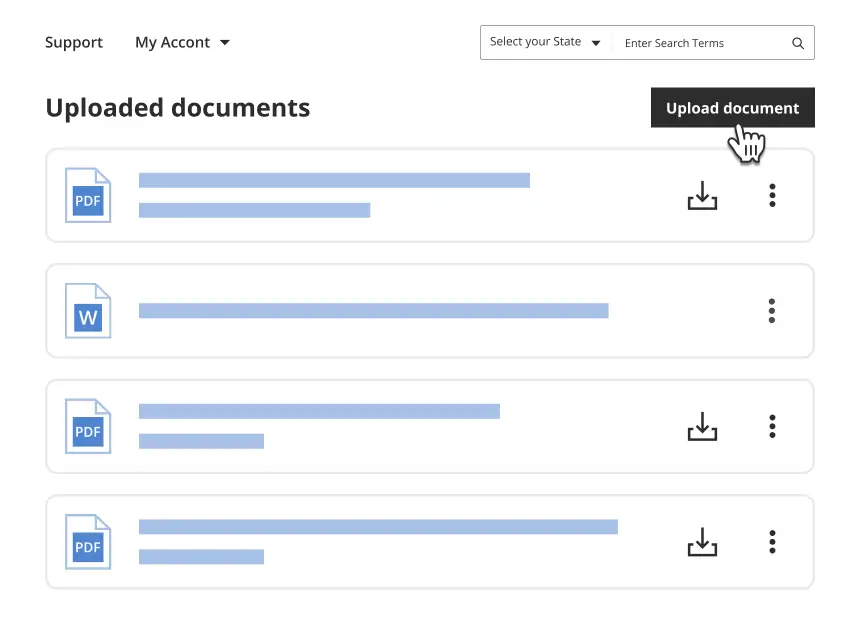

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

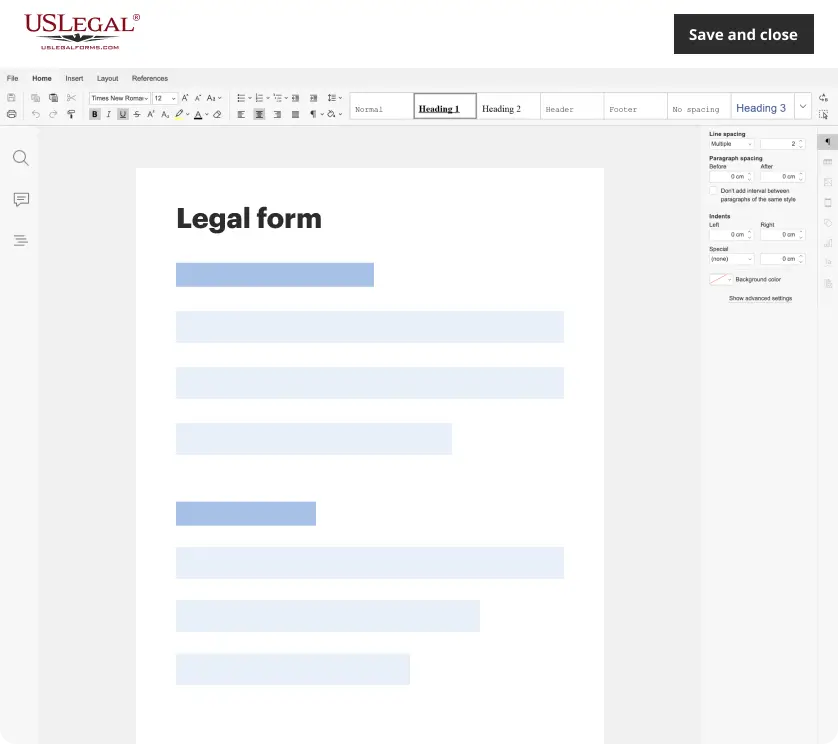

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

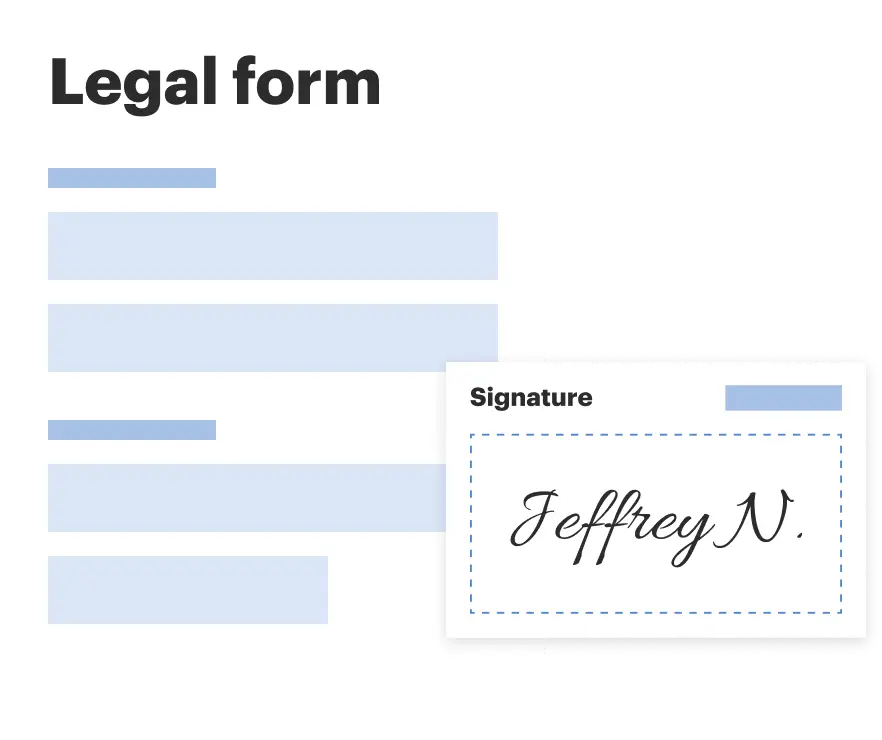

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

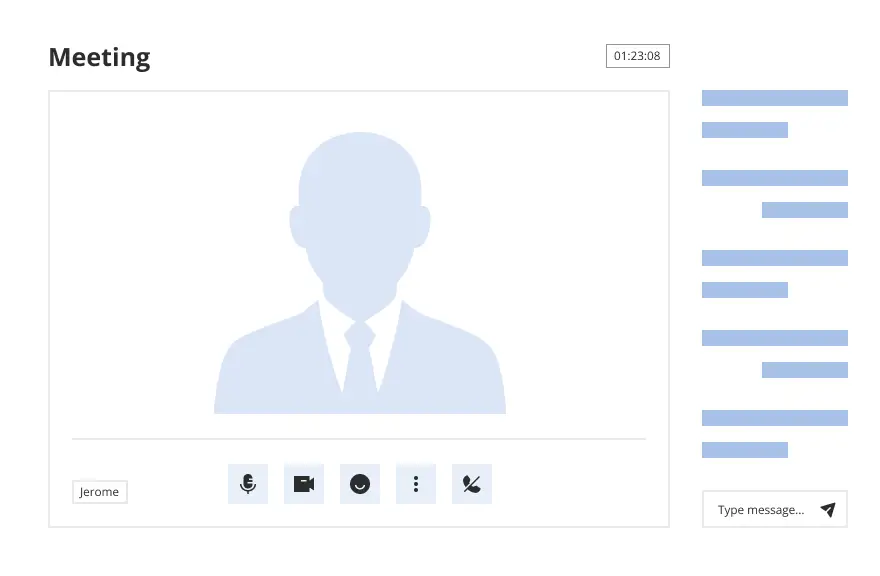

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to clearly outline the forgiveness terms can lead to misunderstandings.

- Not specifying the due date or conditions can result in ambiguity about repayment obligations.

- Incomplete or inaccurate information about the parties involved may invalidate the agreement.

Why use this form online

- Convenience: Easily accessible and downloadable form allows for quick completion.

- Editability: Users can fill in necessary details as needed, ensuring accuracy.

- Reliability: Forms are drafted by licensed attorneys, ensuring they meet legal requirements.

Legal use & context

- This form binds the employee to repay the loan unless forgiven under the stated conditions.

- Proper documentation is crucial for both parties to avoid misunderstandings regarding loan terms.

- The form should comply with state-specific laws regarding loans between employers and employees.

Looking for another form?

Form popularity

FAQ

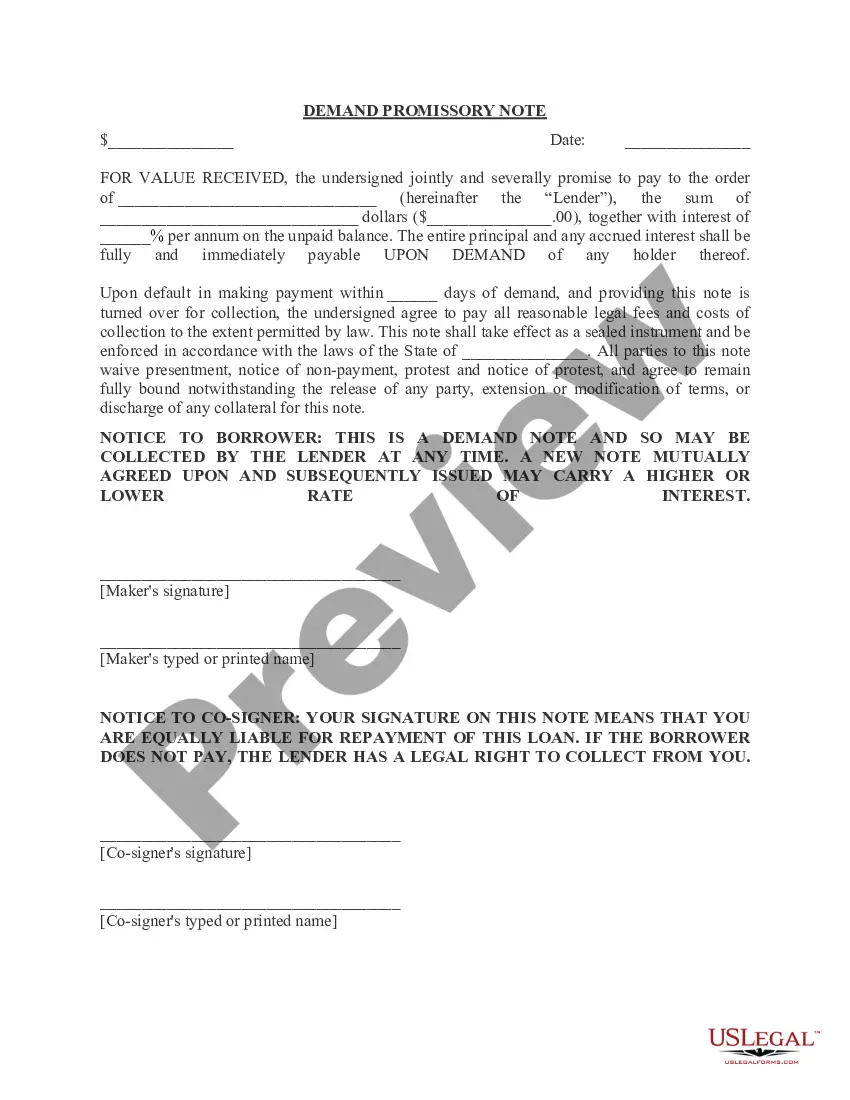

If the sum is not huge and the relationship is trustworthy, it is preferred to go with a promissory note to avoid potential legal issues. However, if the sum of money is huge and the relationship is not entirely trustable, make sure to use a secured loan agreement to ensure your money is safe with the borrower.

Contrary to a Promissory Note, which is an unconditional promise to repay money, a Forgivable Loan Agreement, or FLA, states that a specified portion of the new employee's loan balance will be ?forgiven.? Presented at the time of recruitment, the FLA differs from a Promissory Note in that a certain percentage of the

In the housing industry, a forgivable loan is a type of second mortgage. You don't have to pay this type of loan back unless you move before your loan term ends. These loans usually come with an interest rate of 0%, so it could be an excellent solution for lower-income homebuyers.

In the housing industry, a forgivable loan is a type of second mortgage. You don't have to pay this type of loan back unless you move before your loan term ends. These loans usually come with an interest rate of 0%, so it could be an excellent solution for lower-income homebuyers.

A forgivable loan, also called a soft second, is a form of loan in which its entirety, or a portion of it, can be forgiven or deferred for a period of time by the lender when certain conditions are met.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

A lender uses a promissory note as a way to ensure there is legal recourse if you do not repay the loan.

Promissory notes and loan agreements are both documents detailing the terms and conditions of a loan. Promissory notes are typically for smaller loans between people with a personal or business relationship, while loan agreements are typically more formal agreements for larger, conventional loans.