Illinois Answer to Complaint for Judicial Foreclosure

Overview of this form

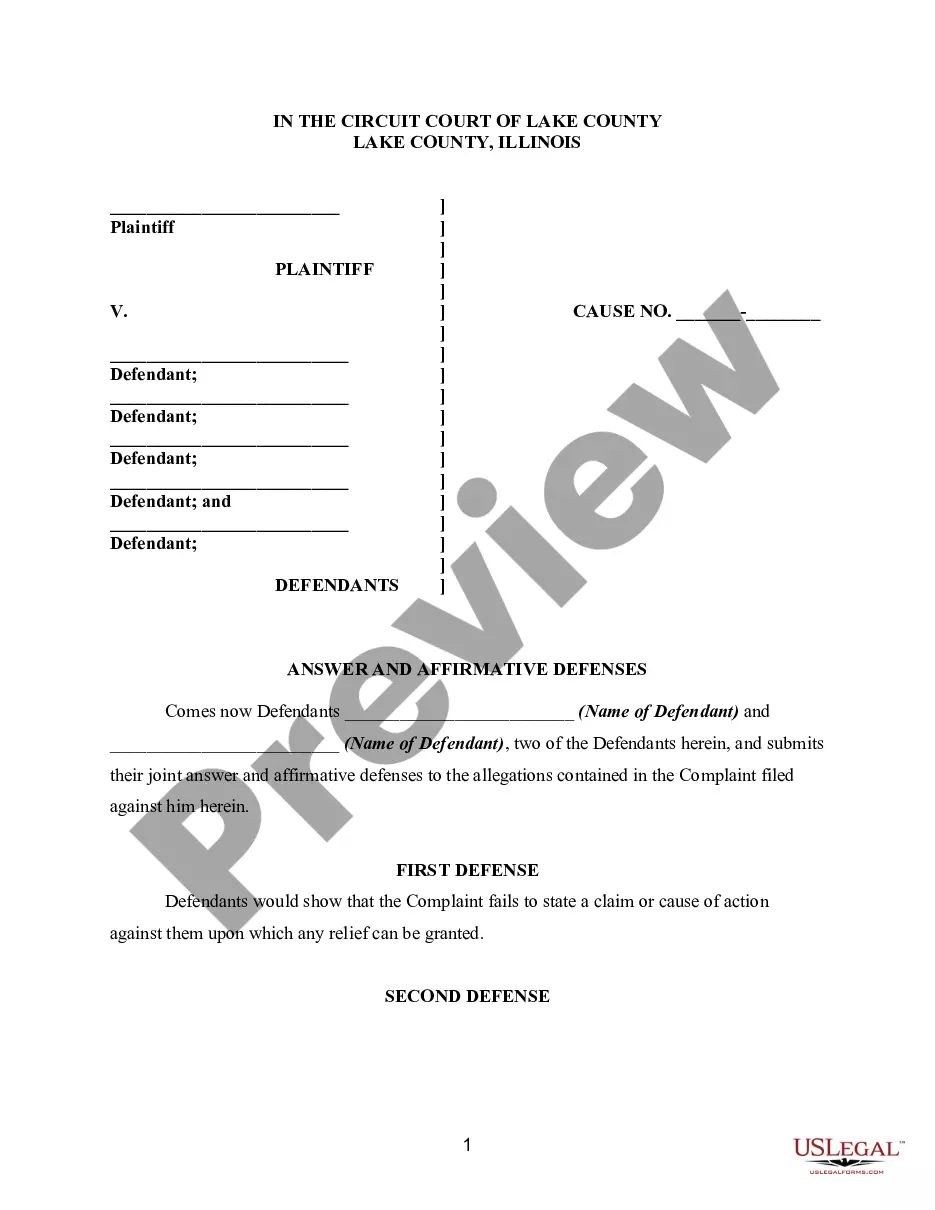

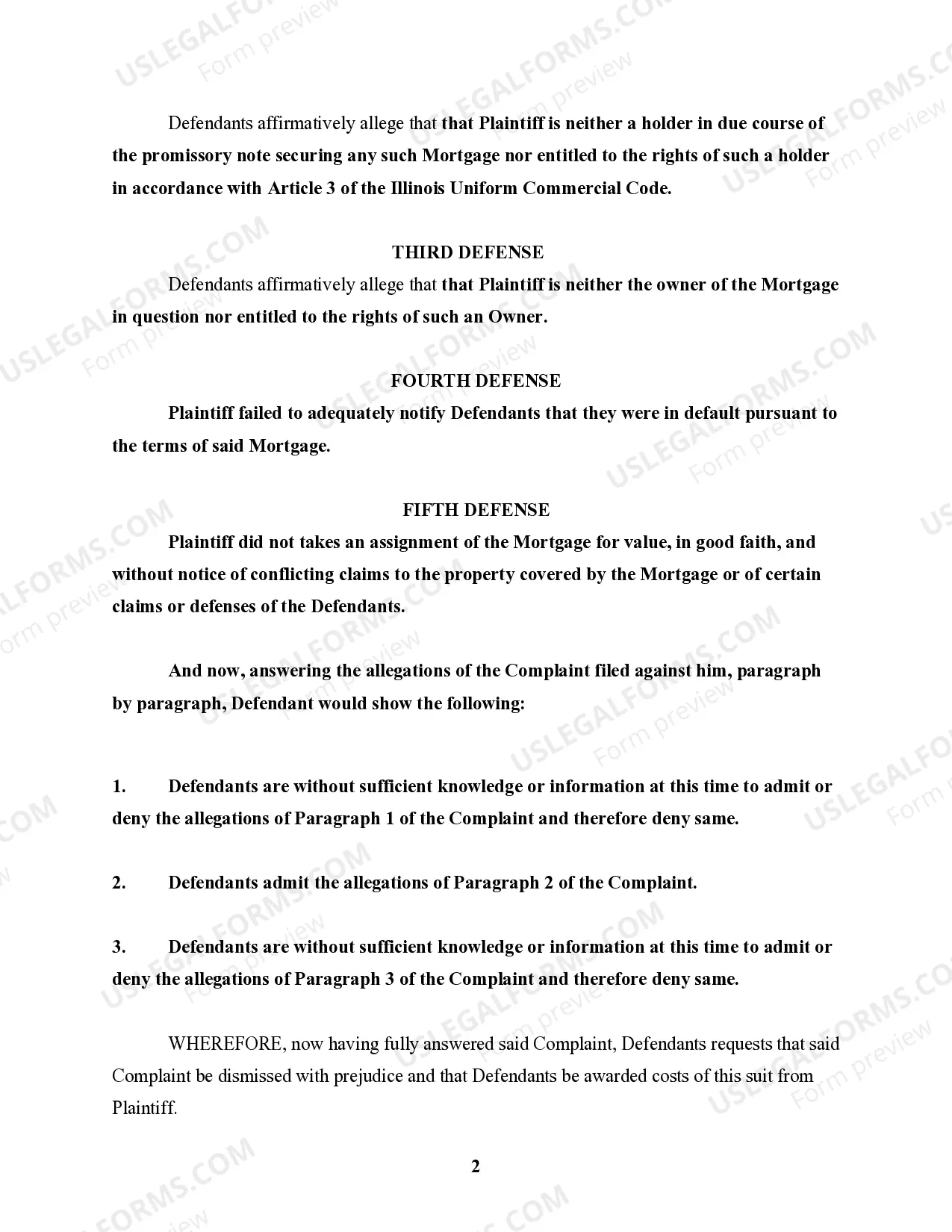

The Answer to Complaint for Judicial Foreclosure is a legal document used by defendants in a judicial foreclosure case to respond to the allegations outlined in the plaintiff's complaint. Unlike non-judicial foreclosure proceedings that do not involve the court, a judicial foreclosure requires the lender to initiate a lawsuit to reclaim the mortgaged property. This form allows defendants to present their defenses and assert any counterclaims, crucial for protecting their rights in the foreclosure process.

What’s included in this form

- Identification of the defendants and the case number.

- Statement of defenses concerning the complaint's allegations.

- Paragraph-by-paragraph responses to the claims made by the plaintiff.

- Request for dismissal of the complaint and recovery of costs.

- Signature section for the defendants and their attorney.

- Notary statement for verification of the attorney's declaration.

When to use this document

This form is necessary when you have been served with a complaint regarding a judicial foreclosure and need to formally respond in court. It is used to dispute claims made by the plaintiff, provide affirmative defenses, and assert your own legal arguments to contest the foreclosure proceedings.

Who needs this form

- Homeowners facing judicial foreclosure proceedings.

- Borrowers who wish to contest the foreclosure lawsuit.

- Individuals seeking to assert legal defenses against a foreclosure complaint.

- Defendants who need to file a counterclaim or related response.

Completing this form step by step

- Enter the names of all defendants along with the case number at the top of the form.

- Provide a detailed answer to each allegation made in the plaintiff's complaint.

- List all affirmative defenses, clearly outlining the reasons why the complaint should be dismissed.

- Include the signature and contact information for the attorney representing the defendants.

- Complete the notary section to validate the document.

Does this document require notarization?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to file the response within the required timeframe.

- Not responding to each allegation individually.

- Leaving out important factual or legal defenses.

- Submitting the form without proper signatures or notarization.

Benefits of using this form online

- Convenient access to essential legal documents without the need for in-person visits.

- Editability allows you to tailor the document to your specific situation easily.

- Secure and reliable downloads ensure you are using up-to-date legal templates.

Looking for another form?

Form popularity

FAQ

To contest a judicial foreclosure, you have to file a written answer to the complaint (the lawsuit). You'll need to present your defenses and explain the reasons why the lender shouldn't be able to foreclose. You might need to defend yourself against a motion for summary judgment and at trial.

In situations where a foreclosure has already occurred, the California Supreme Court held that a borrower has standing to sue for wrongful foreclosure based on an allegedly void assignment of his or her mortgage.

Foreclosure proceedings begin with a complaint filed by the lender. The borrower is served a copy of the complaint and a summons, along with a notice of his or her rights during foreclosure. In most cases, the borrower has 30 days to file a response. Failure to respond will result in a default judgment for the lender.

A lender can rescind a foreclosure sale if a borrower requests to reinstate the loan agreements and then makes payment to bring the loan balance current, provided this is done more than five days before the scheduled sale date.

To get the deficiency judgment, the bank has to file an application with the court within three months of the foreclosure sale. The judge will then hold a fair value hearing to determine the property's value.

If the court grants summary judgment in favor of the bank, typically after a hearing, the bank wins the case, and your home will be sold at a foreclosure sale.order the foreclosure sale, or. dismiss the case, usually without prejudice. (Without prejudice means the bank can refile the foreclosure.)

Negotiate With Your Lender. If you are having financial difficulties, the worst thing that you can do is bury your head in the sand. Request a Forbearance. Modify Your Loan. Make a Claim. Get a Housing Counselor. Declare Bankruptcy. Use A Foreclosure Defense Strategy. Make Them Produce The Not.

Proving Wrongful Foreclosure If you wish to sue the bank for wrongful foreclosure, you must prove the following: The lender owed you, the borrower, a legal duty. The lender breached that duty. The breach of duty caused your injury or loss (damages)