Self-Employed Excavation Service Contract

What this document covers

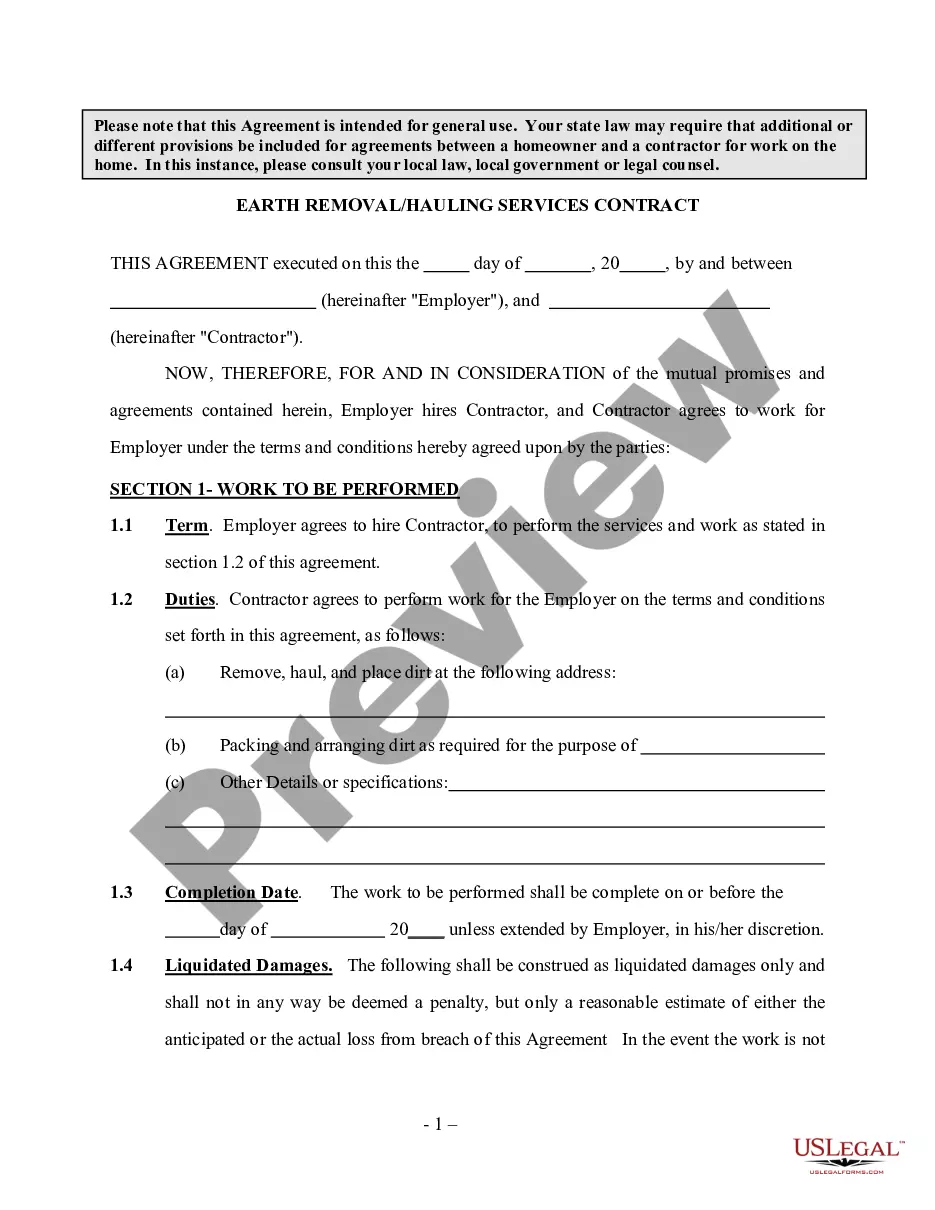

The self-employed excavation service contract is a legal document used to formalize an agreement between an employer and an independent contractor who provides excavation services. This contract outlines the terms of work, responsibilities, and compensation for the services rendered. It is distinct from other contractor agreements due to its focus on excavation services, ensuring both parties are protected under the terms agreed upon.

Key parts of this document

- Identification of the employer and contractor.

- Detailed description of the work to be performed.

- Term of the contract, specifying duration and completion timelines.

- Clauses defining the independent contractor status.

- Representations and warranties made by the contractor.

Common use cases

This contract is essential when hiring an independent contractor for excavation services, such as site preparation for construction, landscaping, or installing utilities. It can be used when engaging a contractor for specific projects, ensuring clarity of terms and reducing disputes over the scope of work and payment.

Intended users of this form

- Homeowners looking to hire an independent contractor for excavation work.

- Business owners needing excavation services for commercial projects.

- Contractors offering excavation services who require a formal agreement to protect their rights and outline obligations.

Instructions for completing this form

- Identify the parties involved, including the employer and contractor.

- Clearly specify the work to be performed, detailing the services required.

- Enter the duration of the contract, including start and end dates if applicable.

- Review and confirm the independent contractor status and any representations made.

- Ensure both parties sign and date the contract to make it legally binding.

Notarization requirements for this form

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to define the scope of work clearly, which can lead to misunderstandings.

- Not specifying the duration of the contract, causing uncertainty in project timelines.

- Neglecting to review and comply with state-specific requirements for contractor agreements.

- Overlooking the inclusion of necessary signatures, making the contract unenforceable.

Advantages of online completion

- Convenience of downloading the form instantly for immediate use.

- Editability allows for easy customization to fit specific project needs.

- Reliable source, drafted by licensed attorneys to ensure legal compliance.

Looking for another form?

Form popularity

FAQ

Get it in writing. Keep it simple. Deal with the right person. Identify each party correctly. Spell out all of the details. Specify payment obligations. Agree on circumstances that terminate the contract. Agree on a way to resolve disputes.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

Paying yourself as an independent contractor As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC. The LLC will be responsible for IRS Form 1099-MISC during tax season.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

An Independent Contractor Agreement is a written contract that spells out the terms of the working arrangement between a contractor and client, including: A description of the services provided. Terms and length of the project or service. Payment details (including deposits, retainers, and other billing details)

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. If you are an independent contractor, you are self-employed.However, your earnings as an employee may be subject to FICA (Social Security tax and Medicare) and income tax withholding.

An Independent Contractor Agreement is a written contract that spells out the terms of the working arrangement between a contractor and client, including: A description of the services provided. Terms and length of the project or service. Payment details (including deposits, retainers, and other billing details)

Obtain the Equipment Excavation equipment costs range anywhere from $10,000 to $100,000 or more for specialty items. Purchase the most frequently used excavators you need to start with and rent any larger or less frequently used machines as needed. Mini excavators can complete most smaller, residential jobs.

An experienced Construction Contractor with 10-19 years of experience earns an average total compensation (includes tips, bonus, and overtime pay) of $35.00 based on 6 salaries. In their late career (20 years and higher), employees earn an average total compensation of $35.