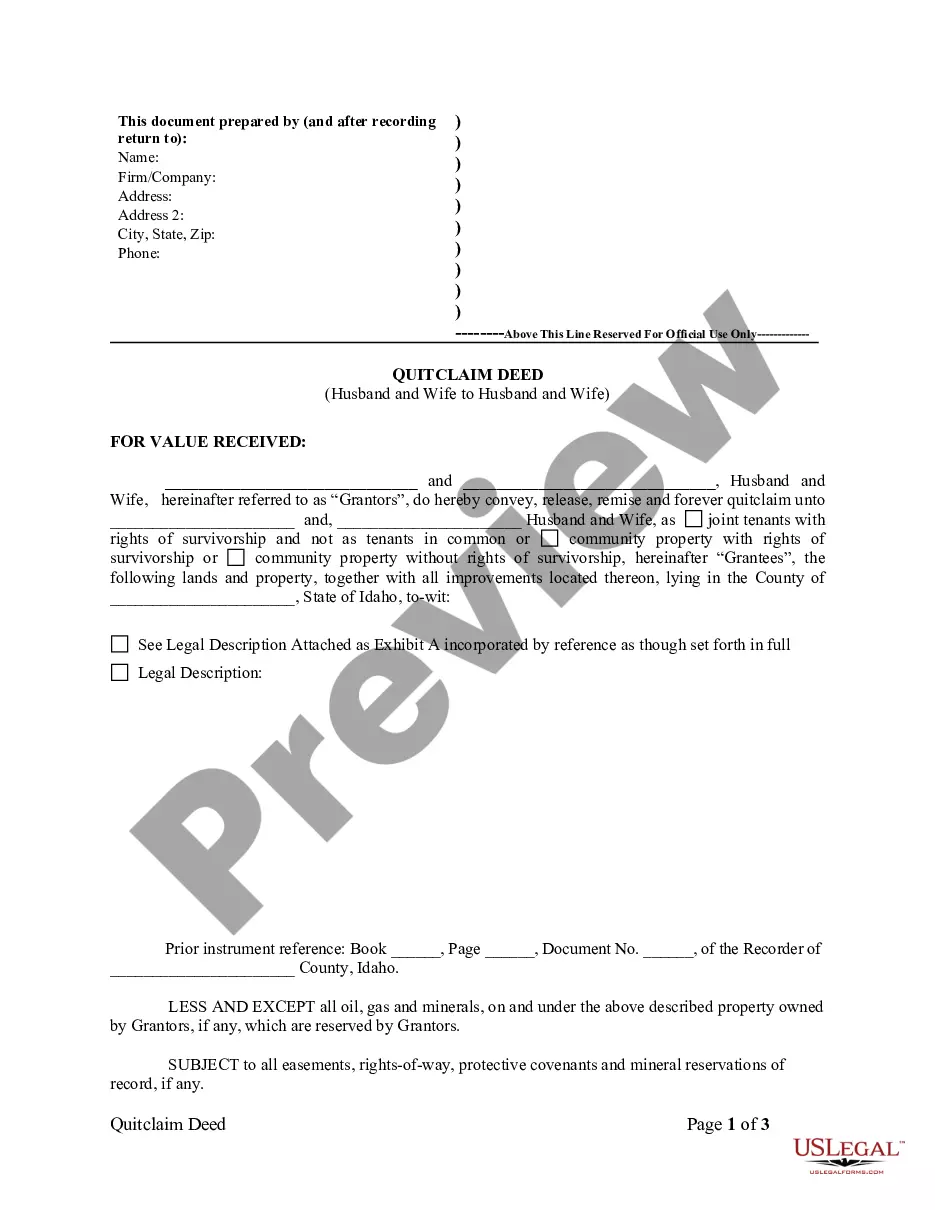

Idaho Quitclaim Deed from Husband and Wife to Husband and Wife

Overview of this form

This form is a Quitclaim Deed specifically designed for husband and wife who wish to transfer property to one another. Unlike other deeds, a quitclaim deed does not guarantee that the grantor holds clear title to the property, making it a simpler option for transferring property ownership without extensive legal examination. This deed is particularly useful for spouses who want to clarify ownership of shared property or when transferring ownership without financial exchange.

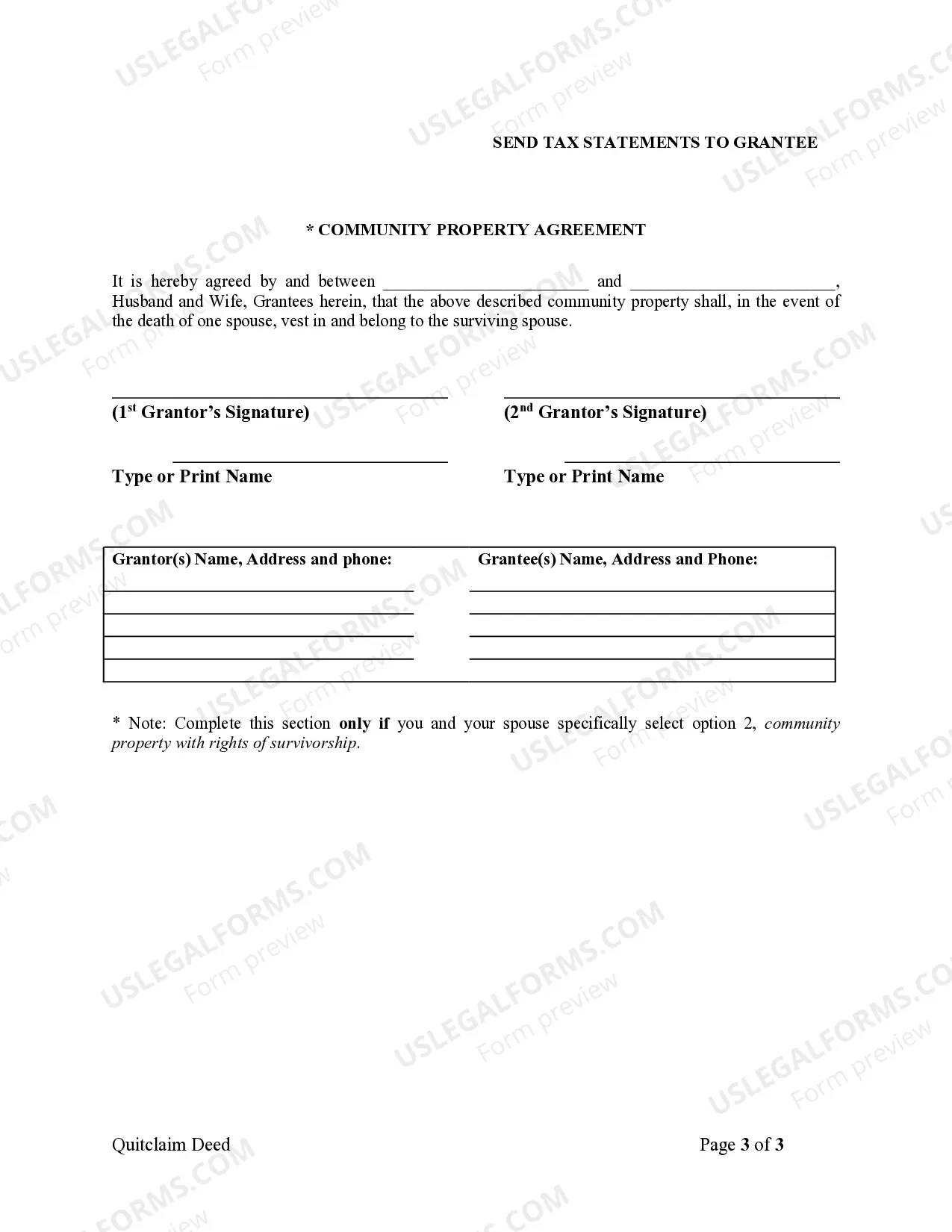

What’s included in this form

- Identification of grantors (husband and wife) and grantees (husband and wife)

- Legal description of the property being transferred

- Reservation of oil, gas, and mineral rights by grantors

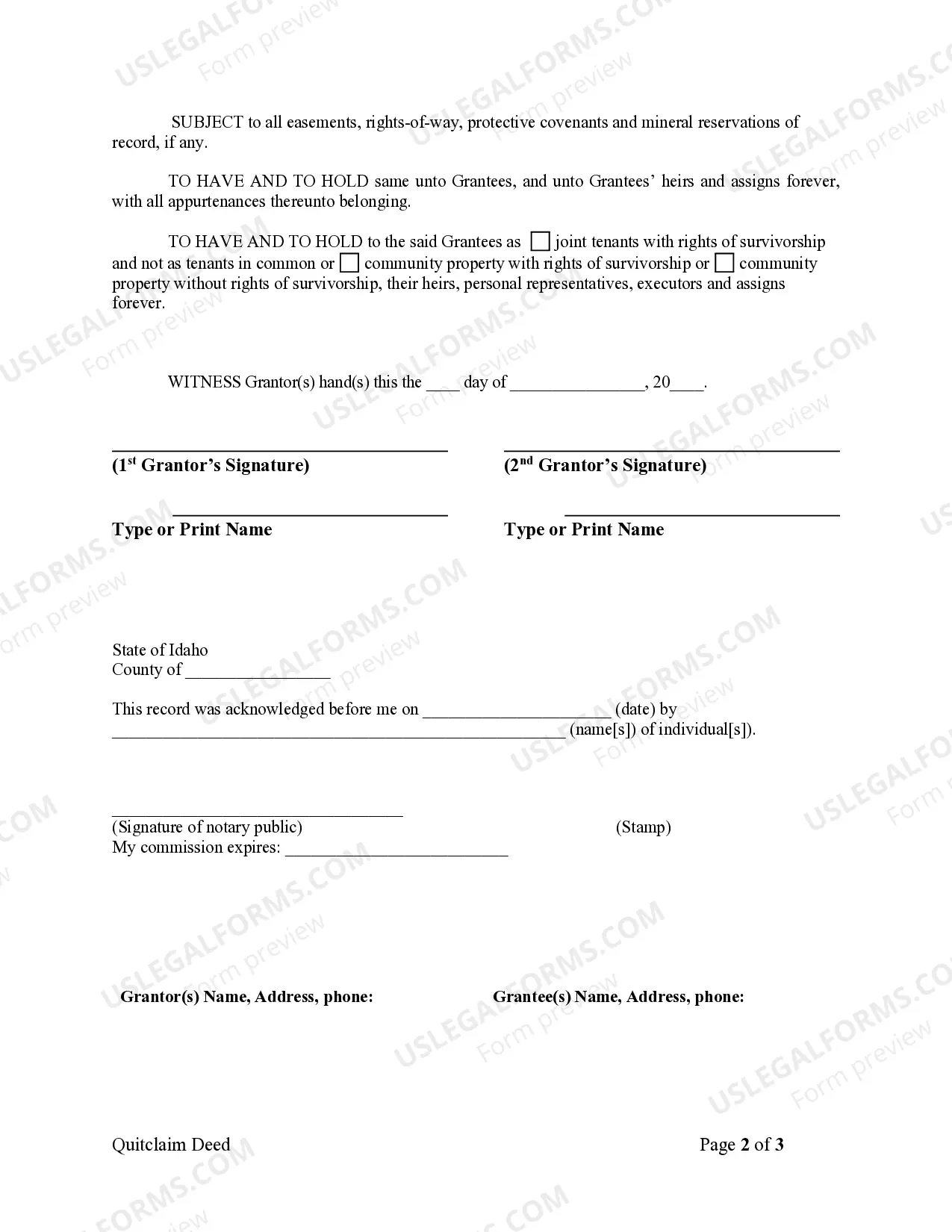

- Joint tenancy with rights of survivorship, clearly stated

- Signatures of both grantors, including notary acknowledgment

When to use this form

This form is used when a husband and wife want to transfer real estate ownership to each other, particularly in situations such as changing title for estate planning, removing a spouse's name after separation, or consolidating owned property. It may also be relevant in property transfers related to divorce settlements or to clear up property interests previously shared.

Intended users of this form

- Married couples looking to transfer property between themselves

- Spouses seeking to clarify ownership interest in shared assets

- Individuals involved in estate planning

- Couples separating or divorcing who need to designate property ownership

Instructions for completing this form

- Identify both grantors (husband and wife) and grantees (husband and wife) clearly.

- Provide a legal description of the property to be transferred, as specified in Exhibit A.

- Indicate any mineral rights being reserved by the grantors.

- Sign the deed in the presence of a notary public to validate the transaction.

- Ensure all relevant details and signatures are correctly filled in before submission.

Does this document require notarization?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Avoid these common issues

- Failing to provide a complete legal description of the property.

- Not having the document notarized or incorrectly signing it.

- Omitting to mention reserved rights, such as minerals or gas.

- Using incorrect or outdated forms not compliant with state laws.

Why complete this form online

- Convenience of downloading and filling out the form at your own pace.

- Access to templates drafted by licensed attorneys for reliable guidance.

- Editable versions that allow for quick adjustments to meet your needs.

- Availability of support and resources to assist with the completion process.

State-specific compliance details

This Quitclaim Deed complies with state statutory laws, ensuring that the form meets specific jurisdictional requirements for property transfers. Users should verify any additional state-specific disclosures or requirements as necessary.

Form popularity

FAQ

Purchasing a home with a quitclaim deed may not be advisable without thorough consideration. While it simplifies transferring ownership, it does not provide guarantees about the title's validity or existing liens. Ensure you conduct proper due diligence to avoid potential pitfalls when involved in an Idaho Quitclaim Deed from Husband and Wife to Husband and Wife.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

Enter the full name of the Grantor (seller) AND. Enter the name(s) of the Grantee(s) (buyer(s)) Address. Legal description of the property. Enter the name of the County where the property is situated.

Two of the most common ways to transfer property in a divorce are through an interspousal transfer deed or quitclaim deed. When spouses own property together, but then one spouse executes an interspousal transfer or a quitclaim deed, this is known as transmutation.

You can gift property to spouse, child or any relative and register the same. Under section 122 of the Transfer of Property Act, 1882, you can transfer immovable property through a gift deed. The deed should contain your details as well as those of the recipient.

To use a Quitclaim Deed to add someone to a property deed or title, you would need to create a Quitclaim Deed and list all of the current owners in the grantor section. In the grantee section, you would list all of the current owners as well as the person you would like to add.