Idaho Quitclaim Deed from Husband and Wife to Husband and Wife

Definition and meaning

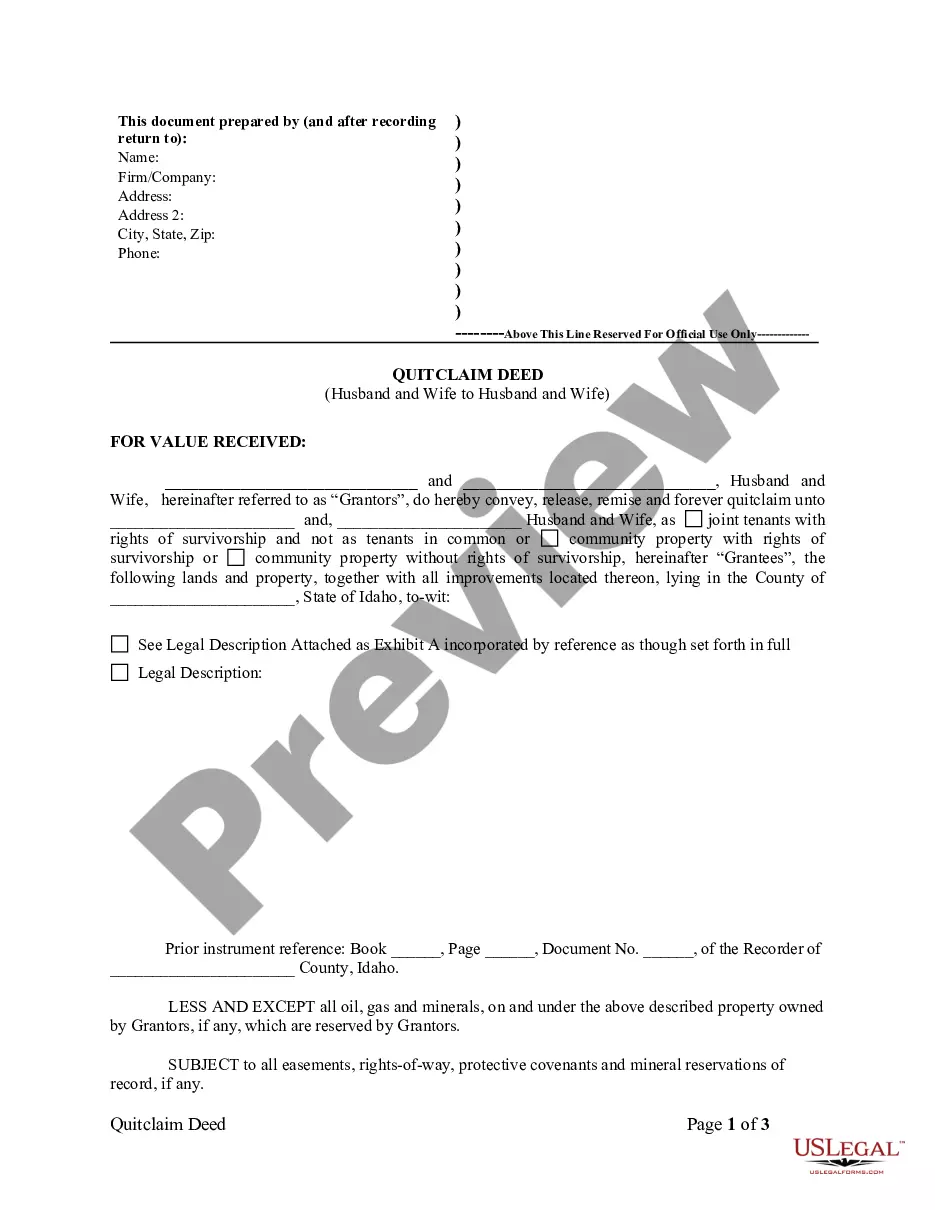

A Quitclaim Deed is a legal instrument used to transfer an interest in real property from one party to another. In the context of an Idaho Quitclaim Deed from Husband and Wife to Husband and Wife, it serves to convey property ownership between spouses without warranties regarding the property title. This type of deed is often utilized in situations involving marital property transfers, including the transfer of assets in the event of a divorce or when attempting to clarify ownership issues.

Who should use this form

This form is suitable for married couples who wish to transfer real property ownership between themselves. It may be used in scenarios such as:

- Changing the way property is titled.

- Planning for future estate distribution.

- Resolving disputes related to property ownership.

- Transferring property as part of a divorce settlement.

Couples should consider using this form if they want to remove one party’s name from property records or clarify ownership status.

How to complete a form

To correctly fill out the Idaho Quitclaim Deed from Husband and Wife to Husband and Wife, follow these steps:

- Enter the names of the Grantors (the spouses transferring the property) and the Grantees (the same or other spouses receiving the property).

- Provide a legal description of the property being transferred. This is usually found in prior property documents or through the county recorder's office.

- Specify any prior instrument references to indicate the history of the property's title.

- Have both Grantors sign the document in the presence of a notary public.

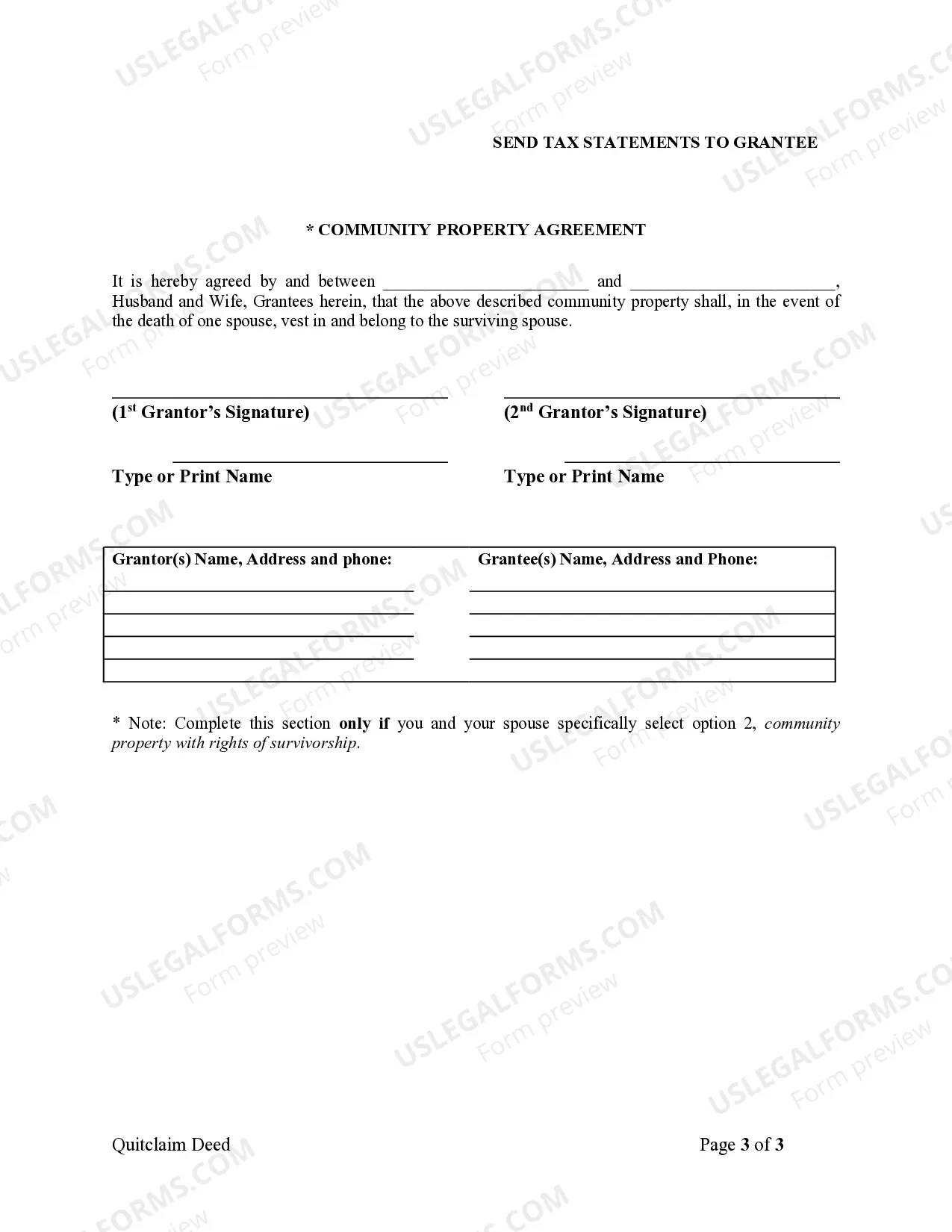

- Complete any additional provisions, such as designating the transfer as community property with rights of survivorship, if applicable.

After completing the form, it should be filed with the relevant county recorder's office to ensure the transfer is officially recognized.

Key components of the form

The Idaho Quitclaim Deed consists of several essential components, including:

- Grantors: The individuals transferring interest in the property.

- Grantees: The individuals receiving ownership of the property.

- Legal Description: A detailed description of the property to ensure clarity and avoid disputes.

- Execution: Signatures of the Grantors in front of a notary public.

- Community Property Agreement (optional): An option to specify that the property will belong to the surviving spouse in the event of one spouse's death.

Each component plays a critical role in the legal effectiveness and clarity of the property transfer.

Common mistakes to avoid when using this form

When completing the Idaho Quitclaim Deed, it is important to avoid several common mistakes, such as:

- Failing to include a complete legal description of the property.

- Not having the document notarized properly.

- Leaving sections incomplete, such as the prior instrument reference.

- Incorrectly identifying the Grantors and Grantees.

- Neglecting to file the deed with the county recorder's office after execution.

Taking care to address these issues can help ensure that the deed is legally sound and effective.

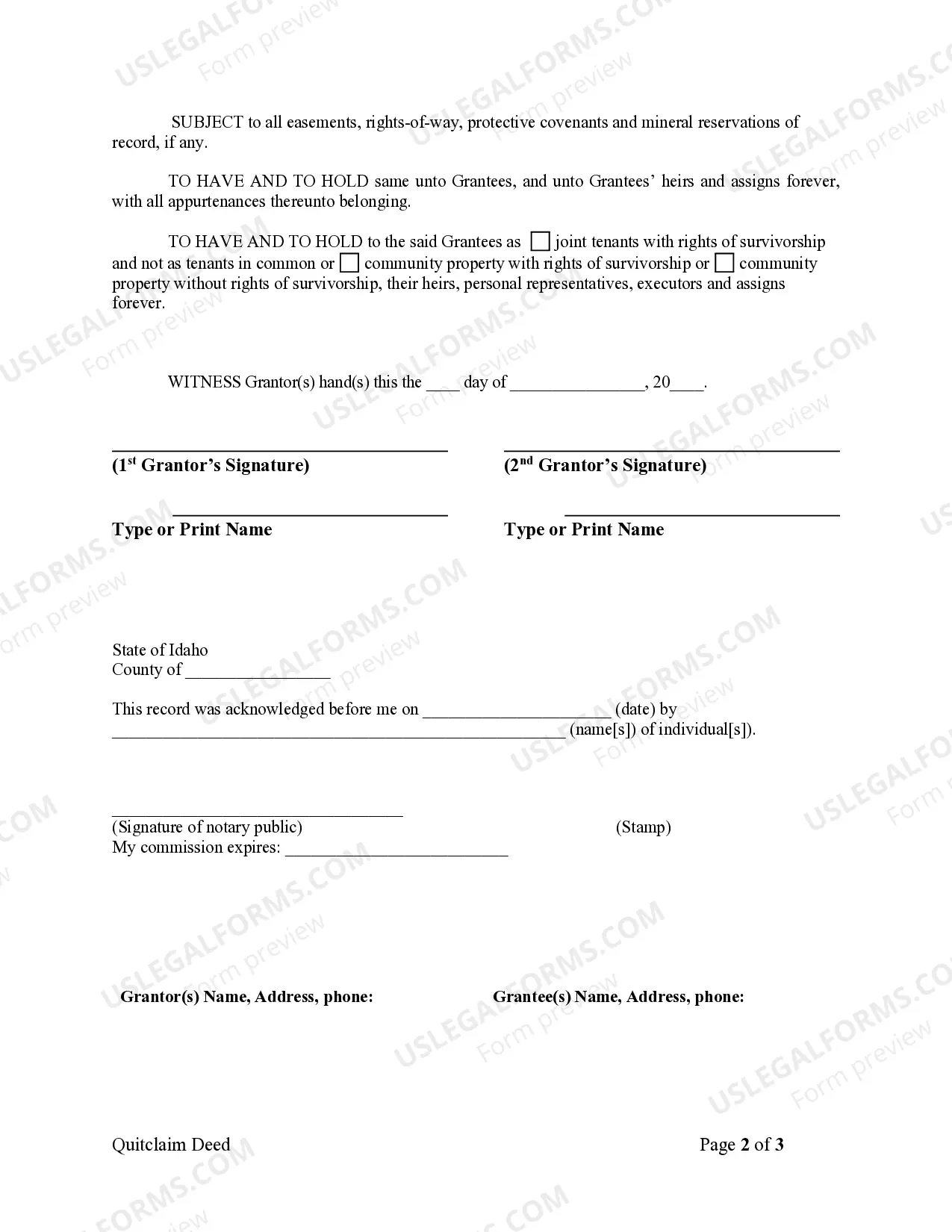

What to expect during notarization or witnessing

When notarizing the Idaho Quitclaim Deed, the following steps typically occur:

- The Grantors appear in person before the notary public.

- The notary will verify the identities of the Grantors, usually by inspecting valid identification.

- The Grantors will sign the deed in the presence of the notary.

- The notary will complete the notarial certificate, affixing their seal to the document.

It is essential to ensure that the notary public is licensed and recognized in the state of Idaho to ensure that the notarization is valid.

Form popularity

FAQ

Purchasing a home with a quitclaim deed may not be advisable without thorough consideration. While it simplifies transferring ownership, it does not provide guarantees about the title's validity or existing liens. Ensure you conduct proper due diligence to avoid potential pitfalls when involved in an Idaho Quitclaim Deed from Husband and Wife to Husband and Wife.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

Enter the full name of the Grantor (seller) AND. Enter the name(s) of the Grantee(s) (buyer(s)) Address. Legal description of the property. Enter the name of the County where the property is situated.

Two of the most common ways to transfer property in a divorce are through an interspousal transfer deed or quitclaim deed. When spouses own property together, but then one spouse executes an interspousal transfer or a quitclaim deed, this is known as transmutation.

You can gift property to spouse, child or any relative and register the same. Under section 122 of the Transfer of Property Act, 1882, you can transfer immovable property through a gift deed. The deed should contain your details as well as those of the recipient.

To use a Quitclaim Deed to add someone to a property deed or title, you would need to create a Quitclaim Deed and list all of the current owners in the grantor section. In the grantee section, you would list all of the current owners as well as the person you would like to add.