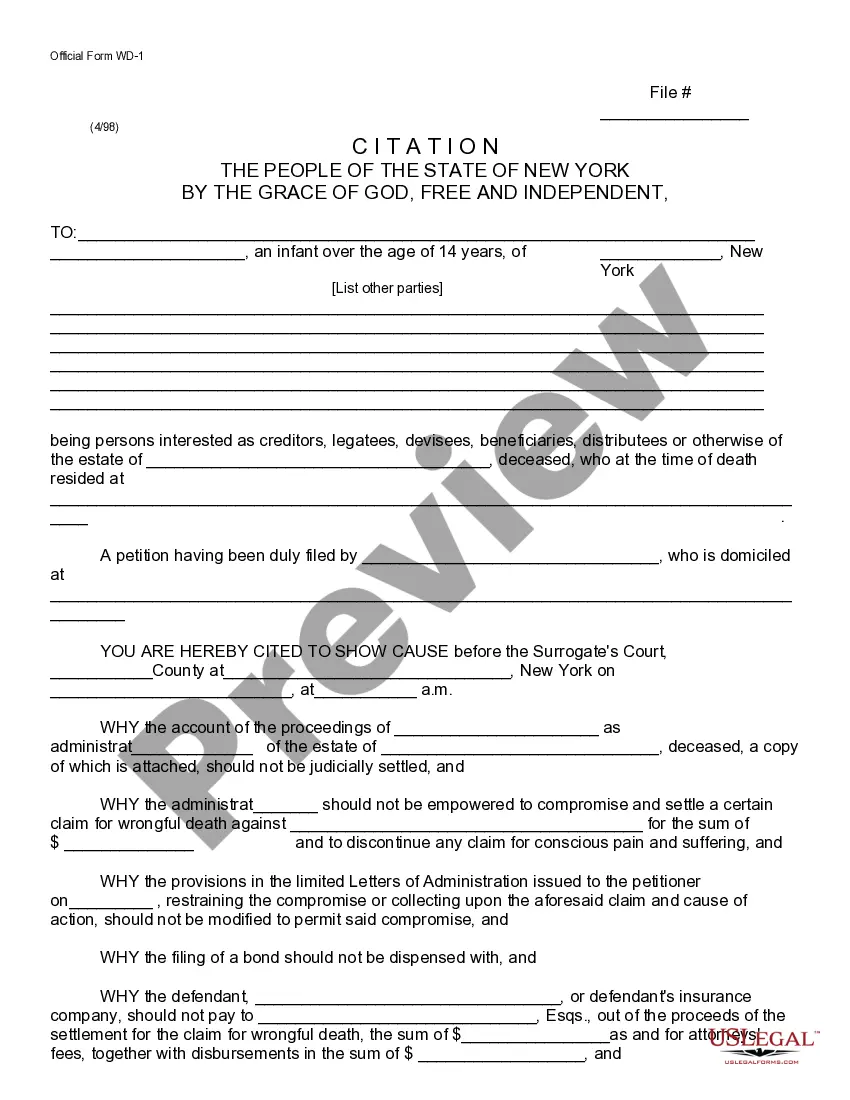

This due diligence workform is used to review property information and title commitments and policies in business transactions.

Iowa Fee Interest Workform

Description

How to fill out Fee Interest Workform?

Are you presently in a position where you often require documents for organization or specific purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms provides a vast array of template forms, such as the Iowa Fee Interest Workform, designed to meet federal and state requirements.

Once you find the right document, click Buy now.

Select the pricing plan you prefer, fill in the required information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Iowa Fee Interest Workform template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for your correct state/region.

- Utilize the Preview button to examine the form.

- Review the description to confirm that you have selected the correct document.

- If the form is not what you are seeking, make use of the Search section to find the form that meets your needs.

Form popularity

FAQ

Iowa does not fully decouple from Section 163 J, but it does have specific rules regarding the treatment of interest expense deductions. As you complete the Iowa Fee Interest Workform, be sure to account for these regulations. Understanding how Iowa interacts with 163 J can help you strategize your tax planning effectively. Clarity on these deductions will benefit you in the long run.

Iowa does require taxpayers to file for a separate extension if they need extra time to complete their taxes. This process is different from federal extensions and can be initiated using the appropriate forms. If you anticipate needing additional time, incorporating the Iowa Fee Interest Workform into your planning will ensure you fulfill your obligations on time. Proactive planning can save you from penalties and interest charges.

Iowa does conform to some aspects of Section 163 J but has specific modifications worth noting. When completing your Iowa Fee Interest Workform, make sure you are aware of these nuances to ensure accurate reporting. Conformity can influence the deductions you can claim, so stay informed about how it applies to your situation. This awareness can lead to a more favorable tax outcome for you.

Several states have chosen to decouple from Section 163 J of the Internal Revenue Code, impacting how they handle interest expense deductions. When you work with the Iowa Fee Interest Workform, you can see how these changes affect your tax situation. It's essential to check the specific regulations for your state, as they may vary. Understanding these differences can help you navigate your tax obligations more effectively.

Calculating Iowa unemployment benefits involves using your recent earnings and the state's established formula. Generally, your weekly benefit amount is based on your highest earning quarter in the base period. To accurately complete your Iowa Fee Interest Workform, ensure that you have all relevant income documentation to determine the correct benefit amount. If you need help, resources are available on the Iowa Workforce Development website.

The SUTA rate for Iowa in 2025 will vary based on your business's experience rating and current regulations. It is essential to stay informed about updates from the Iowa Workforce Development, as they provide information that may impact your Iowa Fee Interest Workform. For the most accurate rate, check with official state resources or consult a tax professional familiar with Iowa's unemployment laws.

To find your Iowa UI account number, start by visiting the Iowa Workforce Development website. You can also check any previous correspondence from the department, such as notification letters concerning your Iowa Fee Interest Workform. If you still cannot locate it, consider calling the Iowa Workforce Development office for assistance.

The interest rate on a tax lien in Iowa is generally set by statute and can be substantial. Understanding the implications of a tax lien is crucial; timely filing of the Iowa Fee Interest Workform can help in managing any related financial obligations. It is advisable to consult the Iowa Department of Revenue or a tax professional for the most current rates and guidelines. This knowledge can assist in preventing financial strain.

To file a tax extension in Iowa, you must complete the appropriate form and submit it to the Iowa Department of Revenue. The Iowa Fee Interest Workform can be utilized for this purpose, allowing you to extend your filing deadline while avoiding penalties. Ensure that you file your extension request before the original due date to maintain compliance. This process provides you with additional time to prepare your tax return.

In Iowa, fees associated with new registration may not be deductible from your taxable income. However, specific deductions can apply depending on the category of the registration and your overall tax situation. Consider reviewing your circumstances or consulting a tax professional to understand how the Iowa Fee Interest Workform may affect your deductions. This approach can help you maximize your tax benefits.