Iowa Basic Debt Instrument Workform

Description

How to fill out Basic Debt Instrument Workform?

If you require to complete, download, or print official document templates, make use of US Legal Forms, the largest collection of legal forms available online. Utilize the site's straightforward and user-friendly search to find the documents you need.

A range of templates for business and personal purposes are categorized by groups and states, or keywords. Use US Legal Forms to acquire the Iowa Basic Debt Instrument Workform with just a few clicks.

If you are already a US Legal Forms customer, sign in to your account and click the Download button to get the Iowa Basic Debt Instrument Workform. You can also access forms you previously saved in the My documents tab of the account.

Every legal document template you acquire is yours indefinitely. You will have access to every document you saved within your account. Click the My documents section and select a document to print or download again.

Stay competitive and download, and print the Iowa Basic Debt Instrument Workform with US Legal Forms. There are numerous professional and state-specific forms that you can utilize for your business or personal needs.

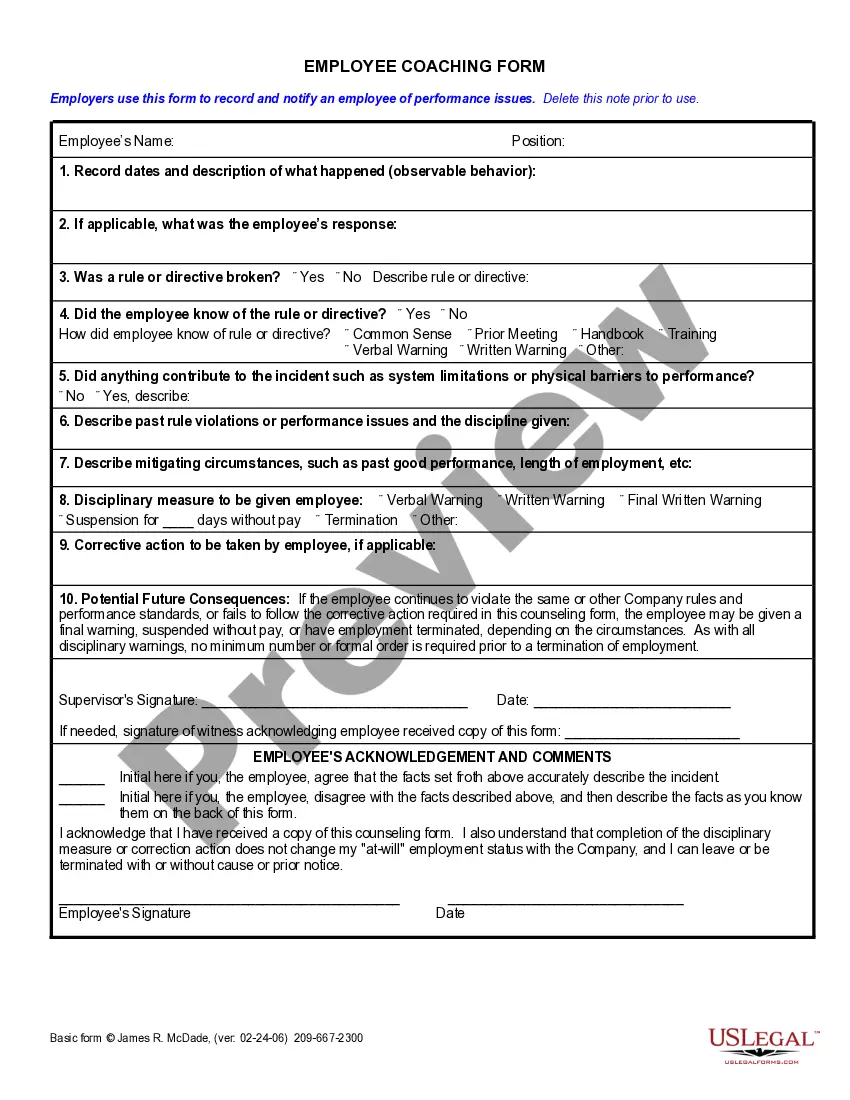

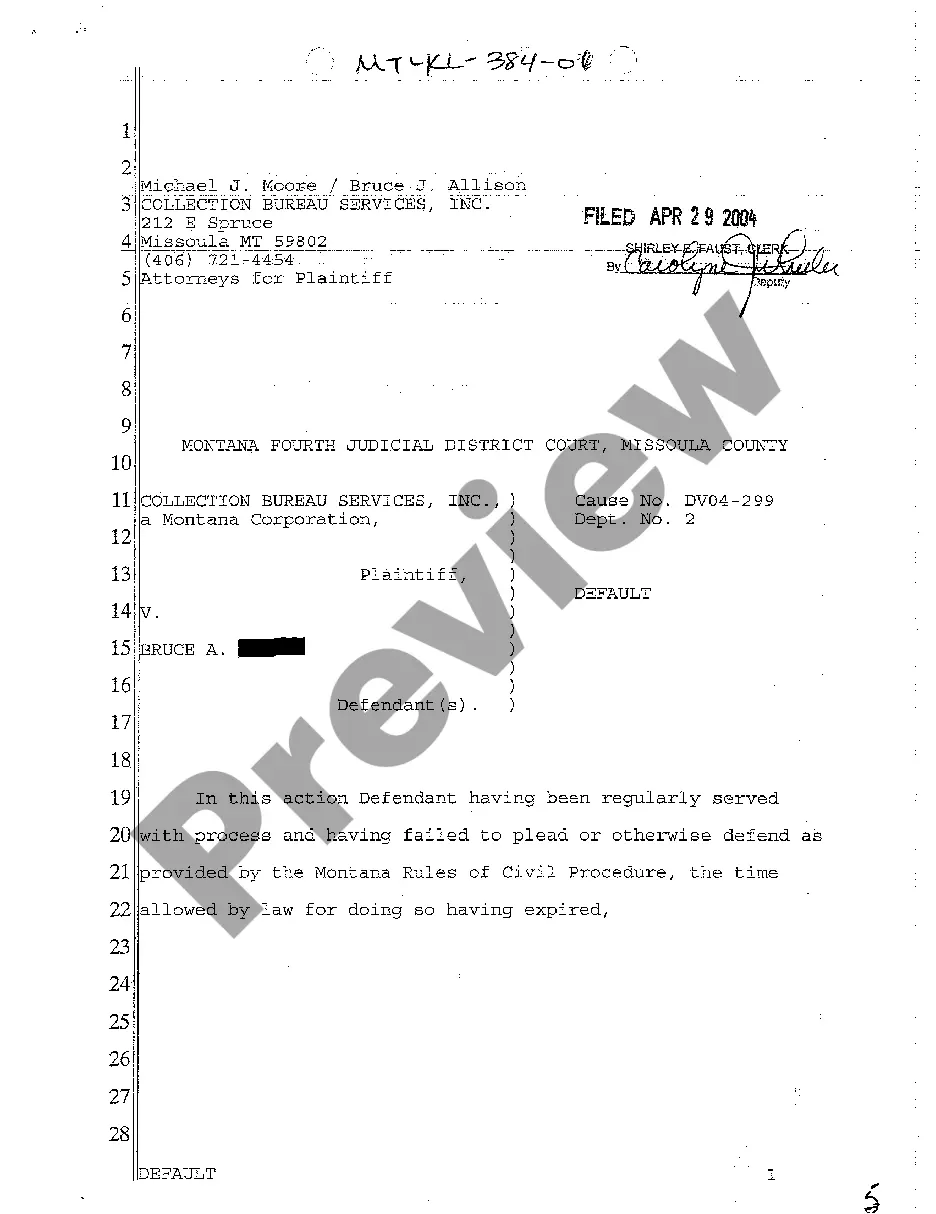

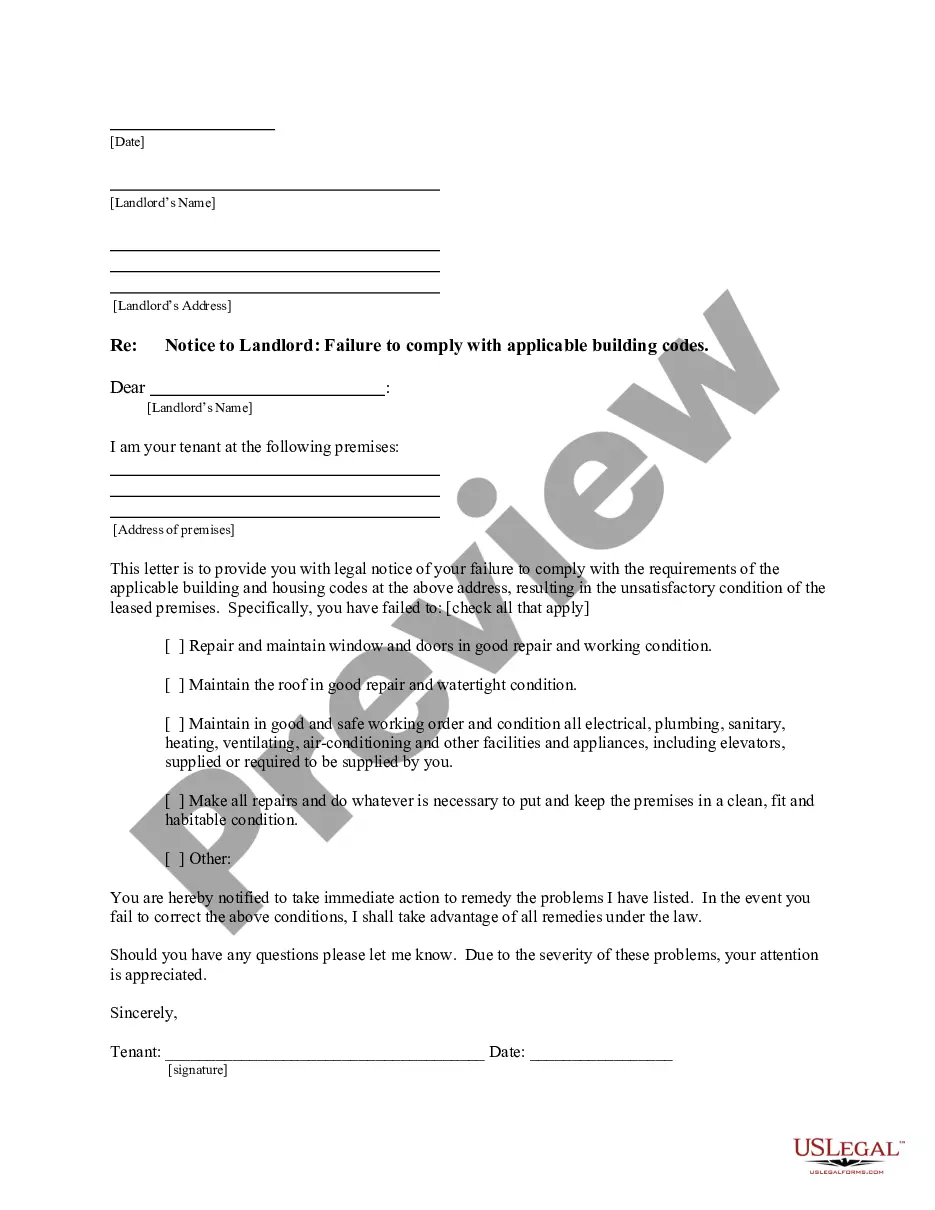

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the document, utilize the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Complete the payment. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Iowa Basic Debt Instrument Workform.

Form popularity

FAQ

Debt instruments are assets that require a fixed payment to the holder, usually with interest. Examples of debt instruments include bonds (government or corporate) and mortgages. The equity market (often referred to as the stock market) is the market for trading equity instruments.

Bonds. Bonds are issued by governments or businesses. Investors pay the issuer the market value of the bond in exchange for guaranteed loan repayment and the promise of scheduled coupon payments.

There are different types of Debt Instruments available in India such as;Bonds.Certificates of Deposit.Commercial Papers.Debentures.Fixed Deposit (FD)G - Secs (Government Securities)National savings Certificate (NSC)

A debt instrument is an asset that individuals, companies, and governments use to raise capital or to generate investment income. Investors provide fixed-income asset issuers with a lump-sum in exchange for interest payments at regular intervals.

Debt instruments are assets that require a fixed payment to the holder, usually with interest. Examples of debt instruments include bonds (government or corporate) and mortgages. The equity market (often referred to as the stock market) is the market for trading equity instruments.

Under the amortized cost method, the debt investment is initially recorded as an asset at its cost; any excess of the purchase price over par value is recorded as bond premium and any excess of par value over bond price is recorded as a bond discount.

A debt instrument is a fixed income asset that allows the lender (or giver) to earn a fixed interest on it besides getting the principal back while the issuer (or taker) can use it to raise funds at a cost.

The first is to get financing from a bank. The other option is to issue debt to investors in the capital markets. This is referred to as a debt issuethe issuance of a debt instrument by an entity in need of capital to fund new or existing projects or to finance existing debt.

1.3 Treasury bills or T-bills, which are money market instruments, are short term debt instruments issued by the Government of India and are presently issued in three tenors, namely, 91 day, 182 day and 364 day.

The fair value of the debt is simply its value if you adjust the price of the debt so that a buyer would be earning the market rate of interest. For example, Say I borrow £100 for a year at 10% interest, then say the market rate of interest immediately halves to 5%.