Iowa Senior Debt Term Sheet

Description

How to fill out Senior Debt Term Sheet?

It is possible to devote hrs on the Internet attempting to find the legal document web template that suits the federal and state needs you will need. US Legal Forms gives 1000s of legal kinds which can be analyzed by experts. It is possible to acquire or produce the Iowa Senior Debt Term Sheet from my assistance.

If you have a US Legal Forms profile, you may log in and then click the Acquire option. Afterward, you may total, modify, produce, or sign the Iowa Senior Debt Term Sheet. Each and every legal document web template you buy is your own eternally. To have another copy of the purchased form, proceed to the My Forms tab and then click the related option.

Should you use the US Legal Forms site initially, keep to the basic directions listed below:

- Initial, be sure that you have selected the proper document web template for your state/city that you pick. Look at the form explanation to make sure you have chosen the right form. If available, use the Preview option to look through the document web template as well.

- If you wish to find another model in the form, use the Research field to discover the web template that fits your needs and needs.

- Upon having located the web template you want, simply click Purchase now to continue.

- Pick the rates plan you want, enter your qualifications, and register for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your bank card or PayPal profile to pay for the legal form.

- Pick the structure in the document and acquire it to the product.

- Make adjustments to the document if necessary. It is possible to total, modify and sign and produce Iowa Senior Debt Term Sheet.

Acquire and produce 1000s of document templates making use of the US Legal Forms Internet site, that offers the biggest variety of legal kinds. Use specialist and state-specific templates to deal with your company or specific requires.

Form popularity

FAQ

A Term Sheet is a lender's formal expression of interest making a loan. However, it is not a legally binding contract. A Term Sheet includes a summary of key loan terms like amount, interest rate, payment, and covenants.

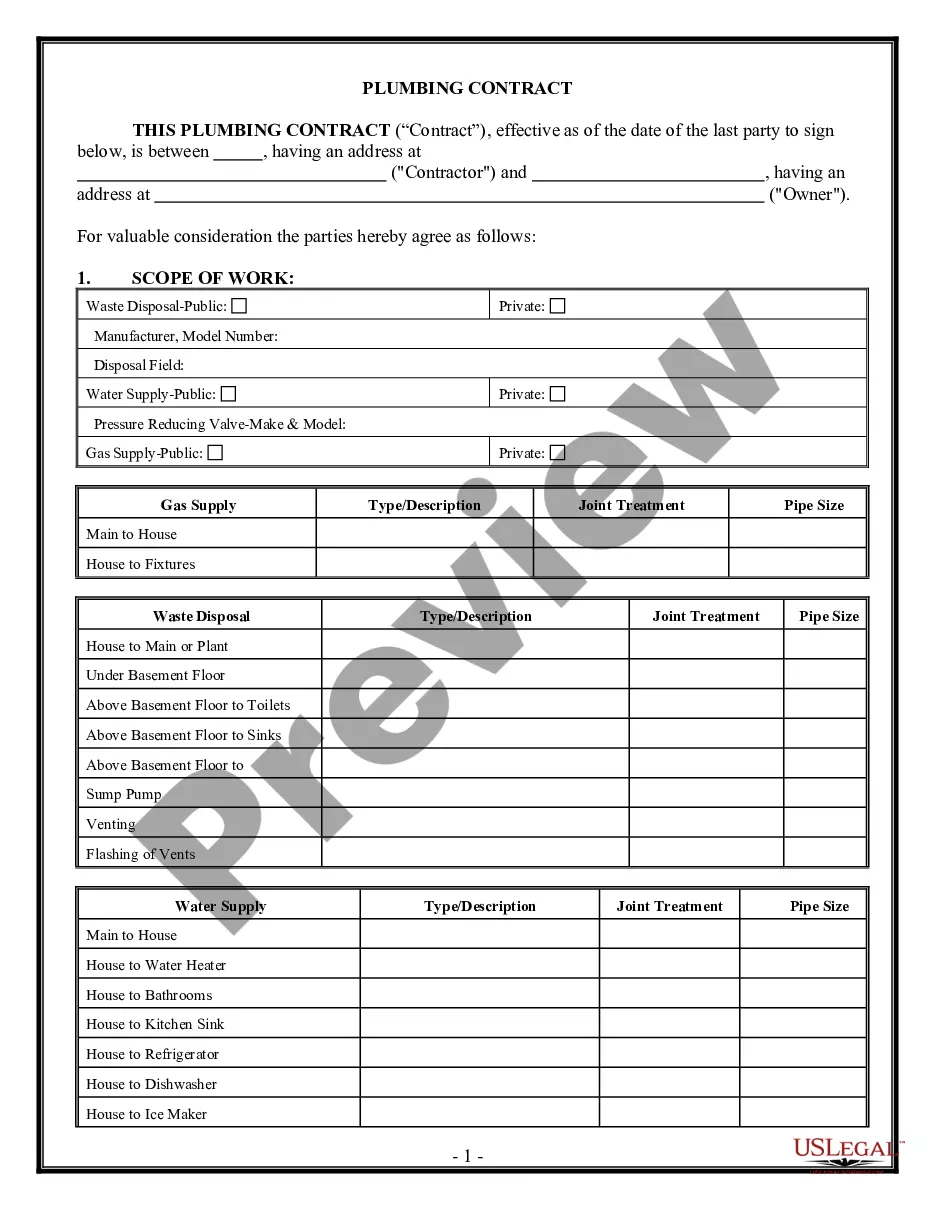

In a loan or debt agreement, the real estate term sheet must outline the repayment terms like loan size, payment structure, and interest rate. Other key terms, which include property taxes, insurance, closing costs, and relevant fees like an origination fee, also need to be addressed.

After agreement on the terms has been reached and formalized in a signed term sheet, legal documents (commonly called ?long-form docs? or ?final docs?) are prepared, reviewed, and executed to finalize the investment.

First, clarify how much funding you need and what you'll use it for, then identify your non-negotiables, then go line by line in each of the venture debt term sheets you've received to compare apples-apples, then kick off the negotiation process ensuring that you engage legal counsel, and finally sign the term sheet ...

Elements of a Term Sheet General Information. The top of a term sheet will outline general information such as the company name, investor name, date, and currency of the transaction. Amount. This section provides the amount of funding the investor and investee have tentatively agreed upon. ... Structure. ... Interest Rate.

The term sheet serves as a template and basis for more detailed, legally binding documents. Once the parties involved reach an agreement on the details laid out in the term sheet, a binding agreement or contract that conforms to the term sheet details is drawn up.

Examine the financial terms specified in the term sheet. Pay close attention to the valuation, investment amount, and the type of funding being offered, whether it is equity, debt, or a combination. Analyze any provisions related to future financing rounds, including pre-emption rights and anti-dilution clauses.

ANSWER: A Pre-approval differs from Pre-qualification in commercial lending in that the ?Pre-approval? or Term Sheet/Letter of Interest is issued after a preliminary underwriting determination has been made.

Term sheets typically specify how many seats on a company's board of directors will go to investors, and founders obviously don't want to find themselves outvoted, particularly during a startup's early stages.

Venture debt is a term loan typically structured over a four-to-five-year amortization period, usually with a period of time to draw the loan down, such as 9-12 months. Interest-only periods of 3-12 months are common.