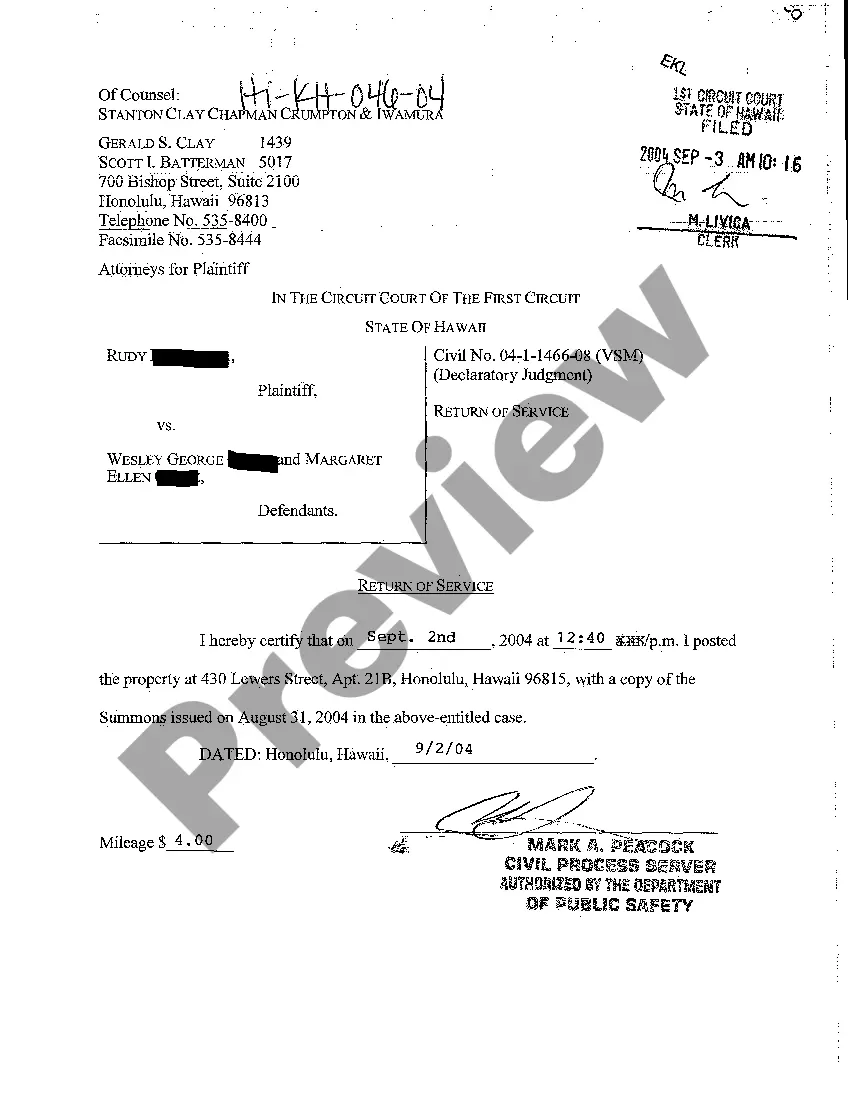

Hawaii Return of Service

Description

How to fill out Hawaii Return Of Service?

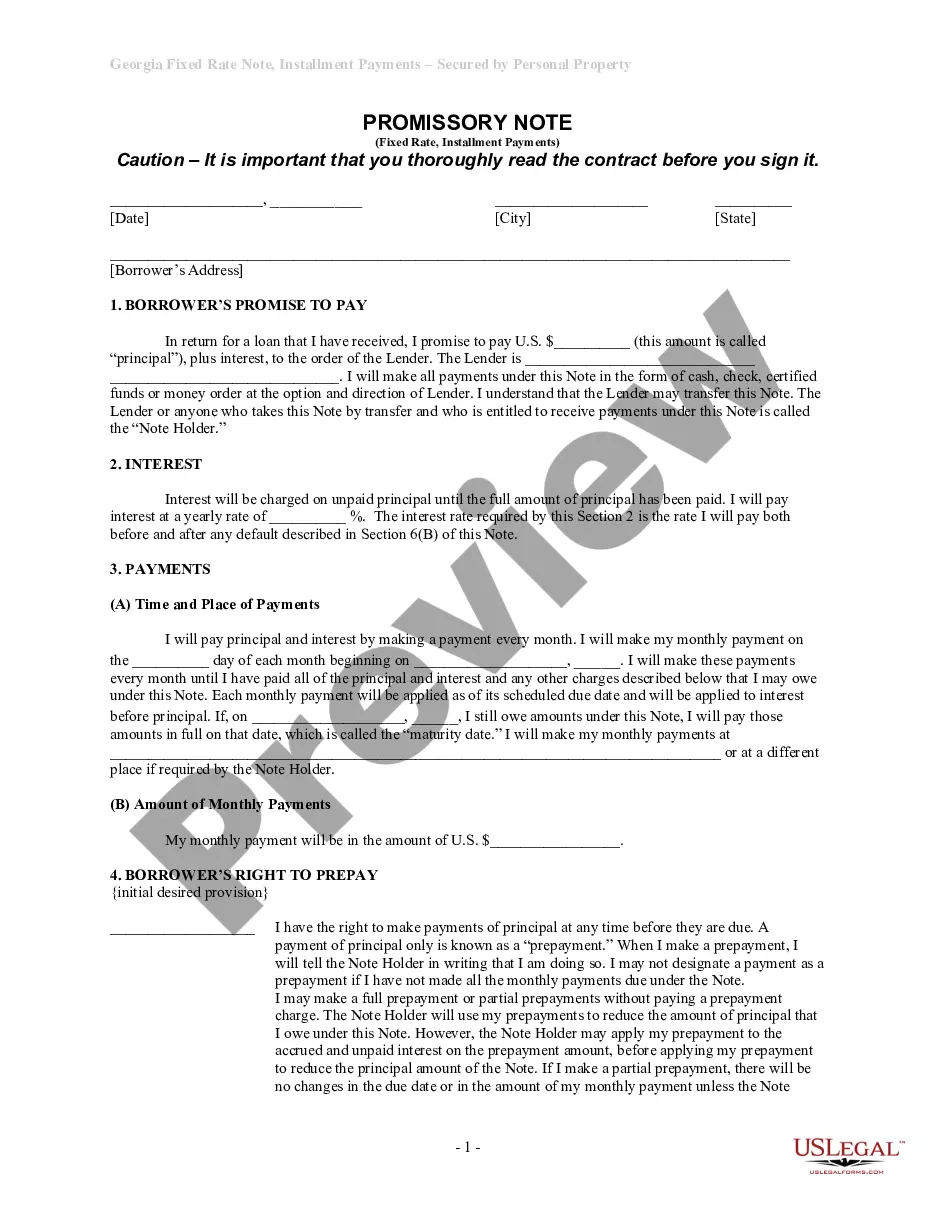

Among countless complimentary and paid illustrations available online, you cannot guarantee their dependability.

For instance, who created them or whether they possess sufficient qualifications to handle your requirements.

Stay composed and utilize US Legal Forms!

Ensure that the document you discover is applicable in your residing state. Review the template by evaluating the description through the Preview feature. Click Buy Now to initiate the ordering process or search for another document using the Search bar located at the top. Select a pricing option and create an account. Complete the payment for the subscription with your credit/debit card or Paypal. Retrieve the form in your desired format. Once you have enrolled and acquired your subscription, you can make use of your Hawaii Return of Service as frequently as required or for the duration that it remains valid in your location. Edit it with your preferred online or offline editor, complete it, sign it, and produce a physical copy. Achieve more for less with US Legal Forms!

- Find Hawaii Return of Service documents crafted by experienced legal professionals.

- evade the costly and lengthy process of searching for an attorney.

- and subsequently compensating them to prepare a document that you could obtain independently.

- If you hold a membership, access your profile and locate the Download option adjacent to the file you’re seeking.

- You will also be able to view all your previously saved templates in the My documents section.

- If you are utilizing our service for the first occasion, adhere to the directions outlined below to acquire your Hawaii Return of Service swiftly.

Form popularity

FAQ

To serve someone’s papers in Hawaii, you must deliver legal documents to the person named in the case. This can be done through personal service or by using a process server, with Hawaii law requiring proof of service. Ensuring the correct delivery is crucial for maintaining valid legal proceedings. For ease and reliability, many individuals choose to utilize Hawaii Return of Service, which simplifies the process of serving legal documents.

Rule 48 in Hawaii deals with the dismissal of cases for lack of prosecution. This rule allows the court to dismiss a case if it has not progressed for a certain period. It emphasizes the importance of timely action within court proceedings. To ensure that your filings are submitted and served on time, you may want to consider utilizing Hawaii Return of Service to track your legal documents.

In Hawaii, the law does not specify a fixed age at which a child can decide which parent to live with. However, children aged 14 and older may be heard in court regarding their preferences. The court considers this input along with various factors that impact the child's best interests. To communicate their preference formally, it is important to file appropriate motions, and Hawaii Return of Service can assist in serving those documents.

Rule 58 in Hawaii concerns the entry of judgment. It stipulates that a judgment must be entered in accordance with the court's decisions and can involve specific orders. Understanding Rule 58 is vital for knowing how and when judgments affect your case. To ensure that all parties are notified effectively, the Hawaii Return of Service is a reliable method to serve documents related to these judgments.

Rule 59 of the Hawaii Family Court addresses the process of filing a motion for a new trial or seeking to amend a judgment. After a decision is made, either party can request a review of the case based on alleged errors that affect the outcome. This rule helps ensure fairness and offers a second chance to present your case. Utilizing Hawaii Return of Service can ensure that your motions and related documents are properly delivered.

Rule 35 in Hawaii pertains to mental or physical examinations. This rule allows a party to request an examination of another party when their mental or physical condition can impact the case. If you are involved in a legal dispute, understanding this rule can help clarify expectations for examinations. For effective communication regarding such procedures, consider using Hawaii Return of Service to deliver necessary documents.

If you have earned income in Hawaii, you typically need to file a state tax return. There are specific income thresholds that dictate whether you are required to file, so it’s best to review Hawaii's tax laws or consult professionals. Using platforms like US Legal Forms can help determine your filing obligations and streamline the filing process. Don't hesitate to seek assistance if you're unsure about your requirements.

Yes, you can file your Hawaii return electronically through designated e-filing services. Many taxpayers prefer this method for its simplicity and efficiency. Just ensure that you are using approved software that meets Hawaii's e-filing requirements. This option also makes tracking your Hawaii Return of Service more accessible and convenient.

Generally, you do not need to attach a federal return to your Hawaii return. However, if you are claiming certain credits or adjustments, additional documentation may be required. Always check the latest guidelines from the Hawaii Department of Taxation to ensure you follow proper procedures. Resources such as US Legal Forms can guide you in assembling the necessary documentation.

You should mail your Hawaii state tax return to the address specified on the tax form you are using. Typically, these addresses can vary based on the type of return you are filing. For e-filers, you may not need to worry about mailing, but for paper returns, double-check that you are sending it to the right place. Using US Legal Forms can further clarify these addresses based on your specific situation.