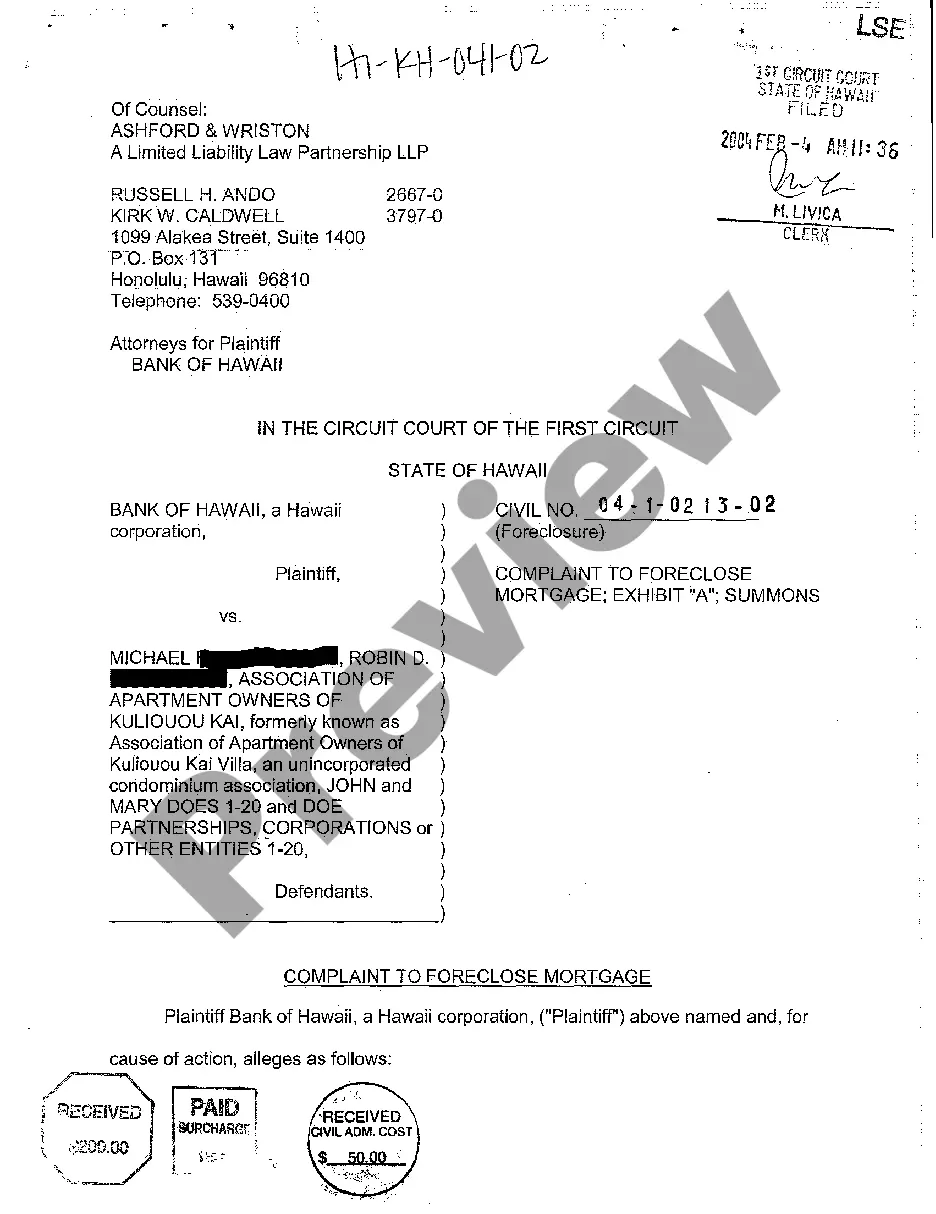

Hawaii Complaint to Foreclose Mortgage

Description

How to fill out Hawaii Complaint To Foreclose Mortgage?

Among a variety of complimentary and paid examples available online, you cannot guarantee their precision.

For instance, who made them or whether they possess the expertise to handle what you need them for.

Remain composed and utilize US Legal Forms!

If you are using our site for the first time, adhere to the instructions listed below to effortlessly obtain your Hawaii Complaint to Foreclose Mortgage.

- Locate Hawaii Complaint to Foreclose Mortgage examples crafted by proficient legal professionals.

- and evade the costly and time-consuming endeavor of searching for an attorney.

- and subsequently compensating them to draft a document for you that you can obtain yourself.

- If you have a subscription, Log In to your profile.

- and look for the Download button next to the file you need.

- You'll also have access to your previously saved templates in the My documents section.

Form popularity

FAQ

To file a Hawaii Complaint to Foreclose Mortgage, start by gathering all necessary documentation related to your mortgage. Next, prepare your complaint, which should detail the amount owed, your mortgage agreement, and the reasons for the foreclosure. Once your complaint is complete, file it with the appropriate court in Hawaii, and ensure you serve a copy to the borrower. Consider using USLegalForms to streamline this process, as they provide templates and resources tailored for filing foreclosure complaints effectively.

Under Hawaii law, when facing a Hawaii Complaint to Foreclose Mortgage, borrowers have certain redemption rights. They may redeem the property by paying off the total amount owed, including any fees, within a specific time frame. This redemption period gives homeowners an opportunity to reclaim their home and relieve financial burdens. Utilizing US Legal Forms can provide you with the necessary documents and detailed guidance to navigate this process effectively.

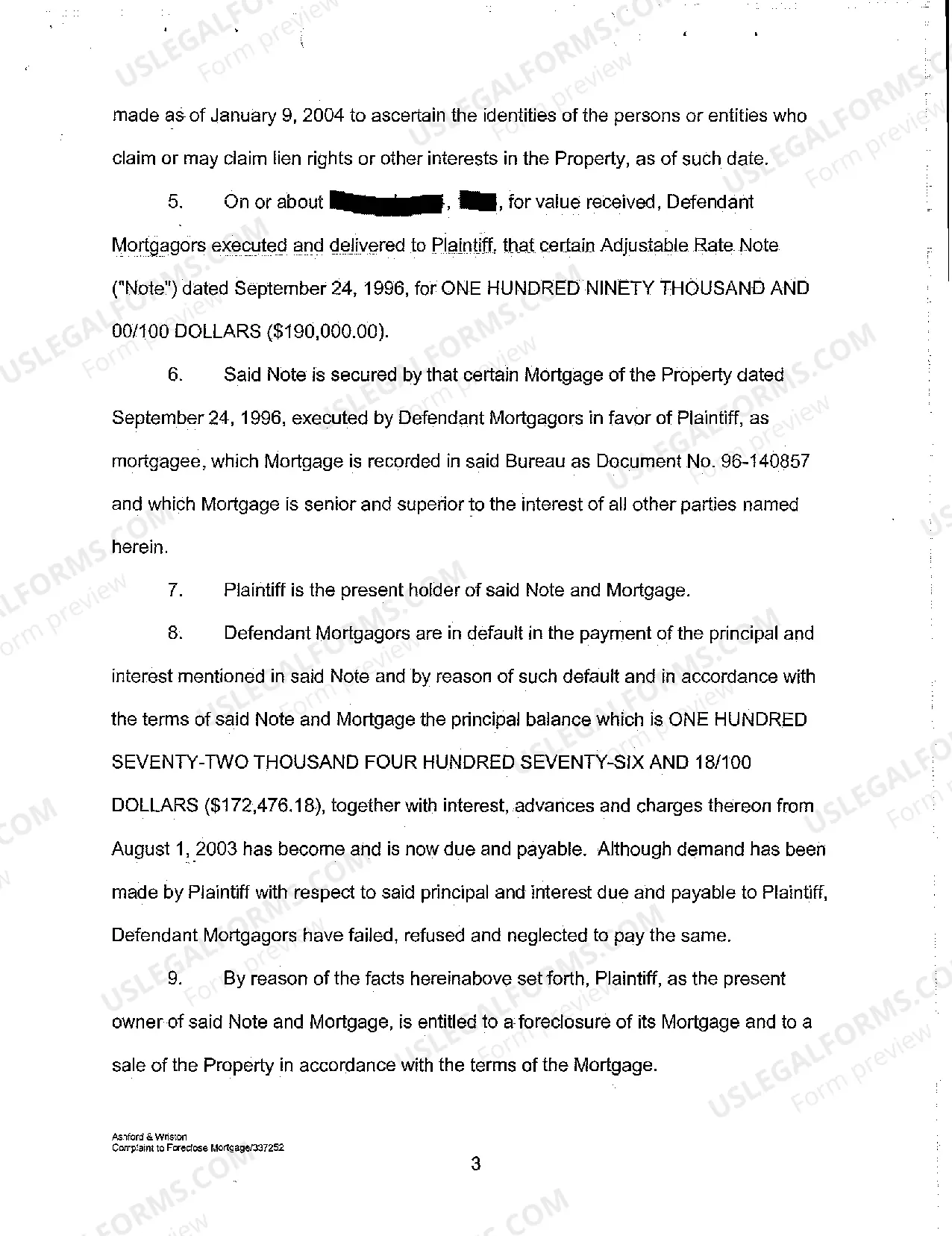

Most lenders begin the foreclosure process after three to six missed mortgage payments, depending on their specific policies. Generally, after 90 days of missed payments, a lender may consider starting legal action. Being aware of exactly how many payments can be missed before foreclosure can help you manage your finances effectively. If you receive a Hawaii Complaint to Foreclose Mortgage, swift action is crucial to mitigate the situation.

Acquiring a foreclosed home typically takes a few months to a year, depending on the auction process, any legal challenges, and local regulations. After the auction, there may be additional delays related to paperwork and ownership transfer. Understanding this timeline helps prospective buyers make informed decisions. Knowing about Hawaii Complaint to Foreclose Mortgage can provide insights on the process of buying foreclosed properties.

A complaint in mortgage foreclosure is a legal document filed by a lender to initiate foreclosure proceedings against a borrower. This document outlines the lender's case and the reasons for seeking foreclosure of the property. Responding appropriately to a complaint can significantly alter the outcome, making it crucial for a homeowner to understand its implications. If you face a Hawaii Complaint to Foreclose Mortgage, timely action is essential.

Usually, the timeframe to foreclose on a house in Hawaii can range from six months to several years, influenced by many factors like the court's calendar and the borrower's response. Factors such as a contested foreclosure or complications with documentation can extend the process. Keeping communication with your lender and understanding your rights can help manage expectations. Engaging with a Hawaii Complaint to Foreclose Mortgage opens necessary discussions on this matter.

Foreclosure in Hawaii can take six months to over a year, depending on the complexity of the case and court schedules. Delays can often occur if there are complications during the legal process or if attempts at resolution are made. Homeowners should remain patient but informed throughout this timeline. Understanding the implications of a Hawaii Complaint to Foreclose Mortgage is crucial during this period.

When you are 120 days delinquent, it means you have not made a mortgage payment for four consecutive months. At this point, your lender may begin the foreclosure process, depending on their policies. It is essential to respond proactively if you reach this stage, as options for resolution may still be available. Learning about how a Hawaii Complaint to Foreclose Mortgage affects your rights can help you navigate this challenging period.

The 120-day rule requires lenders in Hawaii to wait 120 days after a homeowner’s first missed payment before initiating foreclosure. This initiative serves to provide homeowners a chance to rectify their situation, whether through repayment or negotiating alternatives. Being informed about the 120-day rule equips you with tools to tackle potential foreclosure. Engaging in discussions about a Hawaii Complaint to Foreclose Mortgage can open pathways to solutions.

Exceptions to the 120-day foreclosure rule include situations where the property is vacant, abandoned, or involved in a real estate transaction that affects the mortgage status. Other exceptions may vary based on specific circumstances, such as bankruptcy filings or missed payments due to unforeseen hardships. Be sure to consult with experts to determine how these exceptions might apply in your case. A Hawaii Complaint to Foreclose Mortgage may be impacted by these nuances.