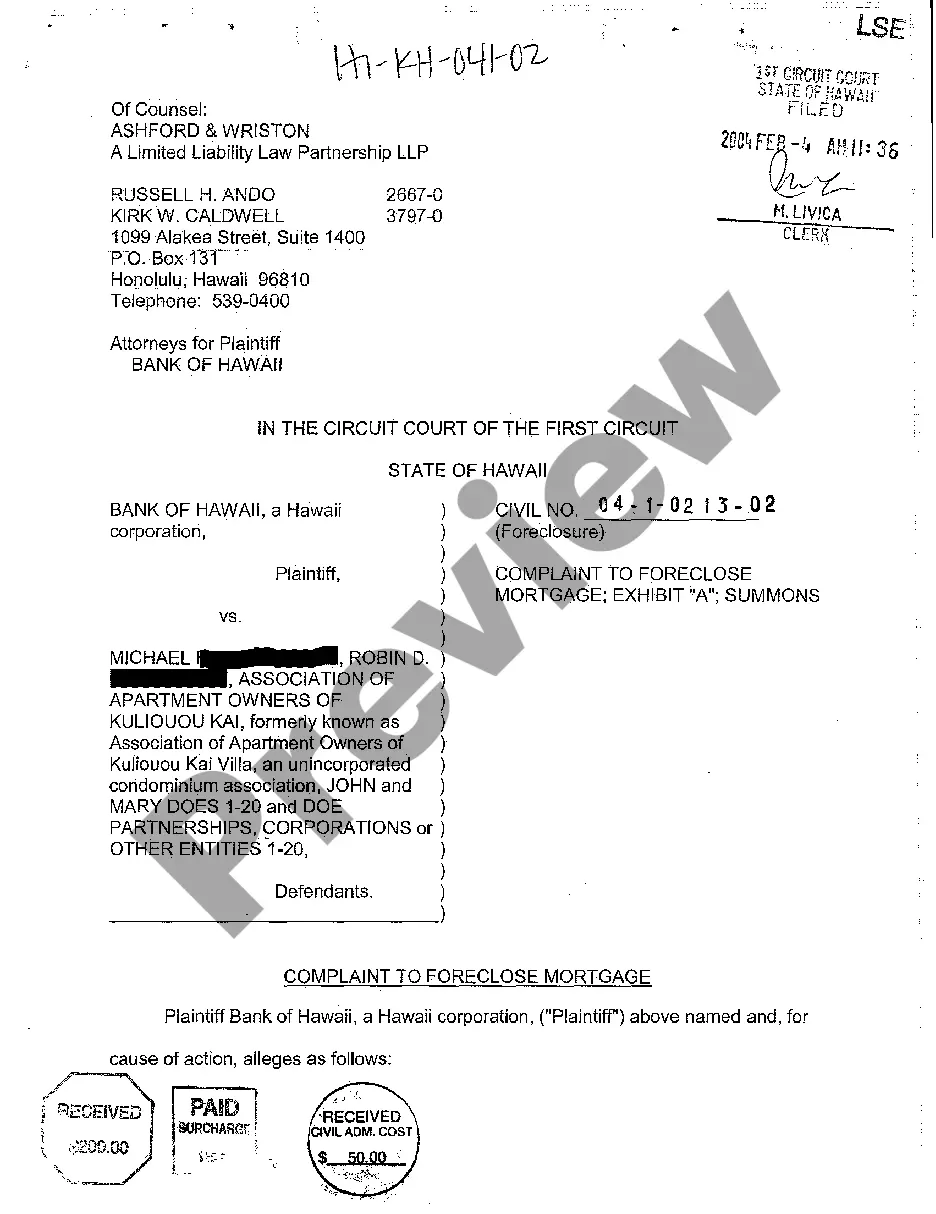

Hawaii Complaint to Foreclose Mortgage

Description

How to fill out Hawaii Complaint To Foreclose Mortgage?

Among numerous complimentary and paid examples found online, you cannot guarantee their precision.

For instance, the identity of the creators or their expertise to manage the matter you require assistance with is uncertain.

Always remain composed and utilize US Legal Forms!

Examine the document by reading the details using the Preview feature. Select Buy Now to initiate the ordering process or search for another template using the Search bar at the top. Choose a payment plan and create an account. Complete the payment using your credit/debit card or Paypal. Download the form in the desired format. After registering and completing your payment, you can use your Hawaii Complaint to Foreclose Mortgage as many times as you like, as long as it remains valid in your state. Edit it in your preferred software, fill in the necessary information, sign it, and print a physical copy. Achieve more for less with US Legal Forms!

- Obtain Hawaii Complaint to Foreclose Mortgage templates crafted by experienced attorneys.

- Avoid the costly and time-intensive process of searching for a lawyer and then compensating them to draft a document for you that you can acquire yourself.

- If you already possess a subscription, Log In to your account and locate the Download button next to the form you need.

- You will also have access to your previously saved templates in the My documents section.

- If this is your first time using our site, adhere to the steps below to obtain your Hawaii Complaint to Foreclose Mortgage swiftly.

- Ensure that the document you view is legitimate in your residing state.

Form popularity

FAQ

While the 120-day rule generally applies, there are exceptions that may allow for quicker foreclosure proceedings, particularly if the borrower fails to respond or defaults repeatedly. Additionally, specific conditions like bankruptcy filings can alter the timeline of foreclosure. It's crucial to understand these exceptions, and consulting US Legal Forms can provide clarity and necessary documentation to effectively manage your foreclosure situation.

The 120-day rule in Hawaii pertains to the timeline of foreclosure proceedings. Specifically, the rule requires that a lender must file the foreclosure complaint within 120 days after the notice of default. This rule is designed to give borrowers time to address their situation and potentially work out solutions. Staying informed about such timelines is essential when dealing with a Hawaii Complaint to Foreclose Mortgage.

To file an Answer to a foreclosure complaint, you must prepare your response and file it with the court where the original complaint was lodged. Typically, you will outline your defenses and any claims you have against the lender. If you feel overwhelmed, consider relying on the resources available through US Legal Forms to help you navigate the process and ensure accuracy.

Responding to a foreclosure motion involves filing your own documents with the court within the time limit set by the court notice. You should address every point raised by the lender while providing any defenses or counterclaims. Again, using US Legal Forms can help you craft a comprehensive and well-organized response to protect your rights.

To overturn a foreclosure, you will likely need to file a motion with the court, arguing that the foreclosure was improper or unlawful. Providing evidence, such as proof that you are current on payments or that the lender did not follow proper procedures, is crucial for your case. Seeking assistance from US Legal Forms can provide you with the necessary legal documents and guidance to effectively present your argument.

Disputing a foreclosure on your credit report involves contacting the credit reporting agencies to report inaccuracies. Provide documentation, including your Hawaii Complaint to Foreclose Mortgage, to support your case. The agencies are required to investigate your claim, usually within 30 days. Utilize resources like US Legal Forms to ensure you follow the correct procedures.

To file an Answer to a foreclosure complaint in Hawaii, you must respond to the allegations in the complaint within the specified time. Typically, you would submit your Answer to the court where the case is filed. This response should clearly state your position on the mortgage and address any defenses you may have. If you are unsure how to proceed, consider using the services offered by US Legal Forms to streamline the process.

Typically, in Hawaii, a homeowner may face a foreclosure after missing three mortgage payments. However, the lender might initiate a Hawaii Complaint to Foreclose Mortgage even earlier depending on the lender’s policies. It's important to reach out to your lender as soon as you foresee challenges in making payments. Staying proactive can often lead to options that may prevent foreclosure.

The six phases of a Hawaii Complaint to Foreclose Mortgage include the pre-foreclosure phase, where the lender sends a notice of default, and the foreclosure filing phase, where the lender officially files the complaint. Next, there is the court process, where the borrower can respond. Afterward, the court issues a judgment, allowing the lender to sell the property. Following this, the auction takes place, and finally, there's the post-foreclosure phase, where the new owner takes possession. Understanding these phases can help you navigate the process more effectively.

A complaint in foreclosure is a legal document filed by a lender to begin the foreclosure process. This document outlines the mortgage details and asserts the lender's right to reclaim the property due to payment defaults. If you've received a Hawaii Complaint to Foreclose Mortgage, it’s important to understand the implications of this document and consider legal counsel.