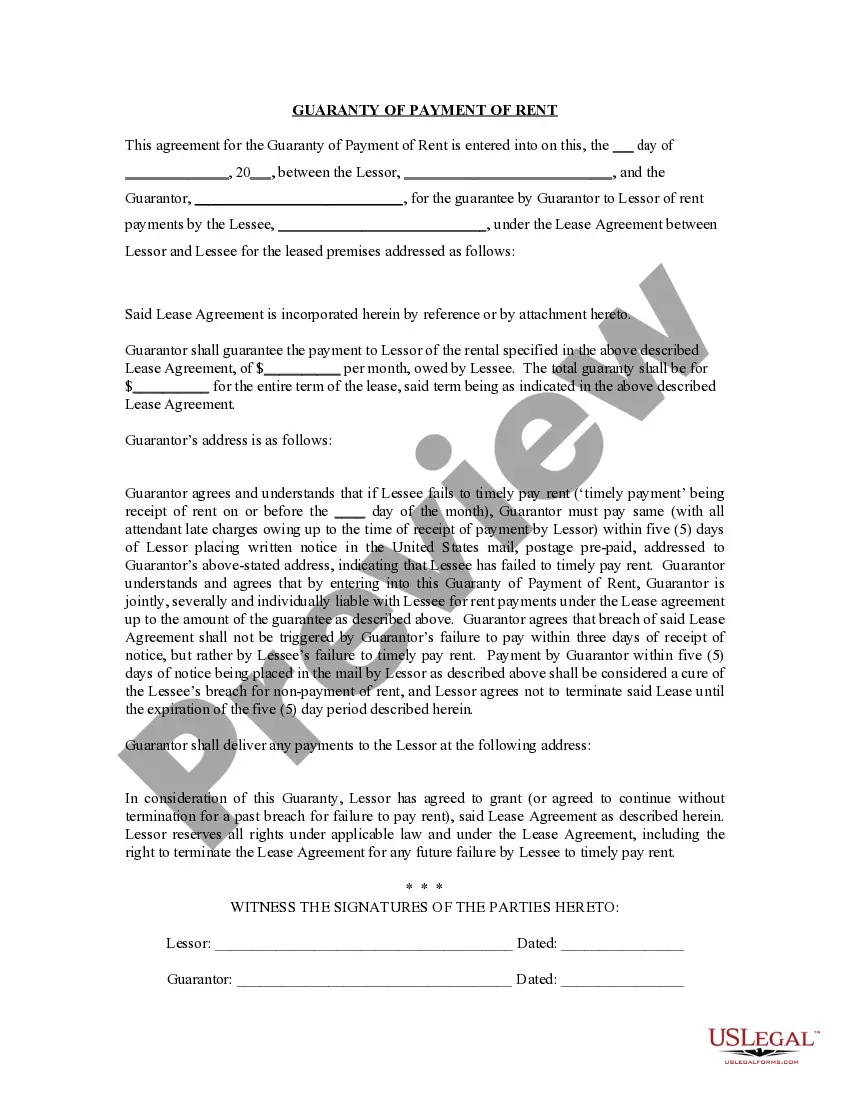

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Agreement to Modify Promissory Note and Mortgage to Extend Maturity Date

Description

Key Concepts & Definitions

Agreement to Modify Promissory Note and Mortgage: A legal document that amends the terms of an existing promissory note and mortgage, typically modifying elements such as the interest rate, payment schedule, or other conditions agreed upon by the lender and borrower.Promissory Note: A financial instrument in which one party promises in writing to pay a determinate sum of money to the other, either at a fixed or determinable future time or on demand of the payee, under specific terms.Real Estate: Property consisting of land or buildings.Intellectual Property: A category of property that includes intangible creations of the human intellect.

Step-by-Step Guide to Modifying a Promissory Note and Mortgage

- Review the Original Agreement: Understand the current terms of your promissory note and mortgage.

- Consult a Financial Advisor: Discuss your financial situation and the feasibility of a modification.

- Negotiate with the Lender: Initiate discussions with your lender to find agreeable terms for both parties.

- Legal Review: Have a legal expert review the modification agreement before signing to ensure all new terms are clear and legally binding.

- Sign the Modification Agreement: Both parties must sign the modified agreement to make it legally effective.

- Register the Changes: Depending on local laws, register the modified agreement with relevant authorities to ensure its enforceability.

Risk Analysis

Modifying a promissory note and mortgage involves several risks such as legal risks due to non-compliance with documentation or filing requirements,financial risks associated with altered repayment terms potentially leading to higher overall costs, and credit risks if the modification is not properly reported to credit bureaus, potentially affecting credit ratings. Proper legal guidance and thorough documentation can mitigate most of these risks.

How to fill out Agreement To Modify Promissory Note And Mortgage To Extend Maturity Date?

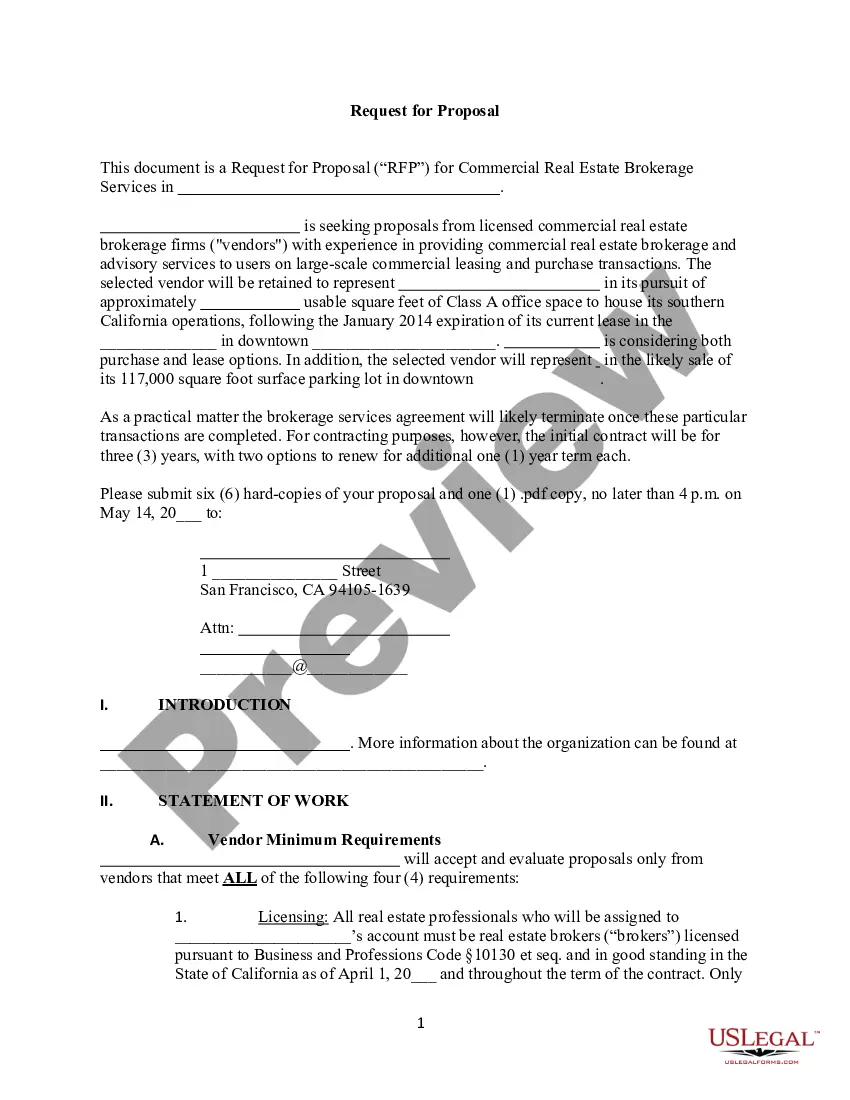

Aren't you tired of choosing from countless samples each time you want to create a Agreement to Modify Promissory Note and Mortgage to Extend Maturity Date? US Legal Forms eliminates the wasted time an incredible number of American people spend surfing around the internet for suitable tax and legal forms. Our expert group of lawyers is constantly upgrading the state-specific Forms collection, so it always provides the proper files for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Users who don't have a subscription should complete simple steps before being able to get access to their Agreement to Modify Promissory Note and Mortgage to Extend Maturity Date:

- Make use of the Preview function and look at the form description (if available) to make certain that it’s the proper document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the proper example to your state and situation.

- Utilize the Search field at the top of the web page if you want to look for another file.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your template in a convenient format to finish, create a hard copy, and sign the document.

As soon as you’ve followed the step-by-step recommendations above, you'll always be capable of sign in and download whatever document you will need for whatever state you want it in. With US Legal Forms, finishing Agreement to Modify Promissory Note and Mortgage to Extend Maturity Date samples or any other official documents is simple. Get started now, and don't forget to look at the samples with accredited lawyers!

Form popularity

FAQ

In the unlikely event a borrower defaults on a promissory note, it is the lender's responsibility to execute the collection action necessary to claim the item(s) used as collateral. These actions may include: Foreclosure (for real estate investments) Repossession.

The Promissory Note is hereby modified and amended by deleting the last sentence of the first paragraph of the Promissory Note in its entirety, and replacing it with the following: All outstanding principal and interest shall be due and payable on June 3, 2012 (the Due Date).

The Loan shall be evidenced and governed by a new promissory note (the New Note) which amends and restates in its entirety, but does not extinguish, the Note. Anything to the contrary notwithstanding, if any inconsistency exists between the Loan Agreement and the New Note, the New Note shall control.

Identify the terms of the note that are creating difficulty in repayment. Communicate your need to modify the terms of the note to the note holder. Have the holder of the note draft modifications to the original note. Tip.

A loan extension agreement allows the maturity date to be extended on a current note. The agreement amends the current loan along with any other terms that agreed-upon by the lender and borrower.

Loan modification is better for the lenderLoan modification isn't the same as refinancing, which helps you get a better interest rate if you have a good enough credit score. Instead, loan modification tends to be the best option for a homeowner whose credit is bad and can't refinance the loan.

Under this option, you reach an agreement between you and your mortgage company to change the original terms of your mortgagesuch as payment amount, length of loan, interest rate, etc. In most cases, when your mortgage is modified, you can reduce your monthly payment to a more affordable amount.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

A loan modification can improve your terms and save you money without the cost and hassle of a refinance. Unlike a full refinance, a loan modification is not a new note, nor is it a replacement of your original note. It is simply an addendum to the original document, changing the terms as agreed.