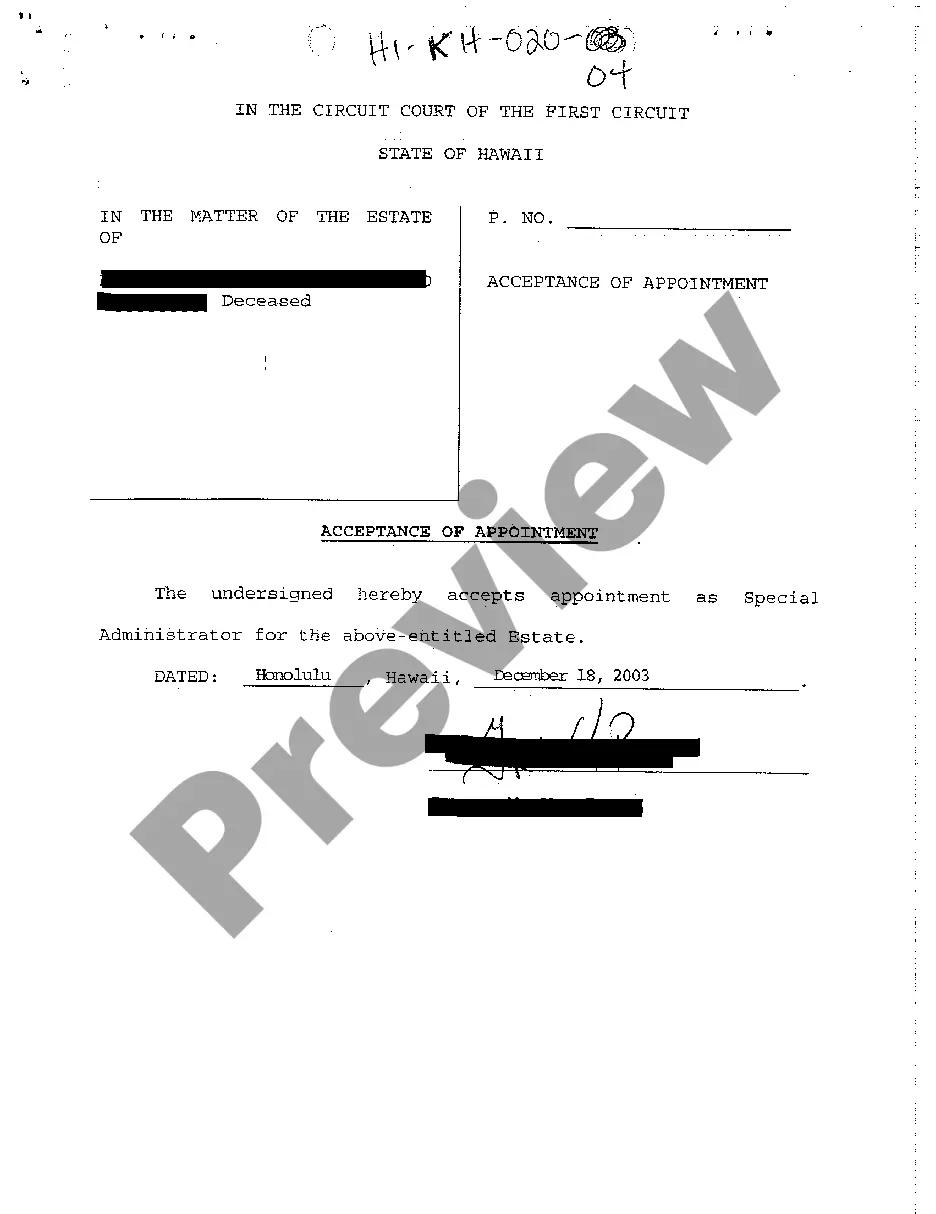

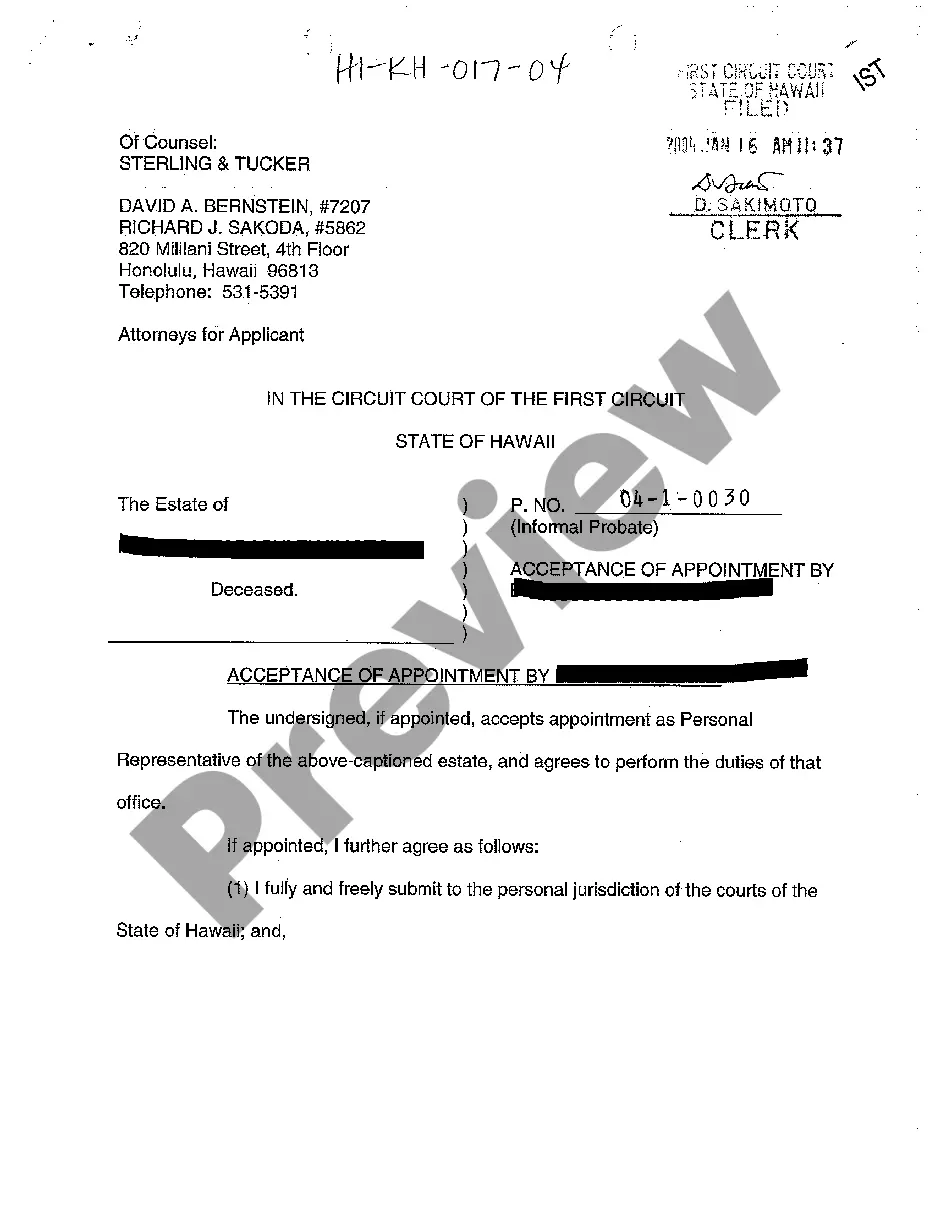

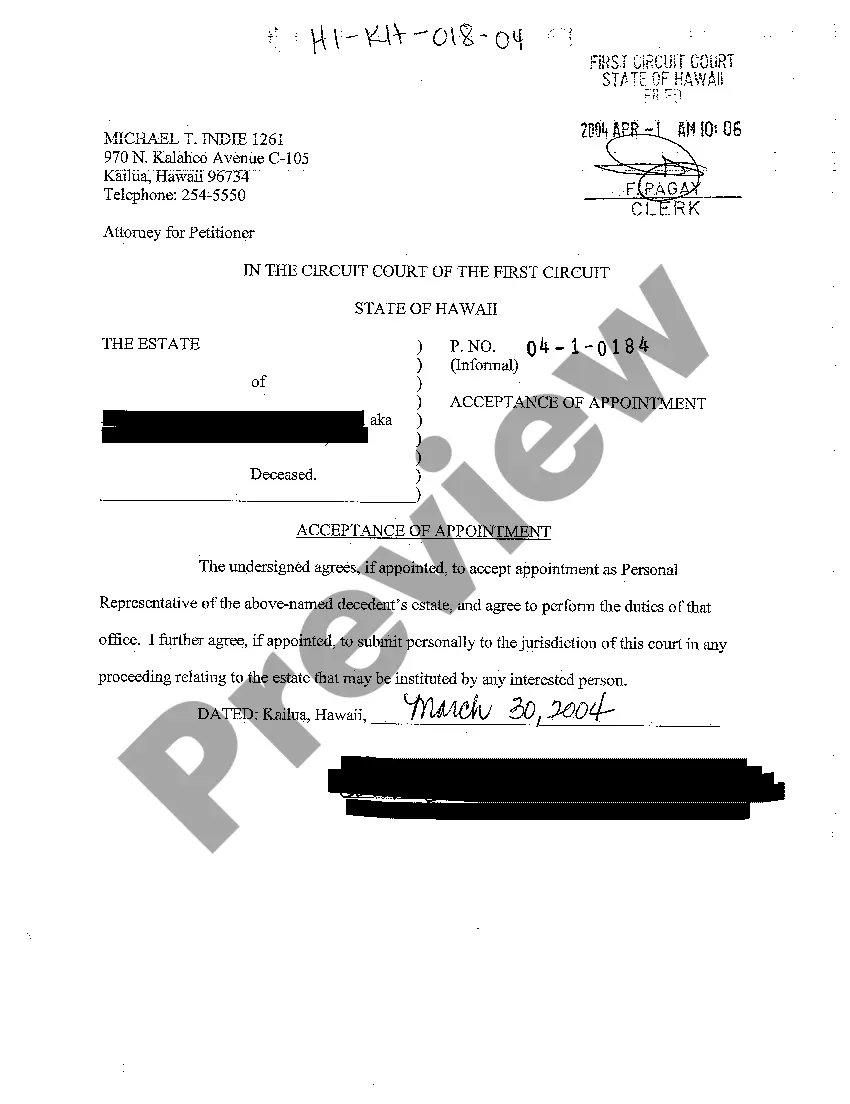

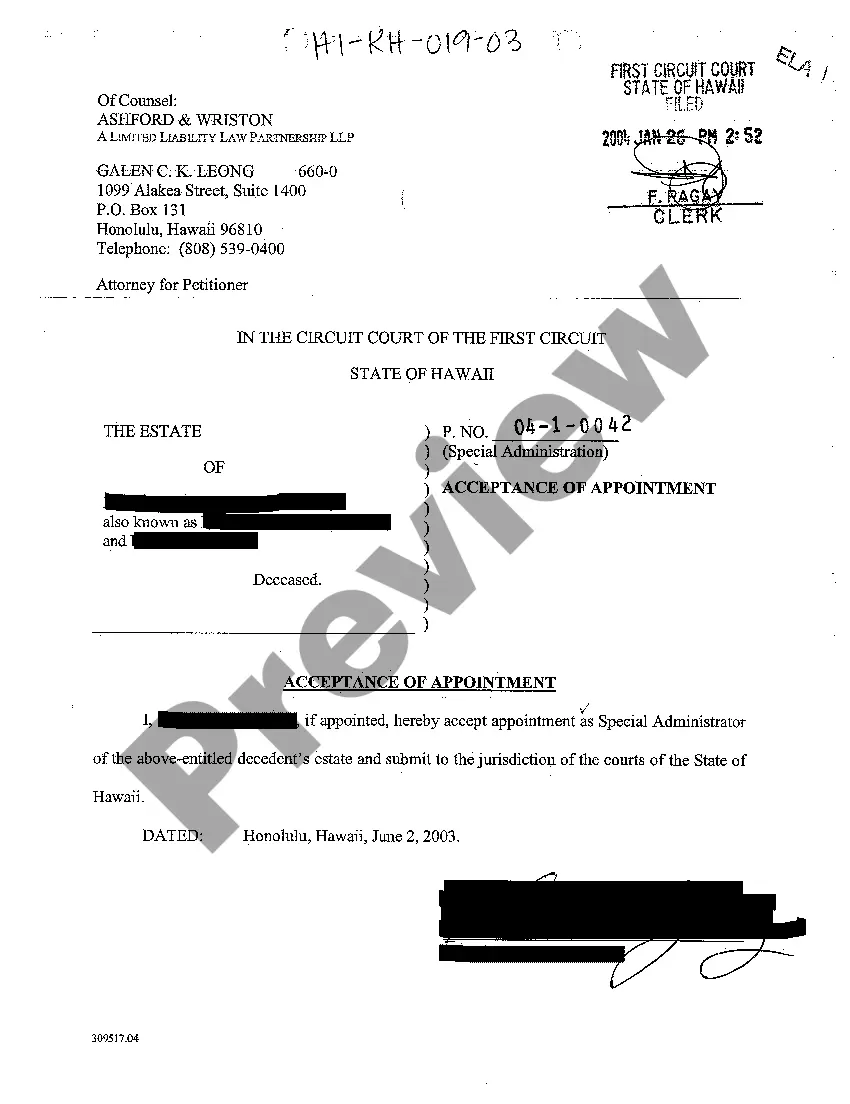

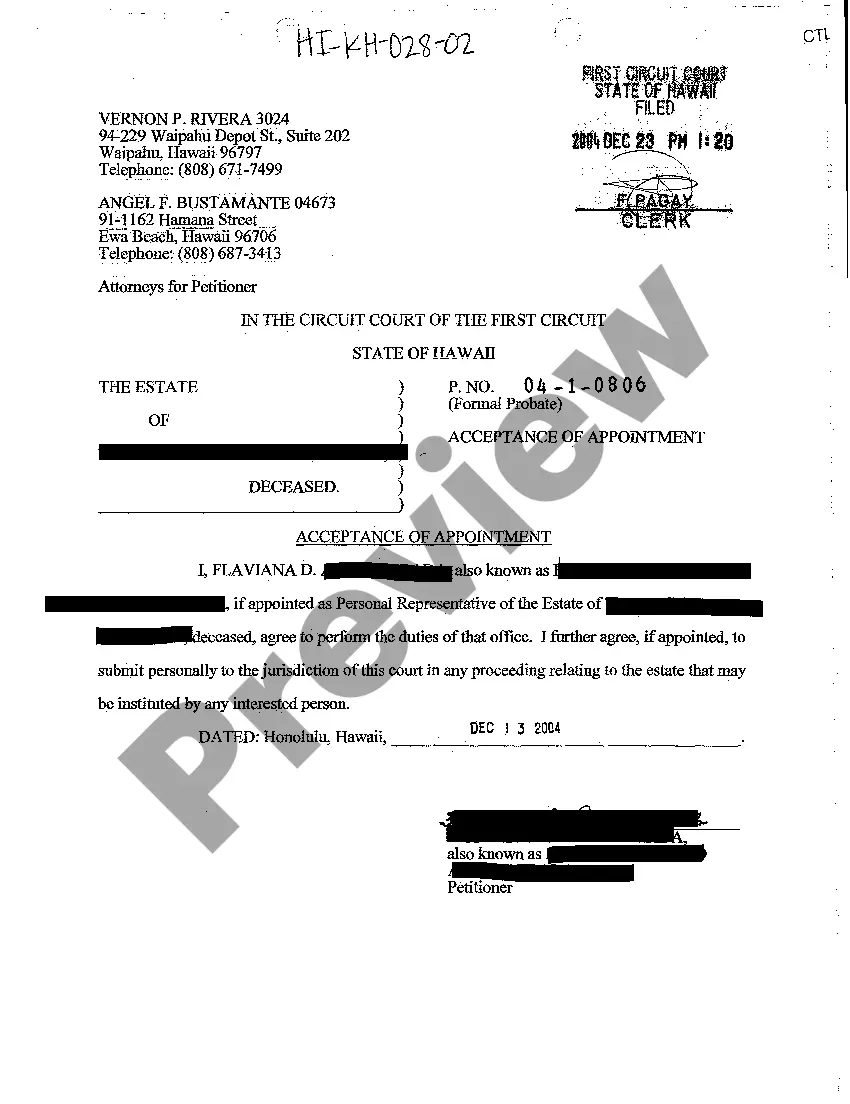

Hawaii Acceptance of Appointment as Special Administrator

Description

How to fill out Hawaii Acceptance Of Appointment As Special Administrator?

Among the multitude of complimentary and paid instances available online, you cannot guarantee their trustworthiness.

For instance, who authored them or whether they possess sufficient qualifications to handle what you need from them.

Stay composed and make use of US Legal Forms!

Inspect the template by reviewing the information utilizing the Preview function. Press Buy Now to initiate the ordering process, or search for an alternative sample using the Search field at the top. Select a pricing plan and set up an account. Remit payment for the subscription using your credit/debit card or Paypal. Download the form in the necessary file format. Once you have registered and paid for your subscription, you can use your Hawaii Acceptance of Appointment as Special Administrator as frequently as you require or for however long it remains valid in your locality. Revise it with your preferred editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- Uncover Hawaii Acceptance of Appointment as Special Administrator templates crafted by experienced legal professionals.

- Steer clear of the expensive and lengthy task of seeking an attorney and subsequently compensating them to draft a document that you can easily retrieve yourself.

- If you currently hold a subscription, Log In to your profile and locate the Download button next to the file you’re trying to find.

- You will also be able to reach your previously stored documents in the My documents section.

- If you are using our site for the first time, adhere to the instructions below to obtain your Hawaii Acceptance of Appointment as Special Administrator promptly.

- Ensure that the document you discover is applicable in the jurisdiction where you reside.

Form popularity

FAQ

In Hawaii, an estate generally must exceed a specific value to require probate. This value can vary, so it's advisable to verify the current threshold with local resources. If the estate's value exceeds this amount, initiating the Hawaii Acceptance of Appointment as Special Administrator can help streamline the management and distribution of assets during this vital process.

To file a will in Hawaii, the executor must first submit the will to the appropriate circuit court in the county where the deceased lived. This process includes completing specific forms and possibly scheduling a hearing. Engaging with resources like US Legal Forms can be beneficial for understanding requirements like the Hawaii Acceptance of Appointment as Special Administrator, ensuring you meet all legal obligations.

The minimum estate value for probate in Hawaii is currently set at a threshold that can change over time. If the value of the decedent's assets exceeds this limit, the probate process is generally required. Should you find yourself in this situation, navigating the complexities of the Hawaii Acceptance of Appointment as Special Administrator will help ensure that the estate is handled according to legal guidelines.

Yes, in Hawaii, there is a minimum estate size that dictates whether probate shall be required. If the total value of the estate is below a certain threshold, the estate may not need to go through the probate process. However, when probate is needed, the Hawaii Acceptance of Appointment as Special Administrator can facilitate the management and distribution of the estate's assets efficiently.

In Hawaii, probate typically begins when a person passes away leaving assets that need to be distributed according to their will, or according to state law if there is no will. Events that can trigger this process include the existence of real estate, financial accounts, or personal property exceeding a certain value. It's crucial to understand that the Hawaii Acceptance of Appointment as Special Administrator may be necessary for managing these assets during probate.

Rule 50 in Hawaii probate deals with the filing of inventories and accounts by personal representatives. This rule mandates that representatives report on the status of the estate's assets and liabilities at specified intervals. Following Rule 50 is vital for maintaining transparency and accountability in estate management, especially during the Hawaii Acceptance of Appointment as Special Administrator process. Staying compliant with these requirements is beneficial for all parties involved.

The probate threshold in Hawaii establishes the value of a decedent's estate that requires formal probate proceedings. If an estate's value falls below this threshold, it may be eligible for simplified procedures. Knowing this threshold is critical when deciding whether to pursue the Hawaii Acceptance of Appointment as Special Administrator. It can save time and resources by determining the best course of action for estate administration.

Rule 42 in Hawaii probate relates to the appointment and powers of personal representatives. This rule clarifies the authority granted to those managing the decedent's estate and details the responsibilities required for proper estate administration. Understanding Rule 42 is important for those involved in Hawaii Acceptance of Appointment as Special Administrator, as it sets the groundwork for how estate matters are handled in court.

To obtain letters of testamentary in Hawaii, you must file a petition for probate with the court after the death of the decedent. The court reviews the will to confirm its validity, and upon approval, it issues letters that grant authority to the appointed personal representative. This process is a key step in the Hawaii Acceptance of Appointment as Special Administrator, as it is essential for managing the estate legally. Using platforms like US Legal Forms can streamline this process.

A special administrator is a temporary fiduciary appointed by the court to manage a decedent's estate when immediate action is needed. This role is essential in situations where delay could harm the estate's value or administration process. The special administrator handles specific tasks, such as securing assets and paying necessary expenses, while awaiting the appointment of a permanent representative. This position is vital in the context of Hawaii Acceptance of Appointment as Special Administrator.