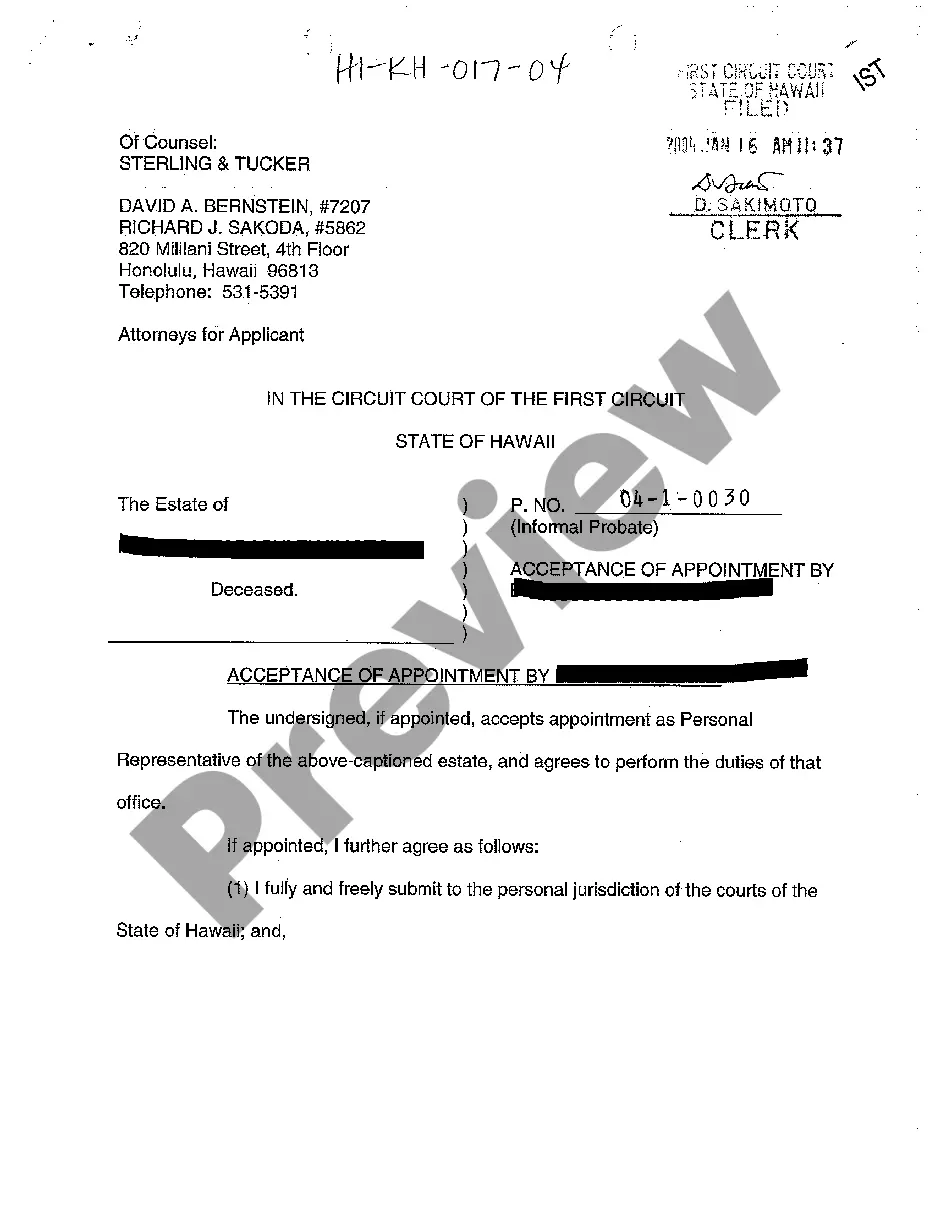

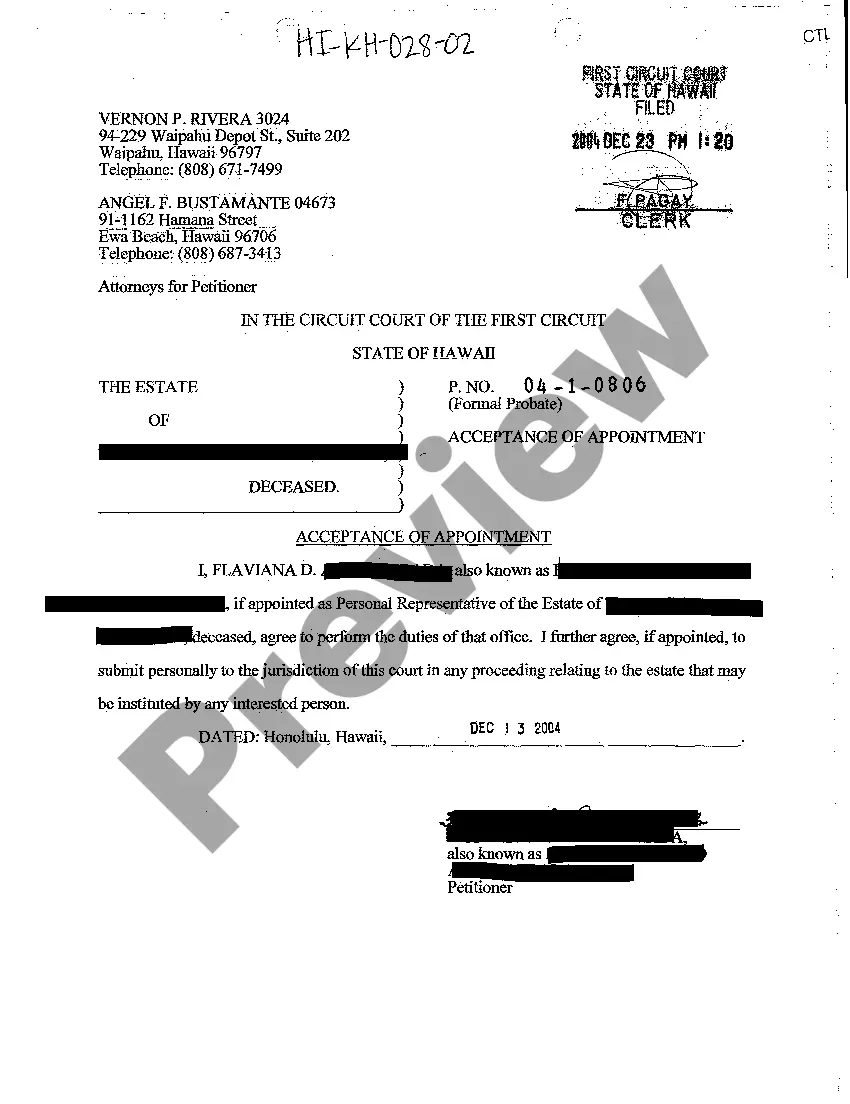

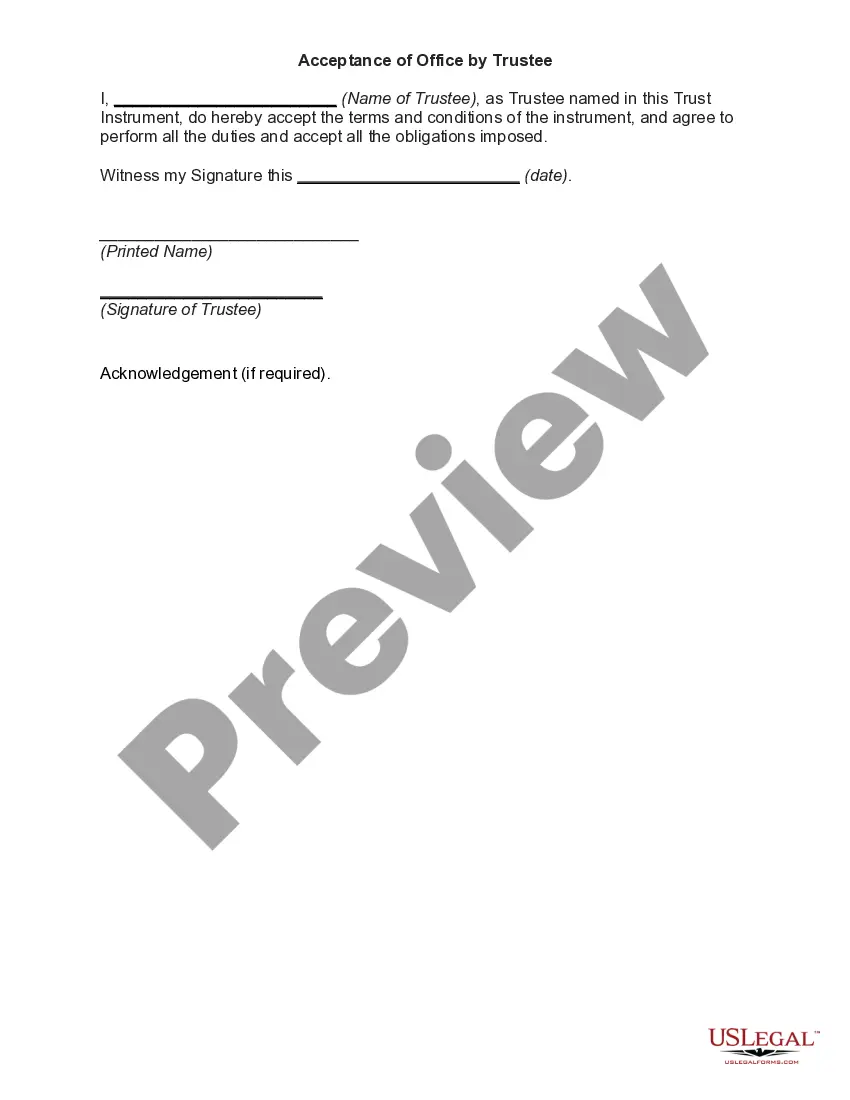

Hawaii Acceptance of Appointment of Personal Representative

Description

How to fill out Hawaii Acceptance Of Appointment Of Personal Representative?

Amidst numerous complimentary and premium templates readily available online, you cannot guarantee their dependability.

For instance, who established them or if they possess the necessary skills to manage your requirements effectively.

Always remain calm and utilize US Legal Forms! Acquire Hawaii Acceptance of Appointment of Personal Representative templates crafted by seasoned attorneys and avoid the expensive and protracted task of seeking an attorney and subsequently paying them to draft a document for you that you can conveniently find yourself.

Once you have registered and purchased your subscription, you can use your Hawaii Acceptance of Appointment of Personal Representative as frequently as needed or while it remains valid in your location. Modify it in your preferred offline or online editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- If you possess an existing subscription, Log In to your account and locate the Download button adjacent to the document you are searching for.

- You will also have access to all your previously downloaded documents in the My documents section.

- If you are accessing our platform for the first time, adhere to the instructions outlined below to obtain your Hawaii Acceptance of Appointment of Personal Representative effortlessly.

- Ensure that the document you discover is applicable in the state of your residence.

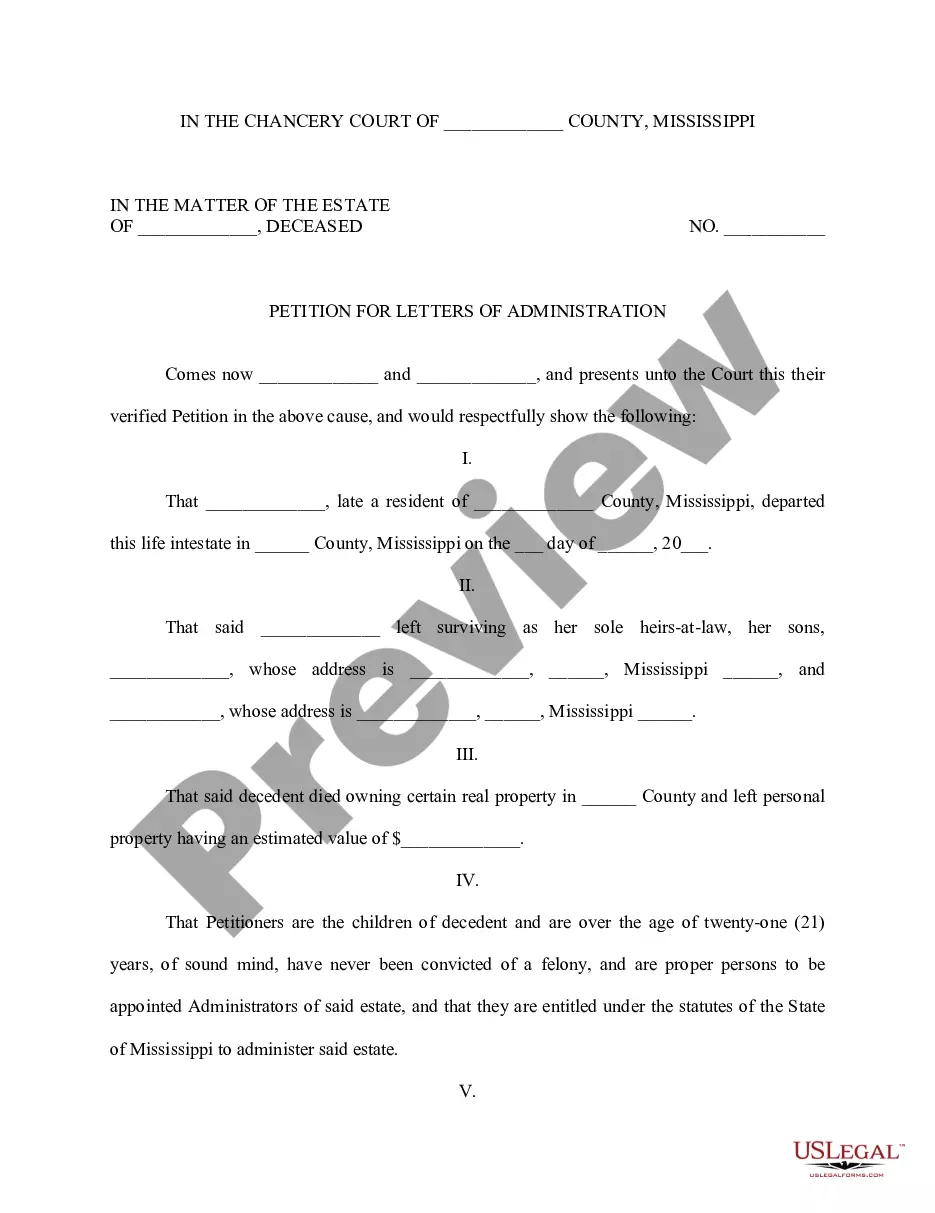

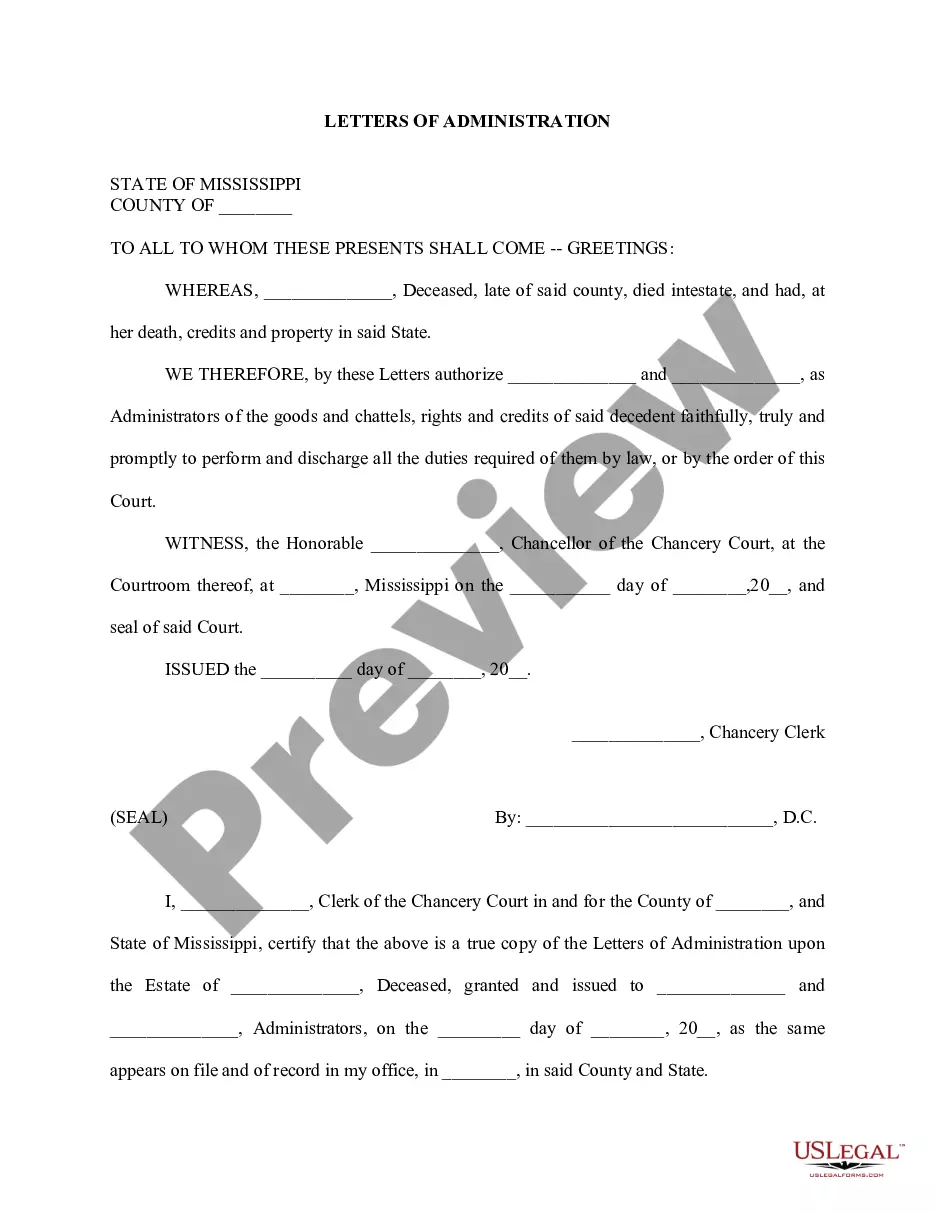

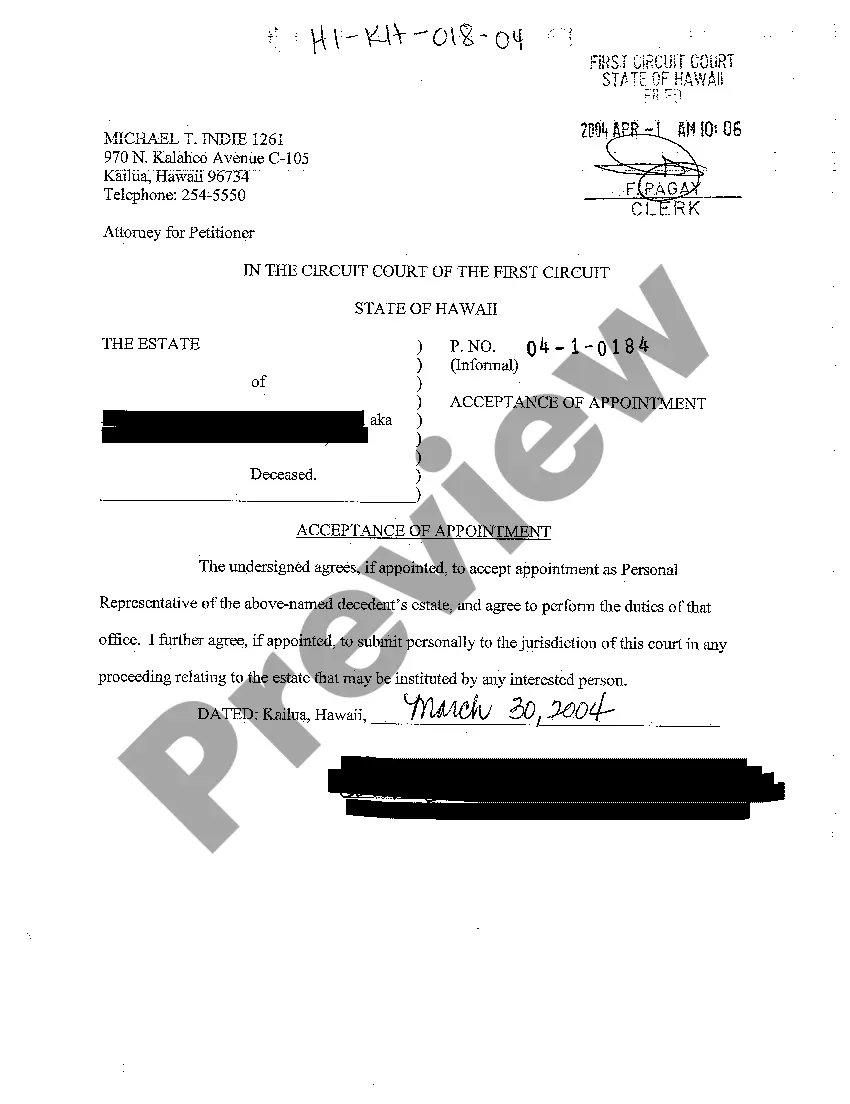

- Examine the template by reviewing the information provided with the Preview function.

- Click Buy Now to initiate the order process or search for another example using the Search bar located in the header.

- Select a pricing plan and register for an account.

- Submit payment for the subscription using your credit/debit card or Paypal.

- Download the document in your desired format.

Form popularity

FAQ

If there is no appointed personal representative, the probate court can appoint an administrator. This process involves filing a petition to the court, which will review the circumstances and select an appropriate individual. It is essential to address this quickly to ensure the estate is properly managed. To navigate this situation, consider using resources that cover the Hawaii Acceptance of Appointment of Personal Representative to find the best solutions.

To secure a personal representative letter, you must initiate probate proceedings in your local court. After filing the necessary legal documents, the court will assess your request. If granted, the letter allows you to administer the estate. For those navigating this process, uslegalforms simplifies obtaining the Hawaii Acceptance of Appointment of Personal Representative forms.

A personal representative and a Power of Attorney (POA) serve different roles. The personal representative deals with the administration of an estate after someone's passing, while a POA is appointed to manage someone else's affairs while they are alive. Understanding these distinctions is crucial in estate planning. If you need assistance, exploring forms regarding the Hawaii Acceptance of Appointment of Personal Representative can be beneficial.

To obtain a letter of personal representative in Hawaii, you must file a petition with the probate court. This petition usually requires details about the deceased and the proposed personal representative. Once accepted by the court, they will issue this letter, confirming your authority. For a seamless experience, consider using uslegalforms, which provides templates tailored for Hawaii Acceptance of Appointment of Personal Representative.

To prove you are the executor of an estate, you will typically need a document called Letters Testamentary. This document is issued by a probate court after the will is validated. It officially confirms your authority to act on behalf of the estate. Utilizing the Hawaii Acceptance of Appointment of Personal Representative documents can simplify this process.

The time it takes to be appointed as a personal representative can vary, but typically it can take several weeks when using the Hawaii Acceptance of Appointment of Personal Representative process. Following the application submission, the court will review the documents and schedule a hearing if necessary. By preparing the required paperwork correctly and promptly, you can help speed up the appointment process and ensure a smoother administration of the estate.

Personal representative paperwork includes all the documents required to establish authority in managing an estate, including the Hawaii Acceptance of Appointment of Personal Representative form. These documents outline the personal representative's duties, such as settling debts, distributing assets, and addressing tax obligations. It is crucial for the personal representative to ensure that all forms are filled out accurately and filed promptly to prevent delays in the probate process.

The signature of a personal representative signifies their agreement to act on behalf of an estate in accordance with the Hawaii Acceptance of Appointment of Personal Representative. This formal act ensures that the personal representative has accepted their responsibilities and obligations related to the management and distribution of the deceased's assets. By signing, they affirm their commitment to follow the laws governing estate administration in Hawaii.

To become a court-appointed personal representative in Hawaii, you must first file a petition with the probate court. This process involves submitting necessary documents, which may include the deceased's will and a formal request for appointment. After the court reviews your petition, a hearing will be scheduled to ensure that the appointment aligns with Hawaii's Acceptance of Appointment of Personal Representative. Once approved, you will receive official documentation, allowing you to manage the estate according to legal requirements.

The terms 'executor' and 'personal representative' are often used interchangeably, but there are distinctions. An executor is typically named in a will, while a personal representative may be appointed if there is no will. Understanding these differences is crucial for effectively managing estate responsibilities. The Hawaii Acceptance of Appointment of Personal Representative can clarify these roles further for anyone involved in estate management.