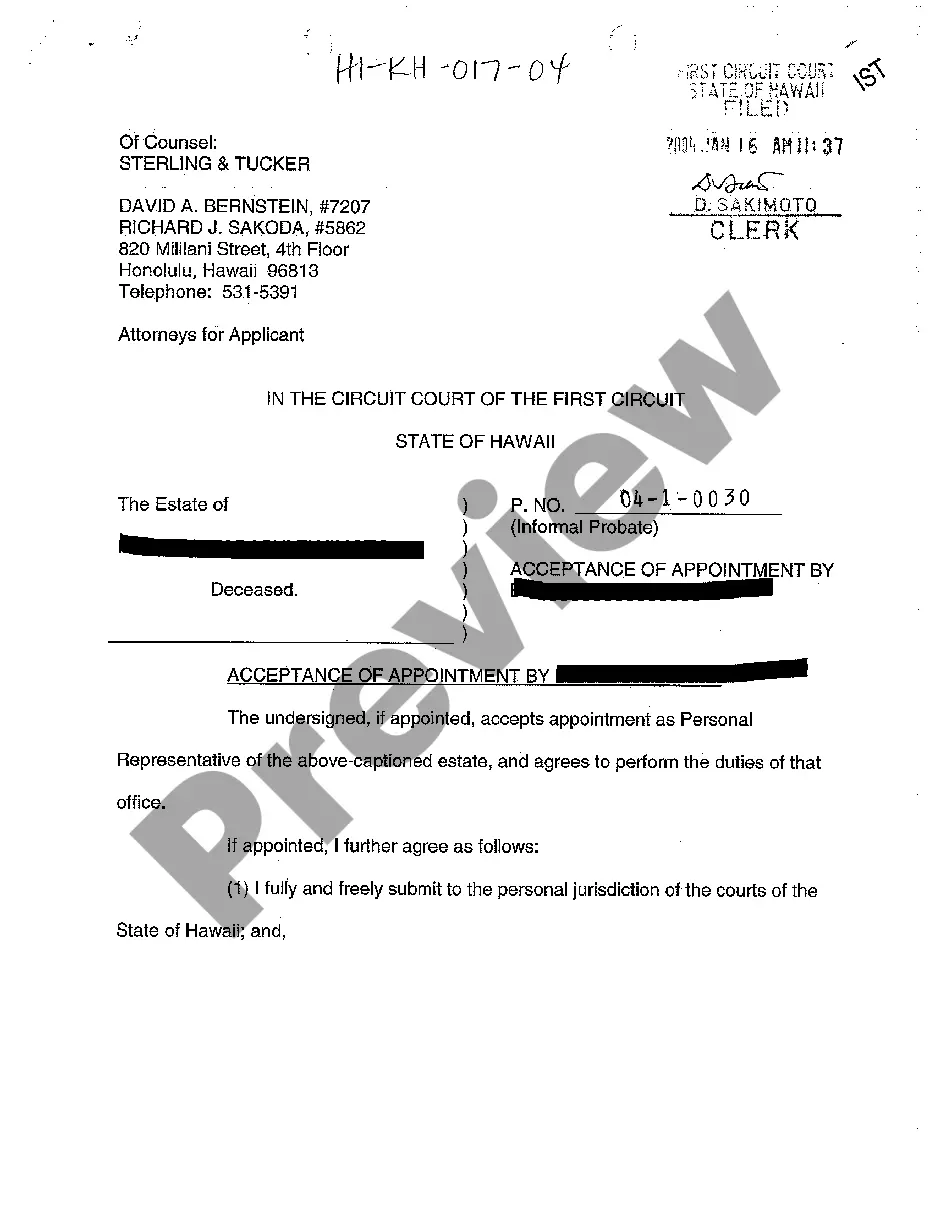

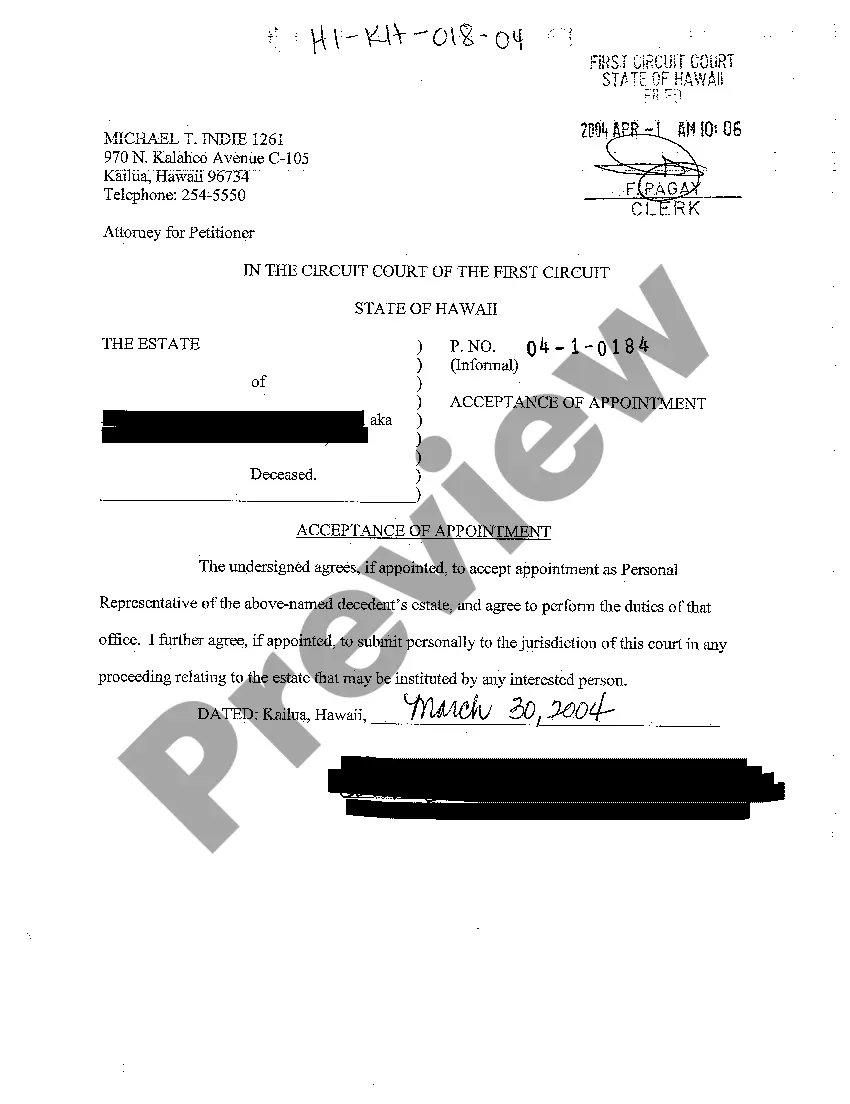

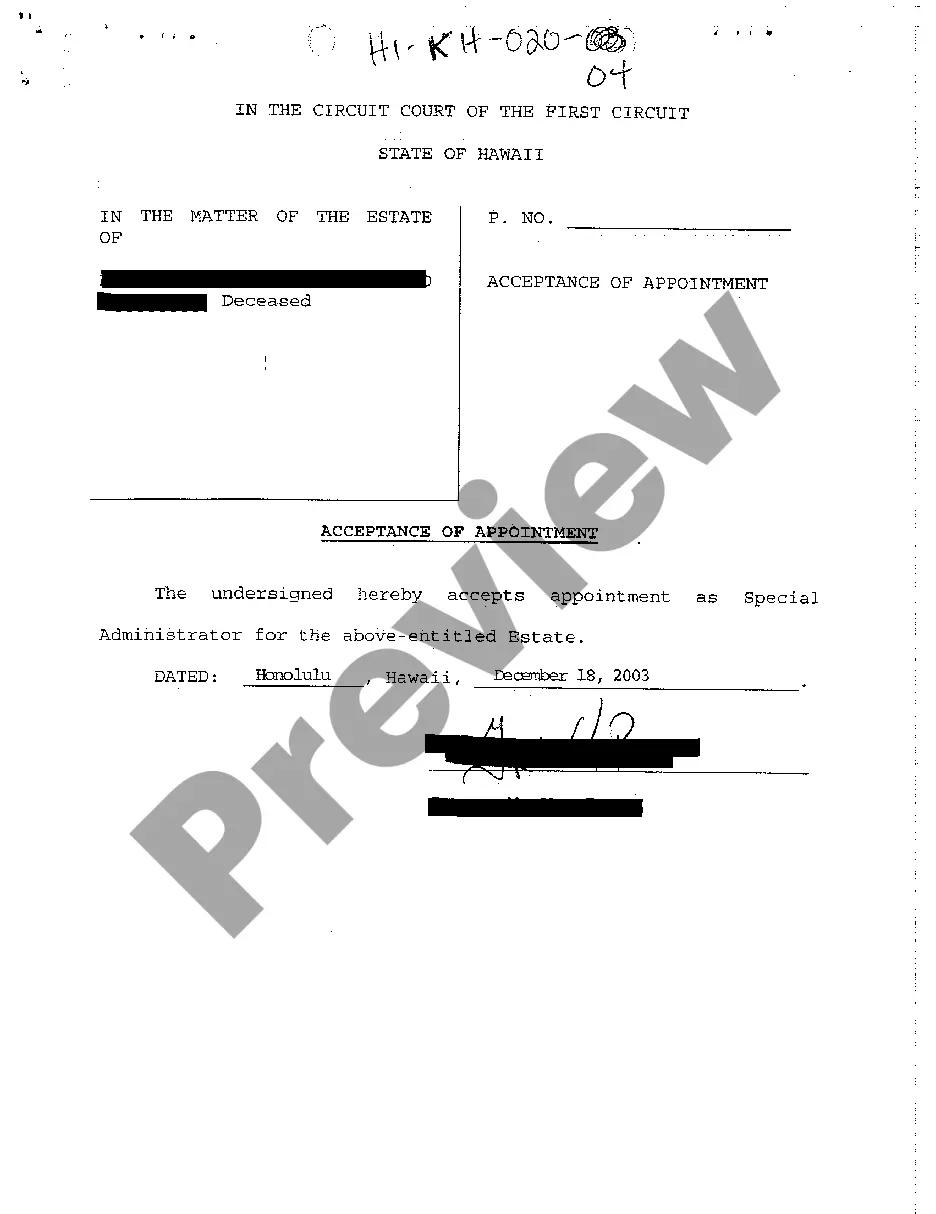

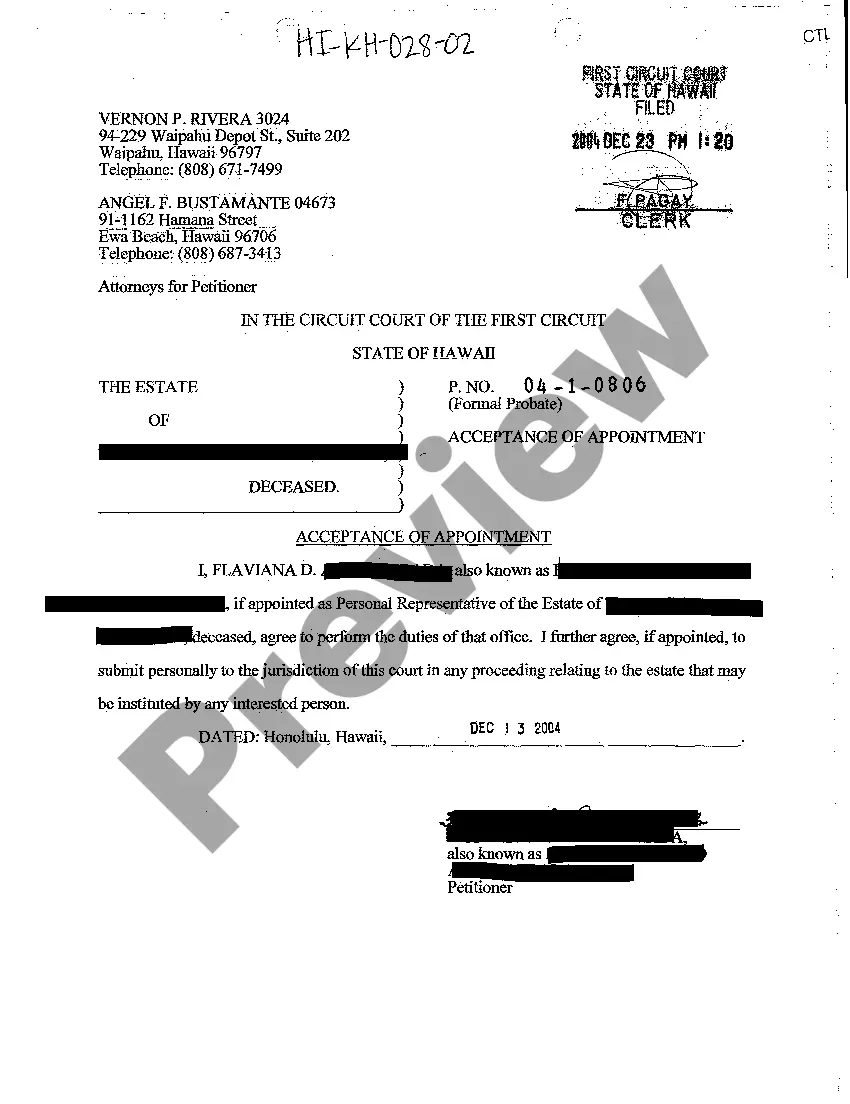

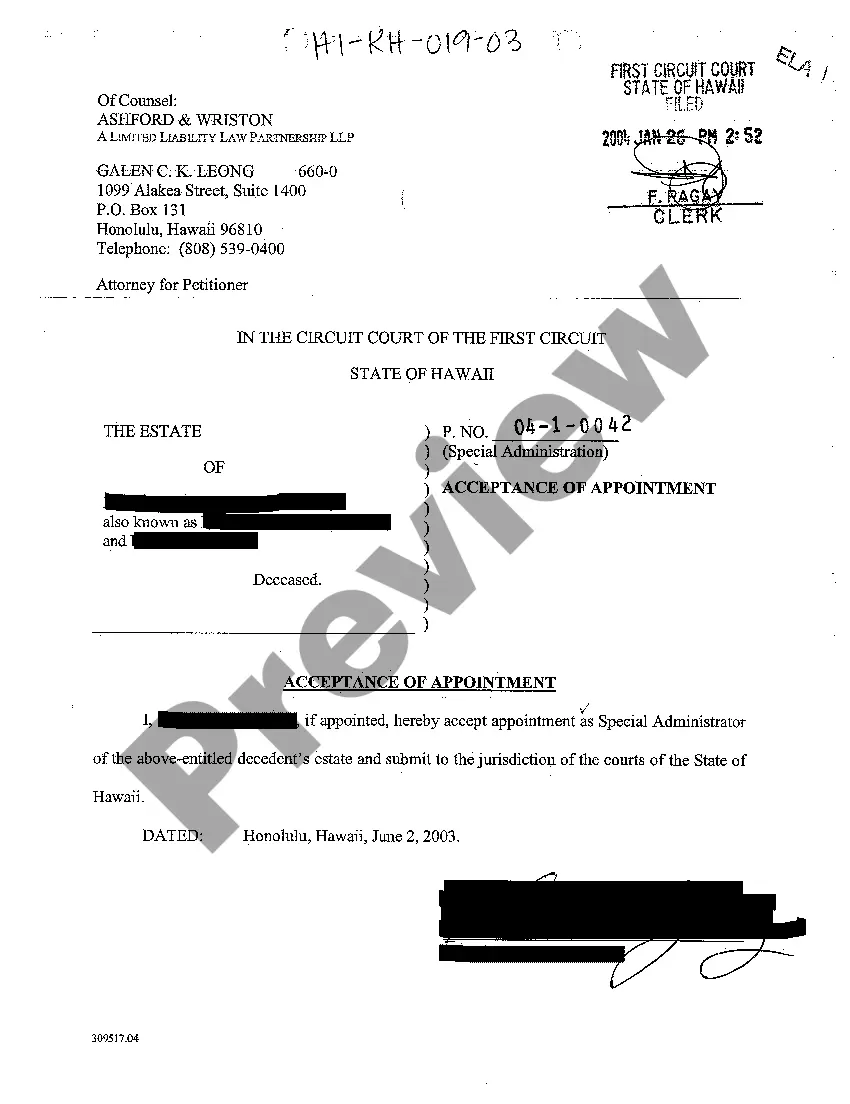

Hawaii Acceptance of Appointment of Special Administrator

Description

How to fill out Hawaii Acceptance Of Appointment Of Special Administrator?

Amid numerous paid and complimentary instances available online, you cannot guarantee their trustworthiness.

For instance, who developed them or whether they possess the necessary qualifications to address your specific needs.

Always stay calm and utilize US Legal Forms!

Ensure the document you view is applicable in your state. Examine the template by perusing the description using the Preview feature. Click Buy Now to initiate the ordering process or search for another template using the Search bar in the header. Choose a pricing plan and register for an account. Complete the payment using your credit/debit card or PayPal. Download the document in your chosen file format. Once you’ve registered and paid for your subscription, you can utilize your Hawaii Acceptance of Appointment of Special Administrator as frequently as necessary or for as long as it remains valid in your state. Modify it in your preferred editor, complete it, sign it, and print a hard copy. Achieve more for less with US Legal Forms!

- Locate Hawaii Acceptance of Appointment of Special Administrator templates created by skilled attorneys.

- Steer clear of the expensive and time-consuming process of searching for a lawyer.

- And subsequently paying them to draft a document that you can easily obtain yourself.

- If you already have a membership, Log In to your account and look for the Download button alongside the document you want.

- You'll also have access to your previously downloaded files in the My documents section.

- If you’re using our website for the first time, adhere to the steps outlined below to swiftly obtain your Hawaii Acceptance of Appointment of Special Administrator.

Form popularity

FAQ

A special administrator is someone appointed to handle specific tasks within an estate, usually during a time-sensitive situation. This role is critical when immediate actions are needed to preserve estate assets or address urgent matters. Utilizing resources like US Legal Forms can guide you through the Hawaii Acceptance of Appointment of Special Administrator process, ensuring you comply with legal requirements.

The primary difference lies in the scope and duration of their roles. An administrator typically oversees the entire estate until its final distribution, while a special administrator serves temporarily, often in urgent situations. The Hawaii Acceptance of Appointment of Special Administrator is essential for understanding these distinct roles and when each should be employed.

Special administration refers to a temporary appointment of an administrator to manage an estate in urgent circumstances. This process allows for immediate action to protect the estate’s assets, especially when significant delays in the regular administration might cause harm. In Hawaii, a special administrator acts swiftly while adhering to the laws governing the Hawaii Acceptance of Appointment of Special Administrator.

An administrator possesses considerable power over the estate they manage. In Hawaii, this power includes managing assets, settling debts, and distributing property. However, they must act in the best interest of the estate and its beneficiaries. Understanding the Hawaii Acceptance of Appointment of Special Administrator helps clarify these powers and responsibilities.

Rule 50 of the Hawaii Probate Rules pertains to the closing of an estate and the final report a personal representative must submit. This rule ensures that all debts and claims against the estate have been settled. By initiating the process through the Hawaii Acceptance of Appointment of Special Administrator, you can make closing the estate smoother and more straightforward.

Hawaii law does not specify a minimum estate value that mandates probate; instead, it depends on the assets owned by the deceased. However, complex estates with valuable assets usually require probate proceedings. You can simplify this process with the Hawaii Acceptance of Appointment of Special Administrator, ensuring everything is managed efficiently.

The threshold for probate in Hawaii primarily depends on the type and value of the assets in the estate. Generally, substantial assets like real property or bank accounts valued over $100,000 will trigger the need for probate. If you encounter complexities, the Hawaii Acceptance of Appointment of Special Administrator can assist in navigating through them.

To obtain letters of testamentary in Hawaii, you must file a petition in the appropriate court, providing necessary documentation such as the will and death certificate. The court reviews the petition and, once approved, issues letters that authorize the executor to manage the estate. Utilizing the Hawaii Acceptance of Appointment of Special Administrator can expedite this process.

Hawaii does not have a strict minimum estate value for probate; however, estates valued over $100,000 may necessitate a formal probate process. This threshold helps to determine the need for legal administration of the estate. If managing an estate seems overwhelming, the Hawaii Acceptance of Appointment of Special Administrator can be incredibly beneficial.

In Hawaii, there is no specific minimum value that automatically requires probate; the process depends on the type of assets. Generally, if the deceased owned real estate or significant assets, probate may be necessary. Engaging in the Hawaii Acceptance of Appointment of Special Administrator can simplify the legal complexities involved.