Hawaii Dissolution Package to Dissolve Corporation

Description

How to fill out Hawaii Dissolution Package To Dissolve Corporation?

Amidst numerous paid and complimentary samples that you can access online, you can't guarantee their dependability.

For instance, who created them or if they're qualified enough to handle what you need them to.

Stay composed and utilize US Legal Forms! Explore Hawaii Dissolution Package to Dissolve Corporation templates developed by proficient attorneys and sidestep the costly and labor-intensive procedure of searching for a lawyer and then compensating them to draft a document for you that you can effortlessly find on your own.

Once you've registered and paid for your subscription, you can utilize your Hawaii Dissolution Package to Dissolve Corporation as often as needed or for the duration of its validity in your location. Modify it in your preferred online or offline editor, fill it out, sign it, and produce a hard copy. Accomplish much more for less with US Legal Forms!

- Ensure that the document pertains to your state.

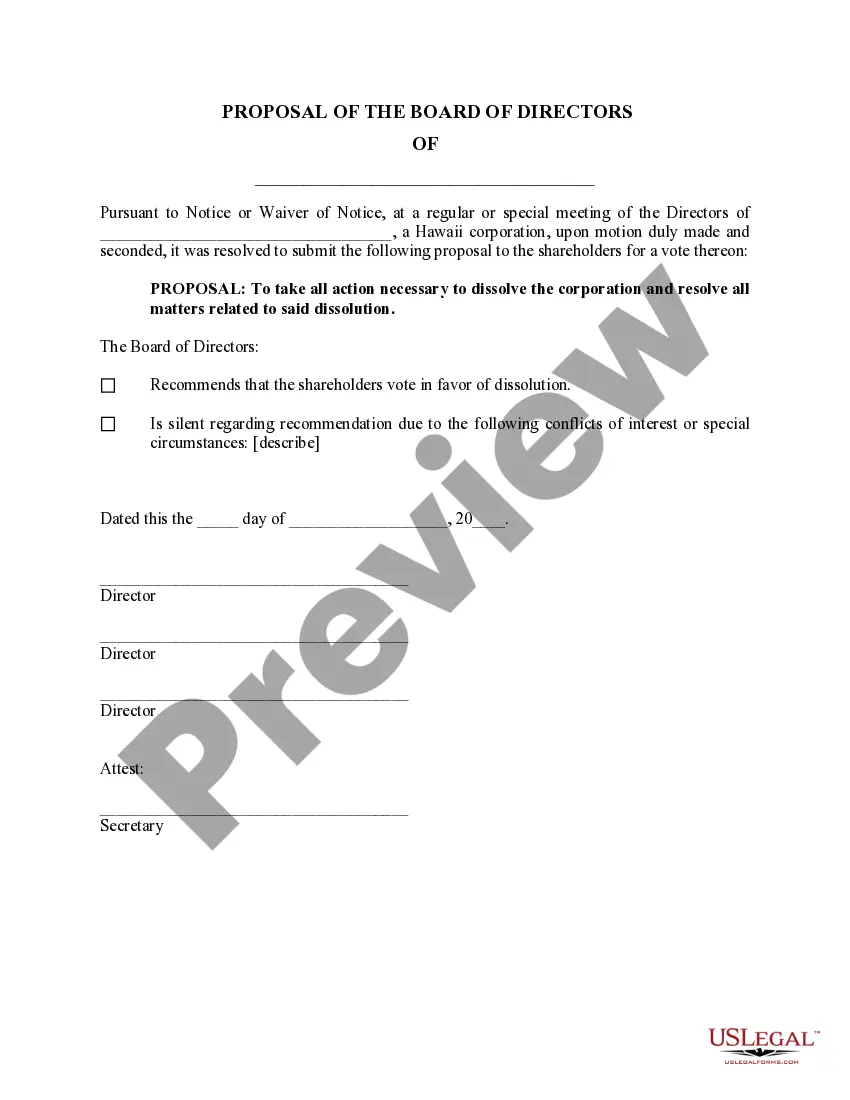

- Examine the template by reviewing the details using the Preview function.

- Click Buy Now to initiate the purchasing process or search for an alternate sample using the Search field found in the header.

- Choose a pricing tier and establish an account.

- Complete the payment for the subscription using your credit card, debit card, or Paypal.

- Download the document in the necessary format.

Form popularity

FAQ

Dissolving a company is not the same as simply closing its doors; it involves legal procedures to end a business's existence formally. When you dissolve a company, you must follow state laws to settle obligations and distribute any remaining assets to owners or shareholders. Using a Hawaii Dissolution Package to Dissolve Corporation ensures you fulfill all legal responsibilities, protecting you and your interests during this process.

Corporate dissolution, or Liquidation Form 966, is a document that officially notifies the IRS and other stakeholders of a corporation's intent to dissolve. This form outlines the company’s plan to settle debts and distribute assets before shutting down. The Hawaii Dissolution Package to Dissolve Corporation includes guidance on completing Form 966, helping you manage financial responsibilities as you transition out of business.

To dissolve a corporation in Hawaii, you must first hold a meeting with your board of directors and shareholders to approve the dissolution. After that, you will need to file a Certificate of Dissolution with the Department of Commerce and Consumer Affairs. The Hawaii Dissolution Package to Dissolve Corporation streamlines this process by providing all necessary forms and clear instructions for each step, making your dissolution smooth and efficient.

When you dissolve an LLC, you formally terminate the business entity, which halts any future business operations. This process includes settling debts, distributing remaining assets, and filing necessary paperwork, ensuring that your company is closed legally. Utilizing a Hawaii Dissolution Package to Dissolve Corporation simplifies this process, guiding you through each step to ensure compliance with state laws.

Closing a company in Hawaii involves a series of important steps to ensure legal compliance. Begin by holding a formal meeting to decide on the closure, followed by filing your dissolution paperwork with the state. The Hawaii Dissolution Package to Dissolve Corporation can assist you in completing this task with ease, guiding you through the necessary forms and requirements. Remember to settle debts and notify any stakeholders to wrap up your company properly.

To dissolve an S Corp in Hawaii, you must follow specific steps starting with a board resolution to dissolve the corporation. Next, file the necessary dissolution documents with the Hawaii Department of Commerce and Consumer Affairs. Using the Hawaii Dissolution Package to Dissolve Corporation can simplify this process, ensuring all paperwork is accurate and submitted correctly. Finally, notify creditors and close any remaining accounts to finalize the dissolution.

Dissolving a corporation does not automatically trigger an IRS audit; however, your final tax return may potentially face scrutiny. It is essential to file accurate and complete final returns to mitigate risks. Using a Hawaii Dissolution Package to Dissolve Corporation can help ensure that your documentation is thorough and compliant with IRS regulations.

To dissolve a corporation in Hawaii, you must first obtain approval from your board of directors and shareholders. Next, file a Certificate of Dissolution with the Department of Commerce and Consumer Affairs in Hawaii. A Hawaii Dissolution Package to Dissolve Corporation can simplify this entire process by providing the necessary forms and clearer instructions.

The steps for dissolving a corporation typically include holding a board meeting to approve the dissolution, preparing and filing dissolution documents with the state, and settling all debts and claims against the corporation. Also, do not forget to notify the IRS and finalize your tax returns. Leveraging a Hawaii Dissolution Package to Dissolve Corporation ensures you do not miss any vital steps.

Dissolving a corporation includes obtaining board approval, filing the necessary dissolution forms with the state, and notifying creditors and stakeholders. Additionally, you must settle any outstanding obligations. To streamline this process, a Hawaii Dissolution Package to Dissolve Corporation can provide all required templates and instructions.