Guam Receipt for Payment of Rent

Description

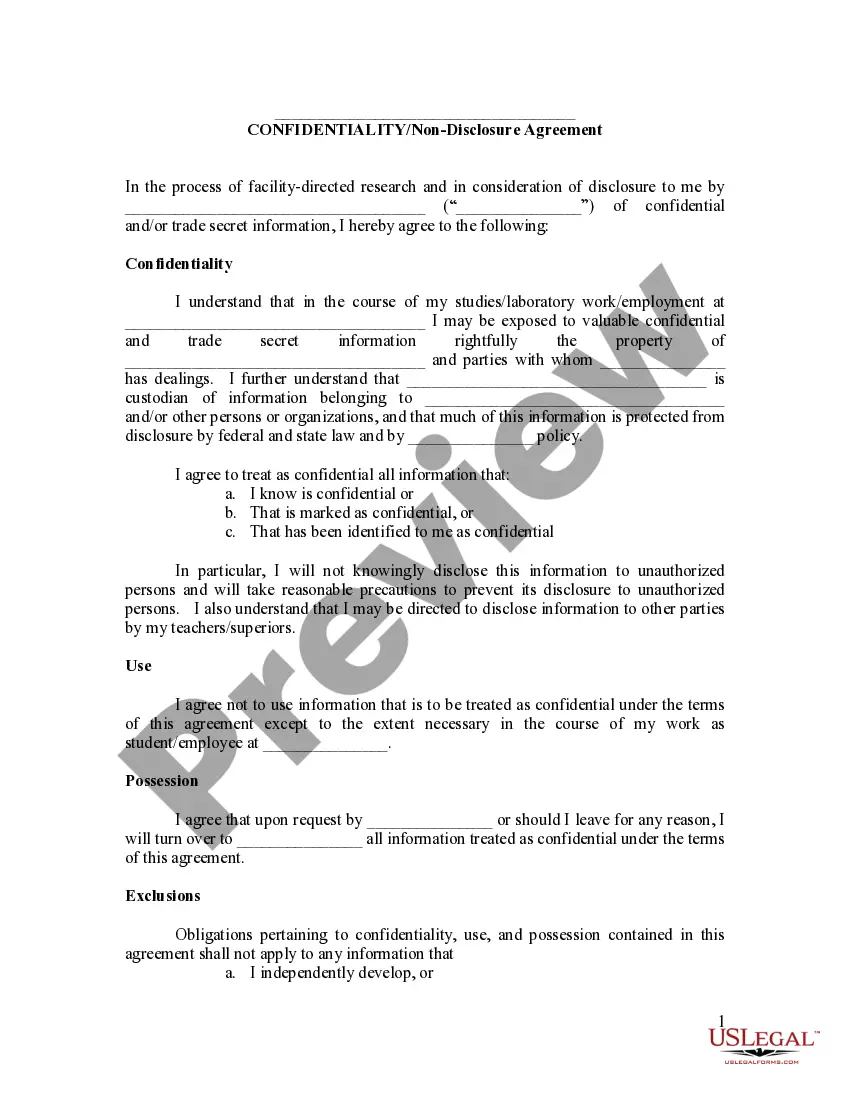

How to fill out Receipt For Payment Of Rent?

Locating the appropriate legal document template can present challenges.

Certainly, there are numerous templates available online, but how can you identify the legal document you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, such as the Guam Receipt for Payment of Rent, suitable for both commercial and personal needs.

You can review the form using the Review button and examine the form details to confirm it is suitable for your needs.

- All templates are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Acquire button to obtain the Guam Receipt for Payment of Rent.

- Use your account to search for the legal documents you have previously purchased.

- Visit the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward steps to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Absolutely, filing your Guam taxes online is possible and highly recommended for efficiency. The online platform offers step-by-step guidance, allowing you to submit your GRT calculations alongside your Guam receipts for payment of rent conveniently. Utilizing online resources can help you stay organized and compliant.

Yes, you can file your Guam taxes online through the Guam Department of Revenue and Taxation's website. This service offers a convenient way to manage your tax duties, including the submission of GRT related to rental payments. Remember to keep your Guam receipts for payment of rent handy to make the process smoother.

Filing GRT tax in Guam requires you to complete the necessary forms and report your total receipts. You can gather your documents related to sales and rental agreements, such as your Guam receipts for payment of rent, to ensure accuracy. Consider using platforms like USLegalForms to simplify the filing process and ensure compliance.

Yes, Guam is a territory of the United States and is considered a foreign jurisdiction for federal tax purposes. However, it has its own tax regulations, including the GRT, which affects business owners and residents alike. If you receive a Guam receipt for payment of rent, it's important to understand your tax obligations to avoid penalties.

The Gross Receipts Tax (GRT) in Guam currently stands at 5%, which applies to all business sales, services, and rentals. When managing your finances, understanding the GRT is essential, especially when dealing with Guam receipts for payment of rent. It's crucial to factor this tax into your budget if you're a landlord or business owner.

Generating a receipt for rent can be done through various methods. You can write one manually or use software that specializes in financial documents. Utilizing resources like US Legal Forms can simplify this process by providing easy-to-customize templates for a Guam Receipt for Payment of Rent. This ensures all necessary details are included and that your receipt meets legal standards.

To obtain a Guam Receipt for Payment of Rent, you can start by asking your landlord for a written receipt when you make your payment. It's essential to document your payment for future reference and to protect your rights as a tenant. If your landlord does not provide one, you can create a simple receipt yourself using a template. Platforms like US Legal Forms offer customizable receipt templates you can use for this purpose.

Writing a receipt for rent payment in the Philippines involves providing details such as the date of payment, the amount, and the names of both the landlord and tenant. You can also specify the payment method and rental property information. Using a standardized template, similar to the Guam Receipt for Payment of Rent, simplifies this process and ensures compliance with local regulations.

A formal letter requesting a payment should clearly state the amount due, the reason for the payment, and the due date. Address the letter to the appropriate person and be polite but direct in your request. Consider following up with a Guam Receipt for Payment of Rent to confirm when the payment is made.

Writing a letter for a rental typically involves stating your intention to rent a property, mentioning the desired rental period, and providing your contact information. Be sure to include any specific details about the property and your rental history. Once the rental terms are confirmed, always obtain a Guam Receipt for Payment of Rent to finalize and document your agreement.