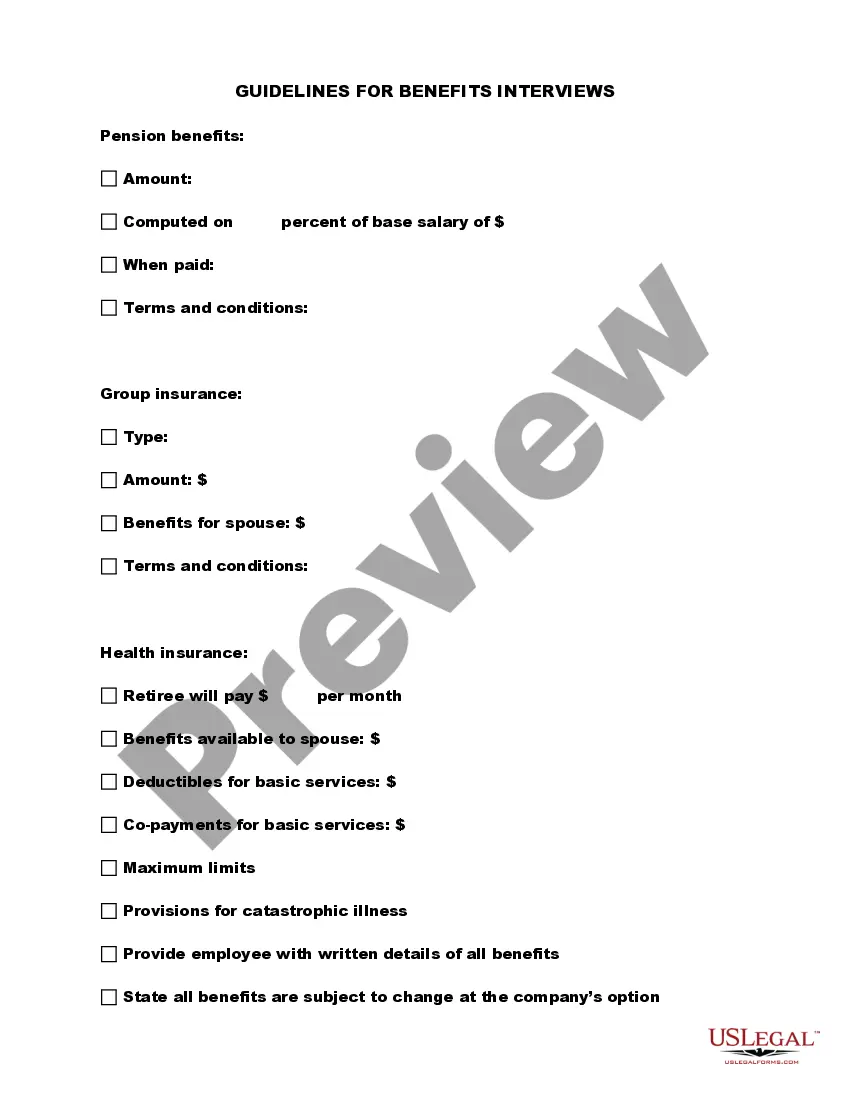

Utah Guidelines for Benefits Interviews

Description

How to fill out Guidelines For Benefits Interviews?

Have you found yourself in a circumstance where you require documents for either professional or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast selection of form templates, including the Utah Guidelines for Benefits Interviews, designed to meet both state and federal standards.

Once you find the correct form, click on Get now.

Select your preferred pricing plan, complete the required information to create your account, and pay for your order using PayPal or credit card. Choose a suitable file format and download your version. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Utah Guidelines for Benefits Interviews at any time if needed. Simply click on the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides precisely crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Utah Guidelines for Benefits Interviews template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/region.

- Use the Review button to examine the form.

- Read the description to confirm you have selected the correct form.

- If the form does not meet your needs, utilize the Search section to find the appropriate form for your requirements.

Form popularity

FAQ

There is no minimum amount of time or wages an employer has to meet in order to qualify under unemployment compensation. To qualify for UI in UT, you must have worked during a minimum of two quarters in the base period.

There are multiple qualifying circumstances related to COVID-19 that can make an individual eligible for PUA, including if the individual quits his or her job as a direct result of COVID-19. Quitting to access unemployment benefits is not one of them.

In general, unemployment benefit programs provide temporary income to people who are out of work due to no fault of their own. If someone was fired due to misconduct or violation of company policy, they might be ineligible to collect unemployment.

You must report any gross earnings for the week the work is performed, regardless of when you are paid. You can earn up to 30% of your weekly benefit amount and still receive the full weekly benefit amount. If you earn over 30% of your weekly benefit amount then a dollar for dollar deduction will be taken.

If your earnings equal or exceed your weekly benefit amount or you work 40 or more hours during the week, you will not receive any payment or waiting week credit for that week.

If you work less than full-time and earn less than your weekly benefit amount during a given week, you may continue filing since you will be entitled to partial unemployment benefits if you are otherwise eligible. Workforce Services will apply a 30 percent earnings allowance to calculate your weekly benefit payment.

Generally, fired employees can only get unemployment benefits if they can prove your termination was wrongful or against labor laws. In many cases, you'll have to prove your case during a claims investigation or appeals process.

Utah's law calls for a benefit ratio to be determined for each qualifying employer. This means that unemployment insurance benefits paid to your former employees will be used as the primary factor in calculating your contribution rate. These payments are known as benefit costs.

You must have earned at least $4500 during your Base Period. Your total Base Period earnings must be at least 1 ½ times the highest quarter of wages during your Base Period. If you do not qualify using earnings in your Base Period, you may qualify under the same conditions by using an Alternate Base Period.