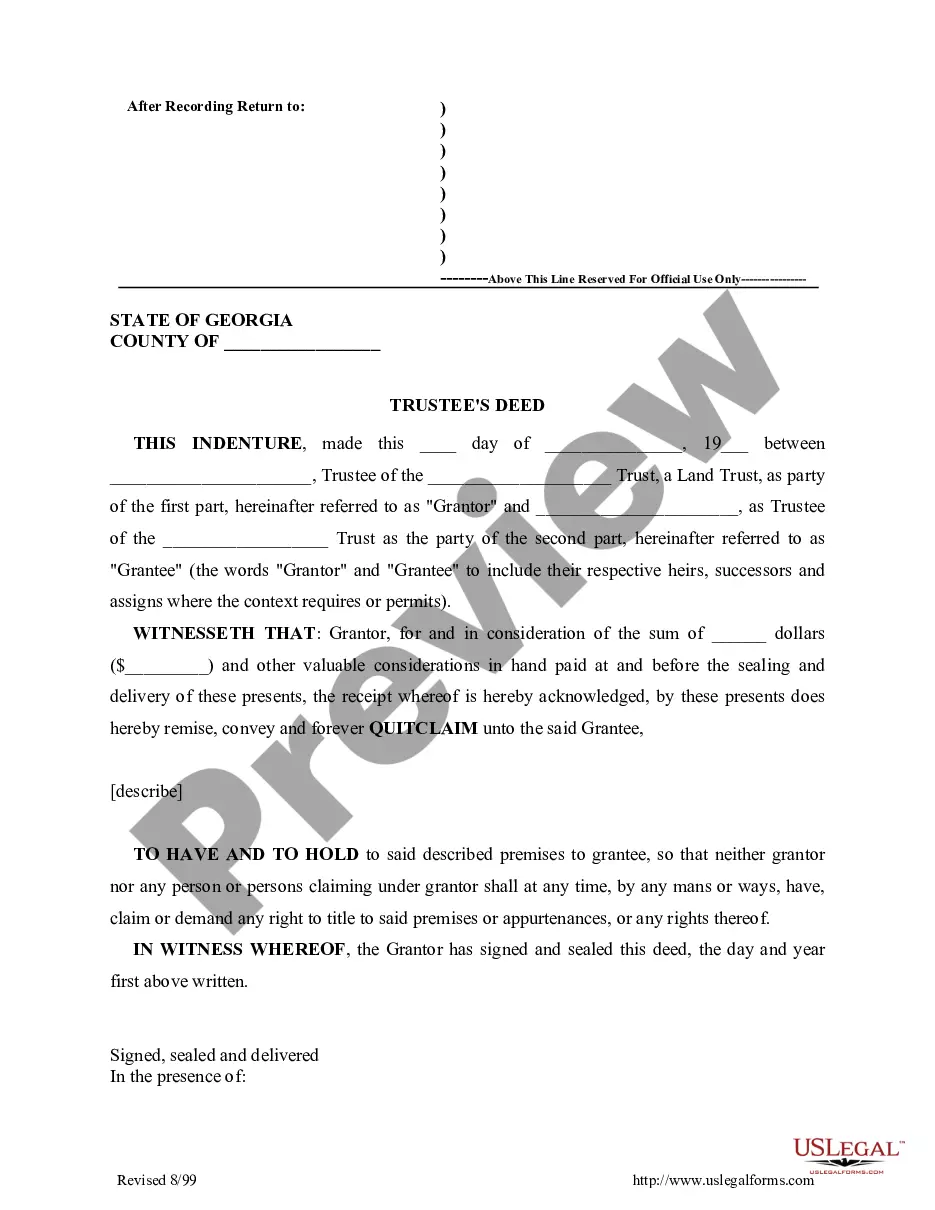

Georgia Trustee's Deed

Overview of this form

The Trustee's Deed is a legal document used to transfer property ownership from a trustee to a grantee. Unlike a standard deed, this form specifically addresses transactions involving land trusts, ensuring the proper legal framework for these transfers. It outlines the roles of both the grantor (the trustee) and the grantee, establishing the agreement for property conveyance clearly and legally. This form is essential for ensuring that property transactions reflect the intentions of the parties involved.

Main sections of this form

- Date of the deed's execution

- Identification of the grantor (trustee) and grantee

- Consideration amount for the property

- Description of the property being transferred

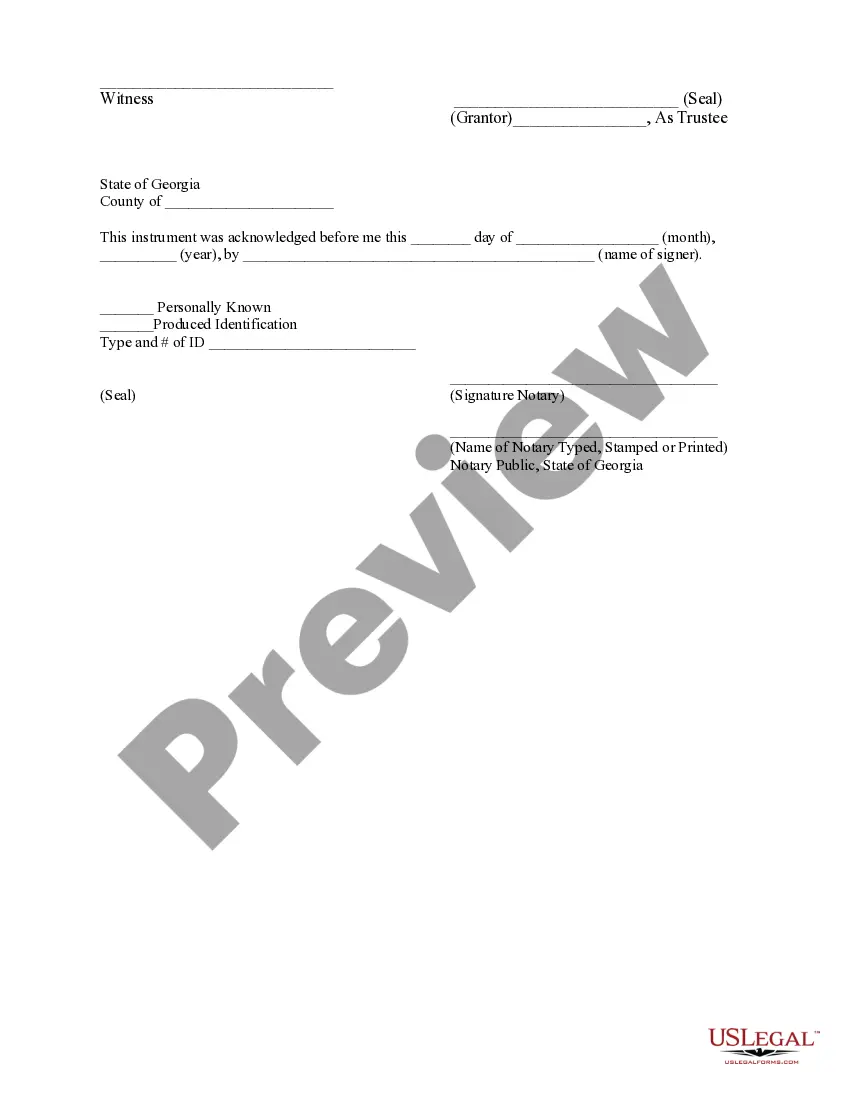

- Signatures of the grantor and witnesses

- Notarization details if applicable

When to use this form

This form should be used when a trustee wishes to transfer property held in a trust to a beneficiary or another party. It is particularly relevant in cases where property ownership must be documented following a trust's directives, such as during the closure of a trust or in the sale of trust-held property. Utilizing a Trustee's Deed ensures the transaction is legally binding and clear, preventing disputes regarding property ownership.

Who can use this document

- Trustees who need to transfer property held in a trust

- Beneficiaries receiving property from a trust

- Real estate professionals involved in trust property transactions

- Individuals looking to ensure legal compliance in property sales involving trusts

How to prepare this document

- Identify the parties involved: the trustee as the grantor and the grantee.

- Enter the date of the transaction.

- Specify the amount of consideration being paid for the property.

- Provide a detailed description of the property being conveyed.

- Have the grantor sign the deed in front of witnesses.

- Ensure notarization of the deed to validate the transaction.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to accurately describe the property being transferred.

- Not obtaining required signatures from witnesses or the notary.

- Leaving the consideration amount blank or inaccurate.

- Not adhering to specific state requirements for execution and recording.

- Using outdated versions of the form that may not meet current legal standards.

Advantages of online completion

- Convenient access to downloadable templates, saving time and effort.

- Editability allows for customization to fit specific situations or needs.

- Reliable, professionally drafted forms provide peace of mind in legal transactions.

Looking for another form?

Form popularity

FAQ

Trust deeds can be a valuable aid to financial stability, but they are not right for everybody. They are best suited to people who have a regular income and can commit to regular payments.

The trustee is a neutral third-party who holds the legal title to a property until the borrower pays off the loan in full. They're called a trustee because they hold the property in trust for the lender.

Like all deeds, these two legal documents are both used to transfer titles from one owner to another. A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

A Trustee's Deed Upon Sale, also known as a Trustee's Deed Under Sale or a Trustee's Deed is a deed of foreclosure. This deed is prepared after a property's foreclosure sale and recorded in the county were the property is located.The property may be in default on taxes, have mechanic's liens and/or other encumbrances.

A trustee deedsometimes called a deed of trust or a trust deedis a legal document created when someone purchases real estate in a trust deed state, such as California (check your local laws to see what is required in your state). A trust deed is used in place of a mortgage.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

In real estate, a trustee sale means the sale of real property through public auction.A trustee sale is typically the second-to-last step in the foreclosure process in a nonjudicial foreclosure state. In this case, after the auction is over, ownership of the property will be transferred to the highest bidder.

A Trustee's Deed Upon Sale, also known as a Trustee's Deed Under Sale or a Trustee's Deed is a deed of foreclosure. This deed is prepared after a property's foreclosure sale and recorded in the county were the property is located.