This is one of the official workers' compensation forms for the state of Georgia.

Georgia Wage Statement for Workers' Compensation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Georgia Wage Statement For Workers' Compensation?

Access one of the most extensive collections of approved forms.

US Legal Forms is indeed a platform to locate any state-specific document in just a few clicks, including Georgia Wage Statement for Workers' Compensation templates.

No need to squander hours searching for a court-acceptable form. Our certified experts make sure that you receive current samples every time.

After selecting a pricing plan, establish an account. Pay via card or PayPal. Download the template to your device by clicking Download. That's it! You should complete the Georgia Wage Statement for Workers' Compensation form and verify it. To ensure that everything is accurate, consult your local legal advisor for assistance. Register and easily explore around 85,000 useful forms.

- To utilize the forms library, select a subscription and create an account.

- If you have already established it, just Log In and then click Download.

- The Georgia Wage Statement for Workers' Compensation template will promptly be stored in the My documents tab (a tab for all forms you download on US Legal Forms).

- To create a new account, follow the brief instructions provided below.

- If you're planning to use a state-specific template, make sure you select the correct state.

- If it’s feasible, review the description to comprehend all the details of the form.

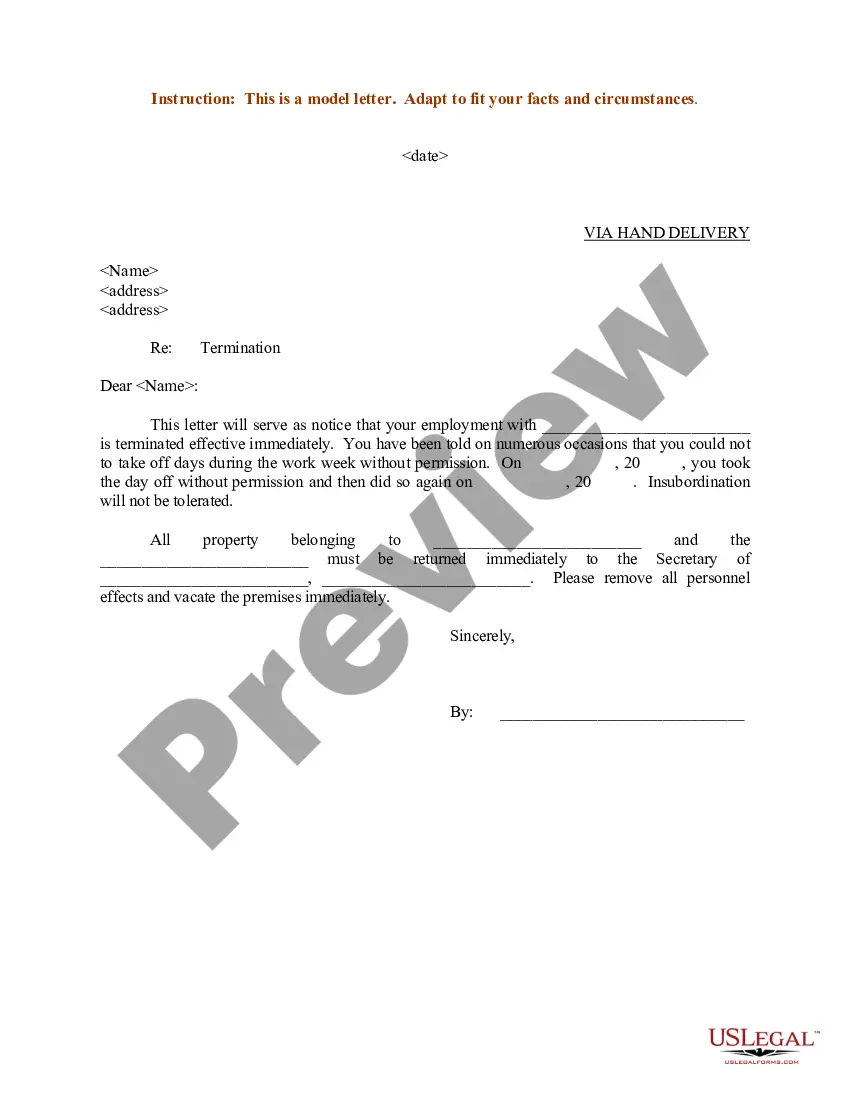

- Utilize the Preview function if it’s available to examine the document's content.

- If everything’s suitable, click Buy Now.

Form popularity

FAQ

Workers' comp pay in Georgia is usually two-thirds of your average weekly salary, depending on how much you make and when your accident occurred. However, there are caps on the pay. You will only receive two-thirds of your average weekly wage if the payment is not more than $675.00 per week.

Meals or lodging (unless the classification phraseology specifically includes them or they are provided in lieu of wages) Tips. Overtime excess pay (the increase above the regular hourly wage)

Workers Compensation Calculator Most often, benefits are calculated and paid based on the average weekly wage. This is calculated by multiplying the employee's daily wage by the number of days worked in a full year. That number is then divided by 52 weeks to get the average weekly wage.

Calculating California Workers' Compensation Benefits In California, if you are injured on the job, you are entitled to receive two-thirds of your pretax gross wage.This is not required by law in California, but it makes up the salary difference so that you receive your entire income if you were injured on the job.

The general rule in Georgia is that a claim for workers' compensation benefits must be filed within one year of the accident date or the right to compensation is barred, not two years as in other personal injury claims.

You will receive a reduced benefit based upon your earnings for a maximum of 350 weeks from the date of injury. This benefit will not exceed $450.00 per week, if your accident occurred on or after July 1, 2019. HOW LONG WILL I RECEIVE WEEKLY BENEFITS?

Receiving Weekly Wages Through Georgia Workers' Comp Depending on the details of your work injury, you may be able to receive wage benefits for up to 400 weeks.

A workers' compensation insurance policy is based on payroll, regardless of whether the employee is full-time, part-time, temporary or seasonal. Begin with the gross payroll for each employee.

Most often, benefits are calculated and paid based on the average weekly wage. This is calculated by multiplying the employee's daily wage by the number of days worked in a full year. That number is then divided by 52 weeks to get the average weekly wage.