Florida Last Will and Testament with All Property to Trust called a Pour Over Will

What this document covers

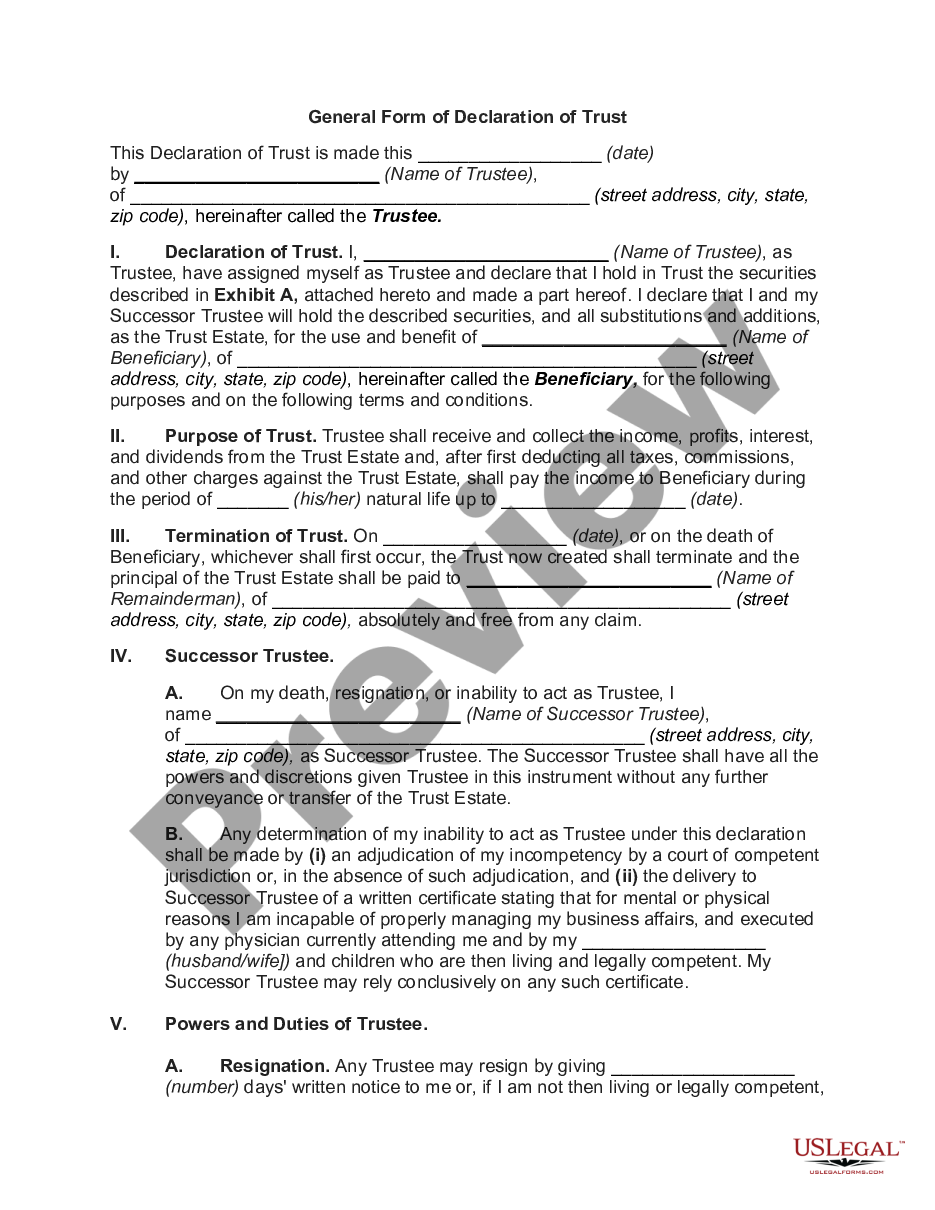

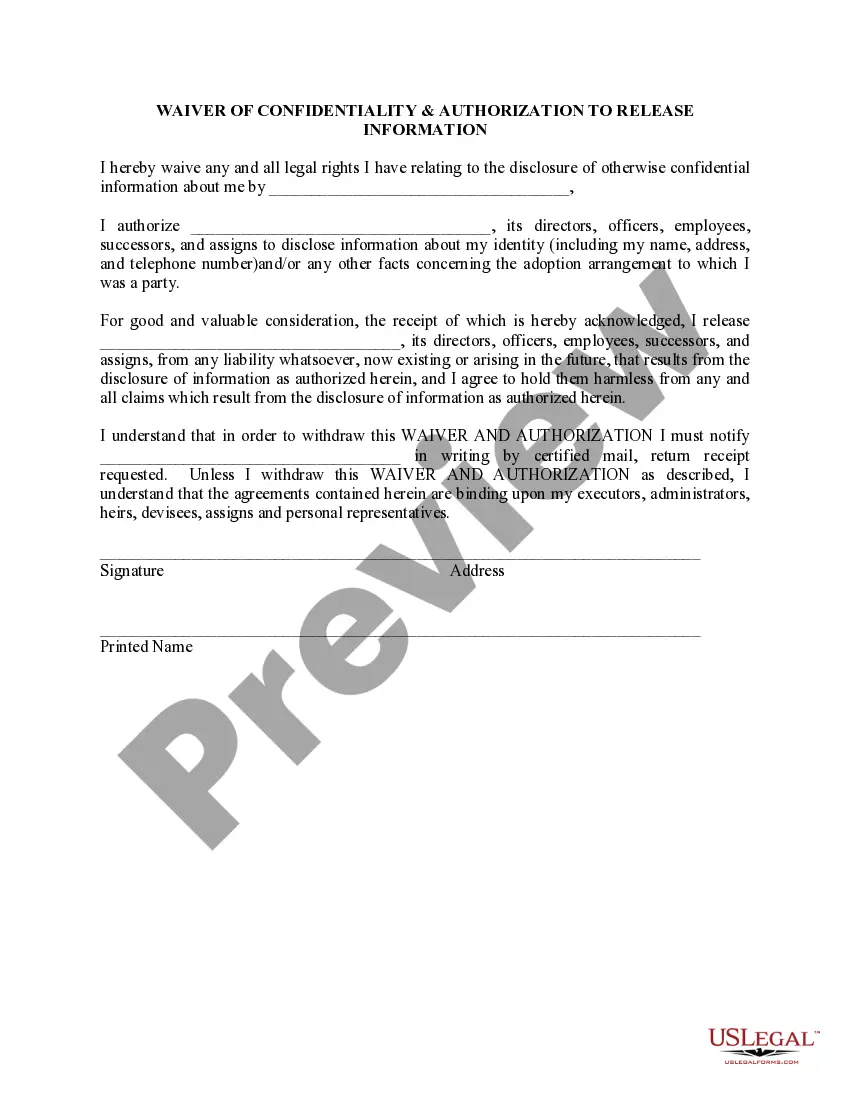

This Last Will and Testament with All Property to Trust, known as a Pour Over Will, serves to ensure that any property not already transferred to a living trust will be directed to that trust upon your death. It is specifically designed for individuals who are establishing or have established a living trust, streamlining the estate planning process. A Pour Over Will is essential to ensure that all assets are managed according to your wishes rather than local intestacy laws.

Key parts of this document

- Article on conveyance to trust, specifying all assets to be directed to the living trust.

- Provision for payment of debts and funeral expenses from the estate.

- Appointment of a guardian for minor children, if applicable.

- Designation of a personal representative to oversee the execution of the will.

- Waiver of bond and accounting requirements for the personal representative.

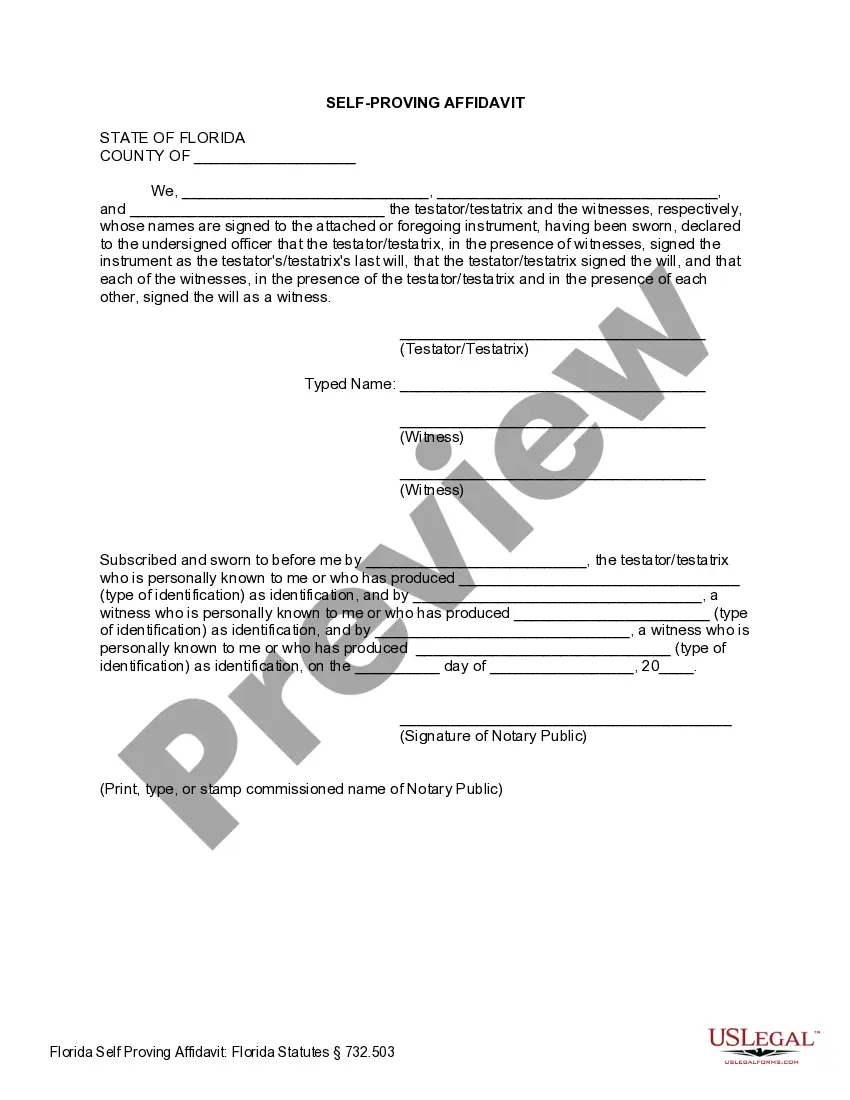

- Self-proving affidavit for easier validation of the will by witnesses.

When to use this document

This form should be used when you have established or are about to establish a living trust and wish to ensure that any assets not previously transferred to the trust will automatically be included in it upon your passing. It is particularly important if you want to avoid the complications of probate for assets that you may acquire after setting up your trust.

Who needs this form

- Individuals setting up or who have an existing living trust.

- Testators seeking clarity on the distribution of their estate to ensure alignment with their trust.

- Those with minor children who require a guardian designation in their will.

Completing this form step by step

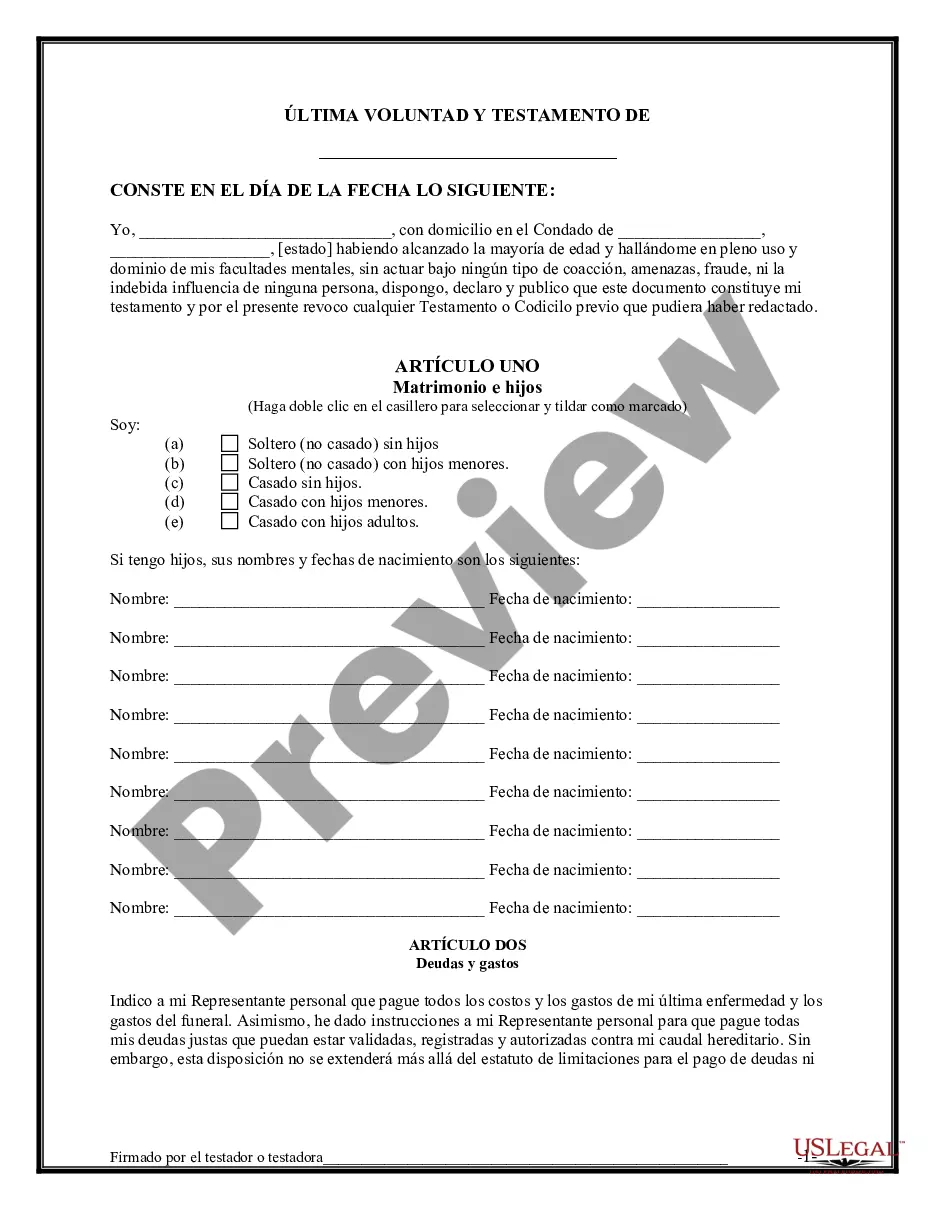

- Identify the testator (yourself) and provide your details, including address.

- Fill in the details of the living trust you have created or are creating.

- Specify the appointment of your personal representative and any successors.

- Indicate any minor children and designate a guardian if applicable.

- Include witness signatures to validate the document and complete the self-proving affidavit.

Notarization requirements for this form

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Mistakes to watch out for

- Failing to transfer all applicable assets to the trust before completion of the will.

- Omitting the appointment of a guardian for minor children.

- Not having the will signed by required witnesses.

Why complete this form online

- Convenience of filling out the form from home, at your own pace.

- Editable form allows for adjustments as your situation changes.

- Access to legal advice and support through US Legal Forms as needed.

State law considerations

This form is tailored to comply with the legal standards of Florida, where specific provisions, such as the witness requirements and the self-proving affidavit, are specified by state law.

Form popularity

FAQ

A Florida Last Will and Testament with All Property to Trust called a Pour Over Will does not avoid probate. Instead, it directs the distribution of your assets into a trust once the will has gone through probate. This means that while the assets will eventually be transferred to the trust, the probate process must take place first. Utilizing platforms like USLegalForms can help you prepare your pour-over will efficiently, ensuring your estate planning is robust and effective.

In Florida, certain types of property are exempt from probate, which can streamline estate management. For example, assets held in a living trust, joint tenancy accounts, and those with designated beneficiaries do not require probate. Additionally, personal property valued under a specific threshold, along with certain financial accounts, can also avoid probate. This exemption can make estate planning easier when utilizing a Florida Last Will and Testament with All Property to Trust called a Pour Over Will.

A drawback of a Florida Last Will and Testament with All Property to Trust called a Pour Over Will is that it does not provide immediate distribution of assets. Instead, the assets must go through probate before they transfer to the trust. This process can take time and may lead to delays in accessing the assets. Therefore, while a pour-over will helps ensure that your assets end up in your trust, the probate process can be a potential downside.

over trust in Florida is a legal arrangement designed to transfer your assets into a trust automatically upon your death. This trust becomes effective when you have a valid Florida Last Will and Testament with All Property to Trust called a Pour Over Will. By using a pourover trust, you can simplify the management of your estate and ensure that your assets are handled according to your wishes. If you need assistance in creating these documents, U.S. Legal Forms provides valuable resources that can help you navigate this important process.

over will works handinhand with a trust to provide a clear plan for your assets after you pass away. When you create a Florida Last Will and Testament with All Property to Trust called a Pour Over Will, any assets not already in your trust will be transferred to it upon your death. This ensures that your estate is managed according to the terms you specified in your trust, avoiding the complexities of probate for most assets. Using this combination helps streamline the process and enhances the efficiency of your estate plan.

The purpose of a pour over trust is to ensure that your assets are efficiently transferred into the trust upon your passing. This type of trust simplifies the estate planning process by making sure all of your property goes directly into the trust, assisting in the management and distribution of your estate. Essentially, it acts as a safety net that captures any assets not previously placed in the trust while you were alive, aligning with your intentions laid out in your Florida Last Will and Testament with All Property to Trust called a Pour Over Will. This creates a seamless transition of your estate to your beneficiaries.

A notarized will does not need to be probated.When a person dies leaving behind a will that is not notarized, the law requires that its validity be ascertained by a notary or by a court. Similarly, any non-notarized modification made to a will must be probated, whether the will is notarized or not.

A note about wills: Whether or not probate will be necessary, Florida law requires that anyone who has possession of a will must file it with the local circuit court within 10 days of learning of the death. If a probate court proceeding is necessary, the court will determine whether or not the will is valid.

Your will must be written. Your will must be witnessed and notarized in the special manner provided by law for wills. It is necessary to follow exactly the formalities required by Florida law for the execution of a will. To be effective, your will must be proved valid in and allowed by the probate court.

Make a List of All Your Assets. Be sure to include make a list of your assets that includes everything you own. Find the Paperwork for Your Assets. Choose Beneficiaries. Choose a Successor Trustee. Choose a Guardian for Your Minor Children.